Monday links: getting stuff done

Abnormal Returns

FEBRUARY 5, 2024

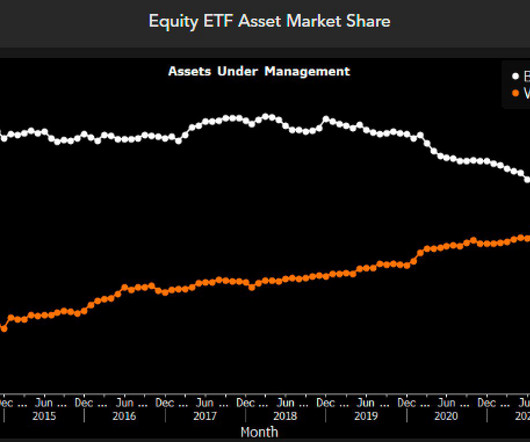

Strategy Valuations matter, but using them in your investment process is a challenge. (entrylevel.topdowncharts.com) When does passive investing become a problem for valuing companies? (silverlightinvest.com) Companies Why are companies holding more cash these days? (hbr.org) A look at the tail winds behind the aggregates business. (fortunefinancialadvisors.com) It's hard to believe but Facebook is now 20 years old.

Let's personalize your content