The Power of Brand for Financial Advisors

Wealth Management

AUGUST 26, 2024

And why it's so hard to create one.

Wealth Management

AUGUST 26, 2024

And why it's so hard to create one.

Abnormal Returns

AUGUST 26, 2024

Strategy Why pessimism sells on Wall Street. (optimisticallie.com) You can't just lock in money market rates. (obliviousinvestor.com) Finance Building a better global market index. (ft.com) The big index fund managers have a problem on their hands. (humbledollar.com) Ukraine How Ukraine successfully invaded Kursk. (ig.ft.com) How Ukraine defeated Russia in the Black Sea.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

AUGUST 26, 2024

The monthly advisor index improved slightly for both the market and the economy.

Abnormal Returns

AUGUST 26, 2024

Podcasts Jill Schlesinger talks with Blair duQuesnay of RWM about her path as a financial adviser. (youtube.com) Michael Kitces talks with Kelli Kiemle, Managing Director of Growth and Client Experience of Halbert Hargrove, about maintaining culture across a remote firm. (kitces.com) Matt Zeigler talks with Eben Burr of Toews Asset Management about his unique path through the industry.

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

Wealth Management

AUGUST 26, 2024

The generation first in line to benefit from the Great Wealth Transfer is surprisingly underserved.

Nerd's Eye View

AUGUST 26, 2024

For most of its history, the financial advice industry has been very slow to change. Over the last 50 years, even the most substantial changes to occur – such as the movement away from commissions and towards fee-based compensation, and the shift from an investment-centric approach to more holistic financial planning – have taken place over decades and, in many cases, are still ongoing.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Advisor Perspectives

AUGUST 26, 2024

As tough as financial advisors claim to be, we still get nervous about “firing” clients, too. When we say “graduate,” that is our delicate way of handling an uncomfortable situation. It’s a cheap, but effective way to massage the misgivings that we have about terminating client relationships.

Wealth Management

AUGUST 26, 2024

Javier Altimari, a former senior director and portfolio manager at Oppenheimer & Co., will be instrumental in building out Americana Partners International, the RIA’s new division serving international UHNW clients.

Alpha Architect

AUGUST 26, 2024

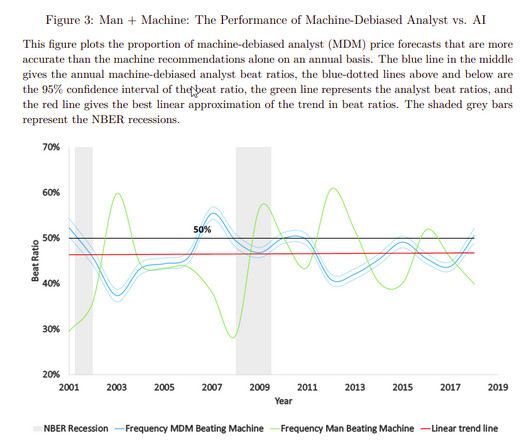

An AI analyst trained to digest corporate disclosures, industry trends, and macroeconomic indicators surpasses most analysts in stock return predictions. AI wins when information is transparent but voluminous. Humans provide significant incremental value in “Man + Machine,” which also substantially reduces extreme errors. From Man vs. Machine to Man + Machine: The Art and AI of Stock Analyses was originally published at Alpha Architect.

Wealth Management

AUGUST 26, 2024

This year’s new ETFs rank among the most expensive of the decade.

Speaker: Erroll Amacker

As businesses increasingly adopt automation, finance leaders must navigate the delicate balance between technology and human expertise. This webinar explores the critical role of human oversight in accounts payable (AP) automation and how a people-centric approach can drive better financial performance. Join us for an insightful discussion on how integrating human expertise into automated workflows enhances decision-making, reduces fraud risks, strengthens vendor relationships, and accelerates R

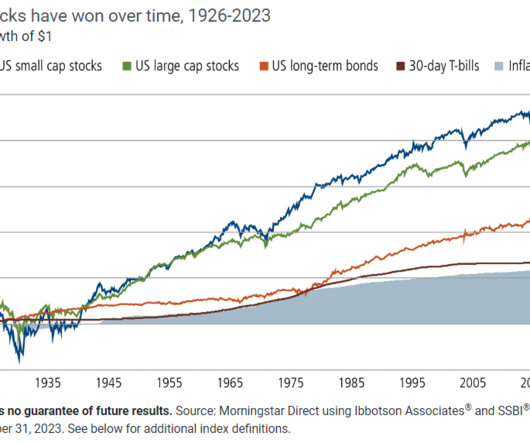

A Wealth of Common Sense

AUGUST 26, 2024

Today’s Talk Your Book is sponsored by Calamos Investments: On today’s show, we spoke with Brandon Nelson, Senior Portfolio Manager for Calamos to discuss investing in the small-cap space. On today’s show, we discuss: Navigating profitable and unprofitable small-cap stocks Calamos’ favorite small-cap sectors Fighting macro headwinds within small caps Why this asset class has flown under the rad.

Advisor Perspectives

AUGUST 26, 2024

Expectations heading into Nvidia Corp.’s Wednesday report are high, with analysts anticipating another strong consensus beat that could prompt the chipmaker to raise its profit guidance.

Financial Symmetry

AUGUST 26, 2024

We all have visions of our ideal retirement. However, our financial plans can quickly veer off-course if we haven’t appropriately managed our risks. On this episode of Financial Symmetry, Greg Suggs from Greg Suggs Insurance joins me to discuss how … Continued The post Risks to Your Ideal Retirement, Ep #223 appeared first on Financial Symmetry, Inc.

Advisor Perspectives

AUGUST 26, 2024

To make an organizational change effort stick, you have to start with the people, not with KPIs or quotas. If you want to move your firm to a client-centric model, you need to consider influencing factors such as your organizational structure and culture, the way employees feel about their work, and how management feels about shaking things up.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Random Roger's Retirement Planning

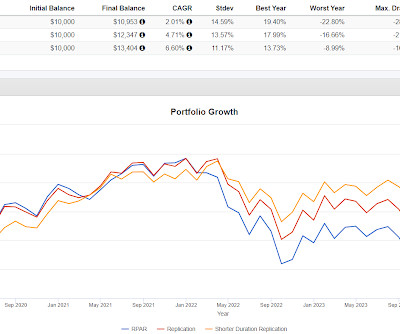

AUGUST 26, 2024

Seven months ago I wrote about the then brand new Defiance Treasury Alternative Yield Fund (TRES). It was a derivative income fund that bought short term treasuries and sold option combos on ETFs like iShares 20+ Year Treasury ETF (TLT). The fund closed in late July. TLTW owns TLT and sells covered calls against that ETF. In March, I guess treasuries got hit a little bit in March, TRES got destroyed and then continued to deteriorate from there.

Advisor Perspectives

AUGUST 26, 2024

Seven of our eight indexes on our world watch list have posted gains through August 26th, 2024. The U.S.'s S&P 500 finished in the top spot with a YTD gain of 18.43%. Tokyo's Nikkei 225 finished in second with a YTD gain of 13.88% while India's BSE SENSEX finished in third with a YTD gain of 13.64%.

Cornerstone Financial Advisory

AUGUST 26, 2024

Weekly Market Insights | August 26th, 2024 The Dow Jones Industrial Average picks up. Stocks notched a solid gain as dovish comments from Federal Reserve officials boosted the market’s recovery from early August lows. The Standard & Poor’s 500 Index rose 1.45 percent, while the Nasdaq Composite added 1.40 percent. The Dow Jones Industrial Average picked up 1.27 percent.

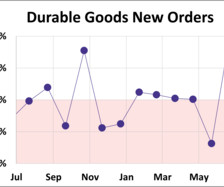

Advisor Perspectives

AUGUST 26, 2024

New orders for manufactured durable goods rose to $289.65B in July, the highest level since November. This represents a 9.9% increase from the previous month and better than the expected 4.0% growth. The series is up 1.3% year-over-year (YoY). If we exclude transportation, "core" durable goods were down 0.2% from the previous month and up 0.6% from one year ago.

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

Validea

AUGUST 26, 2024

Shareholder yield is a comprehensive measure of the value a company returns to its shareholders through various means. It combines three key components: dividend yield, share repurchases, and debt reduction. Dividend yield represents the cash payments made directly to shareholders, while share repurchases increase the ownership stake of existing shareholders by reducing the number of outstanding shares.

Advisor Perspectives

AUGUST 26, 2024

Economic indicators are released every week to provide insight into a country’s overall economic health. They serve as essential tools for policymakers, advisors, investors, and businesses because they allow them to make informed decisions regarding business strategies and financial markets.

Trade Brains

AUGUST 26, 2024

ECOS (India) Mobility & Hospitality Company is coming up with its IPO offer for sale worth Rs. 601.20 crores, which will open on 28 th August 2024. The issue will close on 30 th August 2024 and be listed on the exchange on 4 th September 2024. In this article, we will look at ECOS India Mobility & Hospitality IPO Review and analyze its strengths and weaknesses.

Advisor Perspectives

AUGUST 26, 2024

The market’s 8.5% decline during August sent shockwaves through the media and investors. The drop raised concerns about whether this was the start of a larger correction or a temporary pullback. However, a powerful reversal, driven by investor buying and corporate share repurchases, halted the decline, leading many to wonder if the worst is behind us.

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

Don Connelly & Associates

AUGUST 26, 2024

I met an Advisor at Merrill Lynch in Detroit who told me a very interesting story. Listen to the audio episode or read the transcript below, adapted from the video, to learn an important lesson about client service. The post The Elevator Repair Story appeared first on Don Connelly & Associates.

Advisor Perspectives

AUGUST 26, 2024

In his annual Jackson Hole speech, Fed Chair Powell assessed the post-pandemic U.S. economy and suggested rate cuts are coming soon.

Investment Writing

AUGUST 26, 2024

Can you spot what’s wrong in the image below? Please post your answer as a comment. I wonder if the author dictated their text. I post these challenges to raise awareness of the importance of proofreading. The post MISTAKE MONDAY for August 26: Can YOU spot what’s wrong? appeared first on Susan Weiner Investment Writing.

Advisor Perspectives

AUGUST 26, 2024

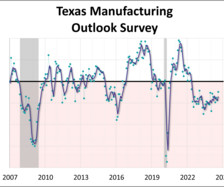

The Dallas Fed released its Texas Manufacturing Outlook Survey (TMOS) for August. The latest general business activity index came in at -9.7, up from -17.5 last month. This marks the highest level for the index since January 2023 but is the 28th consecutive month the index has been in contraction territory.

Speaker: Sierre Lindgren

Fraud is a battle that every organization must face – it’s no longer a question of “if” but “when.” Every organization is a potential target for fraud, and the finance department is often the bullseye. From cleverly disguised emails to fraudulent payment requests, the tactics of cybercriminals are advancing rapidly. Drawing insights from real-world cases and industry expertise, we’ll explore the vulnerabilities in your processes and how to fortify them effectively.

Sara Grillo

AUGUST 26, 2024

We do a crypto debate podcast every year. Here’s this year’s joust which got a leeetle bit rowdy as these financial advisors hash it out. Enjoy! For those of you who are new to my blog/podcast, my name is Sara. I am a CFA® charterholder and I used to be a financial advisor. I have a newsletter in which I talk about financial advisor lead generation topics which is best described as “fun and irreverent.

Advisor Perspectives

AUGUST 26, 2024

I have listened to people bellyache about the Federal Reserve my entire adult life: Alan Greenspan lowered interest rates too much after the dot-com crash in 2000. Ben Bernanke printed too much money to bail out banks during the 2008 financial crisis.

Norman Marks

AUGUST 26, 2024

I want to share a couple of techniques I used when building the audit plan and then the audit scope, and for assessing the level of risk presented by a control failure. The first is like a reverse root cause analysis when there is a control failure. (See this earlier post.

Advisor Perspectives

AUGUST 26, 2024

Mark Zuckerberg may have a history of copying of others’ ideas, but when it comes to navigating the generative AI hype cycle, he’s the one forging a smarter path.

Advertisement

It's the time of year to give our close process some TLC. Join us in this one hour webinar where we discuss how to adopt leading practices and infuse technology into the month-end close process to improve our experience and increase our productivity during month-end and quarter-end close. Learning Objectives: This course's objective is to understand how the month-end close can be improved with automation and adoption of leading practices.

Let's personalize your content