Don’t Be Tempted By Pop-Up Estate Planning Schemes

Wealth Management

AUGUST 22, 2024

Stick with the basics when preparing for the high exemption sunset.

Wealth Management

AUGUST 22, 2024

Stick with the basics when preparing for the high exemption sunset.

Abnormal Returns

AUGUST 22, 2024

Books An excerpt from Brooke Harrington’s forthcoming book, "Offshore: Stealth Wealth and the New Colonialism." (theatlantic.com) An excerpt from “Gray Matters: A Biography of Brain Surgery,” by Dr. Theodore H. Schwartz. (wsj.com) An excerpt from "The Happiness of Dogs: Why the Unexamined Life Is Most Worth Living" by Mark Rowlands. (theguardian.com) A Q&A with Julie McFadden author of "Nothing to Fear: Demystifying Death to Live More Fully.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

AUGUST 22, 2024

The nine-person Paradigm Group will open RBC’s first branch in Cincinnati.

Abnormal Returns

AUGUST 22, 2024

Strategy Successful investors have a long time horizon. (awealthofcommonsense.com) An example of overconfidence and leverage. (novelinvestor.com) Finance The VC boom of the early 2020s is showing up in historically bad performance. (sherwood.news) Credit card companies are adding additional perks like lounges at concert venues. (wsj.com) The popularity of sports gambling as a market failure.

Speaker: Erroll Amacker

As businesses increasingly adopt automation, finance leaders must navigate the delicate balance between technology and human expertise. This webinar explores the critical role of human oversight in accounts payable (AP) automation and how a people-centric approach can drive better financial performance. Join us for an insightful discussion on how integrating human expertise into automated workflows enhances decision-making, reduces fraud risks, strengthens vendor relationships, and accelerates R

Wealth Management

AUGUST 22, 2024

Megan Glover will lead the RIA's human resources functions as it grows to more than 500 employees nationwide.

The Big Picture

AUGUST 22, 2024

My keynote at the Greater Kansas City FPA Symposium 2024 is above. They are a great group of people, and very motivated to serve their clients. The deck is an updated version of last year’s presentation to investors at the Orlando Money Show. It has evolved into a few chapters in my upcoming book (more on that to come later). The folks attending the FPA event are all CFPs and advisors, and so I tailored the presentation to ideas they can use to better serve their clients.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

A Wealth of Common Sense

AUGUST 22, 2024

Callie Cox, our new Chief Market Strategist at Ritholtz Wealth, joined me on the show this week to discuss questions about the potential for a recession, what the Fed should do now, going all in on the Nasdaq 100 in your retirement accounts and how markets move in off hours. Further Reading: What’s the Worst Long-Term Return For U.S. Stocks? 1Taxes and fees are excluded as well, of course.

Wealth Management

AUGUST 22, 2024

The segment is just ahead of interval funds among limited liquidity vehicles, according to Robert A. Stanger & Co.

Advisor Perspectives

AUGUST 22, 2024

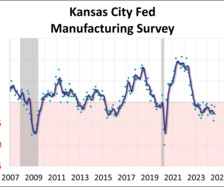

The latest Kansas City Fed Manufacturing Survey composite index did not decline as much in August following a sharper decline last month. The composite index came in at -3, up from -13 in July. Meanwhile, the future outlook increased to 8.

Wealth Management

AUGUST 22, 2024

Jason Andrews and Ross Bauer of Merritt Point Wealth Advisors demonstrate how their transition from Wells Fargo PCG to FiNet resulted in new growth opportunities.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Discipline Funds

AUGUST 22, 2024

Here are some things I think I am thinking about this week: 1) That BIG Employment Revision. The biggest news of the week was the -818K employment revision for 2024. This was the biggest revision since 2009 and very large by any measure. For perspective, here are the most recent revisions: 2018: +43K 2019: -501K 2020 -173K 2021: -165K 2022: +462K 2023: -306K Oh boy, the tinfoil hat guys are gonna have a field day with this one.

Wealth Management

AUGUST 22, 2024

A consortium led by Peter Nobel investing as much as $25 million in Cardea, which is rebranding to Fourcore Capital.

Nerd's Eye View

AUGUST 22, 2024

As advisory firm websites have become crucial to the prospecting pipeline, displaying fees can present a delicate challenge for advisors. On the one hand, displaying fees can help a client determine whether an advisor will fit into their budget and may build trust when an advisor demonstrates transparency by explaining how their fee applies to their value proposition; on the other hand, even with a clear explanation, prospects may find it difficult to understand exactly how the value of an advic

Wealth Management

AUGUST 22, 2024

The lawsuits filed in Minnesota and California federal courts come as a New York-based law firm announced a new task force looking into the controversial practice, assisted by former SEC Commissioner Robert Jackson, Jr.

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

NAIFA Advisor Today

AUGUST 22, 2024

David Wood’s journey in the financial services industry is a testament to dedication, vision, and an unwavering commitment to growth. Based in Marlborough, CT, Wood has been a loyal member of the National Association of Insurance and Financial Advisors (NAIFA) since 2024, though his connection to the field dates back to the 1990s. As the founder and principal of Gateway Financial Partners, Wood’s career is a blend of pioneering spirit and deep-rooted advocacy.

Wealth Management

AUGUST 22, 2024

Ken Leech is taking a leave of absence as co-chief investment officer after receiving a so-called Wells notice from the SEC, a warning that regulators may recommend enforcement.

Advisor Perspectives

AUGUST 22, 2024

In the week ending August 17th, initial jobless claims were at a seasonally adjusted level of 232,000. This represents an increase of 4,000 from the previous week's figure and is right in line with economist forecasts.

Carson Wealth

AUGUST 22, 2024

Social Security spousal benefits can be a crucial component of the Social Security program, designed to provide financial support to spouses — whether they are currently married, divorced or widowed. Understanding these benefits can significantly impact retirement planning and financial security in your later years. Let’s take a closer look at Social Security spousal benefits, explain who qualifies and cover important aspects such as spousal benefits after divorce and what happens to your benefi

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

Advisor Perspectives

AUGUST 22, 2024

The Chicago Fed National Activity Index (CFNAI) fell to -0.34 in July from -0.09 in June. Two of the four broad categories of indicators used to construct the index decreased from June and three categories made negative contributions in July. The index's three-month moving average, CFNAI-MA3, was unchanged at -0.06 in July.

Trade Brains

AUGUST 22, 2024

Candlestick patterns are essential tools in technical analysis, offering insights into potential market reversals and continuations. Among the less common but highly significant patterns is the “Bullish Hikkake” candlestick pattern. In this article, we shall explore the meaning, psychology, formation, and trading strategies of the Bullish Hikkake Candlestick pattern.

Advisor Perspectives

AUGUST 22, 2024

Call me Ishmael. The biggest question about an investment banking client like Elon Musk is whether he turns out to be a Moby Dick.

Walkner Condon Financial Advisors

AUGUST 22, 2024

With the expiration of the Tax Cuts and Jobs Act (TCJA) on the horizon at the end of 2025, we have had an uptick in the number of clients asking about doing Roth conversions. If you’re like “wtf is a Roth conversion?” don’t worry, I got you, keep reading.

Speaker: Sierre Lindgren

Fraud is a battle that every organization must face – it’s no longer a question of “if” but “when.” Every organization is a potential target for fraud, and the finance department is often the bullseye. From cleverly disguised emails to fraudulent payment requests, the tactics of cybercriminals are advancing rapidly. Drawing insights from real-world cases and industry expertise, we’ll explore the vulnerabilities in your processes and how to fortify them effectively.

Advisor Perspectives

AUGUST 22, 2024

Since the end of the financial crisis, economists, analysts, and the Federal Reserve have continued to predict a return to higher levels of economic growth. The hope remains that the Trillions of dollars spent during the pandemic-driven economic shutdown will turn into lasting organic economic growth.

Random Roger's Retirement Planning

AUGUST 22, 2024

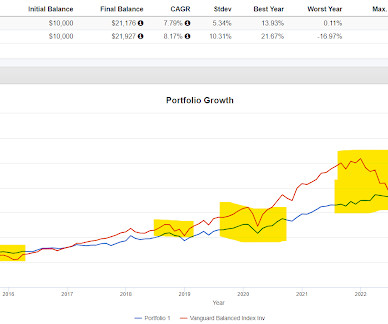

Bob Elliott who manages the Unlimited Hedge Fund ETF (HFND) had a blog post that took a dim view of the defined outcome funds, also known as buffer funds. Read the post but the following graphic stood out to me. WRT to buffer funds, Bob did the work to show whatever you're trying to achieve with a buffer fund can be done in a better way. We've made that point here quite a few times.

Meb Faber Research

AUGUST 22, 2024

Excited news to share… After almost 550 episodes, the podcast has its own website! You may have noticed we stopped posting podcast episodes here on the blog. Going forward, all episode show notes will be on the new website. Be sure to subscribe on Apple, Spotify, or YouTube! The post Podcast Update! appeared first on Meb Faber Research - Stock Market and Investing Blog.

Advisor Perspectives

AUGUST 22, 2024

Robust U.S. stock momentum hit a slowdown in the third quarter, even as strong company earnings results rolled in. Fundamental Equities’ U.S. and Developed Markets CIO Carrie King weighs in on the incongruence with three reflections from Q2 earnings season.

Advertisement

It's the time of year to give our close process some TLC. Join us in this one hour webinar where we discuss how to adopt leading practices and infuse technology into the month-end close process to improve our experience and increase our productivity during month-end and quarter-end close. Learning Objectives: This course's objective is to understand how the month-end close can be improved with automation and adoption of leading practices.

Indigo Marketing Agency

AUGUST 22, 2024

5 Steps to Client Retention for Financial Advisors As a marketing agency for financial advisors, we post a lot about growing your business and attracting new clients. But all too often we see financial advisors ignore marketing when it comes to how to retain clients once they’ve signed. The truth is a strong, consistent marketing strategy is also a great client retention strategy.

Advisor Perspectives

AUGUST 22, 2024

The euro’s August gains have been relentless, taking it to a one year high against the dollar on Wednesday, but a cautious tone from Federal Reserve Chair Jerome Powell on Friday could turn that momentum around.

Calculated Risk

AUGUST 22, 2024

CR Note: On vacation. I will return on Thursday, Sept 5th (If I don't get lost!) In December 2006, my friend Doris "Tanta" Dungey started writing for Calculated Risk. When some people say that here are few women bloggers in finance and economics, I remind them that Tanta was the best of all of us! From December 2006, until she passed away from ovarian cancer on Nov 30, 2008, Tanta was my co-blogger.

Advisor Perspectives

AUGUST 22, 2024

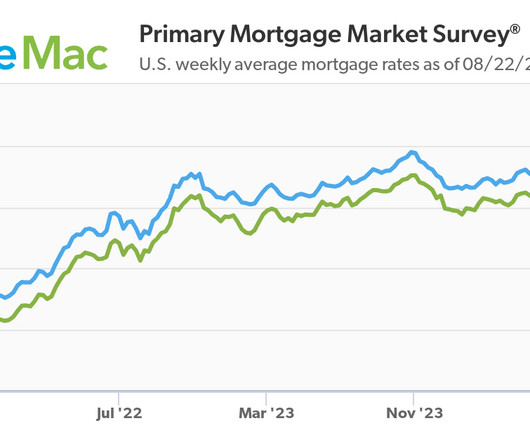

Existing home sales rose for the first time since February, ending a four-month skid. According to the data from the National Association of Realtors (NAR), existing home sales were up 1.3% from June, reaching a seasonally adjusted annual rate of 3.95 million units in July. This figure came in just above the expected 3.94 million. Existing home sales are down 2.5% compared to one year ago.

Speaker: Aaron Berson

Managing spend is more than a cost cutting exercise – it's a pathway to smarter decisions that unlock efficiency and drive growth. By understanding and refining the spending process, financial leaders can empower their organizations to achieve more with less. Explore the art of balancing financial control with operational growth. From uncovering hidden inefficiencies to designing workflows that scale your business, we’ll share strategies to align your organization’s spending with its strategic g

Let's personalize your content