GeoWealth Raises $18M Led By BlackRock

Wealth Management

JULY 25, 2024

The TAMP previously raised funding from Kayne Anderson Growth Capital and J.P. Morgan Asset Management, who also participated in the latest round.

Wealth Management

JULY 25, 2024

The TAMP previously raised funding from Kayne Anderson Growth Capital and J.P. Morgan Asset Management, who also participated in the latest round.

Abnormal Returns

JULY 25, 2024

Books A rave review of "How Tyrants Fall" by Marcel Dirsus. (forkingpaths.co) Insights from "Maxims for Thinking Analytically" by Dan Levy. (novelinvestor.com) Jim Pethokoukis talks with Ruchir Sharma, author of "What Went Wrong with Capitalism." (fasterplease.substack.com) Business PE firm Patricof & Co. is doubling down on its relationships with pro athletes.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

JULY 25, 2024

The research survey also found that this audience said it was more likely to follow advice from a human than computer-generated recommendations.

Calculated Risk

JULY 25, 2024

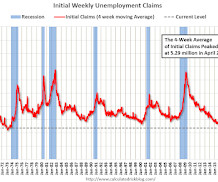

The DOL reported : In the week ending July 20, the advance figure for seasonally adjusted initial claims was 235,000 , a decrease of 10,000 from the previous week's revised level. The previous week's level was revised up by 2,000 from 243,000 to 245,000. The 4-week moving average was 235,500, an increase of 250 from the previous week's revised average.

Speaker: Erroll Amacker

Wealth Management

JULY 25, 2024

The first breakaway team to join Beacon Pointe Advisors offers a perspective on change at the wirehouses, the value of being a true fiduciary and more.

Calculated Risk

JULY 25, 2024

From the BEA: Gross Domestic Product, Second Quarter 2024 (Advance Estimate) Real gross domestic product (GDP) increased at an annual rate of 2.8 percent in the second quarter of 2024 , according to the "advance" estimate released by the U.S. Bureau of Economic Analysis. In the first quarter, real GDP increased 1.4 percent. The increase in real GDP primarily reflected increases in consumer spending, private inventory investment, and nonresidential fixed investment.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Calculated Risk

JULY 25, 2024

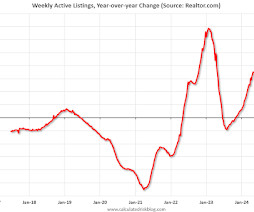

What this means: On a weekly basis, Realtor.com reports the year-over-year change in active inventory and new listings. On a monthly basis, they report total inventory. For June, Realtor.com reported inventory was up 36.7% YoY, but still down 32.4% compared to April 2017 to 2019 levels. Now - on a weekly basis - inventory is up 36.9% YoY. Realtor.com has monthly and weekly data on the existing home market.

Wealth Management

JULY 25, 2024

Brad Morgan joins from Mariner Wealth Advisors, which is suing him and the tech-focused RIA for poaching books of business.

Nerd's Eye View

JULY 25, 2024

About a decade or so ago, one of the most pressing issues facing the financial advice industry was the threat of an imminent deluge of advisor retirements coupled with a paucity of succession plans to transition clients to the next generation. While that scenario has yet to materialize as initially feared, the fact remains that transitions do occur on a regular basis, often as older advisors either sell their practices in one fell swoop or gradually offload part of their book while still staying

Wealth Management

JULY 25, 2024

The acquisition of the three East Coast-based firms will push F.L.Putnam’s assets under advisement above $10 billion, and its AUM will reach about $7.9 billion.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Calculated Risk

JULY 25, 2024

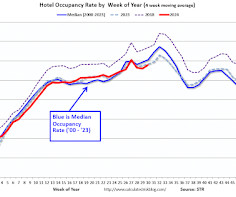

From STR: U.S. hotel results for week ending 20 July The U.S. hotel industry reported higher performance results than the previous week and positive comparisons year over year, according to CoStar’s latest data through 20 July. 14-20 July 2024 (percentage change from comparable week in 2023): • Occupancy: 73.5% (+1.0%) • Average daily rate (ADR): US$165.91 (+2.4%) • Revenue per available room (RevPAR): US$122.02 (+3.4%) emphasis added The following graph shows the seasonal pattern for the hotel

Wealth Management

JULY 25, 2024

Bradford Smithy and Robert Tamarkin are joining the venture launched by former Sanctuary Wealth CEO Jim Dickson, which aims to help smaller RIAs grow.

Calculated Risk

JULY 25, 2024

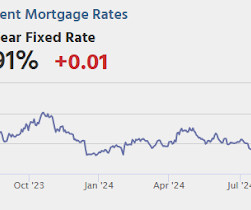

Note: Mortgage rates are from MortgageNewsDaily.com and are for top tier scenarios. Friday: • At 8:30 AM ET, Personal Income and Outlays, June 2024. The consensus is for a 0.4% increase in personal income, and for a 0.2% increase in personal spending. And for the Core PCE price index to increase 0.2%. PCE prices are expected to be up 2.6% YoY, and core PCE prices up 2.6% YoY. • At 10:00 AM, University of Michigan's Consumer sentiment index (Final for July).

Wealth Management

JULY 25, 2024

Your ability to communicate your mission, vision and values builds credibility, trust, and, most importantly, an identity in the increasingly crowded RIA space.

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

Calculated Risk

JULY 25, 2024

Today, in the Calculated Risk Real Estate Newsletter: Watch Months-of-Supply! A brief excerpt: Both inventory and sales are well below normal levels, and I think we need to keep an eye on months-of-supply to forecast price changes. Historically nominal prices declined when months-of-supply approached 6 months - and that is unlikely this year - but we could see months-of-supply back to 2019 levels in the next month or two.

Wealth Management

JULY 25, 2024

Growing numbers of advisors are moving their newsletters to Substack.

Abnormal Returns

JULY 25, 2024

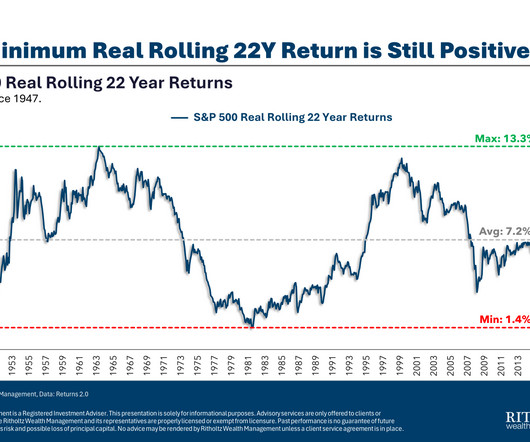

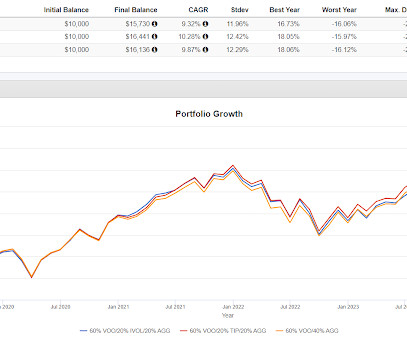

Markets UK stocks look cheap. (ft.com) July has seen a big bounceback in small caps. (bilello.blog) Strategy How much do 20-year real stock market returns vary over time? (awealthofcommonsense.com) Don't hedge equities with equities. (rogersplanning.blogspot.com) Bill Ackman Bill Ackman doesn't want investors to think about Pershing Square USA as a close-end fun.

Wealth Management

JULY 25, 2024

U.S. ETFs are on pace for more than $700 billion in net flows in 2024, and net assets stand at more than $9 trillion.

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

Carson Wealth

JULY 25, 2024

Owning a business can be like parenting. You’ve likely experienced many sleepless nights and spent a countless amount of energy on your “baby.” Like parenting, being a business owner can be an enriching journey and make life worth the trip. To protect your business, you need the right mix of insurance. From the relationships that make your business run to the building it’s housed in, insurance can help prevent devastating financial losses or legal consequences.

Wealth Management

JULY 25, 2024

Do not allow partisanship to impact investment decisions.

A Wealth of Common Sense

JULY 25, 2024

My colleagues Dan LaRosa and Cameron Rufus joined me on the show this week to discuss questions about how to find the best auto insurance rates, owner-only defined benefit plans, finding clients as a financial advisor and how much of your portfolio should be in alternative investments. Further Reading: When is Mean Reversion Coming in the Stock Market The post What’s the Worst Long-Term Return For U.S.

Wealth Management

JULY 25, 2024

Merrill will move some of its 641 sports and entertainment wealth advisers to IMG Academy’s campus to host parent and student teach-ins and simulations that show students what it is like to invest in a real financial market.

Speaker: Sierre Lindgren

Fraud is a battle that every organization must face – it’s no longer a question of “if” but “when.” Every organization is a potential target for fraud, and the finance department is often the bullseye. From cleverly disguised emails to fraudulent payment requests, the tactics of cybercriminals are advancing rapidly. Drawing insights from real-world cases and industry expertise, we’ll explore the vulnerabilities in your processes and how to fortify them effectively.

Advisor Perspectives

JULY 25, 2024

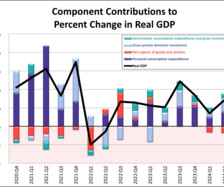

The U.S. economy grew at a faster than expected pace during the second quarter of this year. Real gross domestic product increased at an annual rate of 2.8% in Q2 2024, according to the advance estimate. The latest estimate is above the forecasted 2.0% growth and is a pickup from the Q1 2023 GDP final estimate of 1.4%.

SEI

JULY 25, 2024

Financial Services Leader’s Diverse Experience to Bolster Strategic Growth

Random Roger's Retirement Planning

JULY 25, 2024

Lots of ETF stuff today. First, starting last fall, I walked everyone through my test drive of the Defiance NASDAQ 100 Enhanced Options Income Fund (QQQY). It sells 0dte puts on the NASDAQ 100 and generates a huge "dividend." On a price basis, the fund can't keep up with the payout, not even close. It came out last fall at about $20/share and today it is just under $14.00.

NAIFA Advisor Today

JULY 25, 2024

One-third of financial advisors are predicted to retire in the next 10 years, creating an opportunity for advisors looking to grow or sell their practice. Join NAIFA member, David Wood, for the "M&A Summit: Opportunity of a Lifetime", offered in-person and virtually throughout the rest of 2024. Industry professionals come together for an in-depth exploration of mergers and acquisitions and learn how to harness the wave of retiring advisors to capitalize on this opportunity.

Advertisement

It's the time of year to give our close process some TLC. Join us in this one hour webinar where we discuss how to adopt leading practices and infuse technology into the month-end close process to improve our experience and increase our productivity during month-end and quarter-end close. Learning Objectives: This course's objective is to understand how the month-end close can be improved with automation and adoption of leading practices.

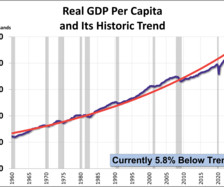

Advisor Perspectives

JULY 25, 2024

The advance estimate for Q2 GDP came in at 2.84%, an acceleration from 1.41% for the Q1 final estimate. With a per-capita adjustment, the headline number is lower at 2.37%, a pickup from 0.95% for the Q1 headline number.

Inside Information

JULY 25, 2024

Did you know that World Investment Advisors recently acquired a Raymond James RIA with $3.5 billion in assets under management? Or that AssetMark is acquiring $12 billion in client assets from Morningstar? Or that Craig Hawley has been hired to run Nationwide’s annuity business? You might be interested to know that Arkadios Capital recruited a former LPL team that manages $850 million in client assets.

Advisor Perspectives

JULY 25, 2024

Real gross domestic product (GDP) is comprised of four major subcomponents. In the Q2 GDP advance estimate, three of the four components made positive contributions.

Norman Marks

JULY 25, 2024

My thanks to Hal Garyn for raising this issue in a recent LinkedIn post. He relates: Internal audit should, of course, be doing follow-up on key/material audit observations, but it is management that owns not only the corrective actions but to do its own follow-up.

Speaker: Aaron Berson

Managing spend is more than a cost cutting exercise – it's a pathway to smarter decisions that unlock efficiency and drive growth. By understanding and refining the spending process, financial leaders can empower their organizations to achieve more with less. Explore the art of balancing financial control with operational growth. From uncovering hidden inefficiencies to designing workflows that scale your business, we’ll share strategies to align your organization’s spending with its strategic g

Let's personalize your content