The “Art” of Market Timing

The Big Picture

NOVEMBER 27, 2023

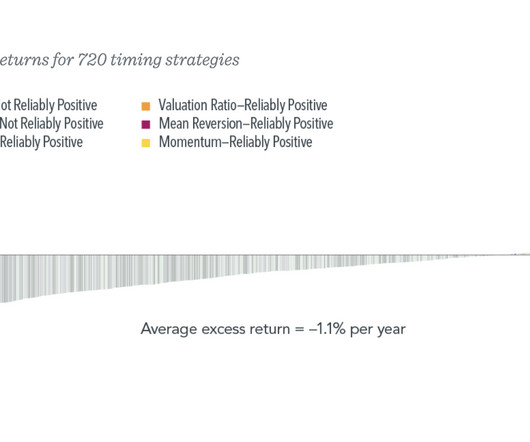

This weekend Jeff Sommer discussed a DFA research paper on market timing; both are well worth your time to read. The broad strokes are: Market timing is extremely difficult, very few people (if any) do it consistently well. Not only are the odds stacked against you, but very often systems that have successfully timed the market have been simply lucky, and do not succeed in out-of-sample tests.

Let's personalize your content