At the Money: How to Pay Less Capital Gains Taxes

The Big Picture

JANUARY 24, 2024

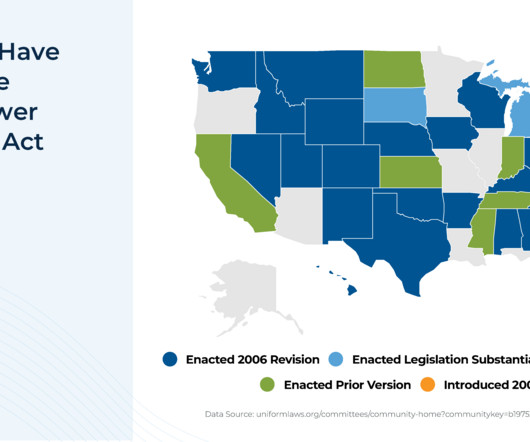

At the Money: How to Pay Less Capital Gains Taxes (January 24, 2024) We’re coming up on tax season, after a banner year for stocks. Successful investors could be looking at a big tax bill from the US government. How can you avoid sticker shock when Uncle Sam comes knocking? On this episode of At the Money, we look at direct indexing as a way to manage capital gains taxes.

Let's personalize your content