$800M Team Joins Raymond James’ Independent Channel From Commonwealth

Wealth Management

MAY 8, 2024

An advisor team collectively manging $800 million in assets are joining Raymond James' independent channel from Commonwealth.

Wealth Management

MAY 8, 2024

An advisor team collectively manging $800 million in assets are joining Raymond James' independent channel from Commonwealth.

Calculated Risk

MAY 8, 2024

Today, in the Calculated Risk Real Estate Newsletter: 1st Look at Local Housing Markets in April A brief excerpt: NOTE: The tables for active listings, new listings and closed sales all include a comparison to April 2019 for each local market (some 2019 data is not available). This is the first look at several early reporting local markets in April.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

MAY 8, 2024

Taxpayers must apply for a private letter ruling to get an extension.

Abnormal Returns

MAY 8, 2024

Markets Earnings continue to be supportive of the bull market. (carsongroup.com) Measures of corporate sentiment are ticking higher. (wsj.com) ETFs The number of single-stock ETFs is growing. (wsj.com) Good performance need not equal AUM. (etf.com) Sports business Sports betting companies are looking for new ways to get your money. (cnn.com) Can a sports league have too much inventory?

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

Wealth Management

MAY 8, 2024

A recent New York Times article suggested that Blackstone's non-traded REIT is inflating its property valuations. But real estate industry insiders say they are not worried.

Abnormal Returns

MAY 8, 2024

Podcasts Brett McKay talks with Jared Dillian author of "No Worries: How to Live a Stress-Free Financial Life." (artofmanliness.com) Cameron Passmore and Benamin Felix talk with Scott Galloway author of "The Algebra of Wealth: A Simple Formula for Financial Security." (rationalreminder.libsyn.com) Barry Ritholtz talks with Larry Swedroe about the challenge of stock picking.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Calculated Risk

MAY 8, 2024

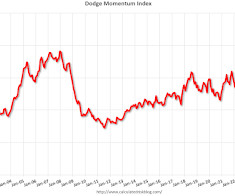

From Dodge Data Analytics: Dodge Momentum Index Rose 6% in April The Dodge Momentum Index (DMI), issued by Dodge Construction Network, increased 6.1% in April to 173.9 (2000=100) from the revised March reading of 164.0. Over the month, commercial planning improved 12.6% and institutional planning dropped 6.3%. “The Dodge Momentum Index (DMI) saw positive progress in April, alongside a deluge of data center projects that entered the planning stage ,” stated Sarah Martin, associate director of for

Wealth Management

MAY 8, 2024

Helping skeptical clients hedge their bets on tax law change.

Nerd's Eye View

MAY 8, 2024

Measuring a client's tolerance for risk is an essential (and required!) step when onboarding a new client, as making any sort of recommendation is impossible without first understanding how comfortable clients may be when their portfolios inevitably experience volatility. Over the years, 2 types of measurement tools have emerged as the standards for assessing risk tolerance: 1) psychometric tests, which feature a series of questions (such as, "What amount of risk do you feel you have taken with

Wealth Management

MAY 8, 2024

McCartan, who became CMO at Hightower in July 2022, shared the “bittersweet update” that she had departed the firm, saying she was unsure but excited about her next opportunity.

Speaker: Erroll Amacker

As businesses increasingly adopt automation, finance leaders must navigate the delicate balance between technology and human expertise. This webinar explores the critical role of human oversight in accounts payable (AP) automation and how a people-centric approach can drive better financial performance. Join us for an insightful discussion on how integrating human expertise into automated workflows enhances decision-making, reduces fraud risks, strengthens vendor relationships, and accelerates R

Calculated Risk

MAY 8, 2024

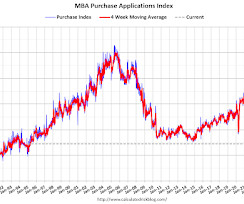

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey Mortgage applications increased 2.6 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending May 3, 2024. The Market Composite Index, a measure of mortgage loan application volume, increased 2.6 percent on a seasonally adjusted basis from one week earlier.

Wealth Management

MAY 8, 2024

Open, honest and candid discussion about the first lawsuit against the DOL fiduciary rule, April job numbers, JP Morgan data breach and more.

Calculated Risk

MAY 8, 2024

Here is another monthly update on lumber prices. SPECIAL NOTE: The CME group discontinued the Random Length Lumber Futures contract on May 16, 2023. I've now switched to a new physically-delivered Lumber Futures contract that was started in August 2022. Unfortunately, this impacts long term price comparisons since the new contract was priced about 24% higher than the old random length contract for the period when both contracts were available.

Wealth Management

MAY 8, 2024

Outside stakeholders have long encouraged the IRS to expand ways to resolve disputes with the agency.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Calculated Risk

MAY 8, 2024

Note: Mortgage rates are from MortgageNewsDaily.com and are for top tier scenarios. Thursday: • At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 206 thousand initial claims, down from 208 thousand last week.

Wealth Management

MAY 8, 2024

Transcript of Episode 105 of 401(k) Real Talk.

The Big Picture

MAY 8, 2024

APPLE EMBED At The Money: Concentrated Portfolios: Andrew Slimmon, Morgan Stanley (May 8, 2024) Are your expensive active mutual funds and ETFs actually active? Or, as is too often the case, are they only pretending to be active? Do they charge a high active fee but then behave more like an index fund? AndrewToday, we discuss the advantages of concentrated portfolios.

Advisor Perspectives

MAY 8, 2024

The idea that power is inherently corrupting has been repeatedly proven throughout history. From politics to business to religion, there are countless examples of individuals who succumb to corruption and abuse their authority.

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

Trade Brains

MAY 8, 2024

Bearish Harami Candlestick Pattern: Technical analysis is a method for forecasting future price movements using previous market data, with a primary focus on price and volume. Candlestick patterns stand out as visual representations of price activity over a set span. These patterns, created by open, high, low, and close prices, provide information on market mood and prospective trend reversals or continuations.

A Wealth of Common Sense

MAY 8, 2024

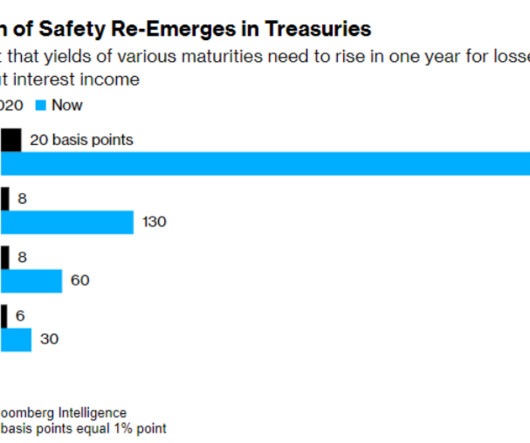

Today’s Animal Spirits is brought to you by Simplify ETFs: See here for more information on Simplify’s suite of active-income solutions! On today’s show, we discuss: At $2M per minute, treasuries mint cash like never before Cost of capital and capital allocation The new math of driving your car till the wheels fall off Consumers fed up with food costs are ditching big brands Long-predicted c.

Advisor Perspectives

MAY 8, 2024

Europe's mild recession is over, with growth expected to continue. Valuations for eurozone stocks remain attractive, offering the potential for further price appreciation.

Random Roger's Retirement Planning

MAY 8, 2024

ETF Think Tank had a fun article looking at a bunch of specialty ETFs in pursuit of building a FIRE (financial independence/retire early) portfolio. The article was right up my alley as far as looking beyond the standard VTI, AGG and so on. The point is not read the article and then run out and buy those funds but is there anything to learn from the article about portfolio construction or how assets blend together?

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

Advisor Perspectives

MAY 8, 2024

The FOMC has enough factors to consider without adding politics to the mix.

Discipline Funds

MAY 8, 2024

Here’s an interview I did with Oliver Renick on the Schwab Network from Wednesday discussing the macro outlook and the risks in the coming 12 months. My baseline assumption is that growth will continue to moderate in the 2-3% RGDP range and the disinflationary trend will persiste thru year-end, albeit at a lower rate than we saw last year. I expected Core PCE to end the year around 2.3%.

Advisor Perspectives

MAY 8, 2024

Your clients deserve access to key players to take the field in dealing with each aspect of their financial lives, and so do you.

The Irrelevant Investor

MAY 8, 2024

Today’s Animal Spirits is brought to you by Simplify ETFs: See here for more information on Simplify’s suite of active-income solutions! On today’s show, we discuss: At $2M per minute, treasuries mint cash like never before Cost of capital and capital allocation The new math of driving your car till the wheels fall off Consumers fed up with food costs are ditching big brands Long-predicted c.

Speaker: Sierre Lindgren

Fraud is a battle that every organization must face – it’s no longer a question of “if” but “when.” Every organization is a potential target for fraud, and the finance department is often the bullseye. From cleverly disguised emails to fraudulent payment requests, the tactics of cybercriminals are advancing rapidly. Drawing insights from real-world cases and industry expertise, we’ll explore the vulnerabilities in your processes and how to fortify them effectively.

Advisor Perspectives

MAY 8, 2024

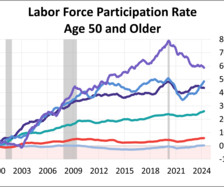

The labor force participation rate (LFPR) is a simple computation: You take the civilian labor force (people aged 16 and over employed or seeking employment) and divide it by the civilian non-institutional population (those 16 and over not in the military and or committed to an institution). As of April, the labor force participation rate is at 62.7%, unchanged from the previous month.

NAIFA Advisor Today

MAY 8, 2024

Evan Fabricant is a financial advisor committed to assisting his clients in achieving their financial goals. He provides cutting-edge solutions prioritizing his clients' objectives, whether planning for retirement or exploring efficient strategies to pass on their wealth to the next generation. Evan has been advising clients since 1997, inspired by his father's career in the same field.

Advisor Perspectives

MAY 8, 2024

Today, one in three of the 65-69 cohort, nearly one in five of the 70-74 cohort, and nearly one in ten of the 75+ cohort are in the labor force.

International College of Financial Planning

MAY 8, 2024

Completing high school marks a significant milestone, opening many pathways for students. In this context, a short term course after 12th , especially within the finance sector, can be an astute choice. These courses are tailored to be time-efficient, allowing students to acquire professional skills and knowledge quickly. By focusing on specific career-oriented competencies, students are well-prepared to meet the demands of the industry without the time commitment required by traditional four-ye

Advertisement

It's the time of year to give our close process some TLC. Join us in this one hour webinar where we discuss how to adopt leading practices and infuse technology into the month-end close process to improve our experience and increase our productivity during month-end and quarter-end close. Learning Objectives: This course's objective is to understand how the month-end close can be improved with automation and adoption of leading practices.

Let's personalize your content