$4B Ritholtz Hires Callie Cox as First Chief Market Strategist

Wealth Management

JUNE 17, 2024

Cox, a former investment analyst at eToro, will be Ritholtz Wealth Management’s first market expert fully dedicated to its advisors.

Wealth Management

JUNE 17, 2024

Cox, a former investment analyst at eToro, will be Ritholtz Wealth Management’s first market expert fully dedicated to its advisors.

The Big Picture

JUNE 17, 2024

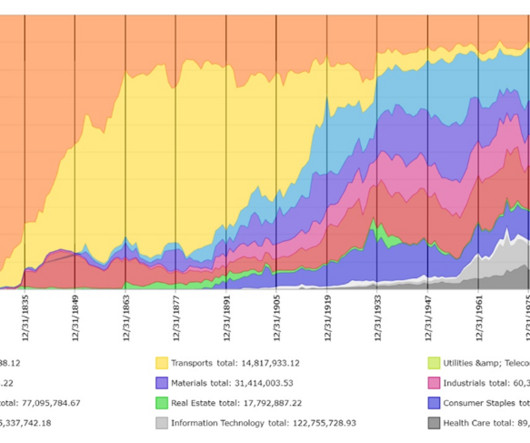

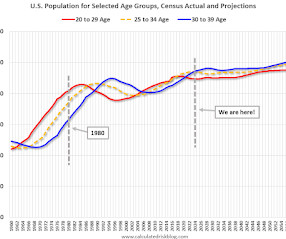

A quick break from book authorship to share a fascinating set of data and charts, via Sam Ro. In his weekly missive, Sam points to some amazing charts from Global Financial Data. They are based on historical data that looks at 200 Years of Market Concentration. You might be surprised at the findings. As the chart above shows, there are long periods of market concentration.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

JUNE 17, 2024

How an $8,000 marketing investment turned into a $650,000 risk.

Abnormal Returns

JUNE 17, 2024

Markets Big technological transitions are often associated with increase market concentration. (ritholtz.com) Every bull market is different. (bloomberg.com) Strategy Short-termism will crush a stock market investor. (awealthofcommonsense.com) Three things financial charlatans say including 'Here's how to get guaranteed returns.' (dariusforoux.com) Conor Mac, "The longer you invest, the more rocks you turn over, and the more you learn from mistakes, the sharper your perception grows over time. "

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

Wealth Management

JUNE 17, 2024

This represents Allworth’s 18th California location, its fifth deal this year and 36th acquisition since 2018. Allworth now has 42 offices nationwide.

Abnormal Returns

JUNE 17, 2024

Podcasts Matt Zeigler talks with Daniel Crosby about his new book "The Soul of Wealth" and much more. (epsilontheory.com) Michael Kitces talks with Mark Berg, Founder of Timothy Financial Counsel, about using an hourly fee model. (kitces.com) Amy Arnott and Christine Benz talk with Andrew Blake who is associate director of wealth management for Cerulli Associates about the upcoming wave of adviser retirements.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Nerd's Eye View

JUNE 17, 2024

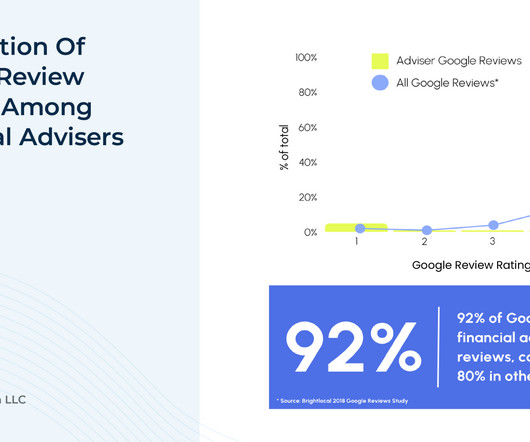

Online reviews are commonly given and used by consumers across many industries, from finding a good restaurant in a new town to reviewing a lawn care service provider. Nonetheless, fewer than 10% of SEC-registered investment advisers report using them, even though the SEC’s updated investment adviser marketing rule allows financial advisors to proactively encourage testimonials (from clients), use endorsements (from non-clients), and highlight their own ratings on various third-party revie

Wealth Management

JUNE 17, 2024

Opto Investments' Jake Miller provides insights on the current state and future trends within private investments.

Calculated Risk

JUNE 17, 2024

Altos reports that active single-family inventory was up 1.5% week-over-week. Inventory is now up 25.6% from the February bottom, and at the highest level since July 2020. Click on graph for larger image. This inventory graph is courtesy of Altos Research. As of June 14th, inventory was at 621 thousand (7-day average), compared to 612 thousand the prior week.

Wealth Management

JUNE 17, 2024

Requiring greater collaboration, cutting edge technology and enabled workers and partners.

Speaker: Erroll Amacker

As businesses increasingly adopt automation, finance leaders must navigate the delicate balance between technology and human expertise. This webinar explores the critical role of human oversight in accounts payable (AP) automation and how a people-centric approach can drive better financial performance. Join us for an insightful discussion on how integrating human expertise into automated workflows enhances decision-making, reduces fraud risks, strengthens vendor relationships, and accelerates R

Calculated Risk

JUNE 17, 2024

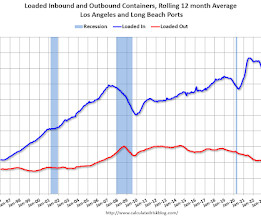

Container traffic gives us an idea about the volume of goods being exported and imported - and usually some hints about the trade report since LA area ports handle about 40% of the nation's container port traffic. The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

Wealth Management

JUNE 17, 2024

After a relatively quiet April, asset managers cranked up the pace of launches in May with 50 new funds hitting the market.

Calculated Risk

JUNE 17, 2024

From Matthew Graham at Mortgage News Daily: Mortgage Rates Back Above 7% to Start New Week Mortgage rates moved modestly higher to start the new week. With the average top tier 30yr fixed rate just under 7% on Friday, this meant a move to just over 7% today. [ 30 year fixed 7.05% ] emphasis added Tuesday: • At 8:30 AM: Retail sales for May is scheduled to be released.

Wealth Management

JUNE 17, 2024

After suffering outflows in January, these long-only systematic funds popular with the retail crowd have now enjoyed five consecutive months of inflows and are on track to beat 2023’s haul.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Calculated Risk

JUNE 17, 2024

Today, in the Calculated Risk Real Estate Newsletter: Comparing the Current Housing Market to the 1978 to 1982 period A brief excerpt: In March 2022, I wrote: Housing: Don't Compare the Current Housing Boom to the Bubble and Bust It is natural to compare the current housing boom to the mid-00s housing bubble. The bubble and subsequent bust are part of our collective memories.

Wealth Management

JUNE 17, 2024

Schwab is the fifth-largest issuer of exchange-traded funds in the US, with its nearly $350 billion suite having more than doubled since 2019.

Alpha Architect

JUNE 17, 2024

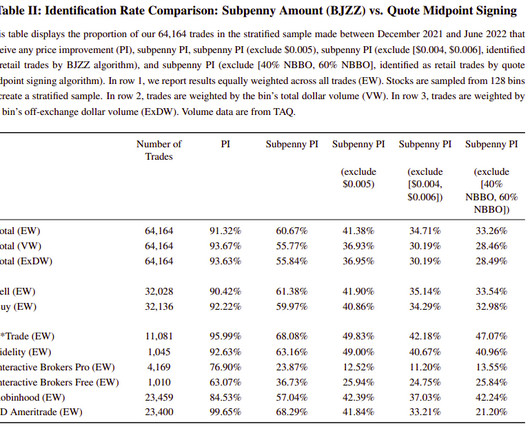

This paper explores the effectiveness of the BJZZ algorithm, developed by Boehmer, Jones, Zhang, and Zhang (2021), in identifying and signing retail trades executed off exchanges with subpenny price improvements. A (Sub)penny For Your Thoughts was originally published at Alpha Architect. Please read the Alpha Architect disclosures at your convenience.

Advisor Perspectives

JUNE 17, 2024

In periods of positive stock/bond correlations, the case for diversified sources of return is much clearer. With stocks and bonds now showing their strongest positive correlation in almost 30 years, the natural diversification and risk protection that a traditional 60/40 portfolio offers is open to question.

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

A Wealth of Common Sense

JUNE 17, 2024

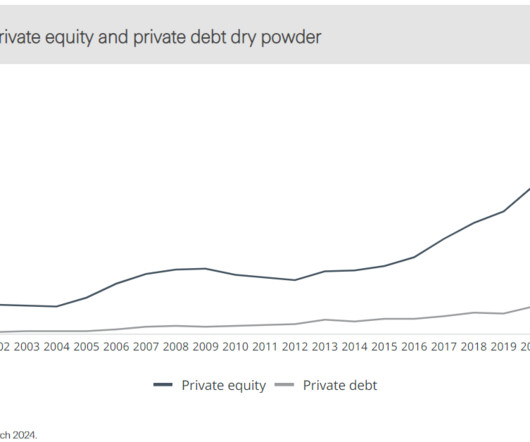

Today’s Talk Your Book is brought to you by StepStone Private Wealth: See here to learn more about investing in StepStone Private Wealth strategies and here for disclosure information On today’s show, we are joined by Bob Long, CEO of StepStone Private Wealth to give us insight into their latest Private Credit Fund CRDEX On today’s show, we discuss: What private credit is and how it works The reason.

MainStreet Financial Planning

JUNE 17, 2024

“MainStreet Chalk Talk” The MainStreet Financial Planning Discussion Club When : Thursday, June 27th at 6pm Eastern; 3pm Pacific ~30-45 minutes Recorded and able to retrieve for one week How : Zoom Meeting Free for current clients, $10 for guests Register here! Navigating Transitions with Purpose and Passion Hosted by: Anna Sergunina , CFP® Guest: Luanne Mullin, Retirement Counselor Retirement is a complex and exciting phase of life that we spend years working, saving, investing, and preparing

Random Roger's Retirement Planning

JUNE 17, 2024

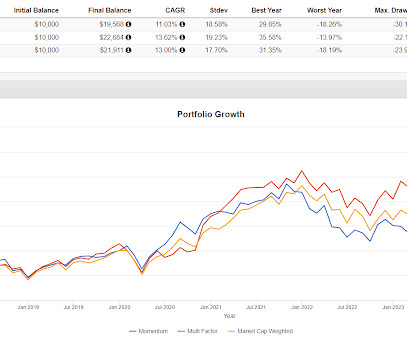

Bloomberg wrote about factor strategies and the ETFs that track those factors. They included this table. There's a lot here I don't understand. Growth is up a lot more than 1.5%. Whatever they mean by Revisions or Trade Activity, I am not aware of ETFs that track these. If you can figure out what I am missing please leave a comment. We've looked at factor investing before and as we revisit it today, really this could be Part 2 from yesterday's post about the challenges of being patient.

Carson Wealth

JUNE 17, 2024

Earnings Expectations Continue to Rise The summer rally continued last week, the S&P 500 gaining 1.4% and hitting more all-time highs. Stock gains ultimately depend on earnings and they continue to look good in both the short and long run. Inflation data finally provided some relief, with the Consumer Price Index coming in below expectations. Despite reining in expectations, the Fed is still likely to cut rates 1-2 times this year.

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

Advisor Perspectives

JUNE 17, 2024

Albert Einstein supposedly said that compound interest is the most powerful force in the universe. (He didn’t.) Thanks to neuronal adaptation, however, amnesia is the most powerful force in the financial universe.

Harness Wealth

JUNE 17, 2024

FOR IMMEDIATE RELEASE NEW YORK, NY — June 17, 2024: Harness, a New York-based fintech startup that is building the future of tax, announced today it has added another member to its leadership team. Steve Cheung, who most recently served as Architect and Director of Engineering at Flatiron Health, joins Harness as its Head of Engineering. Mr. Cheung brings nearly three decades of experience building high-performing teams and bringing technical products to market.

Advisor Perspectives

JUNE 17, 2024

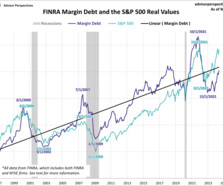

FINRA has released new data for margin debt, now available through May. The latest debt level fell for the first time in six months to $809.43 billion. Margin debt is up 4.4% month-over-month (MoM) and up 25.7% year-over-year (YoY). However, after adjusting for inflation, debt level is up 4.0% MoM and up 21.4% YoY.

Financial Symmetry

JUNE 17, 2024

Have you considered how your instincts influence your decision-making around retirement planning? Our natural instincts and biases create frameworks that lead our perspectives on how we think the world works. These frameworks influence our decisions surrounding our financial decisions. On … Continued The post How to Build Prosperity Through Your Perspective, Ep #218 appeared first on Financial Symmetry, Inc.

Speaker: Sierre Lindgren

Fraud is a battle that every organization must face – it’s no longer a question of “if” but “when.” Every organization is a potential target for fraud, and the finance department is often the bullseye. From cleverly disguised emails to fraudulent payment requests, the tactics of cybercriminals are advancing rapidly. Drawing insights from real-world cases and industry expertise, we’ll explore the vulnerabilities in your processes and how to fortify them effectively.

Advisor Perspectives

JUNE 17, 2024

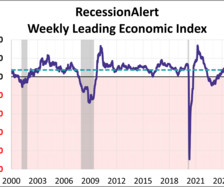

The weekly leading economic index (WLEI) is a composite for the U.S economy that draws from over 20 time-series and groups them into the following six broad categories which are then used to construct an equally weighted average. As of June 7th, the index was at 22.091, up 0.638 from the previous week, with 5 of the 6 components in expansion territory.

Sara Grillo

JUNE 17, 2024

The regulators don’t force insurance companies to provide in-force illustrations to their Universal Life policy holders and it allows them to deceive consumers who aren’t prepared to do the math required to know the truth. Insurance companies make Bernie Madoff look like a petty thief. Don’t fall for it! But before we get into it… Look, there are alot of schmucks out there hawking crap products disguised as financial advice.

Advisor Perspectives

JUNE 17, 2024

All eight of the indexes on our world watch list have posted gains through June 17, 2024. The U.S.'s S&P 500 finished in the top spot with a YTD gain of 15.40%. Tokyo's Nikkei 225 finished in second with a YTD gain of 13.86% while India's BSE SENSEX finished in third with a YTD gain of 7.09%.

Indigo Marketing Agency

JUNE 17, 2024

The internet is famously anonymous, casual, and voyeuristic. The vast majority of people who end up on any page of your website will read a bit, maybe give your page a timid scroll, then disappear forever, never to return. But how can we pump up the persuasion and turn your professional service into more than just an idle web page they glanced at for 12 seconds?

Advertisement

It's the time of year to give our close process some TLC. Join us in this one hour webinar where we discuss how to adopt leading practices and infuse technology into the month-end close process to improve our experience and increase our productivity during month-end and quarter-end close. Learning Objectives: This course's objective is to understand how the month-end close can be improved with automation and adoption of leading practices.

Let's personalize your content