Wrongfully Detained Americans Welcomed Back with IRS Penalties

Wealth Management

AUGUST 14, 2024

The agency doesn’t have the authority to fully forgive fines and interest.

Wealth Management

AUGUST 14, 2024

The agency doesn’t have the authority to fully forgive fines and interest.

Calculated Risk

AUGUST 14, 2024

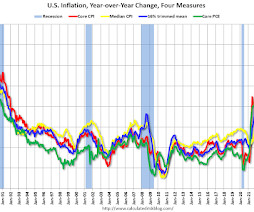

Here are a few measures of inflation: The first graph is the one Fed Chair Powell had mentioned when services less rent of shelter was up around 8% year-over-year. This declined and is now up 4.6% YoY. Click on graph for larger image. This graph shows the YoY price change for Services and Services less rent of shelter through July 2024. Services were up 4.9% YoY as of July 2024, down from 5.0% YoY in June.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

AUGUST 14, 2024

More than two dozen broker/dealers and RIAs agreed to pay a combined $392.75 million in penalties, including Raymond James, LPL, Edward Jones and Osaic, among others.

Calculated Risk

AUGUST 14, 2024

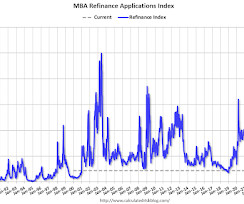

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey Mortgage applications increased 16.8 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Applications Survey for the week ending August 9, 2024. The Market Composite Index, a measure of mortgage loan application volume, increased 16.8 percent on a seasonally adjusted basis from one week earlier.

Speaker: Erroll Amacker

As businesses increasingly adopt automation, finance leaders must navigate the delicate balance between technology and human expertise. This webinar explores the critical role of human oversight in accounts payable (AP) automation and how a people-centric approach can drive better financial performance. Join us for an insightful discussion on how integrating human expertise into automated workflows enhances decision-making, reduces fraud risks, strengthens vendor relationships, and accelerates R

Wealth Management

AUGUST 14, 2024

According to the commission, Russell Todd Burkhalter, the CEO of Drive Planning, allegedly used new funds to pay existing investors’ returns and personal expenses, including yacht and private jet payments.

Abnormal Returns

AUGUST 14, 2024

Companies Mars Inc. is buying Cheez-It maker Kellanova ($K). (wsj.com) Tilray Brands ($TLRY) has acquired four craft breweries from Molson Coors ($TAP). (finance.yahoo.com) Finance How much of the work of a junior analyst can be done by AI? (ft.com) Reverse stock splits are usually a last ditch effort. (sherwood.news) Fund management Ten questions for Vanguard's new CEO Salim Ramji.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Abnormal Returns

AUGUST 14, 2024

Podcasts Barry Ritholtz talks with Meir Statman, author of “A Wealth of Well-Being: A Holistic Approach to Behavioral Finance.” (ritholtz.com) Carl Richards talks money mindfulness with Sharon Salzberg. (50fires.com) Steve Chen talks financial education with Tim Ranzetta, founder of Next Generation Personal Finance. (newretirement.com) Jess Bost and Mark Newfield talk with Dave Nadig about planning for big professional transitions.

Calculated Risk

AUGUST 14, 2024

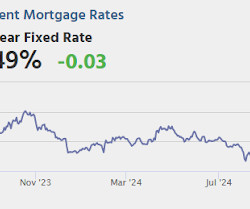

Today, in the Calculated Risk Real Estate Newsletter: Part 2: Current State of the Housing Market; Overview for mid-August 2024 A brief excerpt: Yesterday, in Part 1: Current State of the Housing Market; Overview for mid-August 2024 I reviewed home inventory, housing starts and sales. In Part 2, I will look at house prices, mortgage rates, rents and more.

Wealth Management

AUGUST 14, 2024

Perigon Wealth Management's Beth Bosworth explains why advisors should throw traditional minimums “out the window” to attract next-gen clients.

Calculated Risk

AUGUST 14, 2024

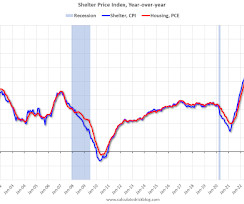

From the BLS : The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.2 percent on a seasonally adjusted basis , after declining 0.1 percent in June, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 2.9 percent before seasonal adjustment. The index for shelter rose 0.4 percent in July, accounting for nearly 90 percent of the monthly increase in the all items index.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Wealth Management

AUGUST 14, 2024

Our speakers will cover the basics of private foundations, including what they are, the basic requirements for creating and maintaining them, which clients will benefit from creating them, their tax implications and how they differ from donor-advised

Calculated Risk

AUGUST 14, 2024

Note: Mortgage rates are from MortgageNewsDaily.com and are for top tier scenarios. Thursday: • At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 238 thousand initial claims, up from 233 thousand last week. • Also at 8:30 AM, Retail sales for July is scheduled to be released. The consensus is for 0.3% increase in retail sales. • Also at 8:30 AM, The New York Fed Empire State manufacturing survey for August.

Wealth Management

AUGUST 14, 2024

In the newly created role as CMO, Samantha Schwimmer will help Advyzon move into new market segments.

Calculated Risk

AUGUST 14, 2024

The Cleveland Fed released the median CPI and the trimmed-mean CPI. According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.3% in July. The 16% trimmed-mean Consumer Price Index increased 0.2%. "The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics’ (BLS) monthly CPI report".

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

Wealth Management

AUGUST 14, 2024

The Securities Industry and Financial Markets Association filed a lawsuit against the regulation that took effect last year, saying there was “no precedent for it in the securities laws.

Advisor Perspectives

AUGUST 14, 2024

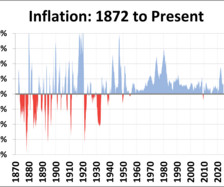

The Consumer Price Index for Urban Consumers (CPI-U) released for July puts the year-over-year inflation rate at 2.89%. The latest reading keeps inflation below the 3.74% average since the end of the Second World War for the 14th straight month. However, inflation remains above the 10-year moving average which is now at 2.83%.

Wealth Management

AUGUST 14, 2024

Open, honest and candid discussion about lawsuits against TIAA and Morningstar, CITs bigger than mutual funds in TDFs, private equity in retirement plans and more.

A Wealth of Common Sense

AUGUST 14, 2024

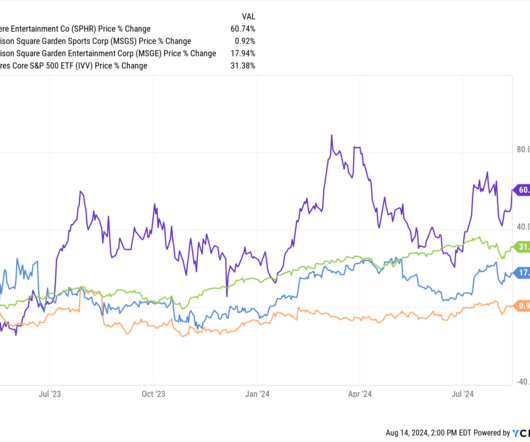

Today’s Animal Spirits is brought to you by YCharts and Fabric: See here for 20% off your initial YCharts professional subscription Go to meetfabric.com/spirits for more information on life insurance from Fabric by Gerber Life On today’s show, we discuss: Campbell Harvey on the soft landing Has the U.S. Economy Reached a Tipping Point? Flights, Hotels and Parks Are All Flashing Travel Warning Signs Rece.

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

Wealth Management

AUGUST 14, 2024

For years, RBC executive Shareen Luze struggled with anxiety. But the more she was vulnerable and shared her story in the workplace, the more she connected with people. Today, she brings a unique perspective on the role a sense of belonging plays within corporate mental health strategies.

Advisor Perspectives

AUGUST 14, 2024

Here are some lessons from interviewing financial advisors and insights into the traits that lead to a recommendation.

Wealth Management

AUGUST 14, 2024

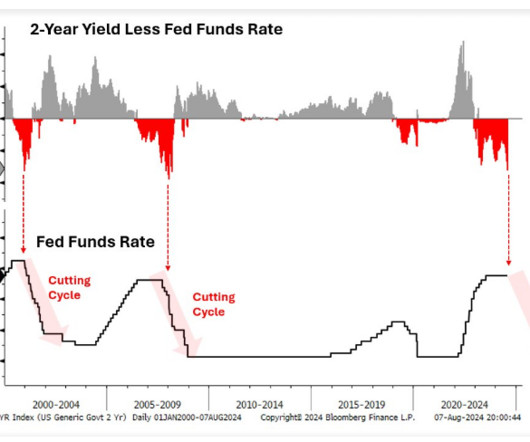

Ask "why is the Fed cutting rates?” rather than just focusing on the cuts themselves.

Wealthfront

AUGUST 14, 2024

Welcome to our Ask Wealthfront series, where we tackle your questions about personal finance and investing. Want to see your question answered here? Reach out to us on social media and we’ll try to address it in a future column. I’m saving for a house. Should I invest my down payment or keep it in […] The post Ask Wealthfront: Should I Invest My Down Payment?

Speaker: Sierre Lindgren

Fraud is a battle that every organization must face – it’s no longer a question of “if” but “when.” Every organization is a potential target for fraud, and the finance department is often the bullseye. From cleverly disguised emails to fraudulent payment requests, the tactics of cybercriminals are advancing rapidly. Drawing insights from real-world cases and industry expertise, we’ll explore the vulnerabilities in your processes and how to fortify them effectively.

Steve Sanduski

AUGUST 14, 2024

Guest: Erin Scannell , Chief Executive Officer of Heritage Wealth Advisors. In a Nutshell: When I talked to Erin Scannell in 2020, he was directing 50 team members, 18 advisors, and about $2 billion in AUM. Four years later, Heritage has doubled to $4 billion in AUM, and Erin is in charge of over 80 team members, including 20 advisors and a robust support team.

Advisor Perspectives

AUGUST 14, 2024

Criticism is a gift when it is used to push people to greatness and watch them develop into their potential.

Random Roger's Retirement Planning

AUGUST 14, 2024

The Bridges Tactical ETF (BGDS) is a new to me ETF that I stumbled into. It is actively managed and allocates to equities and or cash based on a process that I'll get into a little bit below. At a high level it is trying to provide equity upside with less risk. There are of course many different ways that funds try to deliver that result. Narrowing in slightly, the fund uses a three step approach that I'd describe as top down to determine risk on or risk off.

Financial Symmetry

AUGUST 14, 2024

How do you begin to save for your children to go to college? With the rising costs of college education, is it worth the monetary commitment? Including tuition & fees, room & board, books & supplies, etc. the average cost … Continued The post How to Pay for College in 3 Phases, Ep #222 appeared first on Financial Symmetry, Inc.

Advertisement

It's the time of year to give our close process some TLC. Join us in this one hour webinar where we discuss how to adopt leading practices and infuse technology into the month-end close process to improve our experience and increase our productivity during month-end and quarter-end close. Learning Objectives: This course's objective is to understand how the month-end close can be improved with automation and adoption of leading practices.

Advisor Perspectives

AUGUST 14, 2024

Regulators and investors have always had a keen interest in the trades that corporates executives and board members make in their companies’ own shares. The government has to look out for the integrity of financial markets, of course, while investors are eager to ride insiders’ coattails. Unfortunately, it’s never been easy to read the insider tea leaves.

SEI

AUGUST 14, 2024

Investors remain nervous in the aftermath of the recent market decline.

Advisor Perspectives

AUGUST 14, 2024

Inflation cooled for a fourth straight month in July, dropping to its lowest level since March 2021. According to the Bureau of Labor Statistics, the headline figure for the Consumer Price Index fell to 2.9% year-over-year, lower than the expected 3.0% growth. Additionally, core CPI cooled to 3.2% as expected.

Midstream Marketing

AUGUST 14, 2024

Key Highlights Search for ways to get new clients and grow your financial advisor business. Try different strategies like using LinkedIn for networking, hosting webinars, sending email campaigns, and creating great content. Learn how to use Google Ads, set up referral programs, and engage with your community to reach more people. Understand why social media marketing is important on sites like Facebook and Instagram.

Speaker: Aaron Berson

Managing spend is more than a cost cutting exercise – it's a pathway to smarter decisions that unlock efficiency and drive growth. By understanding and refining the spending process, financial leaders can empower their organizations to achieve more with less. Explore the art of balancing financial control with operational growth. From uncovering hidden inefficiencies to designing workflows that scale your business, we’ll share strategies to align your organization’s spending with its strategic g

Let's personalize your content