Wealth.com Scores $30M in Series A Funding

Wealth Management

SEPTEMBER 16, 2024

GV (formerly Google Ventures) led the funding round alongside Citi Ventures, Outpost Ventures, 53 Stations and Firebolt Ventures.

Wealth Management

SEPTEMBER 16, 2024

GV (formerly Google Ventures) led the funding round alongside Citi Ventures, Outpost Ventures, 53 Stations and Firebolt Ventures.

Abnormal Returns

SEPTEMBER 16, 2024

Apple How the new AirPods 4 with Active Noise Cancellation work. (theverge.com) The FDA approved sleep apnea detection on the new Apple Watch. (cnbc.com) Apple has launched a standlone password app. (wired.com) Most hearing loss goes untreated. Apple Air Pod Pro 2s could change that. (wsj.com) Finance Can election prediction markets become a big thing in the U.S.?

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

SEPTEMBER 16, 2024

Moneytree’s financial planning tool features a new architecture, workflows and account aggregation capabilities.

Abnormal Returns

SEPTEMBER 16, 2024

Podcasts Josh Brown and Michael Batnick talk advisor tech with fintech expert Jason Pereira. (youtube.com) Daniel Crosby talks with Cady North, Founder and CEO of North Financial Advisor, about planning for a sabbatical. (standarddeviationspod.com) Retirement Retirees go back to work for any number of reasons. (investmentnews.com) A checklist if a client gets laid off near retirement age.

Speaker: Erroll Amacker

As businesses increasingly adopt automation, finance leaders must navigate the delicate balance between technology and human expertise. This webinar explores the critical role of human oversight in accounts payable (AP) automation and how a people-centric approach can drive better financial performance. Join us for an insightful discussion on how integrating human expertise into automated workflows enhances decision-making, reduces fraud risks, strengthens vendor relationships, and accelerates R

Wealth Management

SEPTEMBER 16, 2024

The move into Raymond James’ independent advisor channel is one of several across the industry Monday, including an advisor with $600 million going to J.P. Morgan Wealth Management.

Calculated Risk

SEPTEMBER 16, 2024

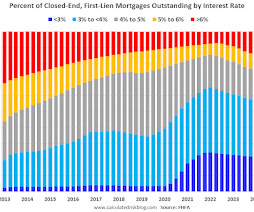

Today, in the Calculated Risk Real Estate Newsletter: Q2 Update: Delinquencies, Foreclosures and REO A brief excerpt: We will NOT see a surge in foreclosures that would significantly impact house prices (as happened following the housing bubble) for two key reasons: 1) mortgage lending has been solid, and 2) most homeowners have substantial equity in their homes.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Nerd's Eye View

SEPTEMBER 16, 2024

The business model of many financial advisory firms revolves around serving clients who are able to pay a certain minimum in annual advisory fees, which reflects not only the value that the advisor can provide for the client, but also the amount that the advisor must charge in order to provide the level of deep planning and investment management that higher-net-worth clients expect (while also earning enough profit to make the venture worthwhile).

Wealth Management

SEPTEMBER 16, 2024

Blackstone's global head of private wealth solutions discusses how private markets are becoming easier to invest in for a broader range of individuals.

Calculated Risk

SEPTEMBER 16, 2024

Back in June, I wrote: The Art of the Soft Landing A few excerpts and an updated graph. The "Art of the Soft Landing" requires that the Fed reduce rates quick enough to keep economic growth positive, and slow enough not to reignite inflation. My view is a soft landing is achieved if growth stays positive, inflation returns to target, and the yield curve flattens or reverts to normal (long yields higher than short yields).

Wealth Management

SEPTEMBER 16, 2024

Who wins, loses or collaborates with convergence of advisors and retirement plans.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Calculated Risk

SEPTEMBER 16, 2024

Altos reports that active single-family inventory was up 1.4% week-over-week. Inventory is now up 44.5% from the February seasonal bottom. Click on graph for larger image. This inventory graph is courtesy of Altos Research. As of September 13th, inventory was at 714 thousand (7-day average), compared to 704 thousand the prior week. The second graph shows the seasonal pattern for active single-family inventory since 2015.

Wealth Management

SEPTEMBER 16, 2024

Small RIAs discuss how they’re staying relevant and competitive, as the larger firms continue to consolidate.

Calculated Risk

SEPTEMBER 16, 2024

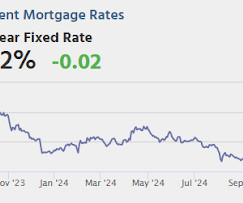

From Matthew Graham at Mortgage News Daily: Mortgage Rates Inch Lower to Begin Potentially Wild Week The new week began on a relatively quiet note in terms of mortgage rate movement and the underlying bond market. Traders have quickly shifted back to expecting slightly better odds of a 0.50% rate cut versus the minimum 0.25%. That's not even the important part of the announcement, however.

Wealth Management

SEPTEMBER 16, 2024

Frank Devincentis, Craig Eyler and Molly Girard, a Chicago-based trio, are creating Verismo Financial to operate within the wirehouse’s independent channel.

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

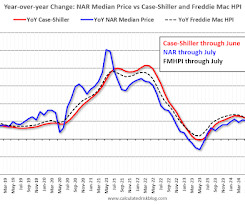

Calculated Risk

SEPTEMBER 16, 2024

Today, in the Calculated Risk Real Estate Newsletter: Part 2: Current State of the Housing Market; Overview for mid-September 2024 A brief excerpt: On Friday, in Part 1: Current State of the Housing Market; Overview for mid-September 2024 I reviewed home inventory, housing starts and sales. In Part 2, I will look at house prices, mortgage rates, rents and more.

Wealth Management

SEPTEMBER 16, 2024

Clients increasingly expect white-glove concierge services from their advisors.

The Big Picture

SEPTEMBER 16, 2024

It’s hard to believe that it has been only 11 years since we launched RWM… I am in Huntington Beach, California at at FutureProof 2024 — I’ll get some photos up later this week — but I don’t have time to get lost in any nostalgia If you are interested in our history , check out any of the links below — or my or Josh ‘s announcements when we launched.

Wealth Management

SEPTEMBER 16, 2024

The updated framework introduces a new method that Morningstar says is more precise in assessing how much alpha a managed investment can add. Nearly one-fifth of the 200,000 funds the firm rates will be affected, mostly as downgrades.

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

Advisor Perspectives

SEPTEMBER 16, 2024

The money manager who hasn’t cracked open the Journal of Finance, Journal of Financial Economics, Journal of Portfolio Management, or Financial Analysts Journal for the past few years probably hasn’t lost any steps.

A Wealth of Common Sense

SEPTEMBER 16, 2024

Today’s Talk Your Book is sponsored by Victory Capital: On today’s show, we spoke with Michael Mack of Victory Capital to discuss their small cap and large cap free cash flow strategies. On today’s show, we discuss: How to define free cash flow The difference between cash flow and net income How the free cash flow screen removes companies from the portfolio The valuation of free cash flow strategies The.

Advisor Perspectives

SEPTEMBER 16, 2024

Consumer staples are one of the sleepiest sectors of the US stock market. Investors buy them for their low volatility and generous dividends, not exhilarating upside potential. But lately, toothpaste, bleach and certain big-box food retailers seem to be acting like the new semiconductors.

Carson Wealth

SEPTEMBER 16, 2024

Stocks Bounce Back Following the worst week since March 2023 for the S&P 500 in the first week of September, the index soared 4.1% last week and was higher all five days of the week, completing a perfect week. Interestingly, August also had a perfect week, making this the first time since September and October 2019 we saw back-to-back months with a perfect week.

Speaker: Sierre Lindgren

Fraud is a battle that every organization must face – it’s no longer a question of “if” but “when.” Every organization is a potential target for fraud, and the finance department is often the bullseye. From cleverly disguised emails to fraudulent payment requests, the tactics of cybercriminals are advancing rapidly. Drawing insights from real-world cases and industry expertise, we’ll explore the vulnerabilities in your processes and how to fortify them effectively.

XY Planning Network

SEPTEMBER 16, 2024

Keeping up with bookkeeping is mandatory for tax & regulatory compliance, informed decision-making, and accurate financial tracking. Your business could be audited at any point in the year, and having up-to-date books is essential to passing that audit. And remember, the earlier, the better to avoid the last-minute frenzy.

Advisor Perspectives

SEPTEMBER 16, 2024

Investors are adding to their fixed income exposure as imminent interest rate cuts create opportunities, according to Emmanuel Roman, chief executive officer of Pacific Investment Management Co.

Financial Symmetry

SEPTEMBER 16, 2024

We are excited to announce that Grace Kvantas has recently achieved the Certified Divorce Financial Analyst (CDFA®) certification. This accomplishment underscores Grace’s unwavering commitment to providing exceptional financial support and clarity to individuals navigating the complexities of life, including divorce. … Continued The post Celebrating Grace Kvantas Achieving the CDFA® Certification to Enhance Divorce Financial Guidance appeared first on Financial Symmetry, Inc.

Advisor Perspectives

SEPTEMBER 16, 2024

In my cycles book I’m reviewing the forecasts of Neil Howe, Peter Turchin, George Friedman, and Ray Dalio. For different historical reasons and patterns, all see a crisis culminating at the end of this decade. Some readers have legitimately pushed back, saying no one knows the future. As fund disclosures always say, past performance is not indicative of future results.

Advertisement

It's the time of year to give our close process some TLC. Join us in this one hour webinar where we discuss how to adopt leading practices and infuse technology into the month-end close process to improve our experience and increase our productivity during month-end and quarter-end close. Learning Objectives: This course's objective is to understand how the month-end close can be improved with automation and adoption of leading practices.

Trade Brains

SEPTEMBER 16, 2024

Once tobacco was used to stop bleeding and to treat wounds. It was used as currency by Native Americans and even paying taxes. They were used to link to the religion. After a certain time, it was not considered to be used as Medicine. Over time it was looked at as a sin and was affecting health leading to cancer. In the world, many governments imposed taxes and they have even banned to consumption of tobacco.

Advisor Perspectives

SEPTEMBER 16, 2024

What is interesting about the growth of hedged equity is that most of the assets are held in passively managed structures.

Validea

SEPTEMBER 16, 2024

In this episode of Two Quants and a Financial Planner, we dive deep into the world of quality and low volatility factors in investing. We explore how these factors work, their academic foundations, and their practical applications in portfolio construction. We discuss the definitions of quality and low volatility, examining how they’re measured and why they can be valuable additions to investment strategies.

Cornerstone Financial Advisory

SEPTEMBER 16, 2024

Weekly Market Insights | September 16th, 2024 Stocks Rally Ahead of Fed Meeting Stocks rallied last week as investors received better-than-expected consumer and producer inflation data. The Dow Jones Industrial Average rose 2.60 percent, while the Standard & Poor’s 500 Index gained 4.02 percent. The Nasdaq Composite led, picking up 5.95 percent as tech stocks rebounded.

Speaker: Aaron Berson

Managing spend is more than a cost cutting exercise – it's a pathway to smarter decisions that unlock efficiency and drive growth. By understanding and refining the spending process, financial leaders can empower their organizations to achieve more with less. Explore the art of balancing financial control with operational growth. From uncovering hidden inefficiencies to designing workflows that scale your business, we’ll share strategies to align your organization’s spending with its strategic g

Let's personalize your content