Warren Presses Wall Street Regulator to Explain Decline in Enforcement Actions

Wealth Management

AUGUST 29, 2024

Fines levied by the Financial Industry Regulatory Authority have dwindled to half their recent levels.

Wealth Management

AUGUST 29, 2024

Fines levied by the Financial Industry Regulatory Authority have dwindled to half their recent levels.

A Wealth of Common Sense

AUGUST 29, 2024

A reader asks: My asset allocation has been pretty conservative since the market run-up in 2020. My basic thesis is that the market is overvalued, and the only way I can keep myself in equities at all is to have a 60/40 stock/bond allocation. One thing I like about having the 60/40 split is that it gives me the option of changing to a more aggressive allocation if stock valuations fall.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

AUGUST 29, 2024

Our technology columnist homes in on a few points from the third annual WealthStack study.

MainStreet Financial Planning

AUGUST 29, 2024

Grandparents, are you looking for ways to transfer some of your assets to your grandchildren while also teaching them valuable financial skills? Opening a UTMA (Uniform Transfers to Minors Act) or UGMA (Uniform Gifts to Minors Act) account could be the perfect solution. Not only do these accounts allow you to gift assets to the younger generation, but they also serve as an excellent educational tool for imparting important lessons about investing and financial management.

Speaker: Erroll Amacker

As businesses increasingly adopt automation, finance leaders must navigate the delicate balance between technology and human expertise. This webinar explores the critical role of human oversight in accounts payable (AP) automation and how a people-centric approach can drive better financial performance. Join us for an insightful discussion on how integrating human expertise into automated workflows enhances decision-making, reduces fraud risks, strengthens vendor relationships, and accelerates R

Wealth Management

AUGUST 29, 2024

Gordon “Gordy” Abel from Dynasty Financial Partners offers perspectives on why marketing matters, how to create and leverage a brand, the key aspects of an effective value proposition and more.

Advisor Perspectives

AUGUST 29, 2024

HSAs are increasingly coming into use. They are a more tax-efficient means of investing, withdrawing money to cover large healthcare expenses, or simply preparing for higher medical costs in one’s later years.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Advisor Perspectives

AUGUST 29, 2024

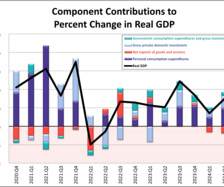

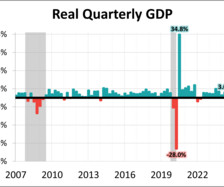

Real gross domestic product (GDP) is comprised of four major subcomponents. In the Q2 GDP second estimate, three of the four components made positive contributions.

Wealth Management

AUGUST 29, 2024

Think of these services as different specialties within a high-end restaurant.

Advisor Perspectives

AUGUST 29, 2024

Is the Japanese yen carry trade back on? Tough question. We think it is, now that the Bank of Japan has toned down its hawkish rhetoric. More on that later. Still, even if we are wrong, the reality is that the market will be talking about the violent ructions of August 2024 for the rest of our careers.

Wealth Management

AUGUST 29, 2024

The new study combines years of research to gauge what clients value most and what areas advisors can focus on in strengthening relationships.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Advisor Perspectives

AUGUST 29, 2024

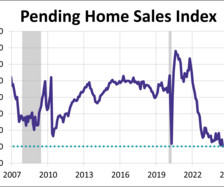

The National Association of Realtors® (NAR)unexpectedly fell 5.5% in July to 70.2, its lowest level in history. Pending home sales were expected to inch up 0.2% from the previous month. The index is down 8.5% from one year ago.

Wealth Management

AUGUST 29, 2024

Silvant Capital Management's CIO and Managing Partner Michael Sansoterra opens up about why he believes growth investing is a condition, not a category.

Trade Brains

AUGUST 29, 2024

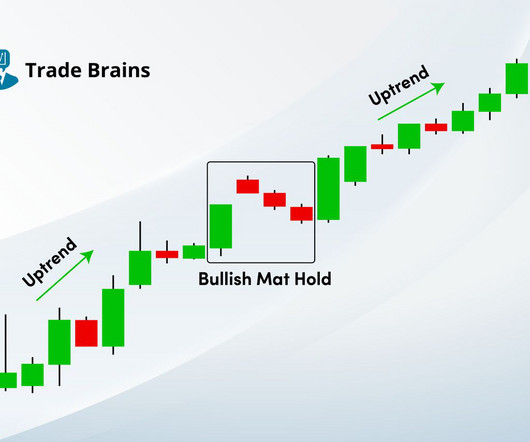

Candlestick patterns are the key technical tool for traders to understand price movements. The patterns formed on candlestick charts over a given time frame offer potential views on trend reversals, continuations, or indecision present in the market. In this article, we will delve into the Bullish Mat Hold candlestick pattern, exploring its meaning, characteristics, and strategies with the example of charts.

Wealth Management

AUGUST 29, 2024

The firm relied on “third-party automated surveillances” to check for potentially manipulative wash and prearranged trading which had overly narrow parameters, according to FINRA.

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

Discipline Funds

AUGUST 29, 2024

There’s a popular joke in financial circles that says you can’t eat risk adjusted returns. In other words, while it might be interesting mental gymnastics to calculate things like a Sharpe Ratio the statistical output isn’t something you eat. In other, other words, if a hedge fund is touting a 9% returns with 10% volatility vs a 10% return in the S&P 500 with 20% volatility the thinking says that the investor who owned the S&P 500 can eat more despite the fact that the

FMG

AUGUST 29, 2024

If you’re looking to boost client retention, look at how frequently and effectively you communicate with clients. According to a recent survey by YCharts, three out of four clients have considered switching financial advisors due to infrequent communications. If you’re only communicating with clients once a month or less, you may want to reconsider your approach.

Advisor Perspectives

AUGUST 29, 2024

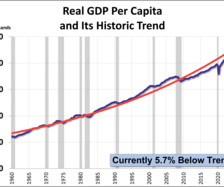

The second estimate for Q2 GDP came in at 2.95%, an acceleration from 1.41% for the Q1 final estimate. With a per-capita adjustment, the headline number is lower at 2.48%, a pickup from 0.95% for the Q1 headline number.

NAIFA Advisor Today

AUGUST 29, 2024

The National Association of Insurance and Financial Advisors (NAIFA) is thrilled to announce that Kathleen Owings has been named the 2024 Young Advisor Team Leader of the Year. This award celebrates outstanding leadership, dedication, and impact within the financial advisory industry, recognizing individuals who exemplify the highest standards of excellence.

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

Advisor Perspectives

AUGUST 29, 2024

The U.S. economy grew at a faster than expected pace during the second quarter of this year. Real gross domestic product increased at an annual rate of 2.95% in Q2 2024, according to the second estimate. The latest estimate is above the forecasted 2.8% growth and is a pickup from the Q1 2023 GDP final estimate of 1.4%.

NAIFA Advisor Today

AUGUST 29, 2024

NAIFA is pleased to announce the inaugural class of the NAIFA Hall of Fame to recognize and celebrate members whose extraordinary service and contributions represent the legacy of the most accomplished, impactful, and inspirational members of the NAIFA family. The NAIFA Board of Trustees authorized the creation of the Hall of Fame earlier this year.

Advisor Perspectives

AUGUST 29, 2024

If your home and/or its contents are destroyed or damaged by a disaster such as a fire or flood, the insurance company will need a complete list of what was lost. Do you have such a list?

Validea

AUGUST 29, 2024

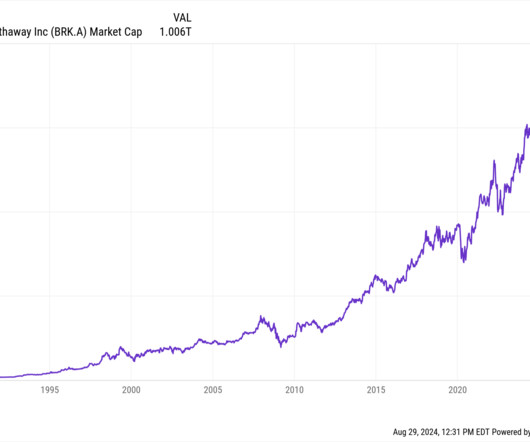

Warren Buffett and Peter Lynch are two of the most renowned investors of all time, each with their own distinct approach to finding winning stocks. While their strategies differ in many ways, there is some overlap in the types of companies they seek out. By identifying stocks that satisfy both Buffett’s and Lynch’s criteria, investors can potentially find high-quality companies with strong fundamentals and attractive valuations.

Speaker: Sierre Lindgren

Fraud is a battle that every organization must face – it’s no longer a question of “if” but “when.” Every organization is a potential target for fraud, and the finance department is often the bullseye. From cleverly disguised emails to fraudulent payment requests, the tactics of cybercriminals are advancing rapidly. Drawing insights from real-world cases and industry expertise, we’ll explore the vulnerabilities in your processes and how to fortify them effectively.

Advisor Perspectives

AUGUST 29, 2024

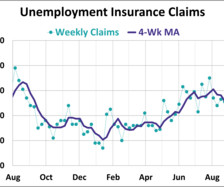

In the week ending August 24th, initial jobless claims were at a seasonally adjusted level of 231,000. This represents a decrease of 2,000 from the previous week's figure and is better than the 232,000 economists were expecting.

Abnormal Returns

AUGUST 29, 2024

Strategy Some financial voices you can safely ignore including permabears. (awealthofcommonsense.com) The stock market is always at risk of an 'accident.' (bestinterest.blog) Meme stocks A sign of just how successful GameStop ($GME) has been in raising equity capital. (sherwood.news) A lockup expiration on Trump Media & Technology Group ($DJT) is expiring.

Advisor Perspectives

AUGUST 29, 2024

Nvidia Corp. failed to live up to investor hopes with its latest results on Wednesday, delivering an underwhelming forecast and news of production snags with its much-awaited Blackwell chips.

Abnormal Returns

AUGUST 29, 2024

Books An excerpt from “At War With Ourselves: My Tour of Duty in the Trump White House,” by H.R. McMaster. (wsj.com) An excerpt from “Reagan: His Life and Legend” by Max Boot. (wapo.st) A Q&A with Eliot Haspel, author of "Crawling Behind: America’s Childcare Crisis and How to Fix It." (annehelen.substack.com) Housing The home insurance market is increasingly dysfunctional.

Advertisement

It's the time of year to give our close process some TLC. Join us in this one hour webinar where we discuss how to adopt leading practices and infuse technology into the month-end close process to improve our experience and increase our productivity during month-end and quarter-end close. Learning Objectives: This course's objective is to understand how the month-end close can be improved with automation and adoption of leading practices.

Advisor Perspectives

AUGUST 29, 2024

Nvidia Corp.’s earnings report was impressive by virtually any metric — except its own recent history.

Advisor Perspectives

AUGUST 29, 2024

Nvidia Corp.’s earnings report needed to be perfect for a stock that’s added nearly $2 trillion in market value in the past year. In the end, a broad beat still sparked a selloff.

Advisor Perspectives

AUGUST 29, 2024

US Treasury yields edged higher after resilient economic reports prompted traders to slightly trim their expectations for the scope of Federal Reserve easing this year.

Advisor Perspectives

AUGUST 29, 2024

Chair Jerome Powell cemented a shift in focus from inflation to employment last week when he said that the Federal Reserve does not seek a further cooling in the labor market. It was a welcome message for those concerned about an economic slowdown. But there are reasons to expect today’s sluggish hiring environment to persist at least into early next year, frustrating job seekers and policymakers alike.

Speaker: Aaron Berson

Managing spend is more than a cost cutting exercise – it's a pathway to smarter decisions that unlock efficiency and drive growth. By understanding and refining the spending process, financial leaders can empower their organizations to achieve more with less. Explore the art of balancing financial control with operational growth. From uncovering hidden inefficiencies to designing workflows that scale your business, we’ll share strategies to align your organization’s spending with its strategic g

Let's personalize your content