RIA Edge Podcast: Helium Advisors' Tax-Optimized Approach to Building Wealth

Wealth Management

JULY 23, 2024

Helium founder and partner Howard Morin explains the benefits of bridging financial planning with deep tax expertise.

Wealth Management

JULY 23, 2024

Helium founder and partner Howard Morin explains the benefits of bridging financial planning with deep tax expertise.

Abnormal Returns

JULY 23, 2024

Markets Small caps have, relative to large caps, seen a lost decade. (ft.com) Joe Wiggins, "Everything within us and around us seems designed to interrupt the positive force of compounding." (behaviouralinvestment.com) Crypto What you need to know about the new spot Ethereum ETFs. (theblock.co) The players in the spot Ethereum space look familiar. (blockworks.co) What happens when you at Ethererum to a 60/40 portfolio.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

JULY 23, 2024

Funds focused on clean energy were among those posting the worst returns over the last year.

Abnormal Returns

JULY 23, 2024

Quant stuff Using Bayesian solutions to 'tame' the factor zoo. (alphaarchitect.com) A round-up of recent research on using AI in finance. (capitalspectator.com) How to read an econometrics paper. (econometrics.blog) Alternatives Why are estimates of alternative asset returns still so high? (mailchi.mp) Endowments are struggling to get capital back from their PE investments.

Speaker: Erroll Amacker

As businesses increasingly adopt automation, finance leaders must navigate the delicate balance between technology and human expertise. This webinar explores the critical role of human oversight in accounts payable (AP) automation and how a people-centric approach can drive better financial performance. Join us for an insightful discussion on how integrating human expertise into automated workflows enhances decision-making, reduces fraud risks, strengthens vendor relationships, and accelerates R

Wealth Management

JULY 23, 2024

Delaware tops the list of best states to retire in 2024, while California and New York bring up the rear.

Calculated Risk

JULY 23, 2024

Note: Mortgage rates are from MortgageNewsDaily.com and are for top tier scenarios. Wednesday: • At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index. • At 10:00 AM, New Home Sales for June from the Census Bureau. The consensus is for 640 thousand SAAR, up from 619 thousand in May. • During the day, The AIA's Architecture Billings Index for June (a leading indicator for commercial real estate).

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Calculated Risk

JULY 23, 2024

From WardsAuto: July U.S. Light-Vehicle Sales Tracking to Strongest SAAR So Far in 2024 (pay content). Brief excerpt: An expected boost to volume in July from lost sales in June, caused by a cyberattack affecting dealer management systems, will not be as big as initially expected. Dealers apparently were quite adept at finding alternative ways to reporting sales and lost volume was less than thought.

Wealth Management

JULY 23, 2024

Powder is using generative AI to automate a lot of the tasks involved in the client proposal process.

Calculated Risk

JULY 23, 2024

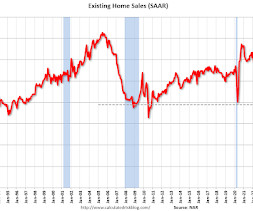

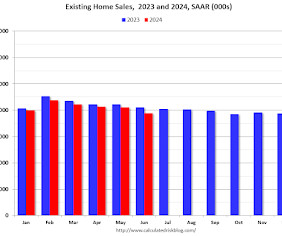

From the NAR: Existing-Home Sales Slipped 5.4% in June; Median Sales Price Jumps to Record High of $426,900 Existing-home sales fell in June as the median sales price climbed to the highest price ever recorded for the second consecutive month, according to the National Association of REALTORS®. All four major U.S. regions posted sales declines. Year-over-year, sales waned in the Northeast, Midwest and South but were unchanged in the West.

Wealth Management

JULY 23, 2024

Morningstar's Jack Shannon discusses the nuances of active ETFs and whether they deliver on their promises.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Calculated Risk

JULY 23, 2024

Today, in the CalculatedRisk Real Estate Newsletter: NAR: Existing-Home Sales Decreased to 3.89 million SAAR in June Excerpt: Sales Year-over-Year and Not Seasonally Adjusted (NSA) The fourth graph shows existing home sales by month for 2023 and 2024. Sales declined 5.4% year-over-year compared to June 2023. This was the thirty-fourth consecutive month with sales down year-over-year.

Wealth Management

JULY 23, 2024

Genstar Capital is making a majority investment in Docupace. FTV Capital took a majority stake in the company in 2020 and will remain a minority investor.

Nerd's Eye View

JULY 23, 2024

Welcome back to the 395th episode of the Financial Advisor Success Podcast ! My guest on today's podcast is Dustin Mangone. Dustin is the Director of Investment Advisor Services of PPC LOAN, a firm based in The Woodlands, Texas that facilitates conventional bank loans to financial advisors. What's unique about Dustin, though, is how his firm allows financial advisors to tap into bank lending, an historically challenging source of debt capital for the advisory industry, to finance both RIA and in

Wealth Management

JULY 23, 2024

Advisors Josh Linton and Mike Koltz join from LPL Financial, where they led the wealth management business for a community bank.

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

A Wealth of Common Sense

JULY 23, 2024

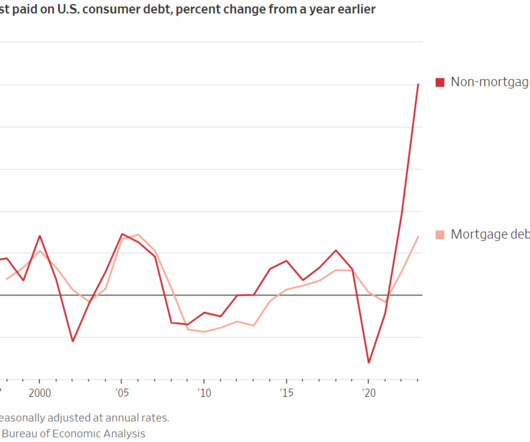

Inflation went from 9% to 3% without a recession. Some people want to give all the credit to the Federal Reserve. I think they got lucky. The soft landing, or whatever you want to call it, happened despite the Fed’s best efforts to cause people to lose their jobs and throw the economy into a recession. It helped that corporations and households came into the rising rate environment prepared.

Wealth Management

JULY 23, 2024

Once the deal closes, Janney will operate as a standalone, private company and create a broad-based equity ownership program for its 2,300 employees.

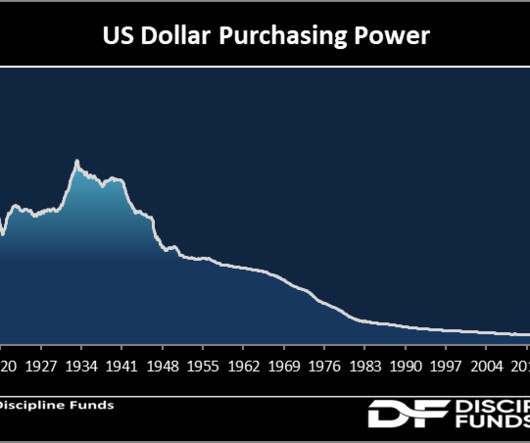

Discipline Funds

JULY 23, 2024

One of the most common questions we get is “ should I be worried about the death of the US Dollar? ” It’s a worthwhile question and certainly not a zero probability event. In fact, as Keynes famously said, “in the long-run we are all dead” and so are all fiat currencies. IN THE LONG RUN. Yes, it’s true, all fiat currencies die in the long-run and the USD isn’t going to be an exception.

Wealth Management

JULY 23, 2024

Mercer claims the owners of an RIA it acquired took the funds from the sale and headed to the golf course.

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

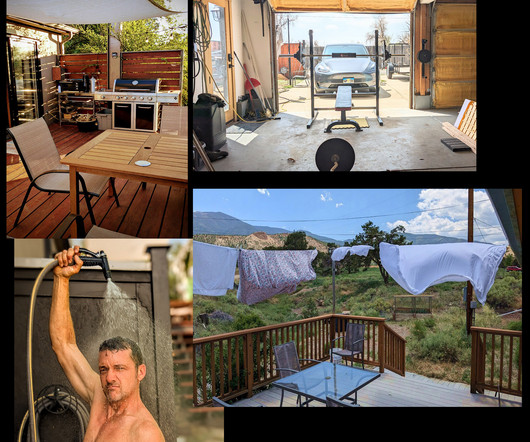

Mr. Money Mustache

JULY 23, 2024

– “I used to read Mr. Money Mustache” , some people say these days, “Until he got all rich and fancy so that he no longer understands the common person’s plight. Stash probably doesn’t even practice any of these money-saving things he preaches any more!” When I read things like this, I can’t help but laugh. Because on the one hand, when you put a bunch of personal life details online like this, being misunderstood is just part of the package.

Wealth Management

JULY 23, 2024

CNIC Funds' Tim Kramer takes a deep dive into investing in electricity.

Million Dollar Round Table (MDRT)

JULY 23, 2024

By Roy John Hall, ADFP, CCFP Change often isn’t easy, especially when it impacts how you run your financial advisory practice, or if you can even be an advisor at all. Regulation changes in Australia, which is where I live, hit us hard and fast. There were 36,000 financial advisors in my country. Now, three years after the changes were announced, there are about 15,000.

Wealth Management

JULY 23, 2024

Managers favored strategies that would protect them from economic and political volatility.

Speaker: Sierre Lindgren

Fraud is a battle that every organization must face – it’s no longer a question of “if” but “when.” Every organization is a potential target for fraud, and the finance department is often the bullseye. From cleverly disguised emails to fraudulent payment requests, the tactics of cybercriminals are advancing rapidly. Drawing insights from real-world cases and industry expertise, we’ll explore the vulnerabilities in your processes and how to fortify them effectively.

Indigo Marketing Agency

JULY 23, 2024

If I went to your website right now, would it pass the 5-second test? Would I be able to immediately discern: Who you are? What you do? Who you do it for? And most importantly—why someone should choose you? Then, would I know what they should do next after visiting ? When envisioning your firm’s next website, it’s easy to articulate its purpose and desired ambiance.

Wealth Management

JULY 23, 2024

Mercer claims the owners of an RIA it acquired took the funds from the sale and headed to the golf course.

MainStreet Financial Planning

JULY 23, 2024

Insurance costs are on the rise, we are all feeling the impact on our wallets. The average American already spends over 5.3% of income on insurance premiums, 60% of that is for auto and home premiums. What can we do? Do we have any control? As a CFP® practitioner, I spend a few hours per month on continuing education. Recently, I got an invitation for a webinar titled “Incorporating Property & Casualty into The Holistic Financial Plan.

Wealth Management

JULY 23, 2024

Redemption requests for non-traded REITs have slowed following a surge in the Spring, according to data from Robert A. Stanger Co. Cooling inflation has led to a rally in small cap stocks, benefiting ETFs built around that strategy, reports ETF Stream. These are among the investment must reads we found this week for wealth advisors.

Advertisement

It's the time of year to give our close process some TLC. Join us in this one hour webinar where we discuss how to adopt leading practices and infuse technology into the month-end close process to improve our experience and increase our productivity during month-end and quarter-end close. Learning Objectives: This course's objective is to understand how the month-end close can be improved with automation and adoption of leading practices.

XY Planning Network

JULY 23, 2024

Becoming an independent fee-only financial advisor can seem overwhelming, lonely, and stressful. Add to that the burdens of everyday life—or, heaven forbid, a major life-changing event—that can almost make you feel like your dream career is unattainable. Fortunately, with XYPN membership , you not only benefit from our end-to-end tech, compliance, and support solutions as well as resource, education, and coaching assistance, but you also have the support of what's been ranked our top benefit 3 t

Advisor Perspectives

JULY 23, 2024

Financial advisors are increasingly turning to social media platforms to expand their client base. But in today’s rapidly evolving digital landscape, the traditional marketing funnel model – comprising awareness, engagement, and conversion stages – often falls short when applied to these platforms.

NAIFA Advisor Today

JULY 23, 2024

All of the firm’s advisors become NAIFA members and are poised to participate in NAIFA’s unmatched state and federal advocacy success under an agency-wide membership program. The National Association of Insurance and Financial Advisors (NAIFA) is pleased to announce that Allstate The Goines Agency in Clarksville, Tennessee has become a NAIFA 100% Agency.

Advisor Perspectives

JULY 23, 2024

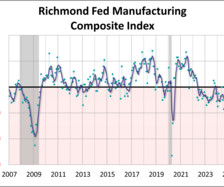

Fifth district manufacturing activity worsened in July, according to the most recent survey from the Federal Reserve Bank of Richmond. The composite manufacturing index fell to -17 this month from -10 in June. This month's reading was worse than the forecast of -7.

Speaker: Aaron Berson

Managing spend is more than a cost cutting exercise – it's a pathway to smarter decisions that unlock efficiency and drive growth. By understanding and refining the spending process, financial leaders can empower their organizations to achieve more with less. Explore the art of balancing financial control with operational growth. From uncovering hidden inefficiencies to designing workflows that scale your business, we’ll share strategies to align your organization’s spending with its strategic g

Let's personalize your content