Advisors Want Clients to Consider History When Assessing Election’s Aftermath

Wealth Management

NOVEMBER 5, 2024

Advisors are telling clients to remain calm and remember the stability of markets throughout tumultuous historical times.

Wealth Management

NOVEMBER 5, 2024

Advisors are telling clients to remain calm and remember the stability of markets throughout tumultuous historical times.

Abnormal Returns

NOVEMBER 5, 2024

ETFs Passive investing continues to take share. Where is the evidence that it is fundamentally changing the stock market? (on.ft.com) 'Peak ETF' is nowhere on the horizon, especially overseas. (klementoninvesting.substack.com) Portfolio construction How portfolio diversification works. (caia.org) How to use trading volume to optimize portfolio construction.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

A Wealth of Common Sense

NOVEMBER 5, 2024

As Charlie Munger liked to say, “Invert, always invert.” Here are some things about investing that I don’t believe: I don’t believe there is a sole way to invest. Everyone has a different emotional make-up and lesser version of themself. Plus, experiences and circumstances can shape your attitudes towards risk and return. There are a lot of strategies that can work.

Calculated Risk

NOVEMBER 5, 2024

Notes: This CoreLogic House Price Index report is for September. The recent Case-Shiller index release was for August. The CoreLogic HPI is a three-month weighted average and is not seasonally adjusted (NSA). From CoreLogic: CoreLogic: Annual Home Price Slowdown Continues in September • On an annual basis, home prices rose by 3.4% in September, the slowest growth rate in over a year, and are projected to slow to 2.3% by the same time next year. • Miami continued to post the highest gain of track

Advertisement

It's the time of year to give our close process some TLC. Join us in this one hour webinar where we discuss how to adopt leading practices and infuse technology into the month-end close process to improve our experience and increase our productivity during month-end and quarter-end close. Learning Objectives: This course's objective is to understand how the month-end close can be improved with automation and adoption of leading practices.

Wealth Management

NOVEMBER 5, 2024

BlackRock became the latest and largest asset manager to seek approval for an ETF share class on existing mutual funds. Morgan Stanley launched an investing index tied to prominent sports leagues globally. These are among the investment must reads we found this week for wealth advisors.

Calculated Risk

NOVEMBER 5, 2024

The Census Bureau and the Bureau of Economic Analysis reported : The U.S. Census Bureau and the U.S. Bureau of Economic Analysis announced today that the goods and services deficit was $84.4 billion in September , up $13.6 billion from $70.8 billion in August, revised. September exports were $267.9 billion, $3.2 billion less than August exports. September imports were $352.3 billion, $10.3 billion more than August imports emphasis added Click on graph for larger image.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Advisor Perspectives

NOVEMBER 5, 2024

Consistent communication through market events is vital for advisors concerned about client retention.

Wealth Management

NOVEMBER 5, 2024

Advisors are telling clients to remain calm and remember the stability of markets throughout tumultuous historical times.

Calculated Risk

NOVEMBER 5, 2024

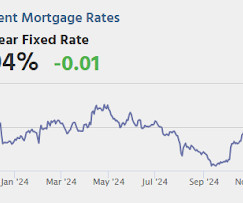

Note: Mortgage rates are from MortgageNewsDaily.com and are for top tier scenarios. Wednesday: • At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

Wealth Management

NOVEMBER 5, 2024

Apollo, like its peers, continues to target high earners for higher-fee-paying assets and has set a goal of raising at least $150 billion for its global wealth business by 2029.

Speaker: Sierre Lindgren

Fraud is a battle that every organization must face – it’s no longer a question of “if” but “when.” Every organization is a potential target for fraud, and the finance department is often the bullseye. From cleverly disguised emails to fraudulent payment requests, the tactics of cybercriminals are advancing rapidly. Drawing insights from real-world cases and industry expertise, we’ll explore the vulnerabilities in your processes and how to fortify them effectively.

Trade Brains

NOVEMBER 5, 2024

Stocks with order books higher than market capitalization highlight companies where the total value of confirmed orders exceeds their current market value. This scenario often indicates strong future revenue potential, suggesting that the company may be undervalued by the market. Such stocks can be attractive to investors, as a robust order book provides visibility into future earnings, enhancing the company’s growth prospects.

Wealth Management

NOVEMBER 5, 2024

Mark and Steven Resnik have teamed up to lead Burling Wealth Partners, a Chicago RIA with over $750 million in AUM.

Steve Sanduski

NOVEMBER 5, 2024

Guest: Mindy Diamond , the founder and CEO of Diamond Consultants and the author of a fantastic new book called Should I Stay or Should I Go? In a Nutshell: Between the competition for top talent at large firms and the proliferation of smaller lifestyle RIAs, many advisors feel like they need to be constantly evaluating their career options. But the grass is not always greener, and FOMO should never be the lead driver of a major career decision.

Wealth Management

NOVEMBER 5, 2024

As competition becomes more cutthroat, investment firms across both sides of the Atlantic have been launching funds with the same tickers as their competitors in another jurisdiction.

Speaker: Aaron Berson

Managing spend is more than a cost cutting exercise – it's a pathway to smarter decisions that unlock efficiency and drive growth. By understanding and refining the spending process, financial leaders can empower their organizations to achieve more with less. Explore the art of balancing financial control with operational growth. From uncovering hidden inefficiencies to designing workflows that scale your business, we’ll share strategies to align your organization’s spending with its strategic g

Midstream Marketing

NOVEMBER 5, 2024

Key Highlights A strong presence on social media can help financial advisors meet potential clients and boost brand awareness. It’s key to develop a social media strategy that matches your target audience and has achievable goals. Explore different social media platforms that financial advisors can use, like LinkedIn, Twitter, Instagram, and Facebook.

Wealth Management

NOVEMBER 5, 2024

Apollo, like its peers, continues to target high earners for higher-fee-paying assets and has set a goal of raising at least $150 billion for its global wealth business by 2029.

Cornerstone Financial Advisory

NOVEMBER 5, 2024

All Bible verses in this article are English Standard Version (ESV). Life can be challenging, and as Christians, we often face the same financial struggles as everyone else. Our faith sets apart, but it doesnt guarantee us a life free from the difficulties of saving, investing, and debt. If youre facing economic uncertainty, its natural to ask a series of challenging questions: Will God provide for me financially ?

Wealth Management

NOVEMBER 5, 2024

Advisors are telling clients to remain calm and remember the stability of markets throughout tumultuous historical times.

Speaker: Duke Heninger, Partner and Fractional CFO at Ampleo & Creator of CFO System

Are you ready to elevate your accounting processes for 2025? 🚀 Join us for an exclusive webinar led by Duke Heninger, a seasoned fractional CFO and CPA passionate about transforming back-office operations for finance teams. This session will cover critical best practices and process improvements tailored specifically for accounting professionals.

Trade Brains

NOVEMBER 5, 2024

Sun Pharmaceutical Industries Ltd. is a leading global pharmaceutical company based in India, renowned for its high-quality generic medications and specialty products. Founded in 1983, Sun Pharma has grown to become one of the largest pharmaceutical manufacturers in the world, serving over 150 countries. The company focuses on therapeutic areas such as cardiology, psychiatry, neurology, and dermatology, emphasizing innovation and research.

Wealth Management

NOVEMBER 5, 2024

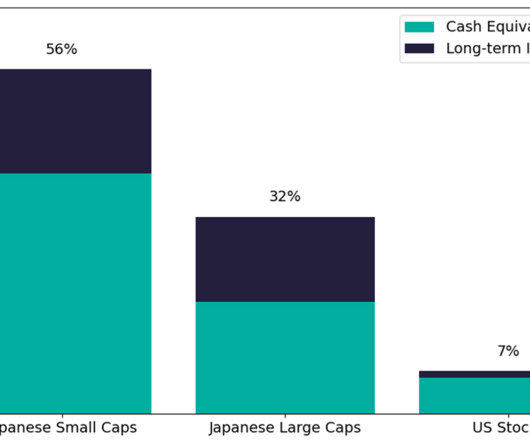

UniFi by CAIA's Aaron Filbeck details the evolution of alternative investments and the importance of client communication.

FMG

NOVEMBER 5, 2024

When someone visits your website, it only takes 50 milliseconds to form an opinion – so make it count. Here are five proven techniques you can implement now to make your website stand out. Plan Your Website Theme and Structure Identify your target audience and create content and navigation that is relevant to their needs and interests. Keep navigation titles simple and concise.

Wealth Management

NOVEMBER 5, 2024

The RIA industry recorded the highest monthly volume on record for M&A deals, which DeVoe & Company attributed to firms’ anticipation of interest rate cuts.

Speaker: Ashley Harlan, MBA

What if your role as a fractional CFO went beyond operational support to actively shaping the future of your clients’ businesses? 💼 ✨ In this session, discover how fractional finance professionals can position themselves as architects of growth, guiding their clients toward sustainable success and preparing them for full-time financial leadership.

Advisor Perspectives

NOVEMBER 5, 2024

Seven of our eight indexes on our world watch list have posted gains through November 4, 2024. The Hong Kong's Hang Seng finished in the top spot with a year-to-date gain of 22.51%. The U.S. S&P 500 finished second with a year-to-date gain of 20.45%. The Tokyo's Nikkei 225 finished in third with a year-to-date gain of 14.97%.

Wealth Management

NOVEMBER 5, 2024

Apollo, like its peers, continues to target high earners for higher-fee-paying assets and has set a goal of raising at least $150 billion for its global wealth business by 2029.

Advisor Perspectives

NOVEMBER 5, 2024

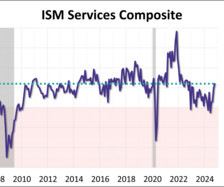

The Institute of Supply Management (ISM) has released its October services purchasing managers' index (PMI). The headline composite index is at 56.0, better than the forecast of 53.8. The latest reading moves the index back into expansion territory for 50th time in the past 53 months.

Wealth Management

NOVEMBER 5, 2024

UniFi by CAIA's Aaron Filbeck details the evolution of alternative investments and the importance of client communication.

Speaker: Abdi Ali, Sr. Lease Accounting Consultant

Join this insightful webinar with industry expert Abdi Ali, who will discuss the challenges that can arise from managing lease accounting with spreadsheets! He will share real-world examples of errors, compliance issues, and risks that may be present within your spreadsheets. Learn how these tools, while useful, can sometimes lead to inefficiencies that affect your time, resources, and peace of mind.

Midstream Marketing

NOVEMBER 5, 2024

Key Highlights Niche marketing helps financial advisors be different in a busy market. By focusing on a specific target market, they can design their services and messages to connect better. To find your niche, know your strengths, interests, and what your audience wants. Good niche marketing strategies are making special content, using targeted online ads, and being active in networking.

Wealth Management

NOVEMBER 5, 2024

The RIA industry recorded the highest monthly volume on record for M&A deals, which DeVoe & Company attributed to firms’ anticipation of interest rate cuts.

Advisor Perspectives

NOVEMBER 5, 2024

Stocks and yields made slight early gains but attention is mainly on today's U.S. election. ISM Services data and a 10-year note auction lie ahead, and bond volatility is high.

Wealth Management

NOVEMBER 5, 2024

Mark and Steven Resnik have teamed up to lead Burling Wealth Partners, a Chicago RIA with over $750 million in AUM.

Advertisement

Change is difficult, whether in our private or work life. However, without change, growth and learning are difficult not to mention keeping up with the market and staying competitive. We have all worked for or ourselves are the bosses that prefer to keep the status quo. We will discuss how to address the "change challenge" to enable you to be a changemaker and a graceful recipient of change.

Let's personalize your content