Blackstone Reports Raising $7.5B in Wealth Products in Q2

Wealth Management

JULY 18, 2024

Alternative asset investment behemoth Blackstone also teased two new funds aimed at wealth clients will launch in 2025.

Wealth Management

JULY 18, 2024

Alternative asset investment behemoth Blackstone also teased two new funds aimed at wealth clients will launch in 2025.

Abnormal Returns

JULY 18, 2024

Markets A great visualization of how calm the U.S. stock had been up until this week. (sherwood.news) Legalized gambling is illegal in India, but online stock trading is not. (on.ft.com) Finance Private equity is sitting on record dry powder. (institutionalinvestor.com) No one really knows where that capital is headed. (ft.com) Private credit has plenty of capital to put to work as well.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

JULY 18, 2024

Tom Taylor, who's been with Cetera for nearly three decades, will depart at the end of the year, while the firm searches for a replacement.

Calculated Risk

JULY 18, 2024

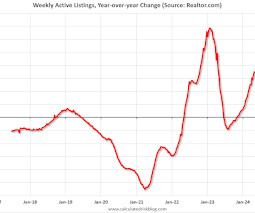

What this means: On a weekly basis, Realtor.com reports the year-over-year change in active inventory and new listings. On a monthly basis, they report total inventory. For June, Realtor.com reported inventory was up 36.7% YoY, but still down 32.4% compared to April 2017 to 2019 levels. Now - on a weekly basis - inventory is up 35.8% YoY. Realtor.com has monthly and weekly data on the existing home market.

Speaker: Erroll Amacker

As businesses increasingly adopt automation, finance leaders must navigate the delicate balance between technology and human expertise. This webinar explores the critical role of human oversight in accounts payable (AP) automation and how a people-centric approach can drive better financial performance. Join us for an insightful discussion on how integrating human expertise into automated workflows enhances decision-making, reduces fraud risks, strengthens vendor relationships, and accelerates R

Wealth Management

JULY 18, 2024

The latest RIA to sign a partnership with the alternative investment platform is Ashton Thomas Private Wealth.

Abnormal Returns

JULY 18, 2024

Books Jack Raines talks with Nat Eliason author of "Crypto Confidential: Winning and Losing Millions in the New Frontier of Finance." (sherwood.news) An excerpt from "The Techno-Humanist Manifesto" by Jason Crawford. (freethink.com) Global China's debt reckoning is ongoing. (wsj.com) How Ukraine spun up a defense industry. (bloomberg.com) Colombia is awash in cocaine.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Calculated Risk

JULY 18, 2024

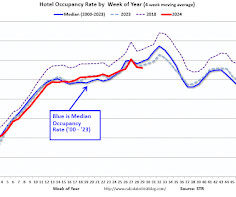

From STR: U.S. hotel results for week ending 13 July The U.S. hotel industry reported higher performance results than the previous week but lower comparisons year over year, according to CoStar’s latest data through 13 July. 7-13 July 2024 (percentage change from comparable week in 2023): • Occupancy: 69.2% (-3.7%) • Average daily rate (ADR): US$158.21 (-1.5%) • Revenue per available room (RevPAR): US$109.51 (-5.2%) emphasis added The following graph shows the seasonal pattern for the hotel occu

Wealth Management

JULY 18, 2024

After a rough 2022 of negative growth, many independent RIAs rebounded last year, with a median organic growth rate of 5%, according to Schwab’s RIA Benchmarking report.

Calculated Risk

JULY 18, 2024

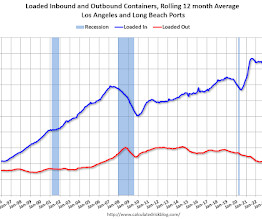

Container traffic gives us an idea about the volume of goods being exported and imported - and usually some hints about the trade report since LA area ports handle about 40% of the nation's container port traffic. The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

Wealth Management

JULY 18, 2024

Mo Sparks, the former director of exchange-traded products at the NYSE and a Vanguard veteran, will lead the initiative.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Calculated Risk

JULY 18, 2024

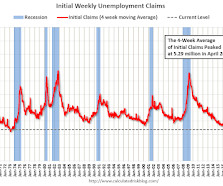

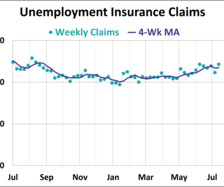

The DOL reported : In the week ending July 13, the advance figure for seasonally adjusted initial claims was 243,000 , an increase of 20,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 222,000 to 223,000. The 4-week moving average was 234,750, an increase of 1,000 from the previous week's revised average.

Wealth Management

JULY 18, 2024

Regulatory intelligence, data management, smart workflow and data security are key tenets compliance officers will need their tools to meet going forward.

Carson Wealth

JULY 18, 2024

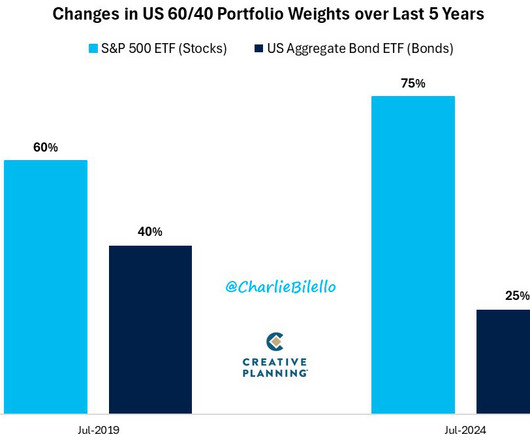

Carson Investment Research 2024 Midyear Outlook: Eyes on the Prize The economy continues to see a solid rate of expansion with low risk of a recession. We are targeting a total return for the S&P 500 of 17-20% in 2024. The Bloomberg US Aggregate Bond Index outperforms short-term Treasuries in the second half of the year. Here we sit at midyear, and many investors should be feeling pretty good.

Wealth Management

JULY 18, 2024

Integrations between the two will enable compliance, capture and analysis of data from ChatGPT Enterprise usage.

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

A Wealth of Common Sense

JULY 18, 2024

A reader asks: As someone that spends too much time thinking about buying a lake house, I would love to hear your thoughts. The argument that you will feel tied down and obligated to go to the lake house at the expense of other travel worries me. A few weeks ago I wrote about my all-time high in savings and why it was a mistake. Here’s something I shared: But I no longer feel it’s necessary to go over and abov.

Wealth Management

JULY 18, 2024

According to the brokerage regulator, Laura Casey purchased securities in clients’ brokerage accounts when she could have avoided sales charges by using advisory accounts.

Advisor Perspectives

JULY 18, 2024

The Conference Board Leading Economic Index (LEI) decreased in June to its lowest level since April 2020. The index fell 0.2% from the previous month to 101.1, its smallest monthly decline in the past four months.

Wealth Management

JULY 18, 2024

Through the end of May, just over 100 ESG funds were launched this year, well short of the 566 launches during all of 2023.

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

Advisor Perspectives

JULY 18, 2024

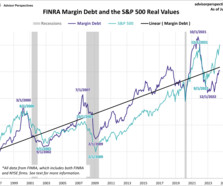

FINRA has released new data for margin debt, now available through June. The latest debt level was flat last month at $809.32 billion. Margin debt is unchanged month-over-month (MoM) and up 18.8% year-over-year (YoY). However, after adjusting for inflation, debt level is down 0.1% MoM and up 15.4% YoY.

Wealth Management

JULY 18, 2024

Learn how WealthManagement.com and The Oasis Group are helping to foster collaboration on cybersecurity, AI, and operational efficiencies.

FMG

JULY 18, 2024

An excellent advisor website can make all the difference in connecting with a potential client. That’s why we’re proud to partner with LPL Financial advisors to help keep their sites up-to-date and modern, with clear value propositions, easy navigation, engaging content, and more. Here are 5 LPL Financial advisor websites that highlight what makes an advisor site great while bringing traffic to their site : 1.

Wealth Management

JULY 18, 2024

John Miller, First Eagle Investments, shares insights on a top-performing fund.

Speaker: Sierre Lindgren

Fraud is a battle that every organization must face – it’s no longer a question of “if” but “when.” Every organization is a potential target for fraud, and the finance department is often the bullseye. From cleverly disguised emails to fraudulent payment requests, the tactics of cybercriminals are advancing rapidly. Drawing insights from real-world cases and industry expertise, we’ll explore the vulnerabilities in your processes and how to fortify them effectively.

AdvicePay

JULY 18, 2024

Are disjointed workflows and manual data entry slowing down your firm’s growth? Imagine eliminating tedious tasks, improving data accuracy, and creating a seamless experience for your entire team – home office, advisors, and clients alike.

Advisor Perspectives

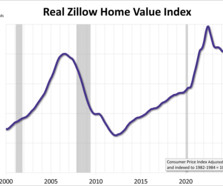

JULY 18, 2024

In June, nominal home values increased for a 15th straight months while "real" home values declined. Last month's ZHVI came in at $363,438, up 0.2% from the previous month and up 3.8% from one year ago. However, after adjusting for inflation, the real figures are -0.1% month-over-month and -1.5% year-over-year.

NAIFA Advisor Today

JULY 18, 2024

Shantell Wright is a seasoned professional with 14 years of experience in the financial services industry. He is also the visionary behind a financial services company that offers solutions to build and grow wealth. Having overcome personal challenges, Shantell uses his experience to empower clients from all socio-economic backgrounds. With a commitment to adding value, making connections, and creating an impact, he partners with marketing expert John Lewis to reimagine financial services throug

Advisor Perspectives

JULY 18, 2024

In the week ending July 13th, initial jobless claims were at a seasonally adjusted level of 243,000, an increase of 20,000 from the previous week's figure. The latest reading is higher than the forecast of 229,000 jobless claims.

Advertisement

It's the time of year to give our close process some TLC. Join us in this one hour webinar where we discuss how to adopt leading practices and infuse technology into the month-end close process to improve our experience and increase our productivity during month-end and quarter-end close. Learning Objectives: This course's objective is to understand how the month-end close can be improved with automation and adoption of leading practices.

Trade Brains

JULY 18, 2024

In earlier days, the power of connectivity was familiar through various meetings in physical and when the internet became prominent it was the value unlocking. Now, with connectivity through the internet, people hold the power to revolutionize the change. The connectivity has ensured integration across people, corporations, and government. Reliance is looking to indulge in various businesses by acquiring, and entering into partnerships and joint ventures as their oil business is cash-generating

Advisor Perspectives

JULY 18, 2024

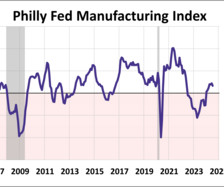

The latest Philadelphia Fed manufacturing index remained in positive territory for a sixth straight month as manufacturing activity expanded overall. In July, the index rose to 13.9 from 1.3 in June, coming in above the forecast of 2.7. The six-month outlook increased to 38.7, its highest level in three years.

Ballast Advisors

JULY 18, 2024

As you approach retirement, safeguarding your financial security takes on new importance in today’s digital world. Just as you’ve diligently planned for your finan cial future, it’s crucial to ensure that your sensitive financial information remains protected online. Wealth management firms play a pivotal role in this, employing stringent data security practices to keep your assets secure and maintain their reputation for reliability.

Advisor Perspectives

JULY 18, 2024

Discover what surprised markets in the second quarter of 2024 and understand the potential drivers of volatility for the third quarter.

Speaker: Aaron Berson

Managing spend is more than a cost cutting exercise – it's a pathway to smarter decisions that unlock efficiency and drive growth. By understanding and refining the spending process, financial leaders can empower their organizations to achieve more with less. Explore the art of balancing financial control with operational growth. From uncovering hidden inefficiencies to designing workflows that scale your business, we’ll share strategies to align your organization’s spending with its strategic g

Let's personalize your content