Holistiplan Launches Estate Plan Document Extraction Tool (And More Of The Latest In Financial #AdvisorTech – November 2024)

Nerd's Eye View

NOVEMBER 4, 2024

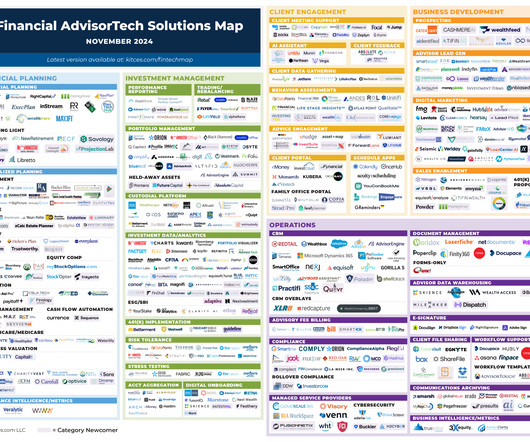

Welcome to the November 2024 issue of the Latest News in Financial #AdvisorTech – where we look at the big news, announcements, and underlying trends and developments that are emerging in the world of technology solutions for financial advisors! This month's edition kicks off with the news that Holistiplan has announced the rollout of a new estate plan document extraction tool to stand alongside its highly popular tax return scanning tool – which highlights how advances in AI technol

Let's personalize your content