Q&A: What Makes SUBSCRIBE Tick

Wealth Management

OCTOBER 23, 2024

The tech firm has quietly become a key cog in the alternative investment ecosystem.

Wealth Management

OCTOBER 23, 2024

The tech firm has quietly become a key cog in the alternative investment ecosystem.

Calculated Risk

OCTOBER 23, 2024

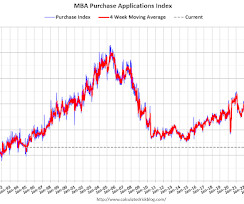

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey Mortgage applications decreased 6.7 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Applications Survey for the week ending October 18, 2024. The Market Composite Index, a measure of mortgage loan application volume, decreased 6.7 percent on a seasonally adjusted basis from one week earlier.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Abnormal Returns

OCTOBER 23, 2024

Companies Google's ($GOOGL) big businesses are in a slow, decline. (wheresyoured.at) Starbucks' ($SBUX) new CEO is clearing the decks. (bloomberg.com) Walmart ($WMT) is expanding home delivery of pharmaceuticals. (fastcompany.com) Finance Howard Marks thinks nearly every investor should look at private debt. (on.ft.com) Banks are increasingly backing capital call loans.

Wealth Management

OCTOBER 23, 2024

How a versatile planning tool can benefit clients and advisors alike.

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

Abnormal Returns

OCTOBER 23, 2024

Podcasts Joe Weisenthal and Tracy Alloway talk mortgages with Tom Graff, CIO of Facet. (podcasts.apple.com) Khe Hy talks with Erin Skinner about the challenges of mid-life. (youtube.com) Jonathan Clements Christine Benz talks with Jonathan Clements about the 'small pleasures.' (morningstar.com) Clark Howard has an honest conversation about death with Jonathan Clements.

Calculated Risk

OCTOBER 23, 2024

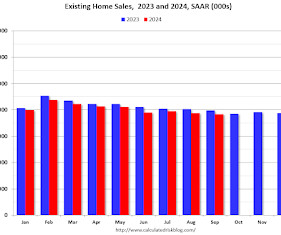

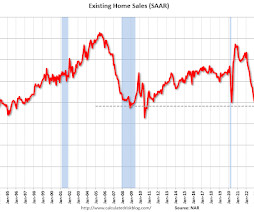

Today, in the CalculatedRisk Real Estate Newsletter: NAR: Existing-Home Sales Decreased to 3.84 million SAAR in September, New Cycle Low Excerpt: Sales Year-over-Year and Not Seasonally Adjusted (NSA) The fourth graph shows existing home sales by month for 2023 and 2024. Sales declined 3.5% year-over-year compared to September 2023. This was the thirty-seventh consecutive month with sales down year-over-year.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Nerd's Eye View

OCTOBER 23, 2024

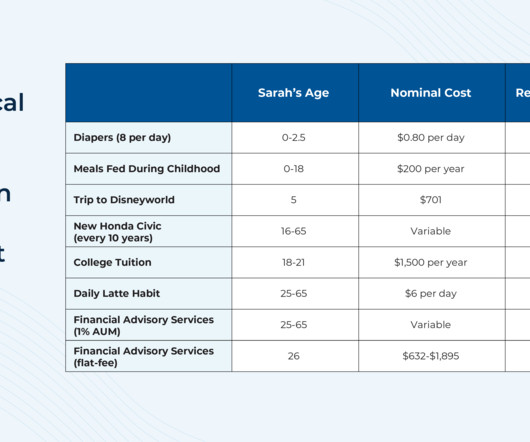

While the financial advice industry has transformed in many ways over the past several decades, one aspect that has remained relatively constant is the use of the Assets Under Management (AUM) fee model as a common way for many advisors to get paid. Though in practice, while a 1% AUM fee is a common 'starting point' in the industry, the actual fee structure can vary based on the firm's approach; for example, some firms may reduce the fee for high-net-worth clients, or charge an additional fee fo

Wealth Management

OCTOBER 23, 2024

Wednesday, November 20, 2024 | 1:00 PM Eastern Standard Time

Calculated Risk

OCTOBER 23, 2024

From the NAR: Existing-Home Sales Slid 1.0% in September Existing-home sales drew back in September, according to the National Association of REALTORS®. Three out of four major U.S. regions registered sales declines while the West experienced a sales bounce. Year-over-year, sales fell in three regions but grew in the West. Total existing-home sales – completed transactions that include single-family homes, townhomes, condominiums and co-ops – receded 1.0% from August to a seasonally adjusted ann

Wealth Management

OCTOBER 23, 2024

The founding members include Mariner Wealth Advisors, Halbert Hargrove and Modera Wealth Management. Co-Chairs Gerry Goldberg and Grant Rawdin hope the initiative will help firms adopt best practices for servicing communities.

Speaker: Erroll Amacker

As businesses increasingly adopt automation, finance leaders must navigate the delicate balance between technology and human expertise. This webinar explores the critical role of human oversight in accounts payable (AP) automation and how a people-centric approach can drive better financial performance. Join us for an insightful discussion on how integrating human expertise into automated workflows enhances decision-making, reduces fraud risks, strengthens vendor relationships, and accelerates R

Calculated Risk

OCTOBER 23, 2024

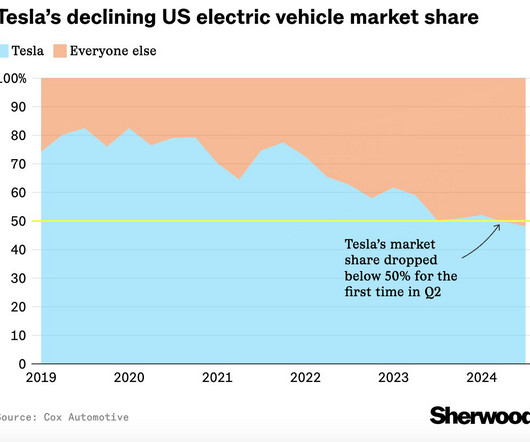

From WardsAuto: October U.S. Light-Vehicle Sales Forecast to Start Q4 with Small Gain (pay content). Brief excerpt: The fourth quarter is forecast to total 4.13 million units, 6.0% above year-ago’s 3.89 million, which was tamped down because of labor-related strikes at three automakers that pared inventory emphasis added Click on graph for larger image.

Wealth Management

OCTOBER 23, 2024

Digital assets and social media fraud were frequently cited in the states’ investigations and enforcement actions in 2023, according to a new NASAA report.

Calculated Risk

OCTOBER 23, 2024

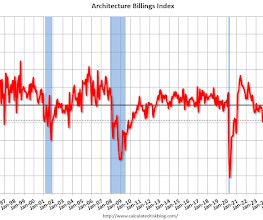

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment. From the AIA: Architecture firm billings worsened in September The AIA/Deltek Architecture Billings Index (ABI) score was 45.7 for the month , as the majority of firms continued to report declining billings. Despite recently announced rate cuts by the Federal Reserve, clients are still cautious about future projects.

Wealth Management

OCTOBER 23, 2024

A recent study identifies gender and age as significant influencers in philanthropy.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

The Big Picture

OCTOBER 23, 2024

At The Money: BlackRock on Building a Bond Ladder (October 23, 2024) Full transcript below. ~~~ About this week’s guest: Karen Veraa is a Fixed Income Product Strategist within BlackRock’s Global Fixed Income Group focusing on iShares fixed-income ETFs. She supports iShares clients, generates content on fixed-income markets and ETFs, develops new fixed-income iShares ETF strategies, and partners with the iShares team on product delivery.

Wealth Management

OCTOBER 23, 2024

John McQuown became revered on Wall Street for having led a team of academics to create the first equity portfolio tracking an index at Wells Fargo & Co.

Calculated Risk

OCTOBER 23, 2024

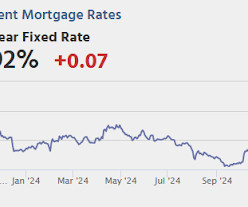

Note: Mortgage rates are from MortgageNewsDaily.com and are for top tier scenarios. Thursday: • At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 247 thousand initial claims, up from 241 thousand last week. • Also at 8:30 AM, Chicago Fed National Activity Index for September. This is a composite index of other data. • At 10:00 AM, New Home Sales for September from the Census Bureau.

Wealth Management

OCTOBER 23, 2024

Open, honest and candid discussion about using data to cross sell, whether the DC system can handle a mobile workforce, a sea change happening now and more.

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

Calculated Risk

OCTOBER 23, 2024

Fed's Beige Book On balance, economic activity was little changed in nearly all Districts since early September , though two Districts reported modest growth. Most Districts reported declining manufacturing activity. Activity in the banking sector was generally steady to up slightly, and loan demand was mixed, with some Districts noting an improvement in the outlook due to the decline in interest rates.

Trade Brains

OCTOBER 23, 2024

Deloitte has released a promising forecast for India’s economic growth. The report predicts GDP growth between 7 and 7.2 percent for FY 2024-2025. Moreover, this matches the RBI’s own growth projection of 7.2 percent. Dr. Rumki Majumdar sees India’s economy showing strong resilience after the election period. The country maintains its position among the world’s fastest-growing large economies.

Diamond Consultants

OCTOBER 23, 2024

Competition and an expanded landscape of options have resulted in additional deal structures for transitioning advisors. Advisors are a lucky lot: They have many ways to monetize their life’s work and take advantage of new opportunities for growth, both in the short and long term. The transition deal is one way that advisors can financially de-risk a move through what is traditionally known as a forgivable loan—a note that typically binds the advisor to the firm for a given length of time.

Trade Brains

OCTOBER 23, 2024

Benchmark indices fell in early trade amid selling pressure on Monday. The BSE Sensex index lost 299 points to open at 79,921.13, down by 0.37 percent, in early trade. On the other hand, the Nifty 50 index opened at 24,378.15, down by 93.95 points or 0.38 percent. However, investment and brokerage firm Prabhudas Lilladher has advised buying a few PSU stocks for 1 year.

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

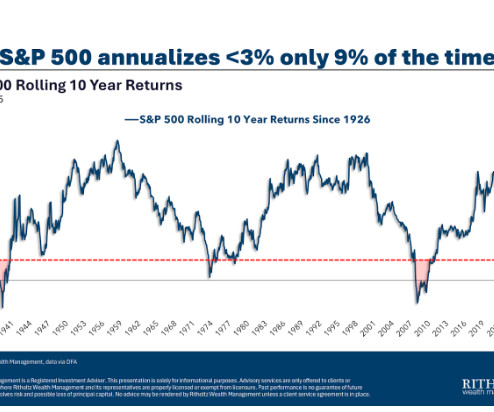

A Wealth of Common Sense

OCTOBER 23, 2024

Today’s Animal Spirits is brought to you by YCharts and CME Group: See here for 20% off your initial YCharts professional subscription See here for more information on adding futures to your portfolio with CME Group See here to subscribe to our new show, The Unlock! On today’s show, we discuss: Come work with us at the Philly office! The American economy has left other rich countries in the dust WhatR.

Trade Brains

OCTOBER 23, 2024

The zinc market has witnessed a remarkable upturn, with prices climbing steadily to Rs 289.6 per kilogram. Moreover, this surge stems from China’s economic stimulus measures and growing supply concerns in global markets. Consequently, the International Lead and Zinc Study Group now predicts a substantial deficit of 164,000 tonnes in 2024. Furthermore, this dramatic shift from an expected surplus has intensified market pressure.

SEI

OCTOBER 23, 2024

Net Sales Events, AUM, and AUA Drive Record Quarter

Steve Sanduski

OCTOBER 23, 2024

Guest: Eric Brotman , CFP®, AEP®, CPWA®, is a Principal and the Chief Executive Officer of BFG Financial Advisors. Eric began his financial planning practice in Baltimore in 1994, and founded Brotman Financial Group in 2003, which later became BFG Financial Advisors. He and his team focus on supporting families and individuals by providing comprehensive financial planning and wealth management services.

Speaker: Sierre Lindgren

Fraud is a battle that every organization must face – it’s no longer a question of “if” but “when.” Every organization is a potential target for fraud, and the finance department is often the bullseye. From cleverly disguised emails to fraudulent payment requests, the tactics of cybercriminals are advancing rapidly. Drawing insights from real-world cases and industry expertise, we’ll explore the vulnerabilities in your processes and how to fortify them effectively.

Advisor Perspectives

OCTOBER 23, 2024

Determining your client’s risk tolerance is a critical first step in constructing a tailored investment portfolio.

Trade Brains

OCTOBER 23, 2024

These two micro-cap companies surged after announcing bonus share issuance alongside strong financial performance and strategic initiatives. Stock Movement of both companies Linc Limited and Sky Gold Limited demonstrated positive momentum. Linc opened at ₹671 and is currently trading at ₹665.50, after touching a high of ₹697.40, marking an 8% surge.

Financial Symmetry

OCTOBER 23, 2024

So far, the 2024 election has provided the suspense and drama we have come to expect in presidential election years. For investors, the same questions continue to plague us as we await the winner in November. Are there signals in … Continued The post Investing Through the 2024 Election appeared first on Financial Symmetry, Inc.

Trade Brains

OCTOBER 23, 2024

Investing in stocks with high dividend yields can be an attractive strategy for income-seeking investors. Recently, a stock yielding an astonishing 480% has caught the attention of market watchers. Price Movement With a market capitalization of Rs. 12.7 crores, Taparia Tools Limited’s share price recently traded at Rs. 8.35 per share. Over the last six months, the company has given a return of 115.21 percent.

Advertisement

It's the time of year to give our close process some TLC. Join us in this one hour webinar where we discuss how to adopt leading practices and infuse technology into the month-end close process to improve our experience and increase our productivity during month-end and quarter-end close. Learning Objectives: This course's objective is to understand how the month-end close can be improved with automation and adoption of leading practices.

Let's personalize your content