What Do World War II & Covid Have in Common?

The Big Picture

NOVEMBER 3, 2023

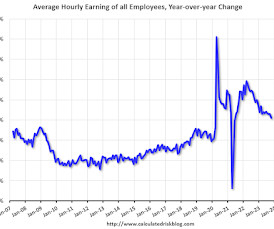

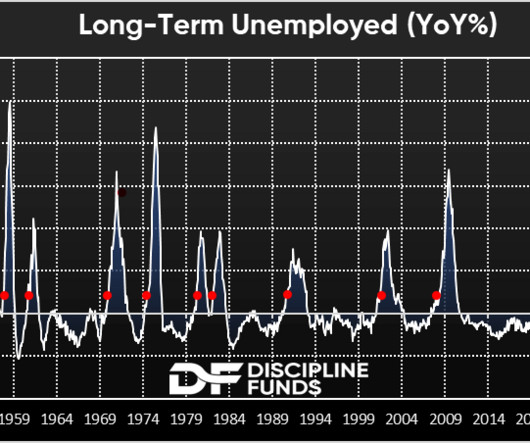

We just experienced the strongest economic recovery since the end of World War II Source: Irrelevant Investor Light posting as I’m getting ready for some travel, but this chart is so amazing. It’s hard not to look at the two biggest recovery outliers: The post-WW2 era, and the post-Covid Era. The parallels are pretty strong, especially when it comes to both the Labor market and the Inflation surges.

Let's personalize your content