EncorEstate Brings a Human Touch to Estate Tech

Wealth Management

JUNE 25, 2024

The estate tech company is betting that increased human service and support are worth sacrificing speed.

Wealth Management

JUNE 25, 2024

The estate tech company is betting that increased human service and support are worth sacrificing speed.

Abnormal Returns

JUNE 25, 2024

Alternatives Pension plans could generate equivalent returns with low-cost, index investments. (crr.bc.edu) Equity funds with VC investments don't outperform. (papers.ssrn.com) Just how big is the carried interest loophole. (papers.ssrn.com) 52 week highs Liquidity picks up at 52-week highs. (papers.ssrn.com) Do corporate bonds take note of 52-week stock highs?

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

JUNE 25, 2024

Terramar Wealth leaves SagePoint, one of the b/ds consolidated into Osaic, after 22 years with the firm.

Nerd's Eye View

JUNE 25, 2024

Welcome everyone! Welcome to the 391st episode of the Financial Advisor Success Podcast ! My guest on today's podcast is Christopher Jones. Chris is the founder of Sparrow Wealth Management, an RIA based in Orlando, Florida, that oversees approximately $110 million in assets under management for 68 client households. What's unique about Chris, though, is how he has built a highly efficient solo practice that allows him to work fewer than 25 hours/ week to have more time for his family and manage

Speaker: Erroll Amacker

As businesses increasingly adopt automation, finance leaders must navigate the delicate balance between technology and human expertise. This webinar explores the critical role of human oversight in accounts payable (AP) automation and how a people-centric approach can drive better financial performance. Join us for an insightful discussion on how integrating human expertise into automated workflows enhances decision-making, reduces fraud risks, strengthens vendor relationships, and accelerates R

Wealth Management

JUNE 25, 2024

Morningstar broke down what advisors and investors need to know about the recent surge in interval funds. The explosion in private credit has had the unintended effect of reducing the broader financial system’s leverage, according to Investing.com. These are among the investment must reads we found this week for wealth advisors.

Calculated Risk

JUNE 25, 2024

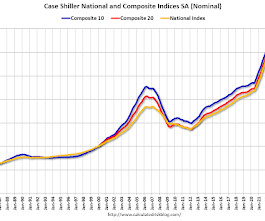

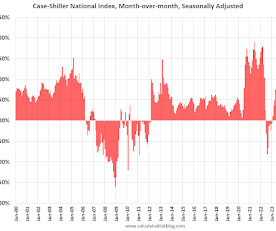

S&P/Case-Shiller released the monthly Home Price Indices for April ("April" is a 3-month average of February, March and April closing prices). This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index. From S&P S&P CoreLogic Case-Shiller Index Break Prvious Month's All-Time High in April 2024 The S&P CoreLogic Case-Shiller U.S.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Calculated Risk

JUNE 25, 2024

Today, in the Calculated Risk Real Estate Newsletter: Case-Shiller: National House Price Index Up 6.3% year-over-year in April; FHFA: House Prices Increased 0.2% in April, up 6.3% YoY Excerpt: S&P/Case-Shiller released the monthly Home Price Indices for April ("April" is a 3-month average of February, March and April closing prices). April closing prices include some contracts signed in December, so there is a significant lag to this data.

Wealth Management

JUNE 25, 2024

A new report from Cerulli & Associates finds the retail financial advisor channel has been the biggest growth driver behind ETFs.

Calculated Risk

JUNE 25, 2024

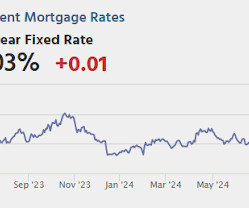

Note: Mortgage rates are from MortgageNewsDaily.com and are for top tier scenarios. Wednesday: • At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index. • At 10:00 AM, New Home Sales for May from the Census Bureau. The consensus is for 650 thousand SAAR, up from 634 thousand in April. • During the day, The AIA's Architecture Billings Index for May (a leading indicator for commercial real estate).

Wealth Management

JUNE 25, 2024

U.S. District Judge Holly Teeter dismissed defamation charges Edelman made against Mariner but allowed the misappropriation and conspiracy claims to remain in place.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Abnormal Returns

JUNE 25, 2024

Strategy Stop dissing standard deviation as a risk measure. (morningstar.com) ETF is not a euphemism for good investment. (etf.com) Finance Can Citi ($C) ever catch up to its peers? (wsj.com) Where did all the Chinese IPOs go? (nytimes.com) The Series A crunch is here. (tomtunguz.com) Weight loss Novo Nordisk ($NVO) is building a new plant in North Carolina to manufacture weight loss drugs.

Wealth Management

JUNE 25, 2024

Amplify efficiency, enhance the client experience, and support compliance.

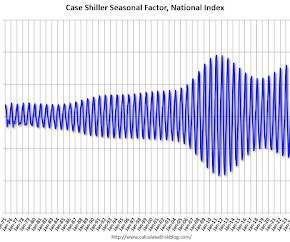

Calculated Risk

JUNE 25, 2024

Two key points: 1) There is a clear seasonal pattern for house prices. 2) The surge in distressed sales during the housing bust distorted the seasonal pattern. This was because distressed sales (at lower price points) happened at a steady rate all year, while regular sales followed the normal seasonal pattern. This made for larger swings in the seasonal factor during the housing bust.

Wealth Management

JUNE 25, 2024

While not exactly a free lunch, for some investors, it's been a free stop at the dessert tray.

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

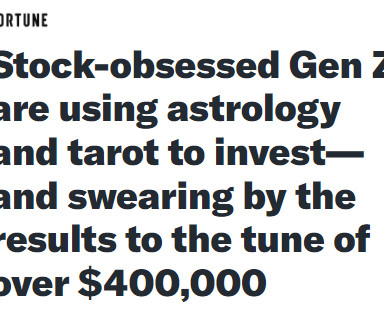

A Wealth of Common Sense

JUNE 25, 2024

Here’s a headline you only see during a bull market: This is from the article: “It’s a new way of making money,” Nova told Fortune. “New possibilities for people: that you don’t have to, in this day and age, work as hard. Work smarter, not harder.” Following the stars has worked out for Nova. She quit her job as a tarot reader and astrology consultant this year to day-trade, fin.

Advisor Perspectives

JUNE 25, 2024

I have long admired Jonathan Clements. His columns in The Wall Street Journal introduced me to index-based investing. I was deeply saddened to read his column in HumbleDollar, dated June 15, 2024, that, at age 61, he has been diagnosed with lung cancer that has metastasized to his brain and “a few other spots.

Calculated Risk

JUNE 25, 2024

From WardsAuto: June U.S. Light-Vehicle Sales Likely Reduced by Cyberattack (pay content). Brief excerpt: Unknown is how many unit sales in June might be lost because of the attack. Not all affected dealers stopped selling vehicles and many that did have since resumed, often manually processing sales and finding alternative ways to deliver vehicles to customers.

Million Dollar Round Table (MDRT)

JUNE 25, 2024

By Bryce Sanders How much do people know about you as a financial advisor or life insurance agent? Suppose someone across the room pointed you out. How would that person describe you, and would it be accurate? When you join a local nonprofit or other community organization, you might be surrounded by high-net-worth individuals, but are they aware of you and do they know how you can be of service to them as an advisor?

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

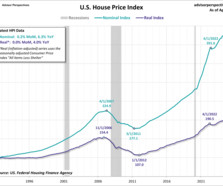

Advisor Perspectives

JUNE 25, 2024

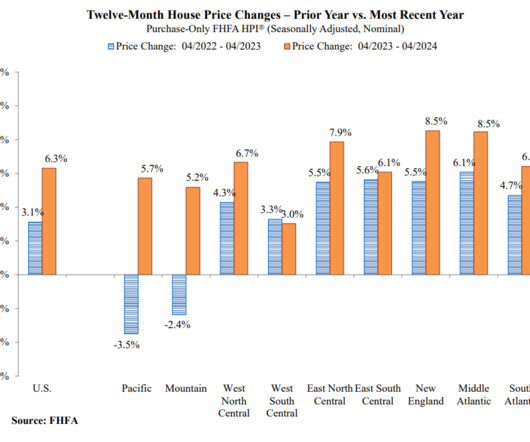

The Federal Housing Finance Agency (FHFA) house price index (HPI) increased to 424.3 in April, a new all-time high. U.S. house prices rose by 0.2% from the previous month and are up 6.3% from one year ago. After adjusting for inflation, the real index was flat month-over-month and up 4.0% year-over-year.

Wealthfront

JUNE 25, 2024

Welcome to our Ask Wealthfront series, where we tackle your questions about personal finance and investing. Want to see your question answered here? Reach out to us on social media and we’ll try to address it in a future column. If I have extra cash, should I use it to pay off my mortgage early […] The post Ask Wealthfront: Should I Pay Off My Mortgage Early or Invest?

Advisor Perspectives

JUNE 25, 2024

The Conference Board's Consumer Confidence Index® slightly weakened in June. The index fell to 100.4 this month from May's downwardly revised 101.3. This month's reading was better than expected, exceeding the 100.0 forecast.

Steve Sanduski

JUNE 25, 2024

Guests: Andrew M. Bailey, Bradley Rettler, and Craig Warmke , philosophers, Bitcoin enthusiasts, and coauthors of the new book Resistance Money: A Philosophical Case for Bitcoin. In a Nutshell: Whenever Bitcoin makes headlines, skeptics dismiss the cryptocurrency as a solution in search of a problem, a technology with no mainstream uses, or a Ponzi scheme waiting for its next sucker.

Speaker: Sierre Lindgren

Fraud is a battle that every organization must face – it’s no longer a question of “if” but “when.” Every organization is a potential target for fraud, and the finance department is often the bullseye. From cleverly disguised emails to fraudulent payment requests, the tactics of cybercriminals are advancing rapidly. Drawing insights from real-world cases and industry expertise, we’ll explore the vulnerabilities in your processes and how to fortify them effectively.

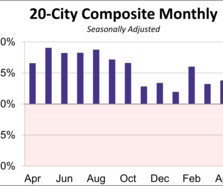

Advisor Perspectives

JUNE 25, 2024

Home prices continued to trend upwards in April as the benchmark 20-city index rose for a fourteenth consecutive month to a new all-time high. The S&P Case-Shiller Home Price Index revealed seasonally adjusted home prices for the 20-city index saw a 0.4% increase month-over-month (MoM) and a 7.2% increase year-over-year (YoY). After adjusting for inflation, the MoM was reduced to 0.0% and the YoY was reduced to 1.3%.

Advisor Perspectives

JUNE 25, 2024

It might seem like a far-fetched concept, but making the sale should be a consistently predictable and effortless experience. Your outcomes should not be unpredictable and you should not have to “follow-up” on qualified prospects who have ghosted you.

Advertisement

It's the time of year to give our close process some TLC. Join us in this one hour webinar where we discuss how to adopt leading practices and infuse technology into the month-end close process to improve our experience and increase our productivity during month-end and quarter-end close. Learning Objectives: This course's objective is to understand how the month-end close can be improved with automation and adoption of leading practices.

Advisor Perspectives

JUNE 25, 2024

When it comes to personalization, automation can be one of our most powerful tools. That might sound paradoxical, but it’s not.

Advisor Perspectives

JUNE 25, 2024

The Chicago Fed National Activity Index (CFNAI) rose to +0.18 in May from -0.26 in April. Three of the four broad categories of indicators used to construct the index increased from April and two categories made positive contributions in May. The index's three-month moving average, CFNAI-MA3, fell to -0.09 in May from -0.05 in April.

SEI

JUNE 25, 2024

Staying at the Omni Nashville Hotel, parking, and things to do in Nashville.

Speaker: Aaron Berson

Managing spend is more than a cost cutting exercise – it's a pathway to smarter decisions that unlock efficiency and drive growth. By understanding and refining the spending process, financial leaders can empower their organizations to achieve more with less. Explore the art of balancing financial control with operational growth. From uncovering hidden inefficiencies to designing workflows that scale your business, we’ll share strategies to align your organization’s spending with its strategic g

Let's personalize your content