Former InvestCloud CEO John Wise’s Firm Acquires Fincentric

Wealth Management

AUGUST 15, 2024

Communify, which will merge with Fincentric to create a new company, is making the investment alongside private equity firm Stellex.

Wealth Management

AUGUST 15, 2024

Communify, which will merge with Fincentric to create a new company, is making the investment alongside private equity firm Stellex.

Abnormal Returns

AUGUST 15, 2024

Business Another example of advisors getting rich while their clients underperform to the tune of billions. (bloomberg.com) Pixar bounced back with 'Inside Out 2' but you shouldn't expect a return to the company's golden age. (readtrung.com) How the U.S. fell behind in the drone business. (noahpinion.blog) How the magazine business died. (honest-broker.com) Companies Nine takeaway from six months of the Apple ($AAPL) Vision Pro.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

AUGUST 15, 2024

Take these steps to ensure your RIA is ready for an influx in advisors and clients.

Abnormal Returns

AUGUST 15, 2024

Companies Brian Niccol has his hands full with turning around Starbucks ($SBUX). (barrons.com) Apple ($AAPL) stock was a much bigger bargain when Buffett first purchased shares. (bloomberg.com) Why Airbus has been unable to take full advantage of Boeing's ($BA) woes. (nytimes.com) Finance It seems the SEC will approve just about any ETF these days. (ft.com) What VC returns look like in the real world.

Speaker: Erroll Amacker

As businesses increasingly adopt automation, finance leaders must navigate the delicate balance between technology and human expertise. This webinar explores the critical role of human oversight in accounts payable (AP) automation and how a people-centric approach can drive better financial performance. Join us for an insightful discussion on how integrating human expertise into automated workflows enhances decision-making, reduces fraud risks, strengthens vendor relationships, and accelerates R

Wealth Management

AUGUST 15, 2024

The Atlanta-based team decided to explore their options when their broke/dealer, Lincoln Financial, was acquired by Osaic.

Calculated Risk

AUGUST 15, 2024

The DOL reported : In the week ending August 10, the advance figure for seasonally adjusted initial claims was 227,000 , a decrease of 7,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 233,000 to 234,000. The 4-week moving average was 236,500, a decrease of 4,500 from the previous week's revised average.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Calculated Risk

AUGUST 15, 2024

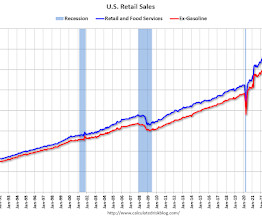

On a monthly basis, retail sales increased 1.0% from June to July (seasonally adjusted), and sales were up 2.7 percent from July 2023. From the Census Bureau report : Advance estimates of U.S. retail and food services sales for July 2024, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $709.7 billion, an increase of 1.0% from the previous month , and up 2.7 percent from July 2023.

Wealth Management

AUGUST 15, 2024

A new study claims that for every dollar spent on sports gambling, net investments in stocks and other financial instruments dropped by just over $2.

Calculated Risk

AUGUST 15, 2024

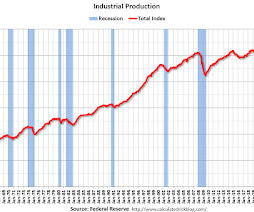

From the Fed: Industrial Production and Capacity Utilization Industrial production fell 0.6 percent in July after increasing 0.3 percent in June. Early July shutdowns concentrated in the petrochemical and related industries due to Hurricane Beryl held down the growth of industrial production by an estimated 0.3 percentage point. Manufacturing output stepped down 0.3 percent as the index for motor vehicles and parts fell nearly 8 percent; manufacturing excluding motor vehicles and parts rose 0.3

Wealth Management

AUGUST 15, 2024

Industry coach John Bowen demonstrates the benefits of building and fostering the development of your team.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Calculated Risk

AUGUST 15, 2024

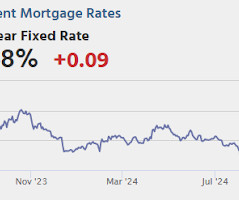

Note: Mortgage rates are from MortgageNewsDaily.com and are for top tier scenarios. Thursday: • At 8:30 AM ET, Housing Starts for July. The consensus is for 1.342 million SAAR, down from 1.353 million SAAR in June.

Wealth Management

AUGUST 15, 2024

When thinking about technology and clients, get back to basics and think first of the customer.

Calculated Risk

AUGUST 15, 2024

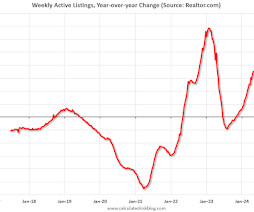

What this means: On a weekly basis, Realtor.com reports the year-over-year change in active inventory and new listings. On a monthly basis, they report total inventory. For July, Realtor.com reported inventory was up 36.6% YoY, but still down 30.6% compared to April 2017 to 2019 levels. Now - on a weekly basis - inventory is up 35.5% YoY. Realtor.com has monthly and weekly data on the existing home market.

Wealth Management

AUGUST 15, 2024

The products, which will be managed by a trio of portfolio managers who joined earlier this year from Invesco Ltd., will focus on lower-rated bonds.

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

Calculated Risk

AUGUST 15, 2024

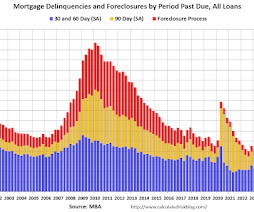

Today, in the Calculated Risk Real Estate Newsletter: MBA: Mortgage Delinquencies Increased in Q2 2024 A brief excerpt: From the MBA: Mortgage Delinquencies Increase in the Second Quarter of 2024 The delinquency rate for mortgage loans on one-to-four-unit residential properties increased to a seasonally adjusted rate of 3.97 percent of all loans outstanding at the end of the second quarter of 2024, according to the Mortgage Bankers Association’s (MBA) National Delinquency Survey.

Wealth Management

AUGUST 15, 2024

Opto Investments and Conway Investment Solutions will be offering clients vintage private market funds.

A Wealth of Common Sense

AUGUST 15, 2024

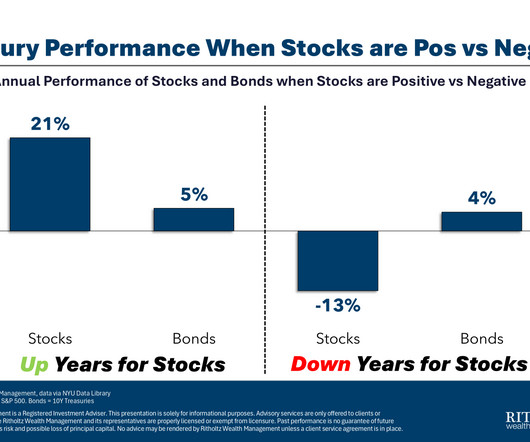

My colleague Alex Palumbo joined us on the show this week to discuss questions about how to deploy a big chunk of cash savings, how to diversify out of company stock, benchmarking financial performance and how to think about alpha when it comes to choosing a financial advisor. Further Reading: The Holy Grail of Portfolio Management 1The S&P 500 was up 9.8% per year while the 10 year Treasury gained 4.6% annually from.

Wealth Management

AUGUST 15, 2024

When thinking about technology and clients, get back to basics and think first of the customer.

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

Advisor Perspectives

AUGUST 15, 2024

Nominal retail sales in July were up 0.97% month-over-month (MoM) and up 2.66% year-over-year (YoY). However, after adjusting for inflation, real retail sales were up 0.81% MoM and down 0.25% YoY.

Wealth Management

AUGUST 15, 2024

The Atlanta-based team decided to explore their options when their broke/dealer, Lincoln Financial, was acquired by Osaic.

Advisor Perspectives

AUGUST 15, 2024

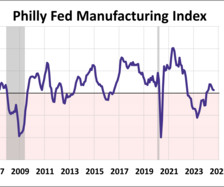

The latest Philadelphia Fed manufacturing index fell into negative territory for the first time since January as manufacturing activity softened overall. In August, the index dropped to -7.0 from 13.9 in July, coming in below the forecast of 5.4. The six-month outlook decreased to 15.4.

Wealth Management

AUGUST 15, 2024

Paul Hoskin will work out of Newport Beach, Calif., and is joining 10 of his former Key Client Group co-workers, who switched to Summit Trail in June.

Speaker: Sierre Lindgren

Fraud is a battle that every organization must face – it’s no longer a question of “if” but “when.” Every organization is a potential target for fraud, and the finance department is often the bullseye. From cleverly disguised emails to fraudulent payment requests, the tactics of cybercriminals are advancing rapidly. Drawing insights from real-world cases and industry expertise, we’ll explore the vulnerabilities in your processes and how to fortify them effectively.

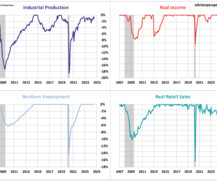

Advisor Perspectives

AUGUST 15, 2024

Official recession calls are the responsibility of the NBER Business Cycle Dating Committee, which is understandably vague about the specific indicators on which they base their decisions. There is, however, a general belief that there are four big indicators that the committee weighs heavily in their cycle identification process.

Wealth Management

AUGUST 15, 2024

Tuesday, September 17, 2024 at 2:00 PM ET

Advisor Perspectives

AUGUST 15, 2024

Warren Buffett’s longtime business partner Charlie Munger brought quality to value investing. Now Buffett is bringing value to quality investing.

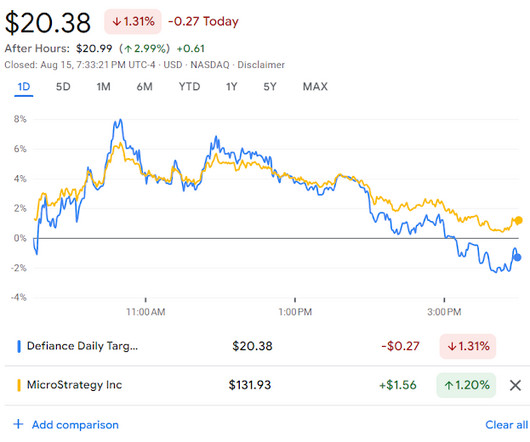

Wealth Management

AUGUST 15, 2024

Defiance launched the Defiance Daily Target 1.75X Long MSTR ETF (MSTX), which looks to offer daily leveraged returns on MicroStrategy Inc.

Advertisement

It's the time of year to give our close process some TLC. Join us in this one hour webinar where we discuss how to adopt leading practices and infuse technology into the month-end close process to improve our experience and increase our productivity during month-end and quarter-end close. Learning Objectives: This course's objective is to understand how the month-end close can be improved with automation and adoption of leading practices.

Advisor Perspectives

AUGUST 15, 2024

Builder confidence fell further in August as a lack of affordability and buyer hesitation continue to slow down the market. The National Association of Home Builders (NAHB) Housing Market Index (HMI) dropped to 39 this month, its lowest level of the year. The latest reading came was below the forecast of 43.

Random Roger's Retirement Planning

AUGUST 15, 2024

ETF.com posted a very brief article where an advisor shared his portfolio allocation and a few high level comments about the particulars. Here's the portfolio. He's 100% equities except he sort of isn't. He has a 10% cash buffer outside of this allocation. The idea behind being so heavy in equities is that he is taking a very long time horizon being 47 with no plans to retire anytime soon.

Advisor Perspectives

AUGUST 15, 2024

For years, the emphasis within fixed income investing has been to seek security-specific alpha in an illiquid bond market where no single security significantly impacts portfolio returns.

Validea

AUGUST 15, 2024

Applied Materials, Inc. (AMAT) reported strong financial results for the third quarter of 2024 today, surpassing analysts’ expectations. The company achieved a record revenue of $6.78 billion, which marked a 5% increase from the same period last year and exceeded the consensus estimate of $6.673 billion. The adjusted earnings per share (EPS) also outperformed expectations, reaching $2.12, compared to the anticipated $2.02 per share.

Speaker: Aaron Berson

Managing spend is more than a cost cutting exercise – it's a pathway to smarter decisions that unlock efficiency and drive growth. By understanding and refining the spending process, financial leaders can empower their organizations to achieve more with less. Explore the art of balancing financial control with operational growth. From uncovering hidden inefficiencies to designing workflows that scale your business, we’ll share strategies to align your organization’s spending with its strategic g

Let's personalize your content