Wednesday links: selling certainty

Abnormal Returns

FEBRUARY 21, 2024

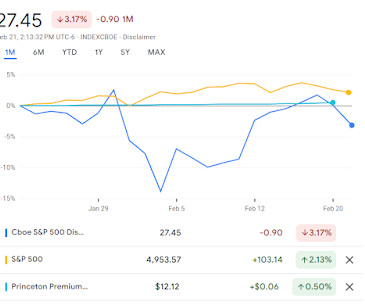

Markets The list of Europe's biggest stocks are filled with pharma companies. (euronews.com) Hedge funds have been underweight the Magnificent Seven. (ft.com) Strategy Certainty sells. Nuance is what matters. (downtownjoshbrown.com) Don't invest in alternatives unless you are in it for the long run. (morningstar.com) Private equity Private equity distributions are way off their highs.

Let's personalize your content