CAIA Charts Challenges for Advisors Interested in Alts

Wealth Management

JUNE 18, 2024

The report shows advisor interest in alternative investments even as some struggle with implementation, according to CAIA Managing Director Aaron Filbeck.

Wealth Management

JUNE 18, 2024

The report shows advisor interest in alternative investments even as some struggle with implementation, according to CAIA Managing Director Aaron Filbeck.

Abnormal Returns

JUNE 18, 2024

Markets Market breadth is not great. (sherwood.news) The Magnificent Seven also stand out for their stock buybacks. (visualcapitalist.com) Alternatives The Bogle Effect has not come for alternative asset classes. (ofdollarsanddata.com) Pension funds could skip on the alternatives and just invest in low-cost index investments. (crr.bc.edu) Strategy The many ways in which investing is NOT like poker.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

JUNE 18, 2024

Does the wisdom of age outweigh the other limitations it can impose?

Calculated Risk

JUNE 18, 2024

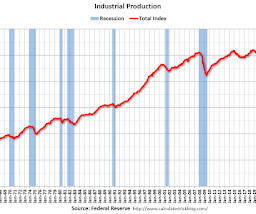

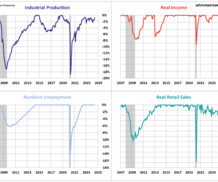

From the Fed: Industrial Production and Capacity Utilization Industrial production rose 0.9 percent in May. Manufacturing output posted a similar gain of 0.9 percent after declining in the previous two months. The index for mining increased 0.3 percent in May, and the index for utilities advanced 1.6 percent. At 103.3 percent of its 2017 average, total industrial production in May was 0.4 percent higher than its year-earlier level.

Speaker: Erroll Amacker

As businesses increasingly adopt automation, finance leaders must navigate the delicate balance between technology and human expertise. This webinar explores the critical role of human oversight in accounts payable (AP) automation and how a people-centric approach can drive better financial performance. Join us for an insightful discussion on how integrating human expertise into automated workflows enhances decision-making, reduces fraud risks, strengthens vendor relationships, and accelerates R

Wealth Management

JUNE 18, 2024

James McDonald was taken into custody in Port Orchard, Wash. and will face federal charges in Los Angeles. He is accused of losing millions in client funds and fled an SEC subpoena in 2021.

Abnormal Returns

JUNE 18, 2024

AlphaSense AlphaSense is buying Tegus. (bloomberg.com) What next for AlphaSense? (mattober.co) Private equity As alts go, so go pension fund returns. (papers.ssrn.com) Comparing the (real) volatility of private equity and private credit. (alphaarchitect.com) Secondary PE investments are a necessary part of the system. (caia.org) How much in taxes have private equity fund managers avoided through carried interest?

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Calculated Risk

JUNE 18, 2024

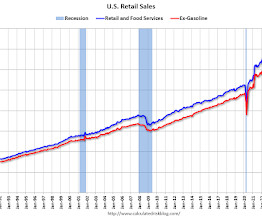

On a monthly basis, retail sales were "virtually unchanged" from March to April (seasonally adjusted), and sales were up 3.0 percent from April 2023. From the Census Bureau report : Advance estimates of U.S. retail and food services sales for May 2024, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $703.1 billion, up 0.1 percent from the previous month, and up 2.3 percent above May 2023.

Wealth Management

JUNE 18, 2024

Blackrock’s Chief Investment Officer reported that while hedge funds and brokerages have dipped into spot bitcoin ETFs, RIAs have been slower to embrace them. Morgan Stanley is adding more manager-traded SMAs to its UMA platform, reports FundFire. These are among the investment must reads we found this week for wealth advisors.

Calculated Risk

JUNE 18, 2024

Note: Mortgage rates are from MortgageNewsDaily.com and are for top tier scenarios. Wednesday: • All US markets will be closed in observance of Juneteenth National Independence Day • At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index. • At 10:00 AM, The June NAHB homebuilder survey.

Wealth Management

JUNE 18, 2024

Stonebridge Financial Partners, a Michigan-based team of 18, has joined NewEdge from Carson.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Calculated Risk

JUNE 18, 2024

Today, in the Calculated Risk Real Estate Newsletter: Lawler: Early Read on Existing Home Sales in May A brief excerpt: From housing economist Tom Lawler: Based on publicly-available local realtor/MLS reports released across the country through today, I project that existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 4.13 million in May, down 0.2% from April’s preliminary pace and down 2.4% from last May’s seasonally adjusted pace.

Wealth Management

JUNE 18, 2024

The Brown-Brinkley Group includes two managing directors with nearly six decades of collective industry experience. They will operate out of RBC’s office in Tysons, Virginia.

Calculated Risk

JUNE 18, 2024

Today, in the Calculated Risk Real Estate Newsletter: 4th Look at Local Housing Markets in May; California Home Sales Down 6% YoY in May A brief excerpt: The National Association of Realtors (NAR) is scheduled to release May Existing Home Sales on Friday June 21st at 10 AM ET. The early consensus is for 4.10 million SAAR, down from 4.14 million in April, and down from 4.23 million in May 2023.

Wealth Management

JUNE 18, 2024

The relationship will give Assetmark’s network of over 10,000 advisors access to TIFIN Give's advanced DAF technology.

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

The Big Picture

JUNE 18, 2024

The transcript from this week’s, MiB: Erika Ayers Badan, CEO of Barstool Sports , is below. You can stream and download our full conversation, including any podcast extras, on Apple Podcasts , Spotify , YouTube , and Bloomberg. All of our earlier podcasts on your favorite pod hosts can be found here. ~~~ Bloomberg Audio Studios, podcasts, radio News.

Wealth Management

JUNE 18, 2024

Nearly three-quarters of wealthy younger Americans say stocks and bonds alone can’t deliver above-average returns.

A Wealth of Common Sense

JUNE 18, 2024

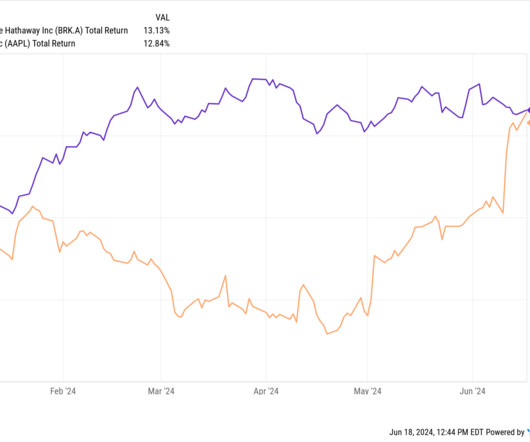

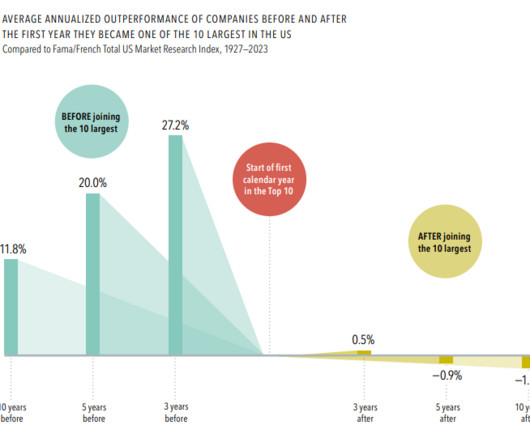

The stock market looks a lot like the wealth profile in this country — the rich keep getting richer. That richness can be expressed in a couple of different ways. First up is market cap. The biggest stocks are a lot bigger than the others: Corporations in the S&P 500 aren’t evenly distributed. In fact, the top 25 companies in the S&P 500 are as big as the rest of the index combined.1 The biggest sto.

Nerd's Eye View

JUNE 18, 2024

Welcome back to the 390th episode of the Financial Advisor Success Podcast ! My guest on today's podcast is Brent Carnduff. Brent is the founder of Advisor Rankings, a marketing firm based in Boise, Idaho that specializes in search engine optimization for financial advisors. What's unique about Brent, though, is how his firm helps advisors maximize both the advisor's organic SEO to attract prospects with specific planning needs through effective content creation , and their local SEO to rise to

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

Advisor Perspectives

JUNE 18, 2024

Official recession calls are the responsibility of the NBER Business Cycle Dating Committee, which is understandably vague about the specific indicators on which they base their decisions. There is, however, a general belief that there are four big indicators that the committee weighs heavily in their cycle identification process.

Million Dollar Round Table (MDRT)

JUNE 18, 2024

By Bryce Sanders Besides being financial advisors, we’re also someone else’s client, customer or patient. When you think of those relationships, do you feel like a valued client or just another number? Your answer might be that you feel like a valued client or customer when, “They treat me like an individual,” or “They care about me as a person.” It is often, “They have taken the time to learn my likes and dislikes.

NAIFA Advisor Today

JUNE 18, 2024

Message From the CEO One hundred and thirty-four years ago today, a group of life insurance agents from different parts of the United States gathered at the Parker House in Boston to create the National Association of Life Underwriters. This organization, which grew into the NAIFA we cherish and celebrate today, was formed to promote the success of the life insurance industry and encourage laws prohibiting life insurance agents from engaging in questionable or unethical practices.

Advisor Perspectives

JUNE 18, 2024

Pacific Investment Management Co. expects more regional bank failures in the US because of a “very high” concentration of troubled commercial real estate loans on their books.

Speaker: Sierre Lindgren

Fraud is a battle that every organization must face – it’s no longer a question of “if” but “when.” Every organization is a potential target for fraud, and the finance department is often the bullseye. From cleverly disguised emails to fraudulent payment requests, the tactics of cybercriminals are advancing rapidly. Drawing insights from real-world cases and industry expertise, we’ll explore the vulnerabilities in your processes and how to fortify them effectively.

Ballast Advisors

JUNE 18, 2024

Living the snowbird lifestyle can be an exciting and rewarding experience. As you navigate the waters of financial planning, it’s crucial to maintain balance and stability amidst the complexities of owning multiple residences in different states. At Ballast Advisors, we understand the unique challenges faced by snowbirds and are here to provide guidance and support on this journey.

Advisor Perspectives

JUNE 18, 2024

Nvidia Corp. insiders have sold shares worth more than $700 million this year as the stock continues to push deeper into record territory amid unrelenting demand for its chips.

Random Roger's Retirement Planning

JUNE 18, 2024

Laurence Kotlikoff was interviewed by Think Advisor and boy howdy he has some strong opinions. The title of the article is Advisors Do Retirement Planning All Wrong so you have a sense of what's coming before you even start reading. First up, he calls 401k plans "abject failures." If I am reading him correctly, he believes Congress and the various parts of the chain that comprise "Wall Street" are working together to make money at the expense of plan participants.

Advisor Perspectives

JUNE 18, 2024

Understanding how to act ethically and appropriately as an advisor is apparently no easy task.

Advertisement

It's the time of year to give our close process some TLC. Join us in this one hour webinar where we discuss how to adopt leading practices and infuse technology into the month-end close process to improve our experience and increase our productivity during month-end and quarter-end close. Learning Objectives: This course's objective is to understand how the month-end close can be improved with automation and adoption of leading practices.

Ballast Advisors

JUNE 18, 2024

Living the snowbird lifestyle can be an exciting and rewarding experience. As you navigate the waters of financial planning, it’s crucial to maintain balance and stability amidst the complexities of owning multiple residences in different states. At Ballast Advisors, we understand the unique challenges faced by snowbirds and are here to provide guidance and support on this journey.

Advisor Perspectives

JUNE 18, 2024

In this episode of Dear Ficomm, I'll talk you through specific, actionable tips about how to get more registrants to your webinar as a financial advisor.

Indigo Marketing Agency

JUNE 18, 2024

These days, videos are everywhere. LinkedIn, Facebook, Instagram, and even your favorite financial news app are filled with video content. From simplifying complex financial concepts to highlighting your personality as an advisor, videos offer a dynamic and engaging way to convey valuable information. At Indigo Marketing Agency, we help financial advisors embrace the evolving marketing landscape by utilizing custom video content.

Advisor Perspectives

JUNE 18, 2024

Why do people so consistently underestimate their lifespan? Their thinking is influenced by the money scripts, financial circumstances, stories, and emotions that drive a person’s cognitive biases, or mental shortcuts.

Speaker: Aaron Berson

Managing spend is more than a cost cutting exercise – it's a pathway to smarter decisions that unlock efficiency and drive growth. By understanding and refining the spending process, financial leaders can empower their organizations to achieve more with less. Explore the art of balancing financial control with operational growth. From uncovering hidden inefficiencies to designing workflows that scale your business, we’ll share strategies to align your organization’s spending with its strategic g

Let's personalize your content