Preparing and Engaging the Next Gen for Future Succession Roles

Wealth Management

APRIL 19, 2024

How to equip inheritors to handle a large influx of wealth.

Wealth Management

APRIL 19, 2024

How to equip inheritors to handle a large influx of wealth.

Calculated Risk

APRIL 19, 2024

Today, in the CalculatedRisk Real Estate Newsletter: NMHC: "Apartment Market Continues to Loosen" Excerpt: From the NMHC: Apartment Market Continues to Loosen Amidst Worsening Financing Conditions Apartment market conditions continued to weaken in the National Multifamily Housing Council’s (NMHC’s) Quarterly Survey of Apartment Market Conditions for April 2024.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

APRIL 19, 2024

JPMorgan is losing two former First Republic teams totaling about $8.5 billion to Citizens and Merrill Lynch.

Abnormal Returns

APRIL 19, 2024

Markets TIPS are on sale. Time to buy. (morningstar.com) Two reasons why yields are higher this year. (carsongroup.com) The stock-bond correlation has flipped positive. (mrzepczynski.blogspot.com) Books Why you should read Rob Copeland's "The Fund: Ray Dalio, Bridgewater Associates, and the Unraveling of a Wall Street Legend." (advisorperspectives.com) A review of "Enrich Your Future: The Keys to Successful Investing" by Larry Swedroe.

Speaker: Erroll Amacker

As businesses increasingly adopt automation, finance leaders must navigate the delicate balance between technology and human expertise. This webinar explores the critical role of human oversight in accounts payable (AP) automation and how a people-centric approach can drive better financial performance. Join us for an insightful discussion on how integrating human expertise into automated workflows enhances decision-making, reduces fraud risks, strengthens vendor relationships, and accelerates R

Wealth Management

APRIL 19, 2024

Caz Craffy faces 20 years in prison for using his position as an Army Financial Counselor to invest survivors’ benefits in firms where he worked, according to the DOJ.

Nerd's Eye View

APRIL 19, 2024

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with the news that CFP Board announced that it has crossed the milestone of 100,000 CFP professionals in the United States, and despite having just celebrated its 50th anniversary last year, just set a record high in the number of advisors sitting for the CFP exam this March, reflecting the value many financial advisors and consumers place on the brand, including the requirements to obtain i

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Calculated Risk

APRIL 19, 2024

From BofA: Since our update last week, 1Q GDP tracking is up two-tenths to 2.1% q/q saar. [Apr 19th estimate] emphasis added From Goldman: We left our Q1 GDP forecast unchanged at +3.1% (qoq ar) and our domestic final sales forecast also unchanged at +3.1% (qoq ar). [Apr 18th estimate] And from the Altanta Fed: GDPNow The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2024 is 2.9 percent on April 16, up from 2.8 percent on April 15.

Wealth Management

APRIL 19, 2024

The latest risk alert from the SEC concerning the marketing rule is finding some firms are continuing to make "untrue" statements in ads.

Carson Wealth

APRIL 19, 2024

Congratulations, recent college graduate! You’ve worked hard to earn your degree, and now you’re ready to embark on the next chapter of your life. This is an exciting time – one filled with lots of changes, like starting a new career and learning how to manage living on your own. As you transition into the “real” world, one of the most crucial skills you can develop is managing your finances effectively.

Wealth Management

APRIL 19, 2024

Retirement industry thought leaders answer three probing questions on critical issues, providing an open, honest and candid dialogue.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

A Wealth of Common Sense

APRIL 19, 2024

How much money do you have to make to feel rich? It’s a subjective question. A lot depends on your lifestyle, where you live, how much you spend and save, your peer group, and your vulnerability to comparison. The comparison piece matters more than most are willing to admit. Wealth is relative. JP Morgan once said, “Comparison is the thief of joy.” It’s easy to say when you’re one of the weal.

Wealth Management

APRIL 19, 2024

Deals are down 29% from a year ago, but the amount of assets transacted rose by nearly the same percentage.

Advisor Perspectives

APRIL 19, 2024

In March, nominal home values increased for an 12th straight months while "real" home values were unchanged. Last month's ZHVI came in at $354,179, up 0.44% from the previous month and up 4.09% from one year ago. However, after adjusting for inflation, the real figures are 0.00% month-over-month and -1.71% year-over-year.

Wealth Management

APRIL 19, 2024

Practitioners are well-aware that lifetime gifts are more tax-efficient than transfers at death. But during the past seven years there's been a possibility that the estate tax might be permanently repealed, so it's been out of vogue for practitioners to advise clients to make taxable gifts that exceed the lifetime gift exemption and require tax payments.

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

Advisor Perspectives

APRIL 19, 2024

Existing home sales experienced their largest monthly decline in over a year in March. According to the data from the National Association of Realtors (NAR), existing home sales fell 4.3% from February to reach a seasonally adjusted annual rate of 4.19 million units. This figure came in lower than the expected 4.20 million. Existing home sales are down 3.7% compared to one year ago.

Trade Brains

APRIL 19, 2024

Shooting Star Candlestick Pattern: Technical analysis is utilized by investors to estimate the movements of stock prices based on past trends. One of the most popular methods of analysis is the candlestick pattern, which examines the shape and color of individual candlesticks formed due to movement in price to identify past reactions and predict future movements in the stock price.

Advisor Perspectives

APRIL 19, 2024

Manufacturing activity continued to decline in New York State, according to the Empire State Manufacturing April survey. The diffusion index for General Business Conditions fell to -14.3 from -20.9 in March. The latest reading was worse than the forecast of -5.2.

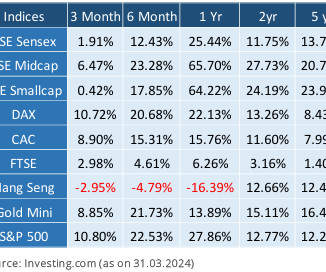

Truemind Capital

APRIL 19, 2024

Equity Market Insights: A few themes are dominating the equity markets worldwide and in India. Many investors decide their investments based on themes which have already gained a lot of popularity. Here are some of the popular themes and the risks associated with them: Falling Interest Rates : There has been earnest demand by market participants to cut interest rates in the US and other developed economies on the back of falling inflation rates.

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

Advisor Perspectives

APRIL 19, 2024

Month-over-month nominal retail sales in March were up 0.7% and up 4.02% year-over-year. However, after adjusting for inflation, real retail sales were up 0.3% MoM and up 0.52% year-over-year.

Sara Grillo

APRIL 19, 2024

One of the biggest fears that people have, when they are looking for a financial advisor, is this: “Is it truly impossible for an advisor to say wire themselves a few million dollars from a client’s account?” I’m going to answer that question in this blog about financial advisors stealing money and how to protect yourself. But before we get into it… Look, there are alot of schmucks out there hawking crap products disguised as financial advice.

Random Roger's Retirement Planning

APRIL 19, 2024

First a quick note on Israel's missile strike on Iran. The initial reaction of markets over night was a swift, but not huge, decline in futures. My thought process was "uh-oh" at first and then I thought, "ok how much work will this be?" The potential work would be to write up a quick "don't panic" note to email to clients. I pretty much had it half written in my head in about ten minutes because the message from any scare or actual decline is always the same.

Advisor Perspectives

APRIL 19, 2024

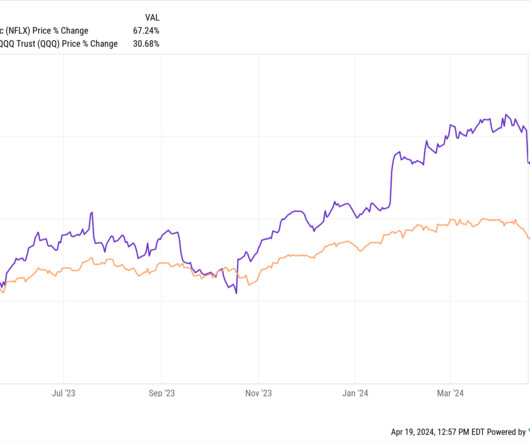

US markets are doing much better than markets everywhere else, but no one seems to know why. Yes, there are theories: Perhaps it’s the promise of AI, although it remains to be seen how AI will play out and who will profit.

Speaker: Sierre Lindgren

Fraud is a battle that every organization must face – it’s no longer a question of “if” but “when.” Every organization is a potential target for fraud, and the finance department is often the bullseye. From cleverly disguised emails to fraudulent payment requests, the tactics of cybercriminals are advancing rapidly. Drawing insights from real-world cases and industry expertise, we’ll explore the vulnerabilities in your processes and how to fortify them effectively.

The Irrelevant Investor

APRIL 19, 2024

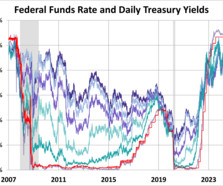

Today’s Compound and Friends is brought to you by Public: See here for more information on Publics option-trading capabilities and option-rebates On today’s show, we discuss: What if Fed rate hikes are actually sparking US economic boom? 10 popular questions about monetary policy Mark Cuban’s tax tweet BoA’s Finance Chief: “We’re all struck by just the sheer amount of cash on the sideli.

Alpha Architect

APRIL 19, 2024

New research reveals that the performance of the hedge fund industry has not been as bad as the results from studies that relied on hedge fund data providers. The Performance of the Hedge Fund Industry was originally published at Alpha Architect. Please read the Alpha Architect disclosures at your convenience.

Advisor Perspectives

APRIL 19, 2024

The Conference Board Leading Economic Index (LEI) decreased in March to its lowest level since May 2020. The index fell 0.3% from last month to 102.4. Overall, the LEI continues to signal a fragile outlook for the U.S. economy.

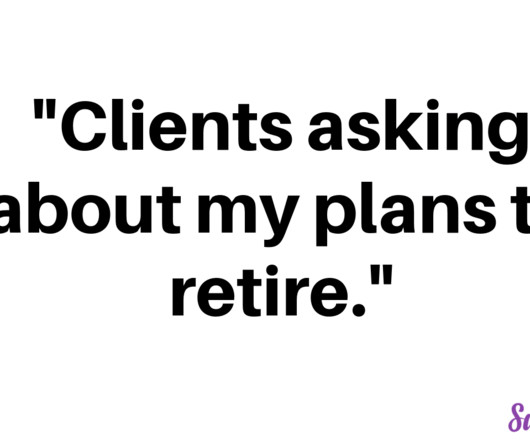

Sara Grillo

APRIL 19, 2024

Finding someone to take over your practice is a huge challenge across the entire industry. Don’t give up! This blog provides practical tips for financial advisor succession planning. It’s a huge problem From a subscriber : “I am in my mid 60s and have no immediate plans to retire. How do I best answer the question if prospects (or clients) ask about my plans to retire?

Advertisement

It's the time of year to give our close process some TLC. Join us in this one hour webinar where we discuss how to adopt leading practices and infuse technology into the month-end close process to improve our experience and increase our productivity during month-end and quarter-end close. Learning Objectives: This course's objective is to understand how the month-end close can be improved with automation and adoption of leading practices.

Advisor Perspectives

APRIL 19, 2024

FINRA has released new data for margin debt, now available through March. The latest debt level rose for a fifth straight month to $784.14 billion, its highest level since March 2022. Margin debt is up 5.5% month-over-month (MoM) and up 21.5% year-over-year (YoY). However, after adjusting for inflation, debt level is up 4.9% MoM and up 17.4% YoY.

Discipline Funds

APRIL 19, 2024

Here are some things I think I am thinking about over the weekend: 1) WAR! The situation in the Middle East is getting more and more uncertain as Iran and Israel trade barbs. I guess that’s an evergreen statement for the Middle East, but this situation does have a different feel given the Ukraine war and the situation in Taiwan. I could easily see a scenario where things get worse in Iran/Israel and the US gets dragged into it all.

Advisor Perspectives

APRIL 19, 2024

The yield on the 10-year note ended April 19, 2024 at 4.62%, the 2-year note ended at 4.97%, and the 30-year at 4.72%.

Financial Symmetry

APRIL 19, 2024

We are thrilled to announce that Niamh Douglas, CFP®, has been promoted to the role of Advisor at Financial Symmetry. Since joining us in 2019, Niamh has demonstrated an unwavering commitment to our clients and a deep understanding of financial … Continued The post Niamh Douglas, CFP® is Financial Symmetry’s Newest Advisor appeared first on Financial Symmetry, Inc.

Speaker: Aaron Berson

Managing spend is more than a cost cutting exercise – it's a pathway to smarter decisions that unlock efficiency and drive growth. By understanding and refining the spending process, financial leaders can empower their organizations to achieve more with less. Explore the art of balancing financial control with operational growth. From uncovering hidden inefficiencies to designing workflows that scale your business, we’ll share strategies to align your organization’s spending with its strategic g

Let's personalize your content