Allocating Retirement Assets to Philanthropy

Wealth Management

AUGUST 21, 2024

An often-overlooked tactic in estate planning.

Wealth Management

AUGUST 21, 2024

An often-overlooked tactic in estate planning.

Nerd's Eye View

AUGUST 21, 2024

Irrevocable trusts lie at the heart of a variety of estate planning strategies, as gifts to irrevocable trusts can allow for the transfer of assets outside of an owner’s estate for estate tax purposes with more structure than an outright gift. The downside, however, is that irrevocable trusts are "irrevocable" and can't easily be undone; in moving assets to the trust, the original owner gives up their authority over the assets, with the trustee taking over the management and distribution o

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

AUGUST 21, 2024

Academy Financial and PFG Advisors, which were with Lincoln's wealth business before Osaic acquired it, will merge under Academy’s brand.

Abnormal Returns

AUGUST 21, 2024

Podcasts Barry Ritholtz talks with Daniel Crosby about why we humans are not built for investing. (ritholtz.com) Peter Lazaroff talks with Taylor Schulte about the myths surrounding dividend investing. (peterlazaroff.com) Scott Galloway talks with Ramit Sethi about the skill of spending money. (youtube.com) Carl Richards talks with author Greg McKeown about creating possibilities beyond money.

Speaker: Erroll Amacker

As businesses increasingly adopt automation, finance leaders must navigate the delicate balance between technology and human expertise. This webinar explores the critical role of human oversight in accounts payable (AP) automation and how a people-centric approach can drive better financial performance. Join us for an insightful discussion on how integrating human expertise into automated workflows enhances decision-making, reduces fraud risks, strengthens vendor relationships, and accelerates R

Wealth Management

AUGUST 21, 2024

Taxpayer didn’t disclose the existence of foreign accounts to his advisor.

The Big Picture

AUGUST 21, 2024

At The Money: At the Money: Learning Lifecycles of Companies. (August 21, 2024) The Magnificent Seven, the Nifty Fifty, FAANG: Each of these were popular groups of companies investors erroneously believed they could “Set & Forget,” put them away forever, and you’re set for life. But as history informs us, the list of once-great companies that dominated their eras and then declined is long.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Advisor Perspectives

AUGUST 21, 2024

Many financial advisors exhibit a risk-averse attitude, leading to missed opportunities for growth and innovation.

Wealth Management

AUGUST 21, 2024

Advisors need to make sure such changes don’t significantly alter their investment’s risk/reward profile.

A Wealth of Common Sense

AUGUST 21, 2024

Today’s Animal Spirits is brought to you by Eaton Vance: See here for more information on Eaton Vance’s suite of ETFs On today’s show, we discuss: Tropical Bros Animal Spirits collection Seinfeld: “Breaking up is like knocking over a Coke machine” Household Debt to Income The Dramatic Turnaround in Millennials’ Finances Florida hit by ‘worst real estate crisis in decades’.

Wealth Management

AUGUST 21, 2024

Andy Watts will take over Mackay’s duties as tax channel leader, overseeing more than 4,000 advisors within Avantax and Cetera Financial Specialists.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Advisor Perspectives

AUGUST 21, 2024

When feedback is done well, it can be the greatest gift you give to someone.

Wealth Management

AUGUST 21, 2024

No penalties or additional tax imposed.

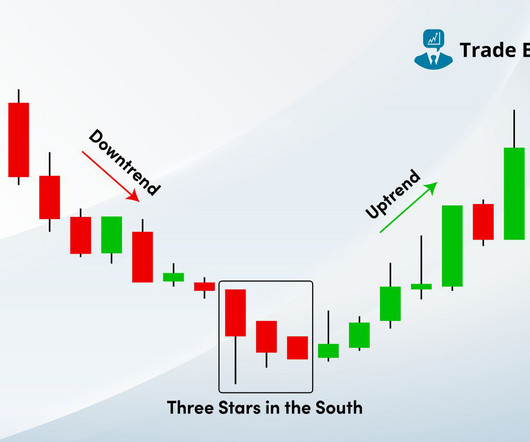

Trade Brains

AUGUST 21, 2024

Three Stars South Candlestick Pattern: In the broad universe of stock market research, where each candle and chart tells a unique story, traders look for minute clues that point to probable swings in market sentiment. Among the numerous candlestick patterns, one stands out for indicating a bearish reversal: the Three Stars South candlestick pattern.

Wealth Management

AUGUST 21, 2024

The judge said the FTC lacked the authority to enact the ban, which she said was “unreasonably overbroad without a reasonable explanation.

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

Clever Girl Finance

AUGUST 21, 2024

Setting a budget might sound about as fun as doing your taxes, but trust me, it doesn’t have to be a drag! Think of it as planning your future, making sure you have enough for those big dreams, and yes, even being able to order your favorite dinner in on Friday night. Whether you’re just starting out or need a little refresher, let’s break down the key factors you should consider when setting a budget!

Validea

AUGUST 21, 2024

Dividend Aristocrats are a select group of S&P 500 companies that have increased their dividend payouts for at least 25 consecutive years. This exclusive club represents some of the most financially stable and well-managed corporations in the United States. As of 2024, there are 67 companies that have earned this prestigious title. Why Dividend Aristocrats Matter to Investors Dividend Aristocrats are significant for several reasons: Consistent Income: These companies provide a reliable strea

Aleph

AUGUST 21, 2024

Picture Credit: sevoo || I’m not dead yet… In my view, these were my best posts written between August 2017 and January 2018: The Crisis at the Tipping Point A reprise of what some people knew in advance of the Great Financial Crisis. Includes a link to what I wrote 10 years earlier , where I got a lot right, and a lot wrong. Where Money Goes to Die Wrong at least in the medium-run: Bitcoin.

Advisor Perspectives

AUGUST 21, 2024

Having the best referral in the world doesn’t convert a prospect. It’s your website that seals the deal, not only for referrals but for organic prospects as well.

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

Steve Sanduski

AUGUST 21, 2024

Guests: Susie Cranston , President and Chief Operating Officer of Cresset , a family office RIA firm with more than $50 billion in assets under management. Susie oversees Cresset’s Wealth Advisors, Client Service, Operations and Compliance. In a Nutshell: In Life-Centered Planning , advisors encourage their clients to think about what their money is for.

Advisor Perspectives

AUGUST 21, 2024

A wide variety of asset managers need to look at investing in private markets if they want to avoid wipe-out, while revamping their entire strategies to ride the wave, according to Bain & Co.

Indigo Marketing Agency

AUGUST 21, 2024

5 Steps to an Effective Lead Magnet for Financial Advisors As a financial advisor, you already know that one of your key goals is to attract and retain clients. The question is HOW? One highly effective tool that can help you rake in more A+ clients is a lead magnet. A lead magnet is a valuable piece of content or resource offered to potential clients in exchange for their contact information.

Clever Girl Finance

AUGUST 21, 2024

Automating your finances is like setting your financial life on cruise control. It’s a simple, effective way to ensure you stick to your budget and meet your financial goals without the stress of constant monitoring. Whether you’ve been notorious for paying bills late or just want to streamline your savings strategy, automating your finances can be a game-changer.

Speaker: Sierre Lindgren

Fraud is a battle that every organization must face – it’s no longer a question of “if” but “when.” Every organization is a potential target for fraud, and the finance department is often the bullseye. From cleverly disguised emails to fraudulent payment requests, the tactics of cybercriminals are advancing rapidly. Drawing insights from real-world cases and industry expertise, we’ll explore the vulnerabilities in your processes and how to fortify them effectively.

NAIFA Advisor Today

AUGUST 21, 2024

In a recent episode of the BetterWealth podcast , I had the opportunity to discuss the critical role NAIFA plays in the financial services industry, particularly in today’s politically charged environment. I highlighted how the upcoming elections could significantly impact the federal tax code, with key provisions related to life insurance and annuities set to expire in 2025 if no action is taken.

Advisor Perspectives

AUGUST 21, 2024

Economic indicators provide insight into the overall health and performance of an economy. They are essential tools for policymakers, advisors, investors, and businesses because they allow them to make informed decisions regarding business strategies and financial markets. In the week ending on August 15th, the SPDR S&P 500 ETF Trust (SPY) rose 0.14% while the Invesco S&P 500® Equal Weight ETF (RSP) was up 2.45%.

Validea

AUGUST 21, 2024

Small-cap stocks have struggled relative to their large-cap counterparts for a long time now. But their fundamentals haven’t lagged their large counterparts in the way their price has. This has made finding fundamentally sound stocks trading at reasonable valuations much easier in the small-cap space than in the S&P 500. Validea’s guru system uses 22 quantitative strategies based on historically successful investors like Warren Buffett and Peter Lynch and academic research to unc

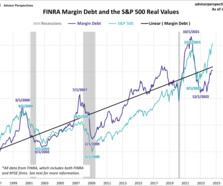

Advisor Perspectives

AUGUST 21, 2024

FINRA has released new data for margin debt, now available through July. The latest debt level is at $810.84 billion, its highest level since February 2022. Margin debt is up 0.2% month-over-month (MoM) and up 14.2% year-over-year (YoY). However, after adjusting for inflation, debt level is up 0.1% MoM and 11.0% YoY.

Advertisement

It's the time of year to give our close process some TLC. Join us in this one hour webinar where we discuss how to adopt leading practices and infuse technology into the month-end close process to improve our experience and increase our productivity during month-end and quarter-end close. Learning Objectives: This course's objective is to understand how the month-end close can be improved with automation and adoption of leading practices.

Norman Marks

AUGUST 21, 2024

Before I start, if you haven’t already done so, please answer a two-question poll on how your internal audit budget is built.

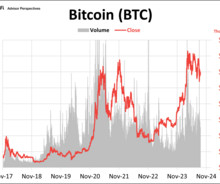

Advisor Perspectives

AUGUST 21, 2024

Bitcoin's price inched down to $59,000 this past week. BTC is currently up ~34% year to date. Here's the latest charts on three of the largest cryptocurrencies by market share through 8/20/24.

YouSet Insurance

AUGUST 21, 2024

Your home insurance may cover your child while they’re away at university or college, however, it will depend on your policy.

Advisor Perspectives

AUGUST 21, 2024

With questions swirling around Federal Reserve policy, the state of the economy and the US presidential race, at least one thing seems clear on Wall Street: spending on artificial intelligence remains a central priority.

Speaker: Aaron Berson

Managing spend is more than a cost cutting exercise – it's a pathway to smarter decisions that unlock efficiency and drive growth. By understanding and refining the spending process, financial leaders can empower their organizations to achieve more with less. Explore the art of balancing financial control with operational growth. From uncovering hidden inefficiencies to designing workflows that scale your business, we’ll share strategies to align your organization’s spending with its strategic g

Let's personalize your content