$109 Trillion Global Stock Market

The Big Picture

OCTOBER 4, 2023

Source: Visual Capitalist Batnick also takes a swing at this: What’s the Stock Market Worth? The post $109 Trillion Global Stock Market appeared first on The Big Picture.

The Big Picture

OCTOBER 4, 2023

Source: Visual Capitalist Batnick also takes a swing at this: What’s the Stock Market Worth? The post $109 Trillion Global Stock Market appeared first on The Big Picture.

Abnormal Returns

OCTOBER 4, 2023

Podcasts Sam Dogen talks fear with Farnoosh Torabi author of "A Healthy State of Panic: Follow Your Fears to Build Wealth, Crush Your Career, and Win at Life." (sites.libsyn.com) Dan Haylett talks with Hal Hershfield author of "Your Future Self: How to Make Tomorrow Better Today." (humansvsretirement.com) Jon Luskin talks with Steve Chen about DIY retirement planning tools.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Nerd's Eye View

OCTOBER 4, 2023

People often talk about "the economy" as a single entity whose parts move in unison, with a small number of key indicators (such as GDP, the unemployment rate, and inflation) moving reliably in relation to each other. In reality, though, the economy is a complex web of interdependent factors where events often make sense only in hindsight – and sometimes, not at all.

Abnormal Returns

OCTOBER 4, 2023

Markets The stock market is coming to terms with higher interest rates (for longer). (awealthofcommonsense.com) Japan's stock market has some catalysts working in its favor. (wsj.com) Why Treasury securities are different. (ft.com) ETFs State Street Global ($STT) is expanding the number of ETFs that engage in securities lending. (etf.com) The number of fixed income ETFs is on the rise.

Advertisement

It's the time of year to give our close process some TLC. Join us in this one hour webinar where we discuss how to adopt leading practices and infuse technology into the month-end close process to improve our experience and increase our productivity during month-end and quarter-end close. Learning Objectives: This course's objective is to understand how the month-end close can be improved with automation and adoption of leading practices.

Wealth Management

OCTOBER 4, 2023

Advisors are overdelivering services such as health care, estate and business planning, while falling short in the areas their clients most desire.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Wealth Management

OCTOBER 4, 2023

Orion Advisor Solutions’ chief behavioral officer explains why advisors should employ “human-first” thinking in their practices at annual Nitrogen conference.

Validea

OCTOBER 4, 2023

By Justin Carbonneau ( Twitter | LinkedIn | YouTube ) — Patience can be defined as the capacity to accept or tolerate delay, trouble, or suffering without getting angry or upset. It’s the ability to endure difficult circumstances, persevere in the face of adversity, or wait calmly for the achievement of a goal. Patience pays off when investing.

Wealth Management

OCTOBER 4, 2023

Luis Rosa, founder of Build a Better Financial Future discusses the importance of authenticity in your approach and your business model.

Advisor Perspectives

OCTOBER 4, 2023

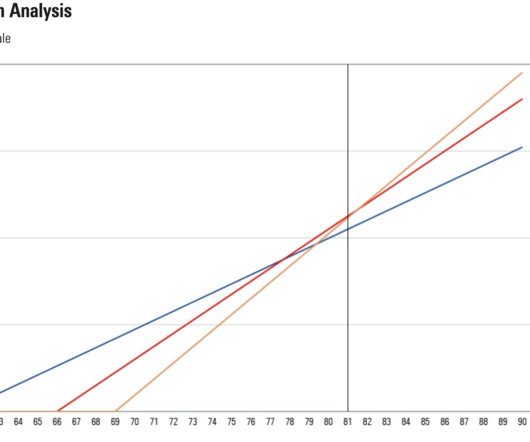

The S&P 500 real monthly averages of daily closes peaked in November of 2021 and 2022 was a bear market. Let's examine the past to broaden our understanding of the range of historical trends in market performance.

Speaker: Sierre Lindgren

Fraud is a battle that every organization must face – it’s no longer a question of “if” but “when.” Every organization is a potential target for fraud, and the finance department is often the bullseye. From cleverly disguised emails to fraudulent payment requests, the tactics of cybercriminals are advancing rapidly. Drawing insights from real-world cases and industry expertise, we’ll explore the vulnerabilities in your processes and how to fortify them effectively.

Wealth Management

OCTOBER 4, 2023

The new marketing campaign uses Nitrogen’s “Risk Numbers” to help advisors drive traffic to its “Risk Assessment Questionnaire” and capture leads.

Trade Brains

OCTOBER 4, 2023

Top Stocks Held by Quant Small-Cap Fund : Quant Mutual Fund-Quant Small Cap mutual fund product is the Quant Small Cap Fund Direct Plan-Growth. This fund was established on January 1, 2013. As of June 30, 2023, Quant Small Cap Fund Direct Plan-Growth had 8,075 Crores in assets under management (AUM), making it a medium-sized fund in its category. Quant mutual fund Quant small cap fund publicly owns 29 stocks with a net worth of over Rs. 3,601.0 Cr, according to corporate shareholdings declared f

Wealth Management

OCTOBER 4, 2023

"If you’re completely adverse to change, you may want to retire real soon.

Advisor Perspectives

OCTOBER 4, 2023

This article summarizes two interest rate-related crises, Long Term Capital Management (LTCM) and the lesser-known financial crisis of 1966.

Speaker: Aaron Berson

Managing spend is more than a cost cutting exercise – it's a pathway to smarter decisions that unlock efficiency and drive growth. By understanding and refining the spending process, financial leaders can empower their organizations to achieve more with less. Explore the art of balancing financial control with operational growth. From uncovering hidden inefficiencies to designing workflows that scale your business, we’ll share strategies to align your organization’s spending with its strategic g

Wealth Management

OCTOBER 4, 2023

Help clients protect clients themselves before the onset of challenges or the occurrence of abuse.

Advisor Perspectives

OCTOBER 4, 2023

The most challenging assignments I receive start with the advisor asking: “I had a great meeting with a prospect. Now I’m being ghosted. What should I do?

Wealth Management

OCTOBER 4, 2023

The average amount donated by affluent individuals to charity in 2022 was up 19% from pre-pandemic levels, according to a recent Bank of America study.

Advisor Perspectives

OCTOBER 4, 2023

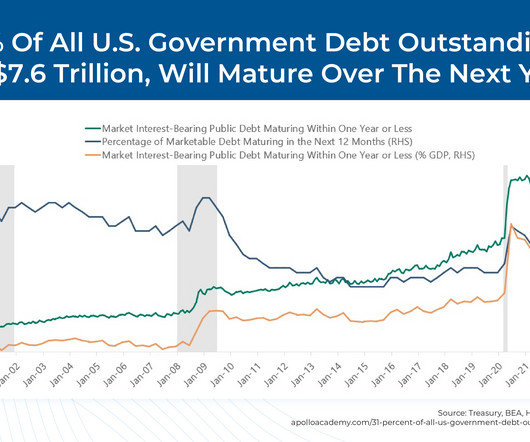

As global financial markets reel under the possibility of 5% benchmark Treasury yields, the question on investors’ minds: how much worse could it get?

Speaker: Duke Heninger, Partner and Fractional CFO at Ampleo & Creator of CFO System

Are you ready to elevate your accounting processes for 2025? 🚀 Join us for an exclusive webinar led by Duke Heninger, a seasoned fractional CFO and CPA passionate about transforming back-office operations for finance teams. This session will cover critical best practices and process improvements tailored specifically for accounting professionals.

Wealth Management

OCTOBER 4, 2023

After a year and a half of high-level upheaval and no reported asset growth, Sanctuary has brought in a 30-year Morgan Stanley vet to lead East Coast expansion.

AdvicePay

OCTOBER 4, 2023

A Customer-Centric Culture In the ever-evolving landscape of the wealth management industry, one factor that remains constant is the paramount importance of customer support. At the heart of this mission lies the superheroes of AdvicePay’s success – our exceptional Customer Support Team, aka Happiness Allies. At AdvicePay, our team has made customer satisfaction our North Star.

Wealth Management

OCTOBER 4, 2023

The serial entrepreneur discussed a range of topics Tuesday with Nitrogen CEO Aaron Klein during Nitrogen's annual conference.

A Wealth of Common Sense

OCTOBER 4, 2023

Today’s Animal Spirits is brought to you by Nuveen and Kaplan Schweser: See here for more information on investing with Nuveen See here to save 10% on Schweser CFA exam prep materials On today’s show, we discuss: The worlds priciest stock market Why a US recession is still likely – and coming soon Only richest 20% of Americans still have excess pandemic savings Americans are still spending like th.

Speaker: Ashley Harlan, MBA

What if your role as a fractional CFO went beyond operational support to actively shaping the future of your clients’ businesses? 💼 ✨ In this session, discover how fractional finance professionals can position themselves as architects of growth, guiding their clients toward sustainable success and preparing them for full-time financial leadership.

Wealth Management

OCTOBER 4, 2023

Clients join in to interview competing companies.

Calculated Risk

OCTOBER 4, 2023

The BEA released their estimate of vehicle sales for September today. This graph shows heavy truck sales since 1967 using data from the BEA. The dashed line is the September 2023 seasonally adjusted annual sales rate (SAAR). Heavy truck sales really collapsed during the great recession, falling to a low of 180 thousand SAAR in May 2009. Then heavy truck sales increased to a new record high of 570 thousand SAAR in April 2019.

Wealth Management

OCTOBER 4, 2023

The founder of Palantir, Addepar and Opto Investments discusses working with the government, his new alts investment platform and the complexities of RIAs.

Trade Brains

OCTOBER 4, 2023

Top Stocks Held By President Of India : State-owned or corporations with majority ownership held by the government are called public sector undertakings or PSUs. PSUs are of three types SLPEs – State Level Public Enterprises CPSEs – Central Public Sector Enterprises PSBs – Public Sector Banks. The government holds these companies with the intent of nation-building and advancement of the economy rather than having profits as the primary objective like corporations held by private citizens or othe

Speaker: Abdi Ali, Sr. Lease Accounting Consultant

Join this insightful webinar with industry expert Abdi Ali, who will discuss the challenges that can arise from managing lease accounting with spreadsheets! He will share real-world examples of errors, compliance issues, and risks that may be present within your spreadsheets. Learn how these tools, while useful, can sometimes lead to inefficiencies that affect your time, resources, and peace of mind.

Wealth Management

OCTOBER 4, 2023

Advisors look toward holistic client-focused strategies with converging retirement planning and wealth management.

Calculated Risk

OCTOBER 4, 2023

From ADP: ADP National Employment Report: Private Sector Employment Increased by 89,000 Jobs in September; Annual Pay was Up 5.9% Private sector employment increased by 89,000 jobs in September and annual pay was up 5.9 percent year-over-year, according to the September ADP® National Employment ReportTM produced by the ADP Research Institute® in collaboration with the Stanford Digital Economy Lab (“Stanford Lab”).

Wealth Management

OCTOBER 4, 2023

Open, honest and candid discussions about the latest news in the RPA industry.

Let's personalize your content