Where is This Rally Going?

The Big Picture

NOVEMBER 2, 2023

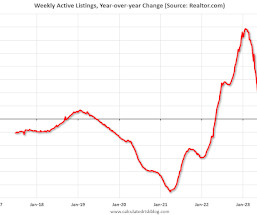

Before yesterday’s FOMC meeting, I reiterated my view from July 2023 that this hiking cycle was – or at least should be – over. The Narrative bias driving commentary today is that this sudden bullishness is the market sussing out the last hike. But this after-the-fact story does not resonate as truth with me, as it looks more like the 10% market correction of October 2023 has ended.

Let's personalize your content