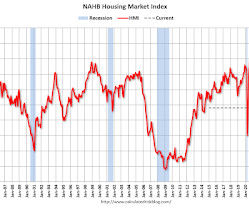

CPI Shelter Measures: 6-12 Month Lag

The Big Picture

FEBRUARY 15, 2024

Last month, I mentioned that CPI inflation measures were based on lagging BLS measures of Owners’ Equivalent Rent (OER). BLS highlighted housing prices, headlining the CPI report as “CPI for all items rose 0.3% in January; shelter up ” As the chart above shows, Shelter was 2/3rds of the increase in the most recent. ( Chart thanks to Michael McDonough ).

Let's personalize your content