The Competition Conundrum: Charge Less or Offer More?

Wealth Management

JULY 5, 2024

If your only differentiator is that you charge 75 basis points, you’ll likely lose the battle when the advisor across town drops to 50.

Wealth Management

JULY 5, 2024

If your only differentiator is that you charge 75 basis points, you’ll likely lose the battle when the advisor across town drops to 50.

Calculated Risk

JULY 5, 2024

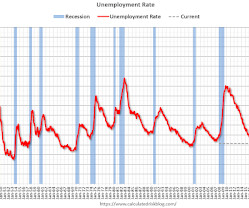

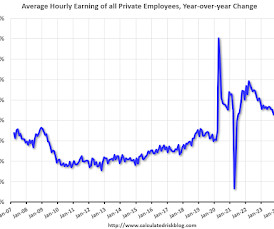

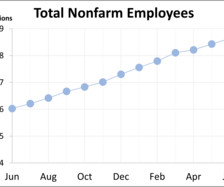

From the BLS: Employment Situation Total nonfarm payroll employment increased by 206,000 in June , and the unemployment rate changed little at 4.1 percent , the U.S. Bureau of Labor Statistics reported today. Job gains occurred in government, health care, social assistance, and construction. The change in total nonfarm payroll employment for April was revised down by 57,000, from +165,000 to +108,000, and the change for May was revised down by 54,000, from +272,000 to +218,000.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

JULY 5, 2024

On the Foundation for Research on Equal Opportunity website, advisors and clients can search for the ROI of individual programs offered by private and state colleges and universities.

Abnormal Returns

JULY 5, 2024

Economy Paul Podolsky talks with Lev Borodovsky, creator of The Daily Shot. (paulpodolsky.substack.com) Tyler Cowen talks with Joseph Stiglitz, author of "The Road to Freedom: Economics and the Good Society." (conversationswithtyler.com) Roben Farzad talks with Hal Hodson about the mind-boggling solar revolution. (pod.link) Alternatives Eric Golden talks with Phil Huber, Head of Portfolio Solutions at Cliffwater, about the case for private credit.

Speaker: Erroll Amacker

As businesses increasingly adopt automation, finance leaders must navigate the delicate balance between technology and human expertise. This webinar explores the critical role of human oversight in accounts payable (AP) automation and how a people-centric approach can drive better financial performance. Join us for an insightful discussion on how integrating human expertise into automated workflows enhances decision-making, reduces fraud risks, strengthens vendor relationships, and accelerates R

Wealth Management

JULY 5, 2024

Retirement industry thought leaders answer three probing questions on critical issues, providing an open, honest and candid dialogue.

Nerd's Eye View

JULY 5, 2024

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with the news that a recent U.S. Supreme Court decision shifting authority to interpret laws passed by Congress from Federal agencies to the judicial system could have significant impacts on regulation of the financial advice industry, including the potential for additional legal challenges to regulations from the Securities and Exchange Commission (SEC), the Department of Labor (DoL), and o

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Abnormal Returns

JULY 5, 2024

Markets The U.S. stock market has crushed international competitors since the GFC. (bilello.blog) A stock picker's market still requires actually picking winning stocks. (wsj.com) Finance Free checking is privilege, not a right. (wsj.com) Active bond ETFs are booming. (ft.com) Real estate Apartment building loans are increasingly at-risk. (nytimes.com) Suburban and CBD are two very different office markets.

Wealth Management

JULY 5, 2024

A federal judge delayed implementation of the US Federal Trade Commission’s near-total ban on noncompete agreements.

Calculated Risk

JULY 5, 2024

The headline jobs number in the June employment report was above expectations, however April and May payrolls were revised down by 111,000 combined. The participation rate increased, the employment population ratio was unchanged, and the unemployment rate increased to 4.1%. Construction employment increased 27 thousand and is now 630 thousand above the pre-pandemic level.

Wealth Management

JULY 5, 2024

James agreed to a two-year, $104 million deal with the Los Angeles Lakers, putting his net worth at almost $1.5 billion.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Calculated Risk

JULY 5, 2024

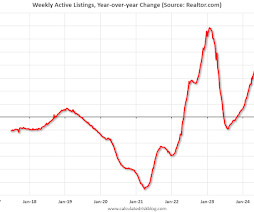

What this means: On a weekly basis, Realtor.com reports the year-over-year change in active inventory and new listings. On a monthly basis, they report total inventory. For April, Realtor.com reported inventory was up 35.2% YoY, but still down almost 34% compared to April 2017 to 2019 levels. Now - on a weekly basis - inventory is up 38.1% YoY. Realtor.com has monthly and weekly data on the existing home market.

Wealth Management

JULY 5, 2024

Insignia Financial will lift its global private credit allocation to 3% to 5% of its portfolio in the next year, from its current allocation of close to zero.

Calculated Risk

JULY 5, 2024

Today, in the Calculated Risk Real Estate Newsletter: Moody's: Apartment Vacancy Rate Unchanged in Q2; Office Vacancy Rate at New Record High A brief excerpt: From Moody’s: The office sector set a record vacancy rate at 20.1%, breaking the 20% barrier for the first time in history. The slow bleed occurring in the office sector has led to a steady rise in the vacancy rate as permanent shifts in working behavior have outlasted the initial wave of the pandemic four years ago.

A Wealth of Common Sense

JULY 5, 2024

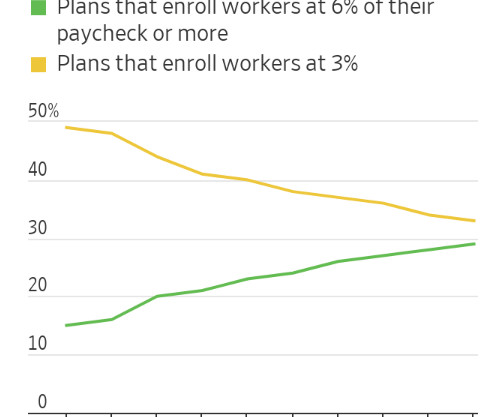

My personal finance pipedream for America is that we adopt something like Australia’s retirement system where workers are forced to save a certain percentage of their income for retirement. That pipedream will never happen because Americans hate being forced to do anything. You need to make people think that saving for retirement is their idea.

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

Alpha Architect

JULY 5, 2024

Atilgan, Demirtas, and Gunaydin found that there has been a pollution premium for US stocks and that the premium translated into superior investment performance. Polluters Provide Higher Returns than Non-Polluters was originally published at Alpha Architect. Please read the Alpha Architect disclosures at your convenience.

Advisor Perspectives

JULY 5, 2024

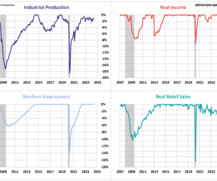

There is a general belief that there are four big indicators that the NBER Business Cycle Dating Committee weighs heavily in their cycle identification process. This commentary focuses on one of those indicators, nonfarm employment. June saw a 206,000 increase in total non-farm payrolls and the unemployment rose to 4.1%.

Discipline Funds

JULY 5, 2024

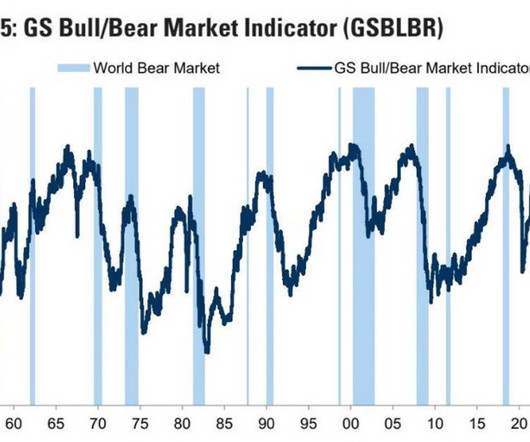

Here are some things I think I am thinking about this weekend. 1) All About Jobs. In an interview with Schwab earlier last week I said that the future path of Fed policy will be determined more so by employment reports and not inflation reports. The reason for this is that the shift in labor markets is likely to be far more meaningful than any shifts we see in future inflation reports.

Truemind Capital

JULY 5, 2024

A client said – I understand market valuations are expensive but it doesn’t seem that it will correct much. Everything is positive – India’s growth story, expected cut in interest rates, and strong domestic inflows. There is nothing to worry about. The fundamental driver of market peaks and exorbitant valuations is the perception that there is nothing to worry about – there is no investment risk.

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

Trade Brains

JULY 5, 2024

Data Center segment: Imagine a warehouse not filled with usual physical goods but with row upon row of servers, the beating heart of the digital age. These are data centers, the unseen silent giants powering our more connected world. Have you ever wondered how the mail you send, the videos you share, and the online purchase you make flow through the data center facilities?

Advisor Perspectives

JULY 5, 2024

Official recession calls are the responsibility of the NBER Business Cycle Dating Committee, which is understandably vague about the specific indicators on which they base their decisions. There is, however, a general belief that there are four big indicators that the committee weighs heavily in their cycle identification process.

Trade Brains

JULY 5, 2024

Data Center segment: Imagine a warehouse not filled with usual physical goods but with row upon row of servers, the beating heart of the digital age. These are data centers, the unseen silent giants powering our more connected world. Have you ever wondered how the mail you send, the videos you share, and the online purchase you make flow through the data center facilities?

Random Roger's Retirement Planning

JULY 5, 2024

That question came up in a podcast with Meb Faber and Jerry Parker. Parker is a very well known and long tenured trend (managed futures) manager. He's been in the space as a hedge fund manager since the early 80's but has transitioned to the ETF wrapper with the Blueprint Chesapeake Multi-Asset Trend ETF (TFPN) which started trading a year ago and more recently, tying up with Meb to manage the newly listed Cambria Chesapeake Pure Trend ETF (MFUT).

Speaker: Sierre Lindgren

Fraud is a battle that every organization must face – it’s no longer a question of “if” but “when.” Every organization is a potential target for fraud, and the finance department is often the bullseye. From cleverly disguised emails to fraudulent payment requests, the tactics of cybercriminals are advancing rapidly. Drawing insights from real-world cases and industry expertise, we’ll explore the vulnerabilities in your processes and how to fortify them effectively.

Advisor Perspectives

JULY 5, 2024

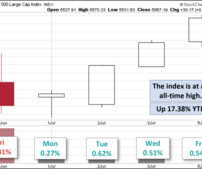

The S&P 500 kicked off the second half of the year with a new record high. The index is currently up 17.38% year to date and has recorded a new all-time high 34 times this year.

Tobias Financial

JULY 5, 2024

In a recent CNBC article, our Wealth Advisor, Catalina Franco-Cicero, MS, CFP®, CTS , was quoted on the topic of tax strategies during periods of unemployment. Despite a strong labor market, some job applicants face increased competition, leading to prolonged job searches. However, a period of lower income in 2024 could present valuable tax planning opportunities.

Advisor Perspectives

JULY 5, 2024

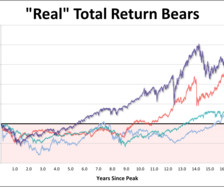

This chart series features an overlay of four major secular bear markets: the Crash of 1929, the Oil Embargo of 1973, the Tech Bubble, and the Financial Crisis. The numbers are through the March 28, 2024 close.

Advisor Perspectives

JULY 5, 2024

Taking a closer look at the different types of active ETFs is important for investors. While many active ETFs incorporate some dynamic investment elements, their management philosophies can differ significantly and that has implications for their performance, risk profile, and alignment with investors’ financial goals.

Advertisement

It's the time of year to give our close process some TLC. Join us in this one hour webinar where we discuss how to adopt leading practices and infuse technology into the month-end close process to improve our experience and increase our productivity during month-end and quarter-end close. Learning Objectives: This course's objective is to understand how the month-end close can be improved with automation and adoption of leading practices.

Advisor Perspectives

JULY 5, 2024

Ongoing budget deficits linger amid the post-COVID economic recovery. While markets appear unconcerned now, the accumulation of debt may exhaust investor patience. Anxiety about the sustainability of the nation’s debt could escalate with the upcoming elections in November. In part one of our series, let’s look at fiscal policy and Treasury debt.

Advisor Perspectives

JULY 5, 2024

Rebalancing events help ensure benchmarks maintain exposure to companies within their targeted asset class or markets, but the rebalancing can also impact investment portfolios.

Advisor Perspectives

JULY 5, 2024

As part of our annual tradition, we’ve reached out to Russell Investments’ associate base to come up with four recommended books for this year’s summer reading list. Below are our choices, which cover a wide variety of topics, including leadership development, diversity and inclusion and the artificial intelligence revolution.

Advisor Perspectives

JULY 5, 2024

Federal Reserve Bank of New York President John Williams said that while inflation has cooled recently toward the Fed’s 2% target, policymakers are still some distance from their goal.

Speaker: Aaron Berson

Managing spend is more than a cost cutting exercise – it's a pathway to smarter decisions that unlock efficiency and drive growth. By understanding and refining the spending process, financial leaders can empower their organizations to achieve more with less. Explore the art of balancing financial control with operational growth. From uncovering hidden inefficiencies to designing workflows that scale your business, we’ll share strategies to align your organization’s spending with its strategic g

Let's personalize your content