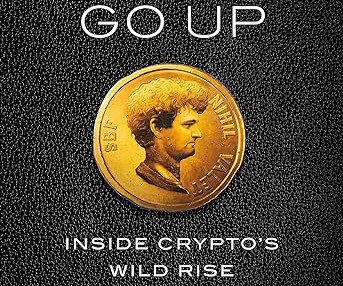

Lessons of “Number Go Up”

The Big Picture

DECEMBER 13, 2023

Tyler Cowen and his colleague Alex Tabarrok write some interesting posts over at Marginal Revolution. Sometimes I agree with them, sometimes I disagree with them. Recently, a post utterly perplexed me: “One doesn’t get a favorable impression of crypto from Number Go Up but in fact one doesn’t learn much about crypto at all. Indeed, Faux’s book isn’t really about crypto it’s about the rise and collapse of a bubble and the consequent madness of crowds.

Let's personalize your content