Monday links: doing nothing

Abnormal Returns

SEPTEMBER 25, 2023

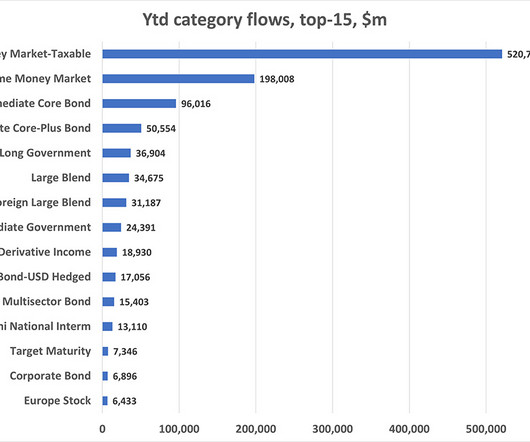

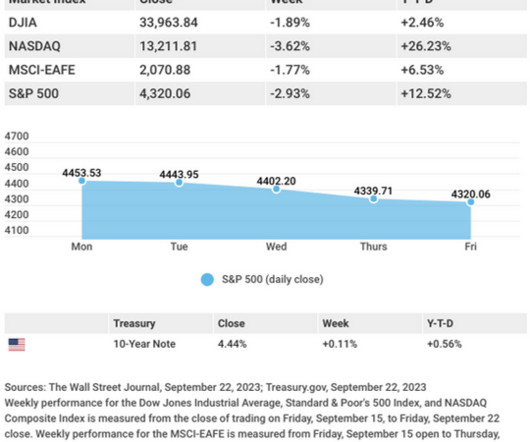

Cash Advisers are seeing more clients interested in cash. (etf.com) Higher yields are going to be a headwind for risky asset classes. (mrzepczynski.blogspot.com) Finance Zero-day options make up 50% of the S&P 500 options volume. (ft.com) Betterment is closing two of its crypto strategies. (citywire.com) Companies Amazon ($AMZN) just made a big investment in AI startup Anthropic.

Let's personalize your content