The 20 Most Future-Ready Large Cities in the U.S.

Wealth Management

OCTOBER 24, 2023

California rules the list of most future-ready cities in the United States, and Texas has a strong showing.

Wealth Management

OCTOBER 24, 2023

California rules the list of most future-ready cities in the United States, and Texas has a strong showing.

The Reformed Broker

OCTOBER 24, 2023

Conservatory at Biltmore, by Ann Vasilik via Our State There are four million households in North Carolina. Approximately half of those households (1.922 million) are comprised of a married male and female with children. Another half million are a female head of household with kids. There’s 180,000 or so male-led homes with children and then 1.4 million non-family households.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

OCTOBER 24, 2023

Today’s risk management tools are too basic and provide mixed results.

Calculated Risk

OCTOBER 24, 2023

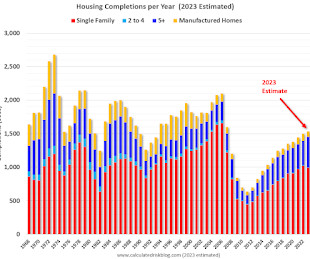

Today, in the Calculated Risk Real Estate Newsletter: Total Housing Completions Will Likely Increase Slightly in 2023; The Mix will Change Brief excerpt: Although housing starts have slowed, completions will likely increase slightly in 2023. This graph shows total housing completions and placements since 1968 with an estimate for 2023 based on completions through September.

Speaker: Claire Grosjean

Finance teams are drowning in data—but is it actually helping them spend smarter? Without the right approach, excess spending, inefficiencies, and missed opportunities continue to drain profitability. While analytics offers powerful insights, financial intelligence requires more than just numbers—it takes the right blend of automation, strategy, and human expertise.

Wealth Management

OCTOBER 24, 2023

But a new FINRA rule making it easier for state regulators to oppose expungements could solve some long-standing problems.

Abnormal Returns

OCTOBER 24, 2023

Markets Money market funds are gorging on T-bills. (ft.com) The markets are not expecting further Fed rate hikes. (capitalspectator.com) Strategy A history of the pandemic era stock market boom (and bust). (morningstar.com) Is gold a good investment? Meh. (monevator.com) Crypto Blackrock ($BLK) is all ready to go with a spot Bitcoin ETF. (etf.com) Grayscale is teaming up with FTSE Russell on crypto indices.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Calculated Risk

OCTOBER 24, 2023

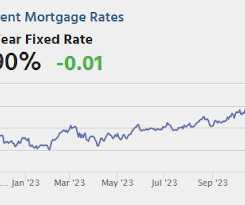

A few excerpts from a research note by Goldman Sachs economist Ronnie Walker: Higher for Longer and the 2024 Housing Outlook Sustained higher mortgage rates will have their most pronounced impact in 2024 on housing turnover. As a result, we expect the fewest annual existing home sales since the early 1990s at 3.8mn. While vacancy rates remain at historic lows, we expect housing starts to decline by 4% to 1.34mn in 2024, reflecting sharply fewer multifamily starts.

Wealth Management

OCTOBER 24, 2023

The CAIS Solutions software-as-a-service platform allows advisors to manage all clients’ alternative investments, even those not sourced through CAIS’s marketplace.

Abnormal Returns

OCTOBER 24, 2023

Corporate finance Why aren't corporate bankruptcies higher already? (mailchi.mp) CEOs who take responsibility for firm performance get better marks. (sciencedirect.com) How AI can be used to identify information in conference calls. (alphaarchitect.com) Companies with available, undrawn lines of credit outpeform. (ft.com) Global How will aging populations affect economic growth and stock returns?

Wealth Management

OCTOBER 24, 2023

For years, BlackRock inaccurately described Aviron as a “diversified financial services” company, when it was a movie production outfit.

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

Nerd's Eye View

OCTOBER 24, 2023

Welcome everyone! Welcome to the 356th episode of the Financial Advisor Success Podcast ! My guest on today's podcast is Sarah-Catherine Gutierrez. Sarah-Catherine is the founder of Aptus Financial, a fee-only financial planning firm based in Little Rock, Arkansas, that is approaching $2M in revenue and works with over 480 client households. What's unique about Sarah-Catherine, though, is that despite the common industry belief that the only way to build and scale a firm is through AUM, she has

Wealth Management

OCTOBER 24, 2023

Instead of embracing a fiduciary mentality, broker/dealers still vie to buy business through alluring advisor retention contracts.

The Reformed Broker

OCTOBER 24, 2023

Final Trades: Wynn, McDonald’s & more from CNBC. The post Clips From Today’s Halftime Report appeared first on The Reformed Broker.

Wealth Management

OCTOBER 24, 2023

Proposed changes to the Uniform Business Practices Rule conflict with Reg BI, will increase costs and decrease choice for investors and financial advisors, writes Cetera’s director of regulatory affairs.

Speaker: Erroll Amacker

As businesses increasingly adopt automation, finance leaders must navigate the delicate balance between technology and human expertise. This webinar explores the critical role of human oversight in accounts payable (AP) automation and how a people-centric approach can drive better financial performance. Join us for an insightful discussion on how integrating human expertise into automated workflows enhances decision-making, reduces fraud risks, strengthens vendor relationships, and accelerates R

The Reformed Broker

OCTOBER 24, 2023

Join Downtown Josh Brown and Michael Batnick for another round of What Are Your Thoughts? On this week’s episode, Josh and Michael discuss the biggest topics in investing and finance, including: ►Small Caps are F*cked – “But as with everything, there is more to the story…” ►Chevron Buys Hess – Second major domestic oil deal in a month after Exxon agreed to buy Pioneer.

Wealth Management

OCTOBER 24, 2023

The former Morningstar executive discussed the drive to start the company, how they have been using artificial intelligence, their philosophy on integrations and their upcoming inaugural conference.

Calculated Risk

OCTOBER 24, 2023

Note: Mortgage rates are from MortgageNewsDaily.com and are for top tier scenarios. Wednesday: • At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index. • At 10:00 AM, New Home Sales for September from the Census Bureau. The consensus is for 679 thousand SAAR, up from 675 thousand in August. • At 4:35 PM, Speech, Fed Chair Jerome Powell , Introductory Remarks , At the 2023 Moynihan Lecture in Social Science and Public Policy, W

Wealth Management

OCTOBER 24, 2023

Savvy Advisors adds a former LPL advisor as the nascent, tech-focused firm reinvigorates recruiting efforts.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

A Wealth of Common Sense

OCTOBER 24, 2023

The housing market is broken. Affordability is as bad as it’s ever been. Mortgage rates are high. Prices are high. There is no supply on the market. It’s a mess. So who’s to blame? In a recent piece at Fortune I went through the suspects to figure out how we got here. * The housing market feels broken at the moment. Prices skyrocketed 50% nationally over the course of the pandemic.

Wealth Management

OCTOBER 24, 2023

Discover the untapped potential of real estate investment advice in revolutionizing financial advisory practices.

The Irrelevant Investor

OCTOBER 24, 2023

The S&P 500 is flat since the Fed started raising rates in March 2022. It’s weathered the hiking cycle much better than smaller stocks that are more sensitive to tighter financial conditions. Over the same time, the Russell 2000 is down 16%. On last week’s What Are Your Thoughts? I shared this chart from Bank of America comparing long-term debt maturities of small versus large-cap indices.

Wealth Management

OCTOBER 24, 2023

If you’re going to sell out, do it at the top of the market.

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

Million Dollar Round Table (MDRT)

OCTOBER 24, 2023

By Nguyễn Thị Minh Nguyệt What started out as a marketing disaster for five-year MDRT member Nguyen Thi Thu Dung , of Ho Chi Minh, Vietnam, became an opportunity to educate the public about insurance and find new clients. It began when Nguyen posted a video supporting life insurance on her TikTok account. It received almost 800,000 views as well as a lot of negative comments about insurance.

Wealth Management

OCTOBER 24, 2023

US stock repurchases are tracking a 3% decline in the third quarter after falling 26% in the previous three months.

The Irrelevant Investor

OCTOBER 24, 2023

Today’s Animal Spirits is brought to you by YCharts and The College for Financial Planning: See here to learn more about how advisors use YCharts to save clients money on taxes See here to learn more about the Accredited Behavioral Financial Professional designation and here for a Master in Personal Financial Planning Email us at info@ritholtzwealth.com to set up an in-person meeting with us while in Charlotte!

Wealth Management

OCTOBER 24, 2023

Approval of the ETFs is seen as a potential watershed moment by digital-asset advocates.

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

Steve Sanduski

OCTOBER 24, 2023

Guest: Dr. Preston Cherry , AFC®, CFT-I , CFP®, Ph.D., the Founder and President of Concurrent Financial Planning , a comprehensive financial planning firm serving households and business owners across generations. Dr. Cherry is also Head of the Financial Planning Program and Director of the Charles Schwab Center for Personal Financial Planning at the University of Wisconsin–Green Bay.

Wealth Management

OCTOBER 24, 2023

Last week, the world’s largest ETF issuer unveiled a suite of 10 funds that shift money into more conservative investments as holders age

Advisor Perspectives

OCTOBER 24, 2023

A major investing mistake that investors often make is avoidable. We all realize that investing mistakes are going to be made. And there are some investing mistakes that are simply unavoidable and there’s really not much you can do about them.

Trade Brains

OCTOBER 24, 2023

Shanthala FMCG Products IPO Review : Shanthala FMCG products is coming up with its Initial public offering. This is an SME (small and medium-sized enterprise) which is going to be listed on NSE SME. The IPO will be open for subscription on 27th October 2023 and closes on 31st October 2023. In this article about Shanthala FMCG Products IPO Review, we shall see about the company, financials, strengths and more.

Speaker: Sierre Lindgren

Fraud is a battle that every organization must face – it’s no longer a question of “if” but “when.” Every organization is a potential target for fraud, and the finance department is often the bullseye. From cleverly disguised emails to fraudulent payment requests, the tactics of cybercriminals are advancing rapidly. Drawing insights from real-world cases and industry expertise, we’ll explore the vulnerabilities in your processes and how to fortify them effectively.

Let's personalize your content