Tony Bennett’s Children Embroiled in Lawsuit Over His Estate

Wealth Management

JULY 3, 2024

Tony Bennett's two daughters accuse their brother of mishandling their late father’s assets

Wealth Management

JULY 3, 2024

Tony Bennett's two daughters accuse their brother of mishandling their late father’s assets

Calculated Risk

JULY 3, 2024

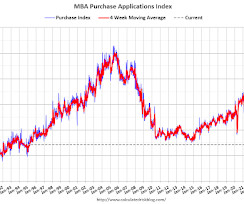

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey Mortgage applications decreased 2.6 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Applications Survey for the week ending June 28, 2024. The Market Composite Index, a measure of mortgage loan application volume, decreased 2.6 percent on a seasonally adjusted basis from one week earlier.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

JULY 3, 2024

Without proper guidance regarding taxes, philanthropy and estate planning, high net worth entrepreneurs can miss opportunities.

Abnormal Returns

JULY 3, 2024

Strategy Politics and investing don't mix. (howardlindzon.com) Good luck trying to time market factors. (rogersplanning.blogspot.com) Not all investment decisions are created alike. (behaviouralinvestment.com) Finance A lot of loans got repriced in 2024, so far. (axios.com) What former Vanguard OCIO clients should expect. (blogs.cfainstitute.org) Startups Half of VC funding in Q2 went to AI-related startups.

Speaker: Erroll Amacker

As businesses increasingly adopt automation, finance leaders must navigate the delicate balance between technology and human expertise. This webinar explores the critical role of human oversight in accounts payable (AP) automation and how a people-centric approach can drive better financial performance. Join us for an insightful discussion on how integrating human expertise into automated workflows enhances decision-making, reduces fraud risks, strengthens vendor relationships, and accelerates R

Wealth Management

JULY 3, 2024

Product launches during the first quarter of the year were dominated by large cap tech equities strategies.

Abnormal Returns

JULY 3, 2024

Podcasts Barry Ritholtz talks with Peter Mallouk about keeping things simple. (ritholtz.com) Christine Benz and Jeff Ptak talk with Scott Burns about financial minimalism. (morningstar.com) Steve Chen talks with Andrew Biggs about whether there really is a retirement crisis brewing in the U.S. (podcasts.apple.com) Katie Gatti Tassin on whether you are saving too much for retirement.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Calculated Risk

JULY 3, 2024

From the Fed: Minutes of the Federal Open Market Committee June 11–12, 2024. Excerpt: With regard to the outlook for inflation, participants emphasized that they were strongly committed to their 2 percent objective and that they remained concerned that elevated inflation continued to harm the purchasing power of households, especially those least able to meet the higher costs of essentials like food, housing, and transportation.

Wealth Management

JULY 3, 2024

Open, honest and candid discussion about the Supreme Court's rulings on regulators, Fisher Investments spinning off its 401(k) business, record keeper turnover and more.

Calculated Risk

JULY 3, 2024

This graph shows heavy truck sales since 1967 using data from the BEA. The dashed line is the June 2024 seasonally adjusted annual sales rate (SAAR). Heavy truck sales really collapsed during the great recession, falling to a low of 180 thousand SAAR in May 2009. Then heavy truck sales increased to a new record high of 570 thousand SAAR in April 2019.

Wealth Management

JULY 3, 2024

Our technology columnist caught up with Alex Bottom and spoke with him about developments to his platform meant to help advisors with managing student debt.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Calculated Risk

JULY 3, 2024

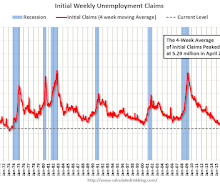

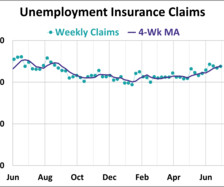

The DOL reported : n the week ending June 29, the advance figure for seasonally adjusted initial claims was 238,000 , an increase of 4,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 233,000 to 234,000. The 4-week moving average was 238,500, an increase of 2,250 from the previous week's revised average.

Wealth Management

JULY 3, 2024

Dan and Olivia Countiss have launched their new practice, Countiss Wealth Management, and join from Edward Jones.

Calculated Risk

JULY 3, 2024

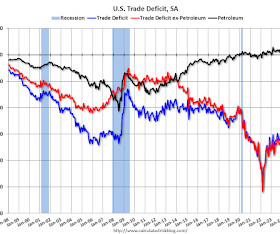

The Census Bureau and the Bureau of Economic Analysis reported : The U.S. Census Bureau and the U.S. Bureau of Economic Analysis announced today that the goods and services deficit was $75.1 billion in May , up $0.6 billion from $74.5 billion in April, revised. May exports were $261.7 billion, $1.8 billion less than April exports. May imports were $336.7 billion, $1.2 billion less than April imports. emphasis added Click on graph for larger image.

Wealth Management

JULY 3, 2024

The deal to acquire the London-based Preqin provider accelerates BlackRock’s push to become a major player in alternative assets

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

Nerd's Eye View

JULY 3, 2024

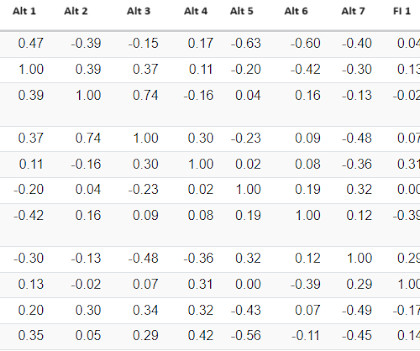

Over the past few decades, technological advances and plummeting transaction costs have facilitated the emergence of a dizzying variety of ways to gain exposure to very specific areas of the market. As a result, advicers have more options than ever to add value for their clients by tailoring investment portfolios that are specific to their unique needs, goals, and risk tolerance.

Wealth Management

JULY 3, 2024

Even after being exposed to some financial education in schools, more young investors are putting speculative bets ahead of building long-term wealth.

Calculated Risk

JULY 3, 2024

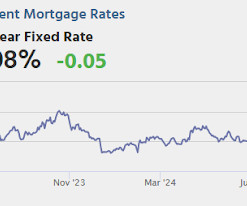

From Matthew Graham at Mortgage News Daily: Mortgage Rates Move Lower After Weak Service Sector Report "Data dependent" is one of the most common phrases heard from the Federal Reserve these days when it comes to rate-setting policy. And while the Fed doesn't directly dictate mortgage rates, the bond market tends to trade the same data that the Fed cares about.

Wealth Management

JULY 3, 2024

Transcript of Episode 112 of 401(k) Real Talk.

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

Calculated Risk

JULY 3, 2024

From ADP: ADP National Employment Report: Private Sector Employment Increased by 152,000 Jobs in May; Annual Pay was Up 5.0% Private sector employment increased by 150,000 jobs in June and annual pay was up 4.9 percent year-over-year, according to the June ADP® National Employment ReportTM produced by the ADP Research Institute® in collaboration with the Stanford Digital Economy Lab (“Stanford Lab”).

Wealth Management

JULY 3, 2024

Firms including BlackRock Inc., Fidelity Investments, 21Shares, and Invesco have filings waiting to be approved.

Calculated Risk

JULY 3, 2024

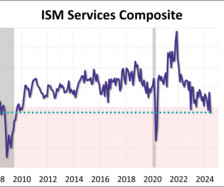

(Posted with permission). The ISM® Services index was at 48.8%, down from 53.8% last month. The employment index decreased to 46.1%, from 47.1%. Note: Above 50 indicates expansion, below 50 in contraction. From the Institute for Supply Management: Services PMI® at 48.8% June 2024 Services ISM® Report On Business® Economic activity in the services sector contracted in June for the second time in the last three months, say the nation's purchasing and supply executives in the latest Services ISM® R

The Big Picture

JULY 3, 2024

At The Money: Changing Your Behavior For Better Investing (July 3, 2024) If you could change only one thing that would help your investing, what would it be? Your own behavior. When it comes to investing, we are our own worst enemies. Why is this, and what can we do to avoid this fate? Neurologist and professional investor Dr. William Bernstein explains how to manage our emotions to avoid poor outcomes in markets.

Speaker: Sierre Lindgren

Fraud is a battle that every organization must face – it’s no longer a question of “if” but “when.” Every organization is a potential target for fraud, and the finance department is often the bullseye. From cleverly disguised emails to fraudulent payment requests, the tactics of cybercriminals are advancing rapidly. Drawing insights from real-world cases and industry expertise, we’ll explore the vulnerabilities in your processes and how to fortify them effectively.

Carson Wealth

JULY 3, 2024

Running a small business involves juggling multiple responsibilities. Managing the business’s finances is one of the most crucial aspects. Proper financial management can be the difference between a thriving business and one that struggles to stay afloat. Here are eight essential financial tips for small business owners to help ensure long-term success. 1.

Calculated Risk

JULY 3, 2024

Today, in the Real Estate Newsletter: ICE Mortgage Monitor: Existing Home Inventory Surges in Florida and Texas Brief excerpt: The local data I track is indicating that Florida and Texas inventory is above normal, whereas inventory is still low in most of the country. • While the new inflow of listings nationally has averaged a 23% deficit from pre-pandemic levels over the past three months, most Texas and Florida markets are seeing new listing volumes near or above pre-pandemic averages • In fa

A Wealth of Common Sense

JULY 3, 2024

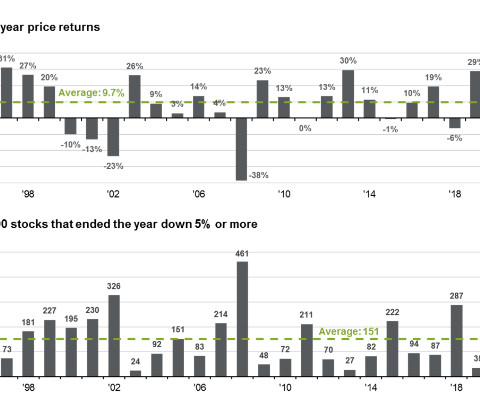

Today’s Animal Spirits is brought to you by YCharts and CME Group: See here for 20% off (new customers only) and for more info on the tearsheet builder See here for more information on CME Group’s valuable educational materials and trading tools and learn more about what adding futures can do for you. On today’s show, we discuss: American stocks are consuming global markets JPM Guide to the Markets 6%.

Advisor Perspectives

JULY 3, 2024

In the week ending June 29th, initial jobless claims were at a seasonally adjusted level of 238,000, an increase of 4,000 from the previous week's figure. The latest reading is higher than the forecast of 234,000 jobless claims.

Advertisement

It's the time of year to give our close process some TLC. Join us in this one hour webinar where we discuss how to adopt leading practices and infuse technology into the month-end close process to improve our experience and increase our productivity during month-end and quarter-end close. Learning Objectives: This course's objective is to understand how the month-end close can be improved with automation and adoption of leading practices.

Steve Sanduski

JULY 3, 2024

Guest: Shannon Warwick , Certified Personal Trainer, Yoga Teacher, & Sports Nutritionist. In a Nutshell: There’s a profound connection between our physical health and the stress that we carry around with us every day. Today’s show is a bit different from my usual focus on financial advisor practice management. Shannon and I dive deep into the topic of reducing stress in our lives – something that I believe is crucial for everyone, regardless of their profession or backgrou

NAIFA Advisor Today

JULY 3, 2024

Documents are ever-present in the lives of insurance and financial professionals. From policy agreements to annuity contracts to the full slate of disclosures, written agreements and promises are important parts of what you do. Today, our nation celebrates one of its founding documents. Along with the Constitution, the Declaration of Independence ranks as the most revered document in the United States.

Advisor Perspectives

JULY 3, 2024

The Institute of Supply Management (ISM) has released its Juneservices purchasing managers' index (PMI). The headline composite index is at 48.8, coming in below the 52.8 forecast. The latest reading is the lowest level for the index since April 2022 and moves the index back into contraction territory for the second time in the past three months.

Random Roger's Retirement Planning

JULY 3, 2024

Eric Crittenden sat for a wide ranging interview on the Show Us Your Portfolio podcast. Eric is the brains and manager of the Standpoint Multi-Asset Fund (BLNDX/REMIX). I've written about this fund many times, I've owned it since it's first or second day of trading and added it for clients shortly thereafter. I met Eric and his partner Matt Kaplan a couple of times in the earliest days of the fund.

Speaker: Aaron Berson

Managing spend is more than a cost cutting exercise – it's a pathway to smarter decisions that unlock efficiency and drive growth. By understanding and refining the spending process, financial leaders can empower their organizations to achieve more with less. Explore the art of balancing financial control with operational growth. From uncovering hidden inefficiencies to designing workflows that scale your business, we’ll share strategies to align your organization’s spending with its strategic g

Let's personalize your content