Mercer Expands Private Market Access with Launch of Aspen Partners

Wealth Management

JUNE 3, 2024

Mercer built the Aspen Partners platform for qualified purchasers in conjunction with Opto Investments.

Wealth Management

JUNE 3, 2024

Mercer built the Aspen Partners platform for qualified purchasers in conjunction with Opto Investments.

Abnormal Returns

JUNE 3, 2024

Podcasts Dan Haylett talks with Jamie Hopkins about rewiring the way we think about retirement and its underlying assumptions. (humansvsretirement.com) Bogumil Baranowski talks with Brian Portnoy of Shaping Wealth about the search for funded contentment. (open.spotify.com) Charles Schwab Charles Schwab ($SCHW) will rely on iCapital to power its push into alternatives.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

JUNE 3, 2024

The former Fidelity and Bluespring exec will serve on the board of directors at Parallel Advisors, a San Francisco-based RIA backed by private equity firm Golden Gate Capital.

Abnormal Returns

JUNE 3, 2024

Markets A review of major asset class performance in May 2024. (capitalspectator.com) Not surprisingly, Nvidia ($NVDA) has been the biggest index contributor YTD. (morningstar.com) Books An excerpt from Nathaniel Popper’s forthcoming "The Trolls of Wall Street: How Outcasts and Insurgents are Hacking the Markets." (bloomberg.com) Ed Slott talks about his book "The Retirement Savings Bomb Ticks Louder.

Speaker: Erroll Amacker

As businesses increasingly adopt automation, finance leaders must navigate the delicate balance between technology and human expertise. This webinar explores the critical role of human oversight in accounts payable (AP) automation and how a people-centric approach can drive better financial performance. Join us for an insightful discussion on how integrating human expertise into automated workflows enhances decision-making, reduces fraud risks, strengthens vendor relationships, and accelerates R

Wealth Management

JUNE 3, 2024

Suggestions on how RPAs and RIAs can navigate it via the words of Tao.

Nerd's Eye View

JUNE 3, 2024

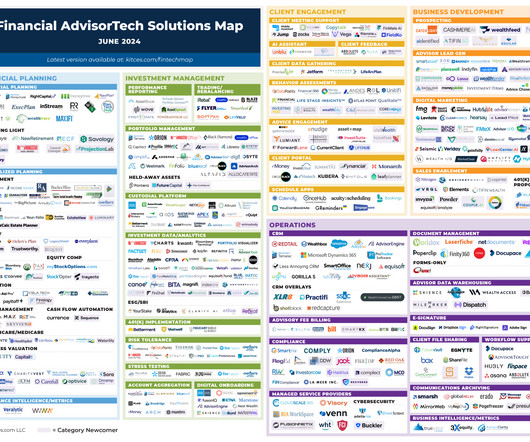

Welcome to the June 2024 issue of the Latest News in Financial #AdvisorTech – where we look at the big news, announcements, and underlying trends and developments that are emerging in the world of technology solutions for financial advisors! This month's edition kicks off with the news that 'startup' custodian Altruist has completed a $169 million fundraising round as it continues to rebuild the RIA custodial tech stack layer-by-layer while positioning itself as the biggest RIA custodian b

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Calculated Risk

JUNE 3, 2024

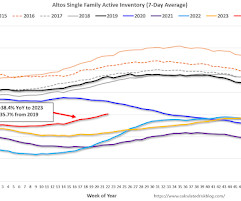

Altos reports that active single-family inventory was up 1.7% week-over-week. Inventory is now up 22.4% from the February bottom, and at the highest level since August 2020. Click on graph for larger image. This inventory graph is courtesy of Altos Research. As of May 31st, inventory was at 605 thousand (7-day average), compared to 595 thousand the prior week.

Wealth Management

JUNE 3, 2024

Avior Wealth Management represents Constellation’s seventh deal since its inception, bringing its assets under management to about $110 billion.

Calculated Risk

JUNE 3, 2024

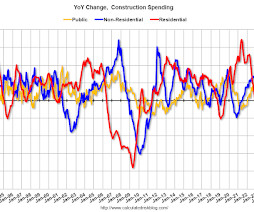

From the Census Bureau reported that overall construction spending decreased: Construction spending during April 2024 was estimated at a seasonally adjusted annual rate of $2,099.0 billion, 0.1 percent below the revised March estimate of $2,101.5 billion. The April figure is 10.0 percent (±1.5 percent) above the April 2023 estimate of $1,907.8 billion. emphasis added Private and public spending decreased: Spending on private construction was at a seasonally adjusted annual rate of $1,611.9 billi

Wealth Management

JUNE 3, 2024

The moves mark the latest examples of consolidation at the RIA aggregator; earlier this year, the firm merged The Colony Group with Buckingham Strategic Wealth.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Calculated Risk

JUNE 3, 2024

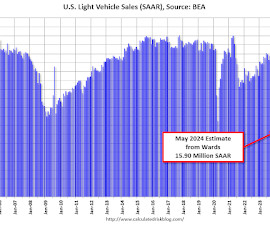

Wards Auto released their estimate of light vehicle sales for May: May U.S. Light-Vehicle Sales Continue 2024 Trend of Slow, Steady Growth (pay site). Further confirming as a theme for 2024, growth in May largely was centered in the most affordable CUV and car segments. Other sectors during the first five months of 2024 have either recorded sporadic gains or fell into steady decline, including some, such as fullsize pickups, that are coming off lengthy periods of strong results.

Wealth Management

JUNE 3, 2024

These funds saw the most activity over the past 30 days.

Calculated Risk

JUNE 3, 2024

From Matthew Graham at Mortgage News Daily: Mortgage Rates Fully Erase Last Week's Spike Sharp improvements in the bond market led to another nice drop in mortgage rates. The average lender is now back to the lowest levels in nearly 2 weeks, but not yet back to the recent lows seen on May 15th. [ 30 year fixed 7.11% ] emphasis added Tuesday: • At 10:00 AM ET, Job Openings and Labor Turnover Survey for April from the BLS.

Wealth Management

JUNE 3, 2024

A novelist does real-world research for his debut, Ways and Means.

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

Calculated Risk

JUNE 3, 2024

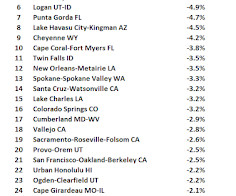

Today, in the Calculated Risk Real Estate Newsletter: Freddie Mac House Price Index Increased in April; Up 6.5% Year-over-year A brief excerpt: On a year-over-year basis, the National FMHPI was up 6.5% in April, down from up 6.6% YoY in March. The YoY increase peaked at 19.1% in July 2021, and for this cycle, bottomed at up 0.9% YoY in April 2023. As of April, 9 states and D.C. were below their previous peaks, Seasonally Adjusted.

Wealth Management

JUNE 3, 2024

The trio of advisors is based out of Ocala, Fla. It comes several months after a $450 million Fla.-based team made a similar move from the wirehouse to Raymond James.

Calculated Risk

JUNE 3, 2024

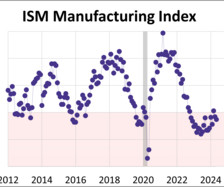

(Posted with permission). The ISM manufacturing index indicated expansion. The PMI® was at 48.7% in May, down from 49.2% in April. The employment index was at 51.1%, up from 48.6% the previous month, and the new orders index was at 45.4%, down from 49.1%. From ISM: Manufacturing PMI® at 48.7%; May 2024 Manufacturing ISM® Report On Business® Economic activity in the manufacturing sector contracted in May for the second consecutive month and the 18th time in the last 19 months, say the nation's su

Wealth Management

JUNE 3, 2024

JPMorgan CEO Jamie Dimon recently said he expects problems to emerge in private credit, and warned that “there could be hell to pay.

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

Advisor Perspectives

JUNE 3, 2024

The Institute for Supply Management (ISM) manufacturing purchasing managers index (PMI) fell to 48.7 in May from 49.2 in April. The latest figures keeps the index in contraction territory for a second straight month. The index has now contracted for 18 of the past 19 months. The May reading was below the forecast of 49.8.

Trade Brains

JUNE 3, 2024

Elecon Engineering: Behind the gleaming skyscrapers and the relentless hum of factories lies a network of silent collaborators, crucial for a nation’s industrial might. These are the Industrial gearboxes and Material Handling Equipment (MHE), the unsung heroes that keep the wheels of industry turning. Industrial gearboxes are the invisible conductors of power.

XY Planning Network

JUNE 3, 2024

Limiting beliefs and failure mindsets often act as invisible barriers, hindering both our professional success and personal fulfillment. A limited belief most will experience is imposter syndrome, the persistent inability to believe that one's success is deserved or has been achieved as a result of one's own efforts or skills. In my experience, working with clients and XYPN members, as well as navigating my own journey, I've witnessed how these beliefs can silently sabotage progress.

A Wealth of Common Sense

JUNE 3, 2024

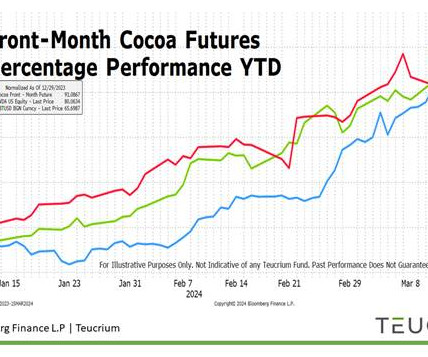

Today’s show is brought to you by Teucrium We had Sal Gilbertie, CEO of Teucrium on the show to get an update on the global commodity market. On today’s show, we discuss: Utilizing the cost of production with commodities How inflation affects commodity prices What is involved within the cost of production equation How oil is affecting commodity prices, and an update on oil moving forward How monetary policy.

Speaker: Sierre Lindgren

Fraud is a battle that every organization must face – it’s no longer a question of “if” but “when.” Every organization is a potential target for fraud, and the finance department is often the bullseye. From cleverly disguised emails to fraudulent payment requests, the tactics of cybercriminals are advancing rapidly. Drawing insights from real-world cases and industry expertise, we’ll explore the vulnerabilities in your processes and how to fortify them effectively.

Random Roger's Retirement Planning

JUNE 3, 2024

Yahoo had an interview with Ed Slott who is a preeminent expert on Roth conversions, or at least a very well know proponent of them. This has been his thing for a long time. Part of the equation is that he is convinced that tax rates have to go up to pay for out debt and so converting to a Roth now before tax rates do go up will result in people ending up with more after tax dollars versus just going the RMD route at what is now 73 on its way to 75.

Your Richest Life

JUNE 3, 2024

For many of us, the financial goals we set in January are a distant memory by June. That New Year enthusiasm can become dulled by the stress and reality of everyday life. But you don’t need to wait until next New Year’s to get excited about your goals again. Summer is the perfect time to get reacquainted with your goals, and see if you need to make any changes to get back on track.

Advisor Perspectives

JUNE 3, 2024

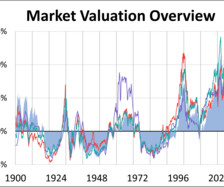

Few investments pay off as well as time spent pursuing financial history – to paraphrase George Santayana only slightly: study the past in order to prevent it from picking your pockets.

Financial Symmetry

JUNE 3, 2024

So today we’re diving in to a specific path that many retirees consider as they move away from the “corporate” world and enter their second act – which is starting a business. With increased life expectancy, cost of living increases … Continued The post What Starting an S-Corp Could Look Like for You, Ep #217 appeared first on Financial Symmetry, Inc.

Advertisement

It's the time of year to give our close process some TLC. Join us in this one hour webinar where we discuss how to adopt leading practices and infuse technology into the month-end close process to improve our experience and increase our productivity during month-end and quarter-end close. Learning Objectives: This course's objective is to understand how the month-end close can be improved with automation and adoption of leading practices.

Advisor Perspectives

JUNE 3, 2024

In this article, I provide a basic framework for understanding and developing a lifelong plan for a person with disabilities. I’ll introduce matters as they relate to establishing a well thought out and comprehensive plan that ties together life, public benefit, and resource planning as well as financial and legal planning.

Trade Brains

JUNE 3, 2024

Sky Gold: More than just embellishment, jewelry whispers a nation’s story. Each piece, from delicate chains to bold statement earrings, embodies a legacy. It’s a language that transcends words, expressing cultural heritage through intricate designs and symbolism. Sky Gold being a company in the jewelry industry has carved a niche for itself in the ever evolving world of jewelry.

Advisor Perspectives

JUNE 3, 2024

Here is a summary of the four market valuation indicators we update on a monthly basis.

NAIFA Advisor Today

JUNE 3, 2024

NAIFA members are invited to the Q3 State of NAIFA webinar at 12 pm Eastern, June 27, 2024. Hear updates on NAIFA's advocacy efforts, professional development programs and other membership activities designed to enhance your professional growth.

Speaker: Aaron Berson

Managing spend is more than a cost cutting exercise – it's a pathway to smarter decisions that unlock efficiency and drive growth. By understanding and refining the spending process, financial leaders can empower their organizations to achieve more with less. Explore the art of balancing financial control with operational growth. From uncovering hidden inefficiencies to designing workflows that scale your business, we’ll share strategies to align your organization’s spending with its strategic g

Let's personalize your content