IEQ Capital to Acquire EPIQ to Create $32B RIA

Wealth Management

AUGUST 27, 2024

Once the deal closes later this year, the combined RIA will have $32 billion in assets under management.

Wealth Management

AUGUST 27, 2024

Once the deal closes later this year, the combined RIA will have $32 billion in assets under management.

Abnormal Returns

AUGUST 27, 2024

Quant stuff Just how much financial analysis can AI already do? (sparklinecapital.com) A look at three different backtesting methodologies. (papers.ssrn.com) Index funds On the performance of stocks kicked out of major indices. (researchaffiliates.com) Why do index funds change benchmarks? (morningstar.com) Private equity A look at the dispersion in private fund returns.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

AUGUST 27, 2024

What can make or break a successful transition?

Calculated Risk

AUGUST 27, 2024

CR Note: On vacation. I will return on Thursday, Sept 5th (If I don't get lost!) In December 2006, my friend Doris "Tanta" Dungey started writing for Calculated Risk. From December 2006, until she passed away from ovarian cancer on Nov 30, 2008, Tanta was my co-blogger. Tanta worked as a mortgage banker for 20 years, and we started chatting in early 2005 about the housing bubble and the changes in lending practices.

Speaker: Erroll Amacker

As businesses increasingly adopt automation, finance leaders must navigate the delicate balance between technology and human expertise. This webinar explores the critical role of human oversight in accounts payable (AP) automation and how a people-centric approach can drive better financial performance. Join us for an insightful discussion on how integrating human expertise into automated workflows enhances decision-making, reduces fraud risks, strengthens vendor relationships, and accelerates R

Wealth Management

AUGUST 27, 2024

The recent outperformance in low-volatility ETFs marks a reversal of factor performance trends.

Abnormal Returns

AUGUST 27, 2024

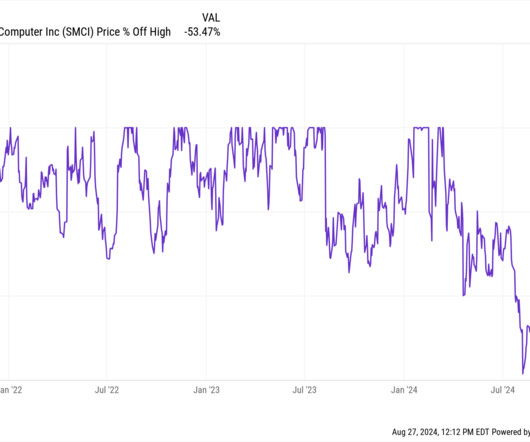

Commodities Farmers are facing a bumper crop for soybeans and corn. (wsj.com) Gasoline prices are at six-month lows. (advisorperspectives.com) Strategy You're not a billionaire. Stop trying to invest like one. (axios.com) What tennis can teach us about success in investing. (carsongroup.com) Companies Snowflake ($SNOW) issues employees A LOT of stock.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

A Wealth of Common Sense

AUGUST 27, 2024

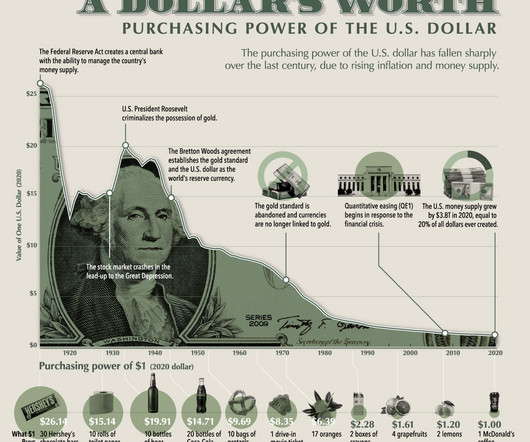

The firehose of information we’re afforded these days is a double-edged sword. There is an abundance of news, analysis, charts and opinions but it can all be overwhelming if you don’t have an effective filter in place. When it comes to finance I have some filters to help understand which types of sources and people to safely ignore. These are the types of financial voices and data I immediately ignore: Pricing.

Wealth Management

AUGUST 27, 2024

Options strategies are increasingly being packaged into SMAs, reports FundFire. The outcome of the U.S. elections has cast some uncertainty on the future of private infrastructure funds. These are among the investment must reads we found this week for wealth advisors.

Nerd's Eye View

AUGUST 27, 2024

Welcome everyone! Welcome to the 400th episode of the Financial Advisor Success Podcast ! My guest on today's podcast is Mark Tibergien. Mark is the former CEO of Pershing Advisor Solutions, a former Principal with Moss Adams Consulting, and is a longtime practice management consultant and thought leader in the financial advisory industry. What's unique about Mark, though, is how, over the course of a 50-year career in financial services, he has seen firsthand the evolution of the financial advi

Wealth Management

AUGUST 27, 2024

Minneapolis-based advisor Denver Gilliand has left Hightower to start his own RIA, among other new launches this week.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Advisor Perspectives

AUGUST 27, 2024

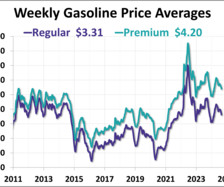

Gas prices fell to their lowest level in 6 months this past week. As of August 26th, the price of regular and premium gas decreased 7 cents and 5 cents from the previous week, respectively. The WTIC end-of-day spot price for crude oil closed at $77.42, up 5.1% from last week.

Wealth Management

AUGUST 27, 2024

Cash returns have nowhere to go but down.

Million Dollar Round Table (MDRT)

AUGUST 27, 2024

By Katrina Ann Church As a financial advisor, there was a time in my career when I realized I’d been giving so much of myself for so long that I felt depleted. Through MDRT’s Whole Person concept, though, I learned how to protect and energize myself so I could support others at work and at home. This also allowed me to create a more balanced life and the type of business I wanted with a more predictable income stream.

Wealth Management

AUGUST 27, 2024

A quick checklist that may help when dealing with mentally ill clients or beneficiaries.

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

Advisor Perspectives

AUGUST 27, 2024

Fifth district manufacturing activity slowed in August, according to the most recent survey from the Federal Reserve Bank of Richmond. The composite manufacturing index fell to -19 this month from -17 in July. This month's reading was worse than the forecast of -14 and is the lowest reading since May 2020.

Wealth Management

AUGUST 27, 2024

Open, honest and candid discussion about DOL Jobs growth numbers, phased retirement and more.

Advisor Perspectives

AUGUST 27, 2024

The Conference Board's Consumer Confidence Index® hit a six-month high in August. The index rose to 103.3 this month from July's upwardly revised 101.9. This month's reading was better than expected, exceeding the 100.9 forecast.

Wealth Management

AUGUST 27, 2024

Eide Bailly’s RIA will become part of Sequoia, and the accounting firm will take a stake in Sequoia.

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

Advisor Perspectives

AUGUST 27, 2024

When you master the art of trust-based selling, you’ll be able to create trust in a split-second and never feel afraid about losing a client again.

XY Planning Network

AUGUST 27, 2024

The newly-renamed AdviceTech Competition is headed to the 10th annual XYPN LIVE conference to put “ Tools for the Modern Advicer ” on center stage. Each year, XYPN turns the spotlight to the tech and solutions that support real financial planners in delivering more efficient, profitable, or impactful advice to clients. For most advisors, the value of financial planning is ascribed to the products they sell.

oXYGen Financial

AUGUST 27, 2024

Advisor Perspectives

AUGUST 27, 2024

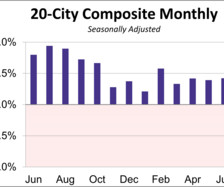

Home prices continued to trend upwards in June as the benchmark 20-city index rose for a sixteenth consecutive month to a new all-time high. The S&P Case-Shiller Home Price Index revealed seasonally adjusted home prices for the 20-city index saw a 0.4% increase month-over-month (MoM) and a 6.4% increase year-over-year (YoY). After adjusting for inflation, the MoM was reduced to 0.1% and the YoY was reduced to 0.9%.

Speaker: Sierre Lindgren

Fraud is a battle that every organization must face – it’s no longer a question of “if” but “when.” Every organization is a potential target for fraud, and the finance department is often the bullseye. From cleverly disguised emails to fraudulent payment requests, the tactics of cybercriminals are advancing rapidly. Drawing insights from real-world cases and industry expertise, we’ll explore the vulnerabilities in your processes and how to fortify them effectively.

Steve Sanduski

AUGUST 27, 2024

Guest: Lisa Salvi , Managing Director, Advisor Services at Charles Schwab. In a Nutshell: If you could start from scratch and sketch out what the ideal advisory practice looks like, what would you come up with? Lisa Salvi and her team have developed just such a blueprint for what the most successful firms at Charles Schwab are doing to manage and grow their businesses.

Advisor Perspectives

AUGUST 27, 2024

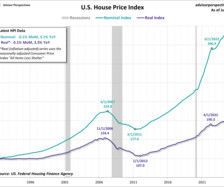

The Federal Housing Finance Agency (FHFA) house price index (HPI) unexpectedly declined to 424.5 in June, just below the all-time high of 424.8 from the previous month. U.S. house prices were down 0.1% from the previous month and are up 5.1% from one year ago. After adjusting for inflation, the real index was up 0.1% month-over-month and up 3.3% year-over-year.

Tobias Financial

AUGUST 27, 2024

Significant changes are on the horizon with the upcoming sunset of the Tax Cuts and Jobs Act (TCJA) at the end of 2025. The anticipated sunset of some important provisions presents a great opportunity to start discussing steps we can take to prepare. To help you navigate these complex changes, our CEO, Marianela Collado , CPA/PFS, CFP®, CDS® has broken down the key points in three detailed videos.

Advisor Perspectives

AUGUST 27, 2024

It’s been the ultimate no-brainer for more than a year: Park your money in super-safe Treasury bills, earn yields of more than 5%, rinse and repeat. Or as billionaire bond investor Jeffrey Gundlach put it last October, “T-bill and chill.

Advertisement

It's the time of year to give our close process some TLC. Join us in this one hour webinar where we discuss how to adopt leading practices and infuse technology into the month-end close process to improve our experience and increase our productivity during month-end and quarter-end close. Learning Objectives: This course's objective is to understand how the month-end close can be improved with automation and adoption of leading practices.

NAIFA Advisor Today

AUGUST 27, 2024

Chris Roper is a seasoned financial advisor who is passionate about helping individuals navigate their financial journeys as a fiduciary and an educator. With over 14 years in the industry, he specializes in 401K advising and personal finance management for high-net-worth individuals. Beyond his professional endeavors, Chris harbors a love for travel, seeking experiences and lessons to bring back to his practice.

Advisor Perspectives

AUGUST 27, 2024

The 19th Century American author Mark Twain once said: “Travel is fatal to prejudice, bigotry, and narrow-mindedness, and many of our people need it sorely on these accounts. Broad, wholesome, charitable views of men and things cannot be acquired by vegetating in one little corner of the earth all one’s lifetime.

Validea

AUGUST 27, 2024

Dividend aristocrats have long been revered by income-focused investors for their consistent track record of increasing dividends year after year. Traditionally, to be considered a dividend aristocrat, a company must be a member of the S&P 500 index and have increased its dividend payout for at least 25 consecutive years. These stocks are prized for their stability, financial strength, and commitment to rewarding shareholders through consistent dividend growth.

Advisor Perspectives

AUGUST 27, 2024

California wants some insurance against pump prices. But in proposing that oil companies there hold a minimum stockpile of fuels, the state is also, and less obviously, seeking insurance against the complications of its own energy policies. In seeking to kill off gasoline demand but ensure suppliers stay engaged for years to come, the state is confronting one of the central challenges of the energy transition.

Speaker: Aaron Berson

Managing spend is more than a cost cutting exercise – it's a pathway to smarter decisions that unlock efficiency and drive growth. By understanding and refining the spending process, financial leaders can empower their organizations to achieve more with less. Explore the art of balancing financial control with operational growth. From uncovering hidden inefficiencies to designing workflows that scale your business, we’ll share strategies to align your organization’s spending with its strategic g

Let's personalize your content