Adviser links: helping clients feel secure

Abnormal Returns

FEBRUARY 19, 2024

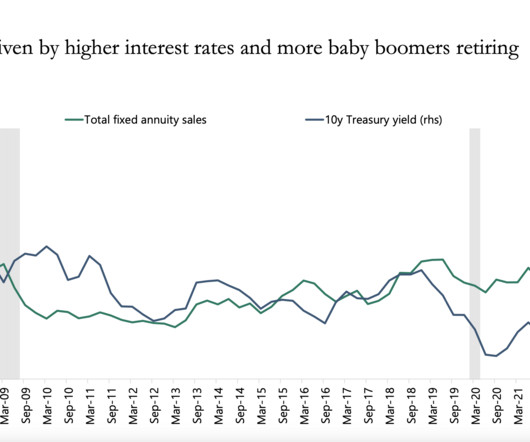

Podcasts Peter Lazaroff dives deeper into equity compensation with Derek Jess of Plancorp. (peterlazaroff.com) Why older women are saying no to marriage, largely for money reasons. (washingtonpost.com) Daniel Crosby offers another sneak preview of an essay from his upcoming book, "The Soul of Wealth." (standarddeviationspod.com) Trends The wealth management industry is going to be slammed with demand.

Let's personalize your content