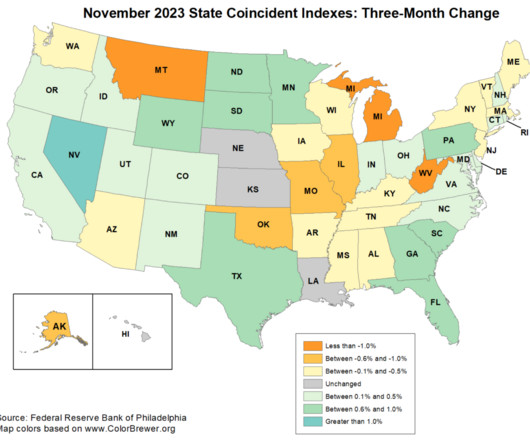

State Coincident Indicators Slipping

The Big Picture

JANUARY 2, 2024

I am popping out of book leave to share this single data point that snuck out over the holidays: The Federal Reserve Bank of Philadelphia’s State Coincident Indicators for November 2023. I like the SCI – its broad, consistent, and does not operate with too big of a lag. Over the past three months, the indexes increased in 25 states, decreased in 21 states, and remained stable in four, for a three-month diffusion index of 8.

Let's personalize your content