ETF Issuers Remained Active in August

Wealth Management

SEPTEMBER 3, 2024

Over half of the 40 new exchange traded funds listed in the U.S. were active ETFs, and eight new buffer funds came onto the market.

Wealth Management

SEPTEMBER 3, 2024

Over half of the 40 new exchange traded funds listed in the U.S. were active ETFs, and eight new buffer funds came onto the market.

Abnormal Returns

SEPTEMBER 3, 2024

Research Why diversifying widely matters. (papers.ssrn.com) Costs are forever. Alpha is fleeting. (blogs.cfainstitute.org) A look at the historical performance of private debt funds. (alphaarchitect.com) How to replicate managed futures trend following returns. (investresolve.com) Do happy employees make for better stock returns? (ft.com) A round-up of recent research including 'Private Credit's Next Act.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

SEPTEMBER 3, 2024

The ‘scapegoating’ of the yen carry trade ignores a bigger, deeper trend, according to Arif Hussain.

Abnormal Returns

SEPTEMBER 3, 2024

Markets How major asset classes performed in August 2024. (entrylevel.topdowncharts.com) REITs have stopped going down. (entrylevel.topdowncharts.com) Strategy Analysts focus on these market numbers, you don't have to. (optimisticallie.com) Stock market investors do best when focusing on the long run. (awealthofcommonsense.com) Everybody's investment journey is different.

Speaker: Erroll Amacker

As businesses increasingly adopt automation, finance leaders must navigate the delicate balance between technology and human expertise. This webinar explores the critical role of human oversight in accounts payable (AP) automation and how a people-centric approach can drive better financial performance. Join us for an insightful discussion on how integrating human expertise into automated workflows enhances decision-making, reduces fraud risks, strengthens vendor relationships, and accelerates R

Wealth Management

SEPTEMBER 3, 2024

Mesirow continues to grow its wealth management headcount with the addition of Price Wealth Management. The firm will expand further in the Southeast via lift-ins and acquisitions.

The Big Picture

SEPTEMBER 3, 2024

The transcript from this week’s, MiB: Heather Brilliant, Diamond Hill , is below. You can stream and download our full conversation, including any podcast extras, on Apple Podcasts , Spotify , YouTube , and Bloomberg. All of our earlier podcasts on your favorite pod hosts can be found here. ~~~ This is Masters in business with Barry Ritholtz on Bloomberg Radio.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Nerd's Eye View

SEPTEMBER 3, 2024

Welcome everyone! Welcome to the 401st episode of the Financial Advisor Success Podcast ! My guest on today's podcast is Zack Hubbard. Zack is the Director of Financial Planning and Participant Engagement of Greenspring Advisors, an RIA based in Towson, Maryland, that manages $2 billion of private wealth assets under management for 1,300 client households and advises on an additional $5 billion in retirement plan assets.

Wealth Management

SEPTEMBER 3, 2024

Benchmark Wealth Management will join the large RIA, which continues to focus on inorganic growth after expanding its M&A executive team earlier this year.

Million Dollar Round Table (MDRT)

SEPTEMBER 3, 2024

By Ming-Fong Huang, CFP, AFP Usually, we define prospects as people we talk to face-to-face; however, people are often too busy to meet. If we redefine prospects by redefining our network, we can grow the number of prospects exponentially. Connect on social media Start by asking for your prospects’ social media information and connect with them there.

Wealth Management

SEPTEMBER 3, 2024

Fiduciary Trust International's Erick Rawling reveals what's driving the popularity in alts and what asset classes he finds most attractive now.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Investment Writing

SEPTEMBER 3, 2024

Financial Blogging’s paperback version is on sale direct from the author for shipment within the U.S. as long as supplies last. If you live in the U.S., you can buy a paperback copy of Financial Blogging: How to Write Powerful Posts That Attract Clients for only $27 including shipping. Email me your shipping address so I can send you a PayPal invoice and confirm that you’re eligible for this offer.

Wealth Management

SEPTEMBER 3, 2024

The convergence of wealth, retirement and benefits is not a fad.

Advisor Perspectives

SEPTEMBER 3, 2024

You did everything by the book. Your prospect talked and you listened. But listening alone is not enough to build trust.

Wealth Management

SEPTEMBER 3, 2024

Investors added $75 billion to U.S. exchange-traded funds last month, five times more than the same period in 2023.

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

Advisor Perspectives

SEPTEMBER 3, 2024

Here is a look at real (inflation-adjusted) charts of the S&P 500, Dow 30, and Nasdaq composite since their 2000 highs. We've updated this through the August 2024 close.

Wealth Management

SEPTEMBER 3, 2024

There's a culture shift unfolding in the $10 trillion U.S. ETF market with leveraged single-stock funds and other risky vehicles.

Advisor Perspectives

SEPTEMBER 3, 2024

The August S&P Global US Manufacturing PMI™ fell to 47.9 in August from 49.6 in July, indicating a modest deterioration in business conditions for a second straight month. The latest reading was just below the forecasted reading of 48.0 and is the index's lowest level of the year.

Alpha Architect

SEPTEMBER 3, 2024

This paper provides new evidence on the efficacy of prioritizing transactions so as to focus portfolio turnover on the trades that offer the strongest signals and hence the highest potential performance impact. Can smart rebalancing improve factor portfolios? was originally published at Alpha Architect. Please read the Alpha Architect disclosures at your convenience.

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

Advisor Perspectives

SEPTEMBER 3, 2024

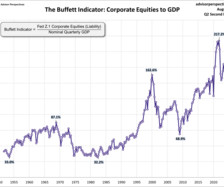

With the Q2 GDP second estimate and the August close data, we now have an updated look at the popular "Buffett Indicator" -- the ratio of corporate equities to GDP. The current reading is 194.9%, down from 197.4% the previous quarter.

Financial Symmetry

SEPTEMBER 3, 2024

We are thrilled to announce that Molly Kaminski and Ella Brotherton have successfully earned the Financial Paraplanner Qualified Professional SM (FPQP®) designation from the College for Financial Planning. This accomplishment showcases their dedication to excellence and commitment to continuous learning … Continued The post Celebrating the Drive to Keep Learning: Molly Kaminski and Ella Brotherton Achieve Their FPQP® Credentials appeared first on Financial Symmetry, Inc.

Advisor Perspectives

SEPTEMBER 3, 2024

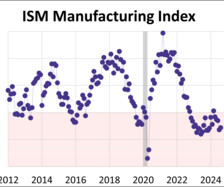

The Institute for Supply Management (ISM) manufacturing purchasing managers index (PMI) inched up to 47.2 in August but remains in contraction territory for a fifth straight month. The index has now contracted for 21 of the past 22 months. The latest reading was worse than the forecast of 47.5.

SEI

SEPTEMBER 3, 2024

In financial services technology, stability is vital for growth. Read how SEI serves wealth and asset management clients through trust, consistency and innovation.

Speaker: Sierre Lindgren

Fraud is a battle that every organization must face – it’s no longer a question of “if” but “when.” Every organization is a potential target for fraud, and the finance department is often the bullseye. From cleverly disguised emails to fraudulent payment requests, the tactics of cybercriminals are advancing rapidly. Drawing insights from real-world cases and industry expertise, we’ll explore the vulnerabilities in your processes and how to fortify them effectively.

Advisor Perspectives

SEPTEMBER 3, 2024

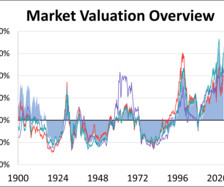

Here is a summary of the four market valuation indicators we update on a monthly basis.

Cornerstone Financial Advisory

SEPTEMBER 3, 2024

Weekly Market Insights | September 3rd, 2024 Pressure on the Nasdaq and S&P 500 There were mixed results for stocks last week as upbeat economic data and a critical Q2 corporate report shaped the week. The Dow Jones Industrial Average rose 0.94 percent, while the Standard & Poor’s 500 Index increased 0.24 percent. The Nasdaq Composite lagged, falling 0.92 percent.

Advisor Perspectives

SEPTEMBER 3, 2024

The weekly leading economic index (WLEI) is a composite for the U.S economy that draws from over 20 time-series and groups them into the following six broad categories which are then used to construct an equally weighted average. As of August 23rd, the index was at 24.827, down 1.545 from the previous week, with 4 of the 6 components in expansion territory.

Alpha Architect

SEPTEMBER 3, 2024

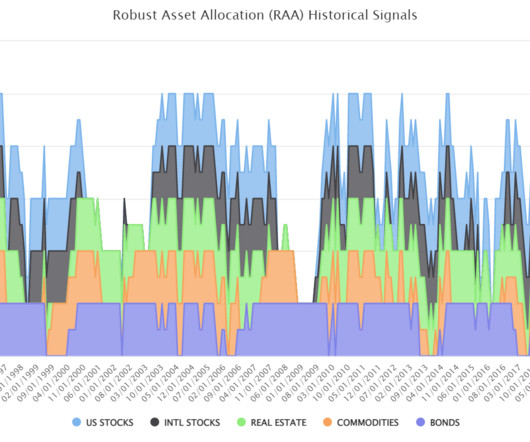

Do-It-Yourself trend-following asset allocation weights for the Robust Asset Allocation Index are posted here. (Note: free registration required) Request a free account here if you want to access the site directly. If you are an advisor and want help implementing our models, please get in touch with Ryan Kirlin. Our Advisor portal is available here. [.

Advertisement

It's the time of year to give our close process some TLC. Join us in this one hour webinar where we discuss how to adopt leading practices and infuse technology into the month-end close process to improve our experience and increase our productivity during month-end and quarter-end close. Learning Objectives: This course's objective is to understand how the month-end close can be improved with automation and adoption of leading practices.

Advisor Perspectives

SEPTEMBER 3, 2024

In this edition, Harold Evensky explores the challenges facing sustainable and active funds, the implications of the new DOL Fiduciary Rule, and the value of long-term performance projections. With candid observations and critical analysis--read on to gain perspective on navigating the complex world of investing, the importance of risk management, and the role of fiduciary advisors in securing your financial future.

Harness Wealth

SEPTEMBER 3, 2024

FOR IMMEDIATE RELEASE NEW YORK, NY — September 3, 2024: Harness , a New York-based fintech startup that seeks to make bespoke tax & financial advice accessible to more households, is excited to announce the appointment of Will Bressman to its Board of Directors. Will Bressman brings a wealth of industry experience and a passion for driving innovation in the financial services sector.

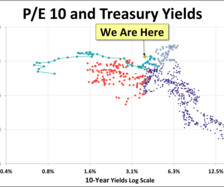

Advisor Perspectives

SEPTEMBER 3, 2024

Our monthly market valuation updates have long had the same conclusion: US stock indexes are significantly overvalued, which suggests cautious expectations for investment returns. On August 4, 2020, the 10-year Treasury yield hit its all-time low of 0.52%. As of August 31, it was 3.91%.

Validea

SEPTEMBER 3, 2024

Validea’s Warren Buffett strategy, also known as our “Patient Investor” strategy, is inspired by the investment principles of Warren Buffett, as interpreted from the book Buffettology by Mary Buffett. This strategy aims to emulate Buffett’s long-term, value-based approach to investing. Below are the key criteria and principles that define this strategy: Key Criteria Earnings Predictability and Stability : Companies should have a consistent earnings history over the past d

Speaker: Aaron Berson

Managing spend is more than a cost cutting exercise – it's a pathway to smarter decisions that unlock efficiency and drive growth. By understanding and refining the spending process, financial leaders can empower their organizations to achieve more with less. Explore the art of balancing financial control with operational growth. From uncovering hidden inefficiencies to designing workflows that scale your business, we’ll share strategies to align your organization’s spending with its strategic g

Let's personalize your content