What Is Most Important to Digital Marketing Campaigns

Wealth Management

OCTOBER 19, 2023

The image, ad copy and targeting should align seamlessly.

Wealth Management

OCTOBER 19, 2023

The image, ad copy and targeting should align seamlessly.

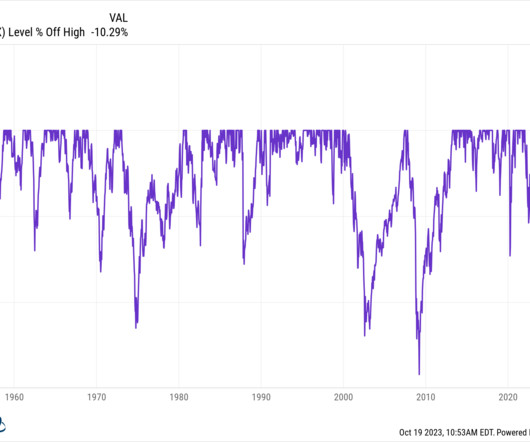

Calculated Risk

OCTOBER 19, 2023

Today, in the CalculatedRisk Real Estate Newsletter: NAR: Existing-Home Sales Decreased to 3.96 million SAAR in September; New Cycle Low Excerpt: Sales Year-over-Year and Not Seasonally Adjusted (NSA) The fourth graph shows existing home sales by month for 2022 and 2023. Sales declined 15.4% year-over-year compared to September 2022. This was the twenty-fifth consecutive month with sales down year-over-year.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

OCTOBER 19, 2023

The Labor Department's latest attempt at amending its fiduciary definition is currently under consideration by the White House’s Budget Department and is expected to be released for comment soon.

Abnormal Returns

OCTOBER 19, 2023

Rates Bonds have had a lost decade. (wsj.com) Mortgage rates have hit 8%. (calculatedrisk.substack.com) Fund management Big money money managers are all in on ETFs. (ft.com) Sentiment How media is driving a wedge between the economy and sentiment. (ritholtz.com) Annie Lowery, "Things are great, but folks are mad." (theatlantic.com) Global Poland's voters pushed back against autocracy.

Speaker: Claire Grosjean

Finance teams are drowning in data—but is it actually helping them spend smarter? Without the right approach, excess spending, inefficiencies, and missed opportunities continue to drain profitability. While analytics offers powerful insights, financial intelligence requires more than just numbers—it takes the right blend of automation, strategy, and human expertise.

Wealth Management

OCTOBER 19, 2023

The Reed Finney team from Bleakley Financial and Private Capital Management expand Beacon Pointe’s presence in New Jersey and California's Bay Area.

Abnormal Returns

OCTOBER 19, 2023

Books An excerpt from “Ours Was the Shining Future” by David Leonhardt. (nytimes.com) Michael Strain talks with James Pethokoukis author of "The Conservative Futurist: How to Create the Sci-Fi World We Were Promised." (fasterplease.substack.com) A Q&A with Helen Czerski author of "The Blue Machine: How the Ocean Works." (e360.yale.edu) A Q&A with Taylor Lorenz author of "Extremely Online: The Untold Story of Fame, Influence, and Power on the Internet.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Nerd's Eye View

OCTOBER 19, 2023

Much of the marketing and practice management advice in the financial advisory space comes back to 1 recommendation: Specialize in a niche. Niching offers several advantages, allowing advisors to be more specific in their marketing, more targeted in their prospecting calls, and more efficient in their processes (since clients within a similar niche are likely to have similar problems, especially in niches of profession).

Wealth Management

OCTOBER 19, 2023

From finance to fintech disruption, CHIP founder Dana Wilson redefines fear and empowers change.

Calculated Risk

OCTOBER 19, 2023

The DOL reported : In the week ending October 14, the advance figure for seasonally adjusted initial claims was 198,000 , a decrease of 13,000 from the previous week's revised level. The previous week's level was revised up by 2,000 from 209,000 to 211,000. The 4-week moving average was 205,750, a decrease of 1,000 from the previous week's revised average.

Wealth Management

OCTOBER 19, 2023

The RIA firm acquires an Indiana-based team of 10, including three CPAs, and around $100 million in managed assets.

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

Calculated Risk

OCTOBER 19, 2023

From the NAR: Existing-Home Sales Fell 2.0% in September Existing-home sales faded in September, according to the National Association of REALTORS®. Among the four major U.S. regions, sales rose in the Northeast but receded in the Midwest, South and West. All four regions registered year-over-year sales declines. Total existing-home sales – completed transactions that include single-family homes, townhomes, condominiums and co-ops – waned 2.0% from August to a seasonally adjusted annual rate of

Wealth Management

OCTOBER 19, 2023

Kellan Brown, chief growth officer at Income Lab, discusses the integration of retirement income planning with next-gen financial advising.

Calculated Risk

OCTOBER 19, 2023

Speech by Chair Powell on the economic outlook. Excerpts: Inflation readings turned lower over the summer, a very favorable development. The September inflation data continued the downward trend but were somewhat less encouraging. Shorter-term measures of core inflation over the most recent three and six months are now running below 3 percent. But these shorter-term measures are often volatile.

Wealth Management

OCTOBER 19, 2023

The $270 billion firm is also getting more active in its Entrepreneurial Capital program, including helping advisors with M&A.

Speaker: Erroll Amacker

As businesses increasingly adopt automation, finance leaders must navigate the delicate balance between technology and human expertise. This webinar explores the critical role of human oversight in accounts payable (AP) automation and how a people-centric approach can drive better financial performance. Join us for an insightful discussion on how integrating human expertise into automated workflows enhances decision-making, reduces fraud risks, strengthens vendor relationships, and accelerates R

A Wealth of Common Sense

OCTOBER 19, 2023

The tax man Bill Sweet joined me on today’s show again to answer questions about expected returns in the stock market, changing income brackets and your finances, getting a late start on tax-deferred savings and borrowing from your portfolio. The post Bad Returns in the Market Aren’t Always Bad appeared first on A Wealth of Common Sense.

Wealth Management

OCTOBER 19, 2023

Matthew Murphy and Rebecca Baker of Marble Wealth discuss their choice to leave UBS and opt for independence, the impact of signing on to the firm’s retire-in-place program, their age as a competitive advantage and much more.

Advisor Perspectives

OCTOBER 19, 2023

The Conference Board Leading Economic Index (LEI) fell for the 18th consecutive month in September as future economic weakness continue to loom. The index dropped 0.7% from last month to 104.6, the index's lowest reading since June 2020.

Wealth Management

OCTOBER 19, 2023

One advisor who left, who declined to be named, said his decision to leave was motivated by the sale to Creative Planning.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Trade Brains

OCTOBER 19, 2023

Jubilant FoodWorks Vs Devyani International : In the hustle & bustle of everyday life, time is of the absolute essence and food that is quickly made available to your liking is the absolute need of the hour. In this report, we will talk about two such Companies that make sure to bring you their delicious cuisine, from their kitchen to your table within a couple of minutes.

Wealth Management

OCTOBER 19, 2023

Technology should not be viewed as a replacement for advisors, but a tool that enhances their capabilities, says Fidelity's director of digital planning.

Trade Brains

OCTOBER 19, 2023

You might remember the time when Hindenburg accused the Adani Group of stock price manipulation. The financial world held its breath, and it seemed like chaos had taken over. But guess what? The tables have turned! India inaugurated its first Container Trans-shipment Port in Trivandrum Kerala, on October 15. The Vizhinjam port is at the southernmost tip of India and will help us compete with China in international maritime trade.

Wealth Management

OCTOBER 19, 2023

Danielle Miura transitioned from being a stay-at-home mom to a career in financial planning after encouragement from her husband.

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

Advisor Perspectives

OCTOBER 19, 2023

In September, nominal home values increased for a 6th straight months while "real" home values declined for the first time in 4 months. Last month's ZHVI came in at $348,539, up 0.35% from the previous month and up 1.13% from one year ago. However, after adjusting for inflation, the real figures are -0.20% month-over-month and -5.56% year-over-year.

Wealth Management

OCTOBER 19, 2023

The Foundation for Financial Planning and the College for Financial Planning presented their Pro Bono Volunteer Training at the virtual eMoney Summit.

Million Dollar Round Table (MDRT)

OCTOBER 19, 2023

By Woei Sean Tong Some experts suggest that advisors are going to be out of a job, as people are now buying everything online, including life insurance. It’s true that we buy more things online than ever. Yet, we’re not running out of business because of that. When we look into the details of what’s being bought online, it’s usually no-brainer stuff, such as toothpaste.

Wealth Management

OCTOBER 19, 2023

Despite their reputation as a safe haven, medical office investments carry some level of risk, reports CoStar. In quarterly earnings banks have been reporting some strain due to commercial real estate loans. These are among the must reads from the real estate investment world to wrap up the week.

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

Integrity Financial Planning

OCTOBER 19, 2023

From October 15 to December 7, Medicare has an open enrollment period. [1] This is the time when you can change your health plan and prescription drug coverage to adapt to your needs. [1] Every year, there are changes to Medicare health plans and networks, so make sure that you know if your coverage is changing. [1] If your coverage stays the same and you feel like it’s working for you, then you don’t have to do anything during the open enrollment period!

Wealth Management

OCTOBER 19, 2023

That’s when a DC court will issue a mandate that could make effective an August opinion that went in favor of Grayscale Investments, which had sued the SEC as it looked to convert its Bitcoin trust into an ETF.

Clever Girl Finance

OCTOBER 19, 2023

It’s not fun to wake up and have “I don’t want to work anymore” as your first thought. You can’t enjoy the day if you’re in a funk that’s hard to shake. But it’s important to find out why you feel this way and what you can do about it. Table of contents Why you may say, “I don’t want to work anymore” 14 tips to recover from work burnout and love your job again Expert tip: Start saving money as you assess your job Got “I don’t want to work” feels?

Wealth Management

OCTOBER 19, 2023

The idea of ESG has been changing since the day it was just a twinkle in a marketer’s eye. Now it’s heading into its inevitable end game.

Speaker: Sierre Lindgren

Fraud is a battle that every organization must face – it’s no longer a question of “if” but “when.” Every organization is a potential target for fraud, and the finance department is often the bullseye. From cleverly disguised emails to fraudulent payment requests, the tactics of cybercriminals are advancing rapidly. Drawing insights from real-world cases and industry expertise, we’ll explore the vulnerabilities in your processes and how to fortify them effectively.

Let's personalize your content