U.S. Technology Adoption, 1900-2021

The Big Picture

FEBRUARY 29, 2024

A century of tech adoption in 30 seconds click for animation Source: Blackrock The post U.S. Technology Adoption, 1900-2021 appeared first on The Big Picture.

The Big Picture

FEBRUARY 29, 2024

A century of tech adoption in 30 seconds click for animation Source: Blackrock The post U.S. Technology Adoption, 1900-2021 appeared first on The Big Picture.

Abnormal Returns

FEBRUARY 29, 2024

Crypto Memecoins are soaring. (theblock.co) A skeptical take on crypto, and factors. (ft.com) Brokers WeBull is going public via a SPAC deal. (wsj.com) Robinhood ($HOOD) wants to provide IRAs to gig workers. (investmentnews.com) Finance Banks are now lending to private credit funds. (semafor.com) Why Goldman Sachs ($GS) trades at a discount to the stock market.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

FEBRUARY 29, 2024

The firm’s board is already conducting a search for his successor. Additionally, Greg Davis has been appointed as president in addition to his current role as chief investment officer.

A Wealth of Common Sense

FEBRUARY 29, 2024

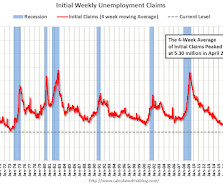

A reader asks: What’s the biggest risk in the markets right now? The simple answer here is the one everyone has been preparing for over the past 24 months — a recession. In the post-WWII era, the U.S. economy has slipped into a recession roughly once every 5 years or so, on average. Look at how spaced out those recessions (the grey bars) have become in recent decades: From the late-1940s through the early-198.

Speaker: Amanda Adams, Fractional CFO, CPA

Are you ready to elevate your accounting processes for 2025? 🚀 Join us for an exclusive webinar led by Amanda Adams, a seasoned fractional CFO and CPA passionate about transforming back-office operations for finance teams. This session will cover critical best practices and process improvements tailored specifically for accounting professionals.

Calculated Risk

FEBRUARY 29, 2024

From the NAR: Pending Home Sales Receded 4.9% in January Pending home sales in January dropped 4.9% , according to the National Association of REALTORS®. The Northeast and West posted monthly gains in transactions while the Midwest and South recorded losses. All four U.S. regions registered year-over-year decreases. The Pending Home Sales Index (PHSI)* – a forward-looking indicator of home sales based on contract signings – decreased to 74.3 in January.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Calculated Risk

FEBRUARY 29, 2024

Here is a graph of the year-over-year change in shelter from the CPI report and housing from the PCE report this morning, both through January 2024. CPI Shelter was up 6.1% year-over-year in January, down from 6.2% in December, and down from the cycle peak of 8.2% in March 2023. Housing (PCE) was up 6.1% YoY in January , down from 6.3% in December, and down from the cycle peak of 8.3% in April 2023.

Wealth Management

FEBRUARY 29, 2024

Wealth Management IQ and Discovery Data have compiled a list of RIAs growing fast while keeping sight of their priorities: the client experience and the sustainability of the business.

Calculated Risk

FEBRUARY 29, 2024

Today, in the Calculated Risk Real Estate Newsletter: Freddie Mac House Price Index Increased in January; Up 6.2% Year-over-year A brief excerpt: On a year-over-year basis, the National FMHPI was up 6.2% in January , from up 6.3% YoY in December. The YoY increase peaked at 19.1% in July 2021, and for this cycle, bottomed at up 0.9% YoY in April 2023.

Wealth Management

FEBRUARY 29, 2024

The dips in M&A and total assets in 2022 should have been a wakeup call for the industry to return its focus to organic growth.

Speaker: Abdi Ali, Sr. Lease Accounting Consultant

Join this insightful webinar with industry expert Abdi Ali, who will discuss the challenges that can arise from managing lease accounting with spreadsheets! He will share real-world examples of errors, compliance issues, and risks that may be present within your spreadsheets. Learn how these tools, while useful, can sometimes lead to inefficiencies that affect your time, resources, and peace of mind.

Calculated Risk

FEBRUARY 29, 2024

The BEA released the Personal Income and Outlays report for January: Personal income increased $233.7 billion (1.0 percent at a monthly rate) in January , according to estimates released today by the Bureau of Economic Analysis. Disposable personal income (DPI), personal income less personal current taxes, increased $67.6 billion (0.3 percent) and personal consumption expenditures (PCE) increased $43.9 billion (0.2 percent).

Wealth Management

FEBRUARY 29, 2024

Growth-minded RIAs often look to bring new services to clients. Research from WMIQ and Marshberry shows widely different motivations and approaches—and sometimes elevated expectations for the impact on firm value.

Advisor Perspectives

FEBRUARY 29, 2024

With the release of January's report on personal incomes and outlays, we can now take a closer look at "real" disposable personal income per capita. At two decimal places, the nominal 0.29% month-over-month change in disposable income comes to -0.05% when we adjust for inflation. The year-over-year metrics are 4.00% nominal and 1.56% real.

Random Roger's Retirement Planning

FEBRUARY 29, 2024

More quick hits. Flow Financial Planning blogged about something it calls Coast FIRE. It's a play on FIRE which stands for financial independence/retire early. We've looked at this quite a few times favoring the idea of achieving some measure of financial independence but not so much actually retiring early. Coast FIRE is a catchier phrase for an idea we've narrowed in on which is the optionality that goes with making some good financial decisions early on so that you have more optionality later

Advertisement

Join us in this webinar, where we share best practices on how to think about the reconciliation work each month, when best to do reconciliations, how they should be prepared, and some common pitfalls to avoid. Learning Objectives: This course objective is to understand how to properly prepare and review balance sheet reconciliations and its impact on the financial statements.

Wealth Management

FEBRUARY 29, 2024

Brett Bernstein realized that he could not achieve his vision and goals within the wirehouse world. So he set out to build his own practice. When he outgrew that, he built a firm. Now, he’s building an enterprise.

Carson Wealth

FEBRUARY 29, 2024

Tom Fridrich, JD, CLU, ChFC ® , Manager and Senior Wealth Planner Giving something you own to someone else. It’s a simple, human act – one that seems like it shouldn’t take too much planning to do it correctly. But when does gifting become a tax issue? What do you need to consider about gifting as it relates to your overall estate plan? Let’s take a closer look at estate and gift taxes and how you can approach them with a financial planning mindset.

Wealth Management

FEBRUARY 29, 2024

The agency this week is sending letters to target 125,000 cases of taxpayers with incomes of more than $400,000 who didn’t file returns between the years 2017 and 2021.

Random Roger's Retirement Planning

FEBRUARY 29, 2024

Barron's had a quick profile on the Blackrock Flexible Income Fund (BINC) which is an active ETF managed by Rick Reider. I am less interested int he fund than this excerpt from the beginning of the article. It pretty much parrots what we've been talking about here for ages. I've been saying meaningful yield without too much volatility is what investors hope the bond portion of their portfolio will give.

Speaker: Igli Laci, Strategic Finance Leader

In today’s competitive market, pricing is more than just a number — it’s the cornerstone of profitability. The right pricing strategy ensures that you capture the true value of your offering, paving the way for sustainable growth and long-term success. Join Igli Laci, Strategic Finance Leader, in this exclusive session where he will explore how a well-crafted pricing approach balances customer perception with business objectives, creating a powerful tool for securing both competitive advantage a

Wealth Management

FEBRUARY 29, 2024

A public filing cited an “organizational realignment of certain business functions” as the reason for the departure.

Million Dollar Round Table (MDRT)

FEBRUARY 29, 2024

By Bryce Sanders If you want to target the affluent as clients, it makes sense to connect with people with enough money to donate to worthy causes. You can meet them while you’re using your sales abilities yet not prospecting. Instead, it can be done in a way where you’ll help the community together. Here’s how this could work. Many insurance agents and financial advisors have a charitable organization they care about.

Wealth Management

FEBRUARY 29, 2024

Merrill and Wells Fargo join Charles Schwab Corp. and Robinhood Markets Inc., which started offering the spot Bitcoin ETFs shortly after their approval.

Calculated Risk

FEBRUARY 29, 2024

From the Las Vegas Visitor Authority: January 2024 Las Vegas Visitor Statistics With a room inventory with roughly 4,300 more rooms than last year, est. visitor volume reached 3.38M, up 3.3% YoY. Despite the larger room inventory vs. Jan 2023, overall hotel occupancy for the month was on par with last January at 78.9% (down ‐0.2 pts). Affected in part by the move of the CES tradeshow back to midweek dates this January instead of the weekend dates it spanned last January, Weekend occupancy for th

Advertisement

Change is difficult, whether in our private or work life. However, without change, growth and learning are difficult not to mention keeping up with the market and staying competitive. We have all worked for or ourselves are the bosses that prefer to keep the status quo. We will discuss how to address the "change challenge" to enable you to be a changemaker and a graceful recipient of change.

Wealth Management

FEBRUARY 29, 2024

Advisor Seth Marshall cited LPL’s evolution and specialized resources for high-net-worth clients as reasons for his return.

The Irrelevant Investor

FEBRUARY 29, 2024

Today’s Compound and Friends is brought to you by Public: See here for more information on Publics recently launched option-trading capabilities On today’s show, we discuss: $1B donation will provide free tuition at a Bronx medical school Warren Buffet was there for the Japanese market rally 9 stock tips hiding in Warren Buffett’s latest letter to Berkshire shareholders Trian’s Disney shares have.

Wealth Management

FEBRUARY 29, 2024

There isn’t a way to make K-1s shorter or less complex. But advisors and clients can cut down on their workload by “bringing organization to the chaos of chasing down K-1s”, says Arch co-founder Ryan Eisenman.

Calculated Risk

FEBRUARY 29, 2024

Note: Mortgage rates are from MortgageNewsDaily.com and are for top tier scenarios. Friday: • At 10:00 AM ET, ISM Manufacturing Index for February. The consensus is for the ISM to be at 49.2, up from 49.1 in January. • At 10:00 AM, Construction Spending for January. The consensus is for a 0.2% increase in construction spending. • At 10:00 AM, University of Michigan's Consumer sentiment index (Final for February). • All day, Light vehicle sales for February.

Speaker: Hilary Akhaabi, PhD - Founder, Chief Financial & Operations Officer at Go Africa Global

In the fast-paced world of corporate finance, staying ahead of the curve is crucial for sustainable growth and profitability. This exclusive webinar with leading expert Hilary Akhaabi, PhD, will teach you practical ways to navigate complex financial landscapes and enhance your company's revenue management capabilities. Whether you're aiming to refine your financial strategies or seeking innovative solutions to drive performance, this new session is for you!

Wealth Management

FEBRUARY 29, 2024

Educate children to be proper stewards of the unique assets they will inherit.

Advisor Perspectives

FEBRUARY 29, 2024

The BEA's Personal Income and Outlays report revealed inflation cooled further in January. Core PCE, the Fed's favored measure of inflation, was up 0.4% from December and slowed to 2.8% year-over-year, the lowest reading since March 2021 and one step closer to the Fed's 2% target rate.

Calculated Risk

FEBRUARY 29, 2024

The DOL reported : In the week ending February 24, the advance figure for seasonally adjusted initial claims was 215,000 , an increase of 13,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 201,000 to 202,000. The 4-week moving average was 212,500, a decrease of 3,000 from the previous week's revised average.

Let's personalize your content