Former Private Advisor Group CMO to Lead StepStone Private Wealth Marketing

Wealth Management

OCTOBER 17, 2024

Berta Aldrich will fill the newly created role, while David Robbins will become the director of enterprise RIA relationship management.

Wealth Management

OCTOBER 17, 2024

Berta Aldrich will fill the newly created role, while David Robbins will become the director of enterprise RIA relationship management.

Abnormal Returns

OCTOBER 17, 2024

Autonomous driving Austin Vernon, "Humans being awful drivers leads to a massive increase in vehicle costs and weight, makes cars more dangerous to people outside of them, and imposes significant costs on infrastructure like roads." (austinvernon.site) What's it going to take to reach full autonomous driving? (stratechery.com) Defense Europe isn't prepared to defend itself absent the U.S.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

OCTOBER 17, 2024

John Hardin will join the UBS in Miami with Integra Partners, a private wealth team with more than $7 billion AUM. Senior Wealth Strategy Associate Katelyn O’Hara will join him.

Abnormal Returns

OCTOBER 17, 2024

Markets Global market correlations are higher than they used to be, but aren't 1.0. (morningstar.com) Investors are already noticing the drop in cash yields. (wsj.com) Asset management Asset managers are rushing to launch CLO ETFs. (wsj.com) India's asset management market is fiercely competitive. (institutionalinvestor.com) Finance Charles Schwab ($SCHW) is deleveraging.

Speaker: Claire Grosjean

Finance teams are drowning in data—but is it actually helping them spend smarter? Without the right approach, excess spending, inefficiencies, and missed opportunities continue to drain profitability. While analytics offers powerful insights, financial intelligence requires more than just numbers—it takes the right blend of automation, strategy, and human expertise.

Wealth Management

OCTOBER 17, 2024

The amount of assets in tax-managed SMAs has jumped 67% from year-end 2022.

Calculated Risk

OCTOBER 17, 2024

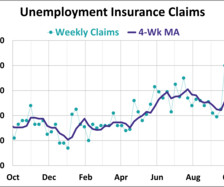

The DOL reported : In the week ending October 12, the advance figure for seasonally adjusted initial claims was 241,000 , a decrease of 19,000 from the previous week's revised level. The previous week's level was revised up by 2,000 from 258,000 to 260,000. The 4-week moving average was 236,250, an increase of 4,750 from the previous week's revised average.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Calculated Risk

OCTOBER 17, 2024

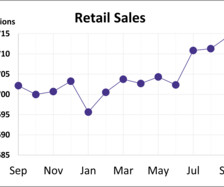

On a monthly basis, retail sales increased 0.4% from August to September (seasonally adjusted), and sales were up 1.7 percent from September 2023. From the Census Bureau report : Advance estimates of U.S. retail and food services sales for September 2024, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $714.4 billion, an increase of 0.4 percent from the previous month , and up 1.7 percent from September 2023.

Wealth Management

OCTOBER 17, 2024

Mindy Diamond and Jason Diamond provide strategies to help advisors help through the decision-making process in this industry update.

Calculated Risk

OCTOBER 17, 2024

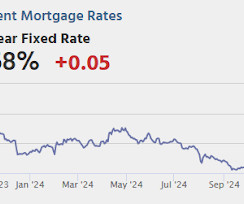

Note: Mortgage rates are from MortgageNewsDaily.com and are for top tier scenarios. Thursday: • At 8:30 AM ET, Housing Starts for September. The consensus is for 1.350 million SAAR, down from 1.356 million SAAR.

Wealth Management

OCTOBER 17, 2024

Have more productive estate plan meetings.

Speaker: David Worrell, CFO, Author & Speaker

Calculated Risk

OCTOBER 17, 2024

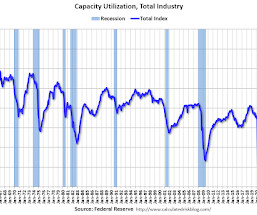

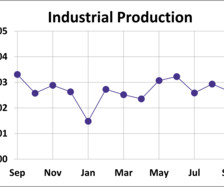

Earlier from the Fed: Industrial Production and Capacity Utilization Industrial production (IP) decreased 0.3 percent in September after advancing 0.3 percent in August. A strike at a major producer of civilian aircraft held down total IP growth by an estimated 0.3 percent in September, and the effects of two hurricanes subtracted an estimated 0.3 percent.

Wealth Management

OCTOBER 17, 2024

Private-equity backed RIAs and private equity firms accounted for most of the third quarter’s deal activity, according to Echelon Partners

Calculated Risk

OCTOBER 17, 2024

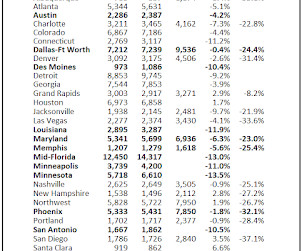

Today, in the Calculated Risk Real Estate Newsletter: 3rd Look at Local Housing Markets in September A brief excerpt: NOTE: The tables for active listings, new listings and closed sales all include a comparison to September 2019 for each local market (some 2019 data is not available). This is the third look at several early reporting local markets in September.

Nerd's Eye View

OCTOBER 17, 2024

Launching an advisory firm can be a daunting endeavor, requiring advisors to take on significant financial and responsibility with no guarantees of success. Given these challenges, advisors may consider bringing on a business partner to share both the costs and the burden of decision-making. By pairing with a partner in the firm's early days, advisors can benefit from their business partner not just by having someone to split costs and risks with, but also to consult with as a sounding board and

Speaker: Erroll Amacker

As businesses increasingly adopt automation, finance leaders must navigate the delicate balance between technology and human expertise. This webinar explores the critical role of human oversight in accounts payable (AP) automation and how a people-centric approach can drive better financial performance. Join us for an insightful discussion on how integrating human expertise into automated workflows enhances decision-making, reduces fraud risks, strengthens vendor relationships, and accelerates R

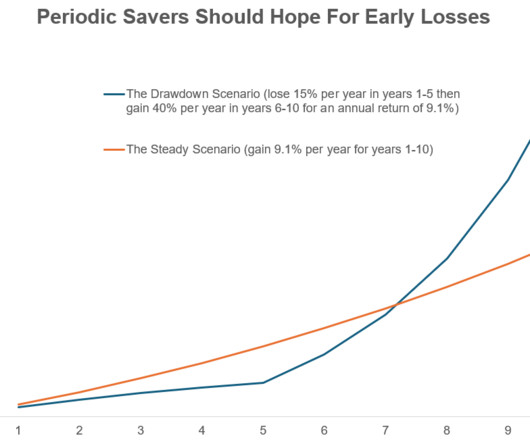

A Wealth of Common Sense

OCTOBER 17, 2024

Callie Cox joined me on the show again this week to discuss questions about investing in alternatives, the plight of the homebuyer, the current state of stock market valuations, and overcoming financial mistakes. Further Reading: What If You Invested at the Peak Right Before the 2008 Crisis? The post Sequence of Returns appeared first on A Wealth of Common Sense.

Advisor Perspectives

OCTOBER 17, 2024

Official recession calls are the responsibility of the NBER Business Cycle Dating Committee, which is understandably vague about the specific indicators on which they base their decisions. There is, however, a general belief that there are four big indicators that the committee weighs heavily in their cycle identification process.

Trade Brains

OCTOBER 17, 2024

Palm oil, the world’s most widely consumed vegetable oil, is facing a complex web of challenges and changes. This article explores the current state of the industry, its major players, and the factors shaping its future. Global Production and Market Dynamics Palm oil is a crucial commodity in the global market. Indonesia and Malaysia are the top producers, dominating the industry.

Million Dollar Round Table (MDRT)

OCTOBER 17, 2024

By Matt Pais, MDRT Content Specialist It should surprise no one to hear that your health is important. Willpower, however, can be incredibly difficult — even when you’re trying to be disciplined about balanced eating. Bob Davies, a former coach of college football players and an Olympian, recommends being proactive to prevent yourself from a binge you’d regret: “I was taking a trip from Los Angeles airport to Newark in New Jersey.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Random Roger's Retirement Planning

OCTOBER 17, 2024

A very long running theme to my writing going back almost to the beginning has been to avoid allocating too much to specific diversifiers. We've talked about this in relation to MLPs. gold and REITs going back 18 or 19 years and more recently we've talked about what a bad idea a 20 or 25% weighting to managed futures is. The behavior carried forward from REITs and the others to managed futures maybe a year or year and a half ago with a lot of content pointing to huge allocations to managed futur

Advisor Perspectives

OCTOBER 17, 2024

Industrial production was down 0.3% in September, coming in worse than the expected 0.1% decrease. Compared to one year ago, industrial production is down 0.64%.

Steve Sanduski

OCTOBER 17, 2024

Guest: Ramesh Srinivasan, a senior partner at McKinsey & Company and co-author of The Journey of Leadership: How CEOs Learn to Lead from the Inside Out. In a Nutshell: How well do you know yourself? The absolute best business leaders work hard to understand their emotions, motivations, and limitations so that they can identify their inner purpose and align it with the outcomes they want their teams to achieve.

Advisor Perspectives

OCTOBER 17, 2024

In the week ending October 12th, initial jobless claims were at a seasonally adjusted level of 241,000. This represents a decrease of 19,000 from the previous week's figure and is right in line with what economists were expecting.

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

Trade Brains

OCTOBER 17, 2024

The global uranium market is experiencing a significant shift. A growing supply deficit, coupled with increasing demand, is reshaping the industry’s landscape. This article explores the current state of the uranium sector and its future prospects. Supply Shortages Loom as Major Producers Cut Back Kazakhstan, the world’s largest uranium producer, recently announced a 17% cut in its planned production for 2025.

Advisor Perspectives

OCTOBER 17, 2024

Nominal retail sales in September were up 0.43% month-over-month (MoM) and up 1.74% year-over-year (YoY). However, after adjusting for inflation, real retail sales were up 0.25% MoM and down 0.65% YoY.

Validea

OCTOBER 17, 2024

The term “bubble” has become ubiquitous in financial media. If you follow financial news, you might conclude that we’re currently surrounded by bubbles. Stocks, bonds, cryptocurrencies – all have been labeled as bubbles at various points. But are we really in a world of pervasive financial bubbles, or is the term being used too liberally?

Advisor Perspectives

OCTOBER 17, 2024

529 plans are one of the most popular ways Americans save for the college expenses of their children. As of June 2024, there were 16.8 million 529 savings accounts holding $508 billion, according to the College Savings Plan Network.

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

Wealthfront

OCTOBER 17, 2024

At Wealthfront, we want to help you build long-term wealth on your own terms. That’s why we’ve built a robust suite of accounts powered by automation, with the goal of keeping both your costs and taxes low. If you’re looking for guidance on which accounts are best suited to your needs and situation, we’re here […] The post Which Wealthfront Account Is Right for You?

Advisor Perspectives

OCTOBER 17, 2024

The Census Bureau's Advance Retail Sales Report for September revealed headline sales were up 0.4% last month. The latest reading was higher than the expected 0.3% monthly growth in consumer spending.

Validea

OCTOBER 17, 2024

In this episode of Excess Returns, we sit down with Larry Swedroe to tackle some of the most pressing issues in investing today. We dive deep into topics that are on many investors’ minds, including: Is value investing still effective in today’s market? How is the rise of passive investing impacting market efficiency? Should we be concerned about market concentration?

Advisor Perspectives

OCTOBER 17, 2024

One of most dangerous habits of a speculative crowd is the tendency to use unconditional averages and unconditional probabilities regardless of how extreme market conditions have become. This is like stepping into a house with two rooms, one with the temperature at 0 degrees and one at 140 degrees, and expecting a temperature of 70 either way.

Speaker: Sierre Lindgren

Fraud is a battle that every organization must face – it’s no longer a question of “if” but “when.” Every organization is a potential target for fraud, and the finance department is often the bullseye. From cleverly disguised emails to fraudulent payment requests, the tactics of cybercriminals are advancing rapidly. Drawing insights from real-world cases and industry expertise, we’ll explore the vulnerabilities in your processes and how to fortify them effectively.

Let's personalize your content