Daffy Launches Custom Portfolios

Wealth Management

JULY 30, 2024

They've expanded the number of possible portfolio constructions from 15 to 100 quintillion.

Wealth Management

JULY 30, 2024

They've expanded the number of possible portfolio constructions from 15 to 100 quintillion.

Calculated Risk

JULY 30, 2024

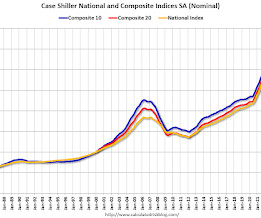

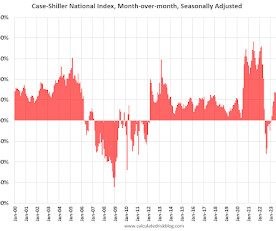

S&P/Case-Shiller released the monthly Home Price Indices for May ("May" is a 3-month average of March, April and May closing prices). This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index. From S&P S&P CoreLogic Case-Shiller Index Again Breaks Previous Month's All-Time High for May 2024 The S&P CoreLogic Case-Shiller U.S.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

JULY 30, 2024

A new survey from Cerulli Associates found model portfolio providers are increasingly focused on offering custom options to keep their clients loyal.

Calculated Risk

JULY 30, 2024

Today, in the Calculated Risk Real Estate Newsletter: Case-Shiller: National House Price Index Up 5.9% year-over-year in May; FHFA House Price Index Unchanged in May, up 5.7% YoY Excerpt: S&P/Case-Shiller released the monthly Home Price Indices for May ("May" is a 3-month average of March, April and May closing prices). May closing prices include some contracts signed in January, so there is a significant lag to this data.

Speaker: Erroll Amacker

As businesses increasingly adopt automation, finance leaders must navigate the delicate balance between technology and human expertise. This webinar explores the critical role of human oversight in accounts payable (AP) automation and how a people-centric approach can drive better financial performance. Join us for an insightful discussion on how integrating human expertise into automated workflows enhances decision-making, reduces fraud risks, strengthens vendor relationships, and accelerates R

Wealth Management

JULY 30, 2024

Ameriprise has filed a suit against LPL, claiming that the broker/dealer directs recruits to take client information and trade secrets when they leave the firm.

Abnormal Returns

JULY 30, 2024

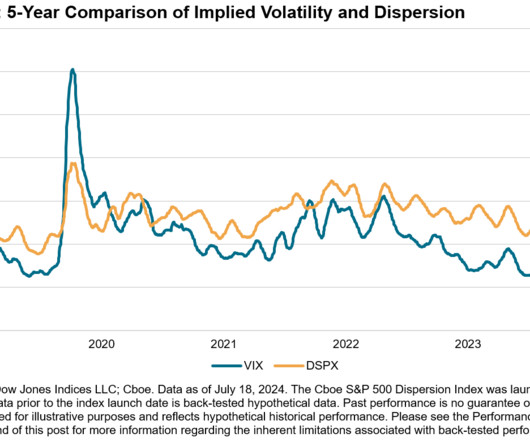

Asset allocation Bonds have some yield now, but that doesn't mean they are the best portfolio diversifier. (man.com) Risk parity is a solution in search of a problem. (rogersplanning.blogspot.com) Crowding How crowding affects active investment returns. (alphaarchitect.com) How fund flows can drive stock returns. (caia.org) Calls You'd be surprise how little companies talk about their employees on conference calls.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Calculated Risk

JULY 30, 2024

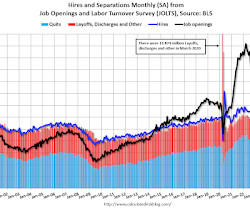

From the BLS: Job Openings and Labor Turnover Summary The number of job openings was unchanged at 8.2 million on the last business day of June, the U.S. Bureau of Labor Statistics reported today. Over the month, both the number of hires and total separations were little changed at 5.3 million and 5.1 million, respectively. Within separations, quits (3.3 million) and layoffs and discharges (1.5 million) changed little. emphasis added The following graph shows job openings (black line), hires (dar

Wealth Management

JULY 30, 2024

Industry accruals are a robust negative predictor of industry returns.

Calculated Risk

JULY 30, 2024

Note: Mortgage rates are from MortgageNewsDaily.com and are for top tier scenarios. Wednesday: • At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index. • At 8:15 AM: The ADP Employment Report for June. This report is for private payrolls only (no government). The consensus is for 168,000 payroll jobs added in June, up from 150,000 in May. • At 9:45 AM: Chicago Purchasing Managers Index for July. • At 10:00 AM: Pending Home Sal

Wealth Management

JULY 30, 2024

The acquisition of Ratio Wealth Group, a Denver-based firm with $530 million in assets, is Robertson Stephens’ fourth deal this year.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Calculated Risk

JULY 30, 2024

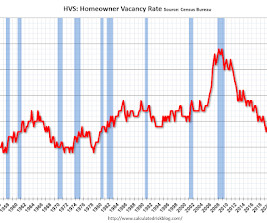

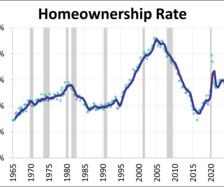

The Census Bureau released the Residential Vacancies and Homeownership report for Q2 2024 today. The results of this survey were significantly distorted by the pandemic in 2020. This report is frequently mentioned by analysts and the media to track household formation, the homeownership rate, and the homeowner and rental vacancy rates. However, there are serious questions about the accuracy of this survey.

Wealth Management

JULY 30, 2024

The milestone validates Captrust’s business model and growth of the registered investment advisor space.

Alpha Architect

JULY 30, 2024

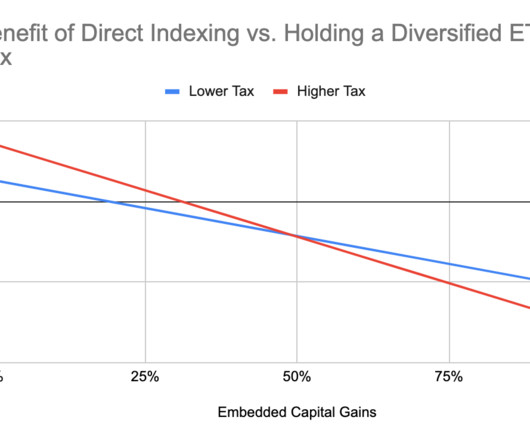

Many investors face the complex decision of whether to transition from a diversified ETF to direct indexing. When is this switch a poor investment choice? My findings suggest that many investors are better off avoiding it. Direct indexing remains attractive even with a decent amount of embedded capital gains, up to approximately 40% of initial investment, for investors in the highest marginal income tax bracket.

Nerd's Eye View

JULY 30, 2024

Welcome everyone! Welcome to the 396th episode of the Financial Advisor Success Podcast ! My guest on today's podcast is Michelle Klisanich. Michelle is a Wealth Advisor for Financially Wise Divorce, a hybrid advisory firm based in Minneapolis, Minnesota, that oversees $87 million in assets under management for 91 client households. What's unique about Michelle, though, is how she has leveraged her learnings from several different business coaches over the course of her career, which gave her th

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

A Wealth of Common Sense

JULY 30, 2024

Seven questions I’m pondering at the moment: 1. Why doesn’t the Fed just cut now? Inflation is under control. The labor market is cooling off. The housing market is a mess. I know people who lived through the 1970s are worried about a replay but this is not that. If the Fed waits too long the economy is going to roll over and they’re not going to be able to stop the unemployment rate from rising.

Advisor Perspectives

JULY 30, 2024

A lack of clients is not a lead generation problem. It’s a conversion problem.

Million Dollar Round Table (MDRT)

JULY 30, 2024

By Stacey Hanke Have you ever noticed that when you ramble, your subconscious encourages you to keep talking, which tortures your clients even more? Eventually, you will figure out what to say. Yet, as financial professionals, you know the power behind asking open-ended questions to instantly build rapport with very few words. Your verbal and nonverbal communication can jeopardize your influence or enhance it without your even knowing it.

Advisor Perspectives

JULY 30, 2024

Over the last decade, the general trend has been consistent: The rate of homeownership has struggled. The Census Bureau released its latest quarterly report for Q2 2024 showing the latest homeownership rate is at 65.6%, unchanged from Q1 2024 and remaining at its lowest rate in over two years.

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

Walkner Condon Financial Advisors

JULY 30, 2024

Walkner Condon Financial Advisors recently had the honor of being selected for the USA Today/Statista “Best Financial Advisory Firms in the US” as the #18 best firm nationally and #1 in Wisconsin.

Darrow Wealth Management

JULY 30, 2024

For founders, employees, and executives with stock-based compensation, an 83(b) election can be a powerful tax planning tool. When you make an 83(b) election, you’re opting to pay tax on unvested shares now, instead of when the stock vests. Most tax planning strategies focus on deferring tax, but an 83(b) election is all about accelerating it.

Advisor Perspectives

JULY 30, 2024

This article examines both breaches at AT&T, discusses how the data can be used to perpetrate detailed deep fakes, and shares how you can advise your clients and staff to protect your clients’ investments.

Financial Symmetry

JULY 30, 2024

Some problems are easily solved with a bit of reasoning, logic, or by using a bit of math. Other problems, however, go beyond quantitative thinking. The most thought-provoking issues aren’t numbers-based. These issues require much deeper consideration and often cause … Continued The post Wild Retirement Problems, Ep #221 appeared first on Financial Symmetry, Inc.

Speaker: Sierre Lindgren

Fraud is a battle that every organization must face – it’s no longer a question of “if” but “when.” Every organization is a potential target for fraud, and the finance department is often the bullseye. From cleverly disguised emails to fraudulent payment requests, the tactics of cybercriminals are advancing rapidly. Drawing insights from real-world cases and industry expertise, we’ll explore the vulnerabilities in your processes and how to fortify them effectively.

Advisor Perspectives

JULY 30, 2024

The Federal Housing Finance Agency (FHFA) house price index (HPI) inched down to 424.6 in May, just below the all-time high of 424.7. U.S. house prices were essentially unchanged from the previous month and are up 5.7% from one year ago. After adjusting for inflation, the real index was up 0.2% month-over-month and up 3.5% year-over-year.

SEI

JULY 30, 2024

Integration Enhances Operational Efficiency and User Experience for Family Offices

Wealthfront

JULY 30, 2024

Wealthfront clients are generally well aware of best practices for building wealth and a retirement nest egg. The holy grail consists of broad diversification, indexing, minimizing costs and taxes, rebalancing, and staying the course (all of which are key tenets of Wealthfront’s investment philosophy). But equally important is to avoid the common mistakes that have […] The post Why Picking the Winning Sector Is a Losing Game appeared first on Wealthfront Blog.

Darrow Wealth Management

JULY 30, 2024

For founders, employees, and executives with stock-based compensation, an 83(b) election can be a powerful tax planning tool. When you make an 83(b) election, you’re opting to pay tax on unvested shares now, instead of when the stock vests. Most tax planning strategies focus on deferring tax, but an 83(b) election is all about accelerating it.

Advertisement

It's the time of year to give our close process some TLC. Join us in this one hour webinar where we discuss how to adopt leading practices and infuse technology into the month-end close process to improve our experience and increase our productivity during month-end and quarter-end close. Learning Objectives: This course's objective is to understand how the month-end close can be improved with automation and adoption of leading practices.

Random Roger's Retirement Planning

JULY 30, 2024

Long/short is a category that can mean anything. All three of the following are different types of long short. The Merger Fund is a client and personal holding. Keeping it simple, Invenomic swings for the fences, the AQR fund says it is "seeking equity like returns with less risk" and the Merger Fund is an absolute return vehicle. The correlations between them are pretty low other than between BIVIX and QLEIX.

Advisor Perspectives

JULY 30, 2024

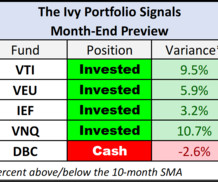

Here is an advance preview of the monthly moving averages we track after the close of the last business day of the month.

Carson Wealth

JULY 30, 2024

Carson Wealth’s Thom Hall CFP®️, ChFC®️, CExP, CEPA Managing Director, Partner & Wealth Advisor and Rick Krebs CPA, CEPA discuss business exit planning and how to make an intelligent exit. Rick Krebs and BSales Group are not an affiliate of Cetera Advisor Networks, LLC, or CWM, LLC. Opinions expressed by the presenter may not be representative of Cetera Advisor Networks, LLC, or CWM, LLC.

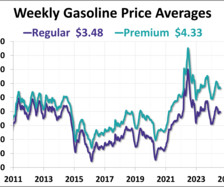

Advisor Perspectives

JULY 30, 2024

Gas prices inched back up this week as prices continue to see-saw. As of July 29th, the price of regular and premium gas increased 1 and 0 cents from the previous week, respectively. The WTIC end-of-day spot price for crude oil closed at $75.81, down 3.3% from last week.

Speaker: Aaron Berson

Managing spend is more than a cost cutting exercise – it's a pathway to smarter decisions that unlock efficiency and drive growth. By understanding and refining the spending process, financial leaders can empower their organizations to achieve more with less. Explore the art of balancing financial control with operational growth. From uncovering hidden inefficiencies to designing workflows that scale your business, we’ll share strategies to align your organization’s spending with its strategic g

Let's personalize your content