Adjusted for Risk: Following Data Driven Trends and The Role of Managed Futures in an Investment Portfolio

Wealth Management

APRIL 16, 2024

AlphaSimplex's Katy Kaminski describes how the firm uses data to measure where the markets are moving.

Wealth Management

APRIL 16, 2024

AlphaSimplex's Katy Kaminski describes how the firm uses data to measure where the markets are moving.

Abnormal Returns

APRIL 16, 2024

Strategy Joe Wiggins, "It is important to remember that behavioural finance would be redundant if it were easy; if it wasn’t hard it wouldn’t be useful." (behaviouralinvestment.com) Investing requires a measure of optimism in the future. (ofdollarsanddata.com) Fund management 15 more ideas from Seth Klarman's "Margin of Safety" including 'Investment must be thought of as more than stock selection or making a series of solid individual investment decisions.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

APRIL 16, 2024

KKR logged $3 billion in sales in products aimed for the private wealth channel—up from $400 million in sales per quarter in 2022. Morningstar published an explainer on the growing world of interval funds. These are among the investment must reads we found this week for wealth advisors.

Calculated Risk

APRIL 16, 2024

Today, in the Calculated Risk Real Estate Newsletter: Single Family Starts Up 22% Year-over-year in March; Multi-Family Starts Down Sharply A brief excerpt: Total housing starts in March were well below expectations, however, starts in January and February were revised up. The third graph shows the month-to-month comparison for total starts between 2023 (blue) and 2024 (red).

Speaker: Erroll Amacker

As businesses increasingly adopt automation, finance leaders must navigate the delicate balance between technology and human expertise. This webinar explores the critical role of human oversight in accounts payable (AP) automation and how a people-centric approach can drive better financial performance. Join us for an insightful discussion on how integrating human expertise into automated workflows enhances decision-making, reduces fraud risks, strengthens vendor relationships, and accelerates R

Wealth Management

APRIL 16, 2024

Advisors may want to reconsider any allocation to these 15 companies, as they’ve been shown to wipe out investors’ wealth—even over the long term.

Abnormal Returns

APRIL 16, 2024

Asset allocaiton Is regret a better measure to target for portfolio allocations? (blogs.cfainstitute.org) Why asset allocation is sensitive to goals and assumptions. (priceactionlab.com) The case against a cryptocurrency allocation. (insights.finominal.com) Global macro hedge funds are mid. (klementoninvesting.substack.com) Corporate finance Are family-controlled firms more at-risk of price crashes?

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Calculated Risk

APRIL 16, 2024

Note: Mortgage rates are from MortgageNewsDaily.com and are for top tier scenarios. Wednesday: • At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index. • At 2:00 PM, the Federal Reserve Beige Book , an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

Wealth Management

APRIL 16, 2024

The addition of Gil Addeo is key to expanding Axos' services to independent broker/dealers and RIAs.

Calculated Risk

APRIL 16, 2024

From the Fed: Industrial Production and Capacity Utilization Industrial production rose 0.4 percent in March but declined at an annual rate of 1.8 percent in the first quarter. Manufacturing output increased 0.5 percent in March, boosted in part by a gain of 3.1 percent in motor vehicles and parts; factory output excluding motor vehicles and parts moved up 0.3 percent.

Wealth Management

APRIL 16, 2024

Martin M. Shenkman and Joy Matak discuss proposals in the 2025 Green Book.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Calculated Risk

APRIL 16, 2024

Today, in the Calculated Risk Real Estate Newsletter: Lawler: Early Read on Existing Home Sales in March A brief excerpt: From housing economist Tom Lawler: Based on publicly-available local realtor/MLS reports released across the country through today, I project that existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 4.23 million in March , down 3.4% from February’s preliminary pace and down 2.8% from last ’s March’s seasonally a

Wealth Management

APRIL 16, 2024

The SEC has repeatedly rewarded firms who self-reported their use of WhatsApp and other unauthorized communication means with leniency.

A Wealth of Common Sense

APRIL 16, 2024

I was perusing the BLS data following the inflation release last week and one number sticks out like Victor Wembanyana standing next to a group of kindergartners. Auto insurance was up 22% over the previous 12 months versus an overall inflation rate of 3.5%. Look at the change in auto insurance rates these past few years: It’s like a meme stock.

Wealth Management

APRIL 16, 2024

Merrill Wealth Management added around 7,300 net new clients during the first quarter, which was in line with the previous two quarters but down year-over-year.

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

The Irrelevant Investor

APRIL 16, 2024

There was a further escalation in Israel over the weekend. It always feels a bit crass to talk about investing when lives are being lost, but part of what I do is help investors contextualize awful world events. Intuitively, you might think that geopolitical events would impact the market. It’s true that in general, investors tend to sell risk assets first and ask questions later.

Wealth Management

APRIL 16, 2024

Morgan Stanley's wealth unit generated $6.88 billion in revenue in the first quarter.

Advisor Perspectives

APRIL 16, 2024

As the US economy hums along month after month, minting hundreds of thousands of new jobs and confounding experts who had warned of an imminent downturn, some on Wall Street are starting to entertain a fringe economic theory.

Wealth Management

APRIL 16, 2024

In speaking with industry watchers, the consensus is that we’re closer to the beginning of the cycle than the end when it comes to M&A.

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

Million Dollar Round Table (MDRT)

APRIL 16, 2024

By Bryce Sanders Doesn’t everyone want to be treated like family? As an insurance agent or financial advisor, you likely position yourself as a resource within your extended family. What does it mean professionally though? When a prospect asks, “What do you mean when you tell me that you will treat me like family?” What points might you bring up?

Advisor Perspectives

APRIL 16, 2024

Here are the top 10 questions (and answers) about advisor marketing for 2024.

Speaker: Sierre Lindgren

Fraud is a battle that every organization must face – it’s no longer a question of “if” but “when.” Every organization is a potential target for fraud, and the finance department is often the bullseye. From cleverly disguised emails to fraudulent payment requests, the tactics of cybercriminals are advancing rapidly. Drawing insights from real-world cases and industry expertise, we’ll explore the vulnerabilities in your processes and how to fortify them effectively.

Random Roger's Retirement Planning

APRIL 16, 2024

The title for this post is inspired by the following post on Threads. Fixed income, meaning intermediate and longer term duration, is having a rough 2024 after a meh 2023 and terrible 2022. For most of those ETFs you can add 100-125 basis points back in for dividends. For TLTW which is TLT with a covered call overlay you can add back about 300 basis points.

Wealth Management

APRIL 16, 2024

Charles A. Redd explains what an advisor should do when a client has declining or diminished capacity.

The Irrelevant Investor

APRIL 16, 2024

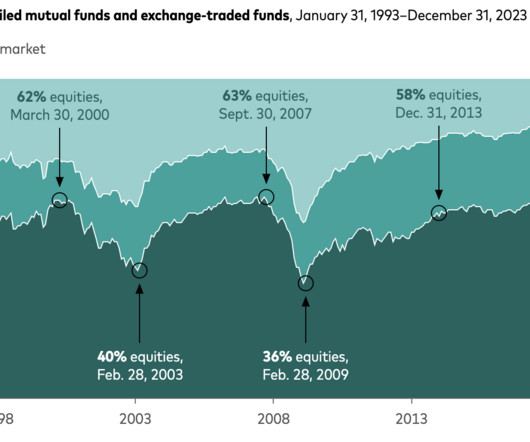

Today’s Animal Spirits is brought to you by YCharts: See here for YCharts’ quarterly economic update slide deck! See here for tickets to The Compound and Friends LIVE in Los Angeles On today’s show, we discuss: Will the growth of indexing lead to its downfall? Fund industry’s asset mix offers encouraging sign CPI Data – motor vehicle insurance Why car insurance rates are so high The hidden.

Wealth Management

APRIL 16, 2024

The LPL veteran of 19 years will serve as the technology incubator's president and chief revenue officer.

Advertisement

It's the time of year to give our close process some TLC. Join us in this one hour webinar where we discuss how to adopt leading practices and infuse technology into the month-end close process to improve our experience and increase our productivity during month-end and quarter-end close. Learning Objectives: This course's objective is to understand how the month-end close can be improved with automation and adoption of leading practices.

Random Roger's Retirement Planning

APRIL 16, 2024

The title to this post is a play on words from the Jimmy Buffett song A Pirate Looks At 40. This is an ongoing series that started when I was 40 with the intention of sort of updating the post at milestone birthdays. The point is to track how my views on various things might evolve or change dramatically and to hold myself accountable for any lifestyle opinions/advice I might write about.

Wealth Management

APRIL 16, 2024

Legal Editor Anna Sulkin Stern discusses this month's cover art.

Advisor Perspectives

APRIL 16, 2024

To keep your clients, do more than just your job – you need to keep them engaged. There’s a place for old-school engagement techniques like birthday cards and regular client meetings, but we can do better.

Wealth Management

APRIL 16, 2024

The most pressing tax law developments of the past month.

Speaker: Aaron Berson

Managing spend is more than a cost cutting exercise – it's a pathway to smarter decisions that unlock efficiency and drive growth. By understanding and refining the spending process, financial leaders can empower their organizations to achieve more with less. Explore the art of balancing financial control with operational growth. From uncovering hidden inefficiencies to designing workflows that scale your business, we’ll share strategies to align your organization’s spending with its strategic g

Let's personalize your content