U.S. Supreme Court Decision Upholds Constitutionality of Transition Tax

Wealth Management

JUNE 21, 2024

What wealth advisors need to know about taxing unrealized gains.

Wealth Management

JUNE 21, 2024

What wealth advisors need to know about taxing unrealized gains.

Calculated Risk

JUNE 21, 2024

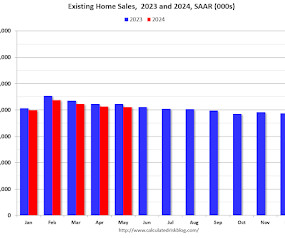

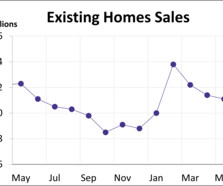

From the NAR: Existing-Home Sales Edged Lower by 0.7% in May as Median Sales Price Reached Record High of $419,300 Existing-home sales slightly declined in May as the median sales price climbed to a record high, according to the National Association of REALTORS®. In the four major U.S. regions, sales slid month-over-month in the South but were unchanged in the Northeast, Midwest and West.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

JUNE 21, 2024

PhilanthPro's Nicholas Palahnuk discusses how clients' growing interest in philanthropy demands a more integrated approach, where giving is strategically aligned with overall financial goals.

Calculated Risk

JUNE 21, 2024

Today, in the CalculatedRisk Real Estate Newsletter: NAR: Existing-Home Sales Decreased to 4.11 million SAAR in May Excerpt: Sales Year-over-Year and Not Seasonally Adjusted (NSA) The fourth graph shows existing home sales by month for 2023 and 2024. Sales declined 2.8% year-over-year compared to May 2023. This was the thirty-third consecutive month with sales down year-over-year.

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

Wealth Management

JUNE 21, 2024

Some strategic actions and best practices in the wake of the sunsetting of the 2017 Tax Reform and Jobs Act in 2025.

Abnormal Returns

JUNE 21, 2024

Listening The Longform Podcast is calling it quits. (defector.com) A list of some of the most popular (and influential) podcasters. (vulture.com) Economy Scott Galloway talks with Kyla Scanlon author of "In This Economy? How Money & Markets Really Work." (podcasts.apple.com) Joe Weisenthal and Tracy Alloway talk with John Arnold about the roadblocks to building in America.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Nerd's Eye View

JUNE 21, 2024

Enjoy the current installment of "Weekend Reading For Financial Planners" – this week's edition kicks off with the news that affluent Americans believe they need an average of $5.5 million in assets to both retire and pass on a legacy interest (though many have yet to establish an estate plan), according to a recent survey. At the same time, they also overwhelmingly recognize the value of financial advisors , not only for increasing their wealth beyond what they could have achieved on thei

Wealth Management

JUNE 21, 2024

The investment manager has added eight new fixed-income and multi-asset SMAs for advisors to use in client portfolios.

Calculated Risk

JUNE 21, 2024

From BofA: Our 2Q tracking estimate is two tenths higher at 1.8% q/q saar largely due to stronger than expected May payrolls and weaker than expected May CPI and PPI [June 20th estimate] emphasis added From Goldman: We lowered our Q2 GDP tracking estimate by 0.1pp to +1.9% (qoq ar) and our Q2 domestic final sales forecast by the same amount to +2.0%.

Wealth Management

JUNE 21, 2024

KKR's Doug Krupa details the private equity firm's strategy for working with wealth advisors.

Speaker: Erroll Amacker

As businesses increasingly adopt automation, finance leaders must navigate the delicate balance between technology and human expertise. This webinar explores the critical role of human oversight in accounts payable (AP) automation and how a people-centric approach can drive better financial performance. Join us for an insightful discussion on how integrating human expertise into automated workflows enhances decision-making, reduces fraud risks, strengthens vendor relationships, and accelerates R

Advisor Perspectives

JUNE 21, 2024

The Conference Board Leading Economic Index (LEI) decreased in May to its lowest level since April 2020. The index fell 0.5% from the previous month to 101.2. While the index does signal softer economic conditions lay ahead, the LEI is currently not signaling a recession.

Wealth Management

JUNE 21, 2024

Schwab's upcoming tech updates aim to improve advisor-client experiences.

A Wealth of Common Sense

JUNE 21, 2024

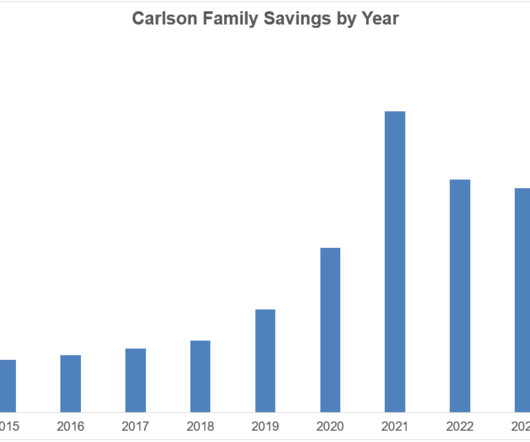

I track all of my savings and investments on Excel. Guess I’m old school and, yes, kind of a personal finance dork. I can’t help it. It’s nothing fancy. Just a collection of the holdings in our various accounts along with some simple calculations — net worth, annual retirement contributions, asset allocation, how much we’re saving each year, etc.

Wealth Management

JUNE 21, 2024

David Tepp, founder and CEO of Tepp Wealth Management, discusses how he uses his CPA background to center financial planning for clients of his $130 million AUM firm.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

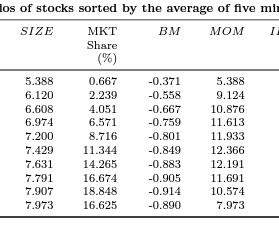

Alpha Architect

JUNE 21, 2024

Low short positions come from positive public news, while negative news can drive average short or extremely high short positions When Shorts Don’t Short was originally published at Alpha Architect. Please read the Alpha Architect disclosures at your convenience.

Wealth Management

JUNE 21, 2024

The platform is specifically tailored to meet the needs of firms that service high- and ultra-high-net-worth clients.

Discipline Funds

JUNE 21, 2024

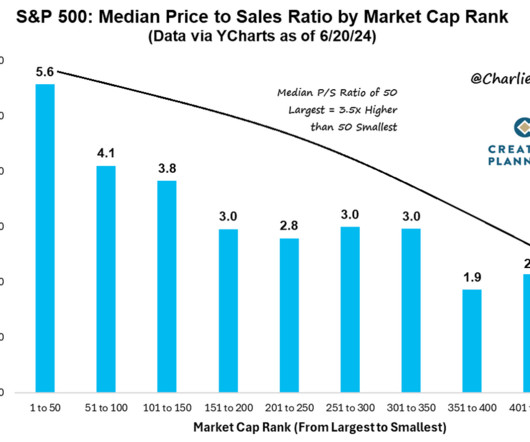

Here are three things I think I am thinking about: 1) The Concentration of the Mag 7 is Both Good and Bad. In a recent piece I discussed the risk of concentration in the US stock market. It’s really amazing. Almost every day now the Magnificent 7 add hundreds of billions of dollars in market cap value. It almost feels like the only game in town now as the market cap weighted stock indices trounce virtually everything else in large part due to this small group of companies.

Wealth Management

JUNE 21, 2024

Thursday, July 18, 2024 | 4:00 PM Eastern Daylight Time

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

Random Roger's Retirement Planning

JUNE 21, 2024

Jeff Ptak from Morningstar Tweeted out that the Stone Ridge LifeX funds we've been talking about lately have started a "conversion" to the ETF wrapper. It's a little confusing but it appears that when the cohort reaches age 80, the ETF will convert to either a longevity pool for males or females, depending, that is referred to in the filing as a closed end trust or holders can simply cash out.

Wealth Management

JUNE 21, 2024

Explore advanced analytics, comprehensive data integrity, and seamless planning integration.

Truemind Capital

JUNE 21, 2024

Lessons to learn to get better value from your wealth manager We onboarded a client with a portfolio of around INR 50 Crores, earlier managed by a big & reputed wealth management company. The portfolio was constructed for retirement purposes with 12 years of investment horizon. The risk profile of the client is moderate. When we did the portfolio health check-up, we found nearly 50 products in the portfolio. 40% allocation in AIFs and 20% average in debt.

Advisor Perspectives

JUNE 21, 2024

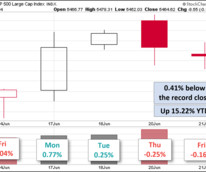

The S&P 500 rose for a third straight week, finishing up 0.61% from last Friday. The index is currently up 15.22% year to date and has recorded a new all-time high 31 times this year.

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

SEI

JUNE 21, 2024

Advisors should act now to position clients for future financial success.

Advisor Perspectives

JUNE 21, 2024

Existing home sales fell for a third straight month in May while the median price reached a new record high. According to the data from the National Association of Realtors (NAR), existing home sales were down 0.7% from April, reaching a seasonally adjusted annual rate of 4.11 million units. This figure came in higher than the expected 4.08 million.

SEI

JUNE 21, 2024

Planning for implementations is just as important as the end outcome.

Sara Grillo

JUNE 21, 2024

Keep it brief. Make it about the opportunity – not the rejection. Put all the emphasis on the type of advisor who is correct and how they should find them, not why they aren’t right for you. Take these actions TODAY: When rejecting the prospect, don’t ramble. Just give them one good reason , and use my Two Sentence Rule. Example: (Smile) “From our conversations I observed that you seem more of a Do-It-Yourself type of investor.

Speaker: Sierre Lindgren

Fraud is a battle that every organization must face – it’s no longer a question of “if” but “when.” Every organization is a potential target for fraud, and the finance department is often the bullseye. From cleverly disguised emails to fraudulent payment requests, the tactics of cybercriminals are advancing rapidly. Drawing insights from real-world cases and industry expertise, we’ll explore the vulnerabilities in your processes and how to fortify them effectively.

Advisor Perspectives

JUNE 21, 2024

After being on the frontline of the pandemic, then grappling with an edgy public and a spike in shoplifting, its been a tough few years to work retail. But for Walmart Inc. managers, at least, things are looking up.

Sara Grillo

JUNE 21, 2024

Question from a subscriber: “I had a welcome video of me on my home page website for a year, but I just took it down. My prospects have slowed since I put it up last year. Tips on what to put in a video on a website?” The sudden reduction in number of leads could be due to a number of factors beyond your control. The Google algorithm is always changing, for example.

Advisor Perspectives

JUNE 21, 2024

A rising number of U.S. taxpayers are subject to an investment income surtax, introduced a decade ago in federal legislation. Here are some strategies that may help mitigate the impact of the tax.

Abnormal Returns

JUNE 21, 2024

Markets Why the battle for market cap king matters for this ETF. (sherwood.news) Do we really miss all those micro-cap stocks? (awealthofcommonsense.com) AI The field of AI is filled with all sorts of drama. (spyglass.org) Perplexity trumps Google in search. (seths.blog) What happens when AI defames you. (theatlantic.com) Is AI going to kill off the translator?

Advertisement

It's the time of year to give our close process some TLC. Join us in this one hour webinar where we discuss how to adopt leading practices and infuse technology into the month-end close process to improve our experience and increase our productivity during month-end and quarter-end close. Learning Objectives: This course's objective is to understand how the month-end close can be improved with automation and adoption of leading practices.

Let's personalize your content