Focus Firm Kovitz Acquires $5.9B Pittsburgh RIA

Wealth Management

OCTOBER 3, 2024

The deal, expected to close in the fourth quarter of 2024, will bring Kovitz’s assets to nearly $30 billion.

Wealth Management

OCTOBER 3, 2024

The deal, expected to close in the fourth quarter of 2024, will bring Kovitz’s assets to nearly $30 billion.

Abnormal Returns

OCTOBER 3, 2024

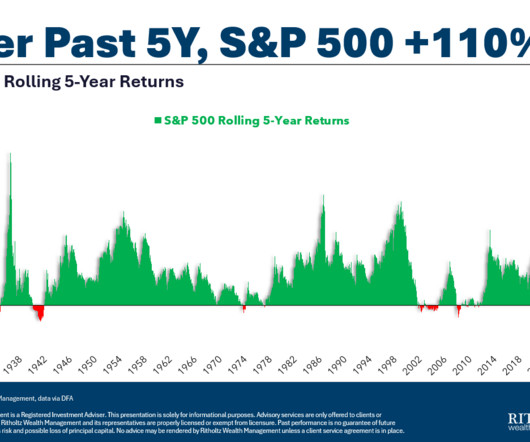

Markets Bonds, stocks AND gold are all having a good year. (carsongroup.com) Utilities are crushing it in 2024. (on.spdji.com) Market quilts, including global markets, updated through Q3. (novelinvestor.com) Crypto MicroStrategy ($MSTR) is not the only company that has Bitcoin on the balance sheet. (blockworks.co) The SEC is not done with Ripple. (theverge.com) Finance Election betting is another sign that gambling and trading are becoming indistinguishable.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

OCTOBER 3, 2024

How financial advisors can thrive with the coming of AI Tools

Calculated Risk

OCTOBER 3, 2024

What this means: On a weekly basis, Realtor.com reports the year-over-year change in active inventory and new listings. On a monthly basis, they report total inventory. For September, Realtor.com reported inventory was up 34.0% YoY, but still down 23.2% compared to the 2017 to 2019 same month levels. Now - on a weekly basis - inventory is up 31.9% YoY.

Speaker: Erroll Amacker

As businesses increasingly adopt automation, finance leaders must navigate the delicate balance between technology and human expertise. This webinar explores the critical role of human oversight in accounts payable (AP) automation and how a people-centric approach can drive better financial performance. Join us for an insightful discussion on how integrating human expertise into automated workflows enhances decision-making, reduces fraud risks, strengthens vendor relationships, and accelerates R

Wealth Management

OCTOBER 3, 2024

F2 Strategy's co-founder and CEO provides his take on the most important wealth management technology news of the last month.

Calculated Risk

OCTOBER 3, 2024

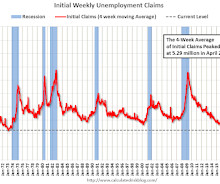

The DOL reported : In the week ending September 28, the advance figure for seasonally adjusted initial claims was 225,000 , an increase of 6,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 218,000 to 219,000. The 4-week moving average was 224,250, a decrease of 750 from the previous week's revised average.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Calculated Risk

OCTOBER 3, 2024

On Friday at 8:30 AM ET, the BLS will release the employment report for September. The consensus is for 145,000 jobs added, and for the unemployment rate to be unchanged at 4.2%. There were 142,000 jobs added in August, and the unemployment rate was at 4.2%. From BofA: Although the labor market has been soft, low jobless claims suggest that the September employment report should be decent.

Wealth Management

OCTOBER 3, 2024

A year after cutting half its staff, Vise has added senior industry executives as advisors and is aggressively pursuing the RIA aggregator market to grow.

Calculated Risk

OCTOBER 3, 2024

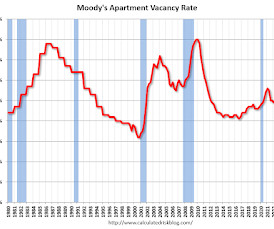

Today, in the Calculated Risk Real Estate Newsletter: Moody's: Apartment Vacancy Rate Unchanged in Q3; Office Vacancy Rate at Record High A brief excerpt: From Moody’s Analytics Economists: Multifamily Performance Steadied, Office Stress Continued to Manifest, Retail Vacancy Declined, And Industrial Cooled Down National multifamily vacancy stayed flat at 5.8%, the highest level on record since 2011.

Wealth Management

OCTOBER 3, 2024

The abrupt firing this week of Dan Arnold, who took over as LPL's CEO in 2017 and once told the firm’s advisors that his mission was about “taking care of you, so you can take care of your clients,” is proving a shock.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

A Wealth of Common Sense

OCTOBER 3, 2024

We emptied the inbox this week covering other questions about getting your CFA designation, the types of bonds you should own in retirement, how pensions fit into a retirement plan, how to spend more money, teaching your kids about money, becoming a landlord, using a HELOC as an emergency fund, how analysts rate stocks and adding international exposure to your portfolio.

Wealth Management

OCTOBER 3, 2024

Wealth Management Industry Awards, Max Lane, CEO of Flourish discusses how his firm helps advisors move from holistic advice to holistic implementation.

The Big Picture

OCTOBER 3, 2024

I used to spill a lot of ink about how terrible the Harvard Endowment was, especially their heavy overweight in Hedge Funds. I stopped not because they got any better, but simply due to the annual performance disaster was boring to keep writing about. Worse still, this was a self-inflicted wound, caused by irate alumni upset at how much the Harvard Management Company (aka The Endowment) was paying their outperforming staff: “Let’s start with Dr.

Wealth Management

OCTOBER 3, 2024

Listen as Joseph Kuo, Founder & CEO of Haven Tower emphasizes the importance of cultivating self-confidence and self-awareness in the wealth management industry.

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

Calculated Risk

OCTOBER 3, 2024

Note: Mortgage rates are from MortgageNewsDaily.com and are for top tier scenarios. Friday: • At 8:30 AM ET, 8:30 AM: Employment Report for September. The consensus is for 145,000 jobs added, and for the unemployment rate to be unchanged at 4.2%.

Wealth Management

OCTOBER 3, 2024

Listen as Ghislain Gouraige, Partner at NewEdge Capital Group as he shares how his firm’s commitment to innovation and staying ahead of industry trends empowers advisors to thrive.

Nerd's Eye View

OCTOBER 3, 2024

"Building in public" is a common piece of advice for tackling new challenges – whether launching content, starting a business, or setting personal or professional goals – as public commitment fosters accountability and motivation, tapping into the human desire to avoid embarrassment. While this approach can be effective, it ultimately poses its own difficulties; for example, when stakes are public, advisors may feel pressured to endlessly perfect their offerings and over-commit their

Wealth Management

OCTOBER 3, 2024

Listen as Teresa Hassara, Senior Vice President at Principal as she outlines the firm’s priorities for the future, including a strong focus on service excellence, discovering innovative solutions, and delivering top-tier technology to empower advisors.

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

Calculated Risk

OCTOBER 3, 2024

(Posted with permission). The ISM® Services index was at 54.9%, up from 51.5% last month. The employment index decreased to 48.1%, from 50.1%. Note: Above 50 indicates expansion, below 50 in contraction. From the Institute for Supply Management: Services PMI® at 54.9% September 2024 2024 Services ISM® Report On Business® Economic activity in the services sector expanded for the third consecutive month in September, say the nation's purchasing and supply executives in the latest Services ISM® Rep

Wealth Management

OCTOBER 3, 2024

The move allows Founder Tom Noble to retire and hand over the reins to the next generation.

Million Dollar Round Table (MDRT)

OCTOBER 3, 2024

By Matt Pais, MDRT Content Specialist Let’s say 100 people call you at the same time. How many of them can you speak to at once? Obviously, only one. That’s why Donald P. Speakman, MSFS , a past MDRT member from Pittsburgh, Pennsylvania, recommends recording an extended voicemail message during high-volume call times to simultaneously address a large number of concerns.

Wealth Management

OCTOBER 3, 2024

Thursday, October 03, 2024 | 4:15 PM ET

Speaker: Sierre Lindgren

Fraud is a battle that every organization must face – it’s no longer a question of “if” but “when.” Every organization is a potential target for fraud, and the finance department is often the bullseye. From cleverly disguised emails to fraudulent payment requests, the tactics of cybercriminals are advancing rapidly. Drawing insights from real-world cases and industry expertise, we’ll explore the vulnerabilities in your processes and how to fortify them effectively.

Advisor Perspectives

OCTOBER 3, 2024

While a strike by East Coast port workers is strangling the flow of goods from Maine to Texas and grabbing headlines, news of machinists at Boeing Co. about to enter their fourth week of picketing near Seattle has receded a bit into the background.

Wealth Management

OCTOBER 3, 2024

Listen as Teresa Hassara, Senior Vice President at Principal as she outlines the firm’s priorities for the future, including a strong focus on service excellence, discovering innovative solutions, and delivering top-tier technology to empower advisors.

Trade Brains

OCTOBER 3, 2024

India’s vibrant marketplaces are changing. Tradition and modernity are merging in the fast-changing retail world. As a result, the retail industry in India is flourishing. Brands from around the world and locally are vying for market share. E-commerce platforms are growing in the interim. In addition, shoppers are welcoming novel shopping encounters.

Wealth Management

OCTOBER 3, 2024

Banks and private credit lenders have been in tense competition to provide financing for what’s been a thin pipeline of mergers and acquisitions.

Advertisement

It's the time of year to give our close process some TLC. Join us in this one hour webinar where we discuss how to adopt leading practices and infuse technology into the month-end close process to improve our experience and increase our productivity during month-end and quarter-end close. Learning Objectives: This course's objective is to understand how the month-end close can be improved with automation and adoption of leading practices.

Carson Wealth

OCTOBER 3, 2024

Retirement is an exciting milestone—a time to leave behind the hustle and bustle of work and embrace a new chapter filled with more freedom and opportunities to enjoy life. But before you clock out for the last time, it’s essential to make sure you’re fully prepared for this significant life change. Planning well in advance ensures that your retirement years will be financially secure, fulfilling, and less stressful than your working years.

Wealth Management

OCTOBER 3, 2024

Such conversions became popular a few years ago after Dimensional Fund Advisors, JPMorgan and Neuberger Berman flipped their funds.

Advisor Perspectives

OCTOBER 3, 2024

Nvidia Corp. insiders have cashed in on shares worth more than $1.8 billion so far this year — and more selling is on the horizon.

SEI

OCTOBER 3, 2024

Expansion of Board Underscores Commitment to Institutional Markets

Speaker: Aaron Berson

Managing spend is more than a cost cutting exercise – it's a pathway to smarter decisions that unlock efficiency and drive growth. By understanding and refining the spending process, financial leaders can empower their organizations to achieve more with less. Explore the art of balancing financial control with operational growth. From uncovering hidden inefficiencies to designing workflows that scale your business, we’ll share strategies to align your organization’s spending with its strategic g

Let's personalize your content