Personal finance links: optimizing wealth strategies

Abnormal Returns

OCTOBER 11, 2023

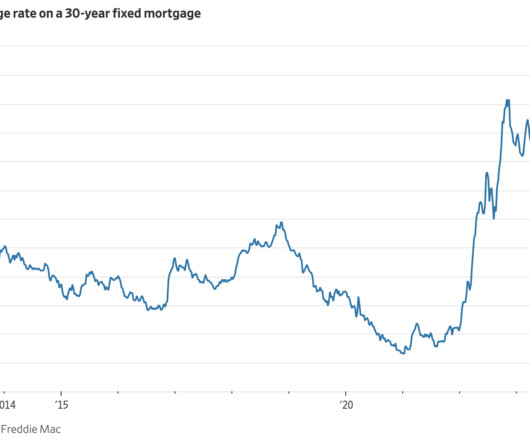

Podcasts Peter Lazaroff talks with Susan Jones of Plancorp about year-end planning opportunities. (peterlazaroff.com) Christine Benz and Jeff Ptak talk with Prof. Anita Mukherje about the challenges of decumulation. (morningstar.com) Earlier on Abnormal Returns Dying with zero: the life of Charles Feeney. (abnormalreturns.com) Sub-3% mortgage rates are now a distant memory.

Let's personalize your content