2023: The Big Picture

The Big Picture

DECEMBER 18, 2023

Love this giant chart! You can order one at Investments Illustrated The post 2023: The Big Picture appeared first on The Big Picture.

The Big Picture

DECEMBER 18, 2023

Love this giant chart! You can order one at Investments Illustrated The post 2023: The Big Picture appeared first on The Big Picture.

Abnormal Returns

DECEMBER 18, 2023

Podcasts Daniel Crosby talks wealth confidence with Anthony Damtsis who is Deputy Head of Behavioral Finance at TD Wealth. (standarddeviationspod.com) Thomas Kopelman talks planning for people planning to move outside the U.S. with Jack Thomas. (podcasts.apple.com) The biz What is the endgame for Betterment? (citywire.com) After some false starts, Apex Fintech, the clearing firm, filed for an IPO.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Nerd's Eye View

DECEMBER 18, 2023

As 2023 comes to a close, I am once again so thankful to all of you, the ever-growing number of readers who continue to regularly visit this Nerd's Eye View Blog (and share the content with your friends and colleagues, which we greatly appreciate!). We recognize (and appreciate!) that this blog – its articles and podcasts – is a regular habit for tens of thousands of advisors, but that not everyone has the time or opportunity to read every blog post or listen to every podcast that is

Abnormal Returns

DECEMBER 18, 2023

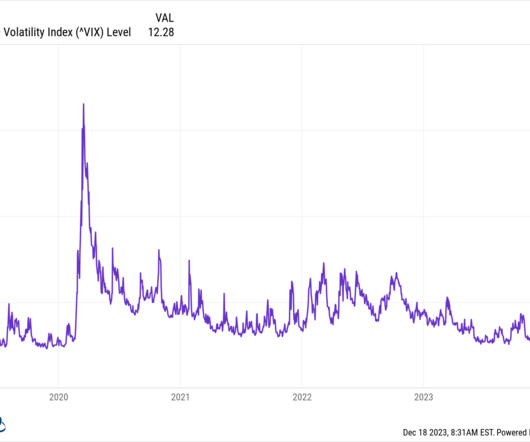

Markets The VIX is at its lowest level since the onset of the pandemic. (axios.com) Junky stocks have benefited greatly from the recent rally. (ft.com) Here are some more signs of market strength. (allstarcharts.com) Strategy The best thing you could have done in 2023 was to stick to your plan. (awealthofcommonsense.com) It was hard to lose money in 2023, but here are five ways it may have happened.

Advertisement

It's the time of year to give our close process some TLC. Join us in this one hour webinar where we discuss how to adopt leading practices and infuse technology into the month-end close process to improve our experience and increase our productivity during month-end and quarter-end close. Learning Objectives: This course's objective is to understand how the month-end close can be improved with automation and adoption of leading practices.

Calculated Risk

DECEMBER 18, 2023

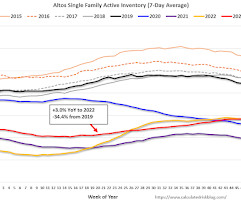

Altos reports that active single-family inventory was down 1.4% week-over-week and is now up 3.0% year-over-year. Inventory will likely decrease seasonally until the Spring. Click on graph for larger image. This inventory graph is courtesy of Altos Research. As of December 15th, inventory was at 539 thousand (7-day average), compared to 546 thousand the prior week.

Wealth Management

DECEMBER 18, 2023

Iraklis Kourtidis is the CEO of Rowboat Advisors.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Trade Brains

DECEMBER 18, 2023

Top 5 Tax Havens In The World : Where most of us are already annoyed by the mere thought of paying income taxes, have you ever wondered how super-rich people avoid taxes legally? They park their money in tax-haven countries where it’s easy to evade taxes. What’s a Tax Haven? Tax haven have been known to have extremely low or zero taxes compared to what you’d pay in your own country.

Advisor Perspectives

DECEMBER 18, 2023

Investors were pleased about the Federal Reserve’s latest policy announcement — perhaps a touch more so than Chair Jerome Powell and his colleagues might wish.

Wealth Management

DECEMBER 18, 2023

Ryan VanGorder is the CEO at Opto Investments.

XY Planning Network

DECEMBER 18, 2023

Over the past year, we've published articles written with one purpose in mind: to help independent financial advisors be successful. As 2023 comes to a close, we rounded up our top 10 most-viewed blogs published this year. From RIA compliance best practices to using behavioral marketing tactics to get more clients, this list is loaded with one helpful resource after another to send you into 2024.

Speaker: Sierre Lindgren

Fraud is a battle that every organization must face – it’s no longer a question of “if” but “when.” Every organization is a potential target for fraud, and the finance department is often the bullseye. From cleverly disguised emails to fraudulent payment requests, the tactics of cybercriminals are advancing rapidly. Drawing insights from real-world cases and industry expertise, we’ll explore the vulnerabilities in your processes and how to fortify them effectively.

Wealth Management

DECEMBER 18, 2023

The industry is grappling with an unprecedented set of existential challenges.

Advisor Perspectives

DECEMBER 18, 2023

We analyze a case study for a wealthier couple with $5.5 million in investment assets and a larger retirement spending goal.

Wealth Management

DECEMBER 18, 2023

CIM Group Principal Emily Vande Krol discusses the firm’s tactics for making inroads with RIAs and financial advisors and why it’s targeting the wealth channel.

Advisor Perspectives

DECEMBER 18, 2023

Trying to outperform the market by timing exits (just before the bear awakens from its hibernation) and entries (as the bull enters the arena) is a fool’s errand.

Speaker: Aaron Berson

Managing spend is more than a cost cutting exercise – it's a pathway to smarter decisions that unlock efficiency and drive growth. By understanding and refining the spending process, financial leaders can empower their organizations to achieve more with less. Explore the art of balancing financial control with operational growth. From uncovering hidden inefficiencies to designing workflows that scale your business, we’ll share strategies to align your organization’s spending with its strategic g

Wealth Management

DECEMBER 18, 2023

Cerulli data shows what would entice wealth advisors to manage defined contribution retirement plans.

Integrity Financial Planning

DECEMBER 18, 2023

One crucial aspect that you should financially monitor is the common financial stumbling block encountered when shifting to a retirement lifestyle. Here are some valuable insights from our professionals for those on the verge of retirement: Stick to a Well-Constructed Plan Having a well-defined blueprint for your retirement plan, which considers your budget and expected expenditures, is crucial.

Wealth Management

DECEMBER 18, 2023

The limited liquidity vehicle is becoming increasingly popular as a tool for individual investors looking for some exposure to private assets.

Carson Wealth

DECEMBER 18, 2023

The Inflation Problem is Easing, and the Fed’s Likely Going to Cut Rates The Federal Reserve recognized strong progress on inflation at its most recent policy meeting. Yields plummeted and equities rallied following the Fed’s announcement. Rate-cut expectations have risen substantially, including by the Fed. Over the next five years, we continue to favor U.S. equities, potentially supported by a virtuous productivity cycle.

Speaker: Duke Heninger, Partner and Fractional CFO at Ampleo & Creator of CFO System

Are you ready to elevate your accounting processes for 2025? 🚀 Join us for an exclusive webinar led by Duke Heninger, a seasoned fractional CFO and CPA passionate about transforming back-office operations for finance teams. This session will cover critical best practices and process improvements tailored specifically for accounting professionals.

Wealth Management

DECEMBER 18, 2023

Christine Simone is the founder and CEO at Caribou.

WiserAdvisor

DECEMBER 18, 2023

Navigating the journey to retirement can often feel like a complex puzzle, especially when it comes to figuring out how much you need to save. It’s a question that resonates with almost everyone, primarily because it determines their comfort during the non-working years of their lives. The answer to “how much you need to retire” is shaped by various factors, including the kind of retirement life you dream of, your age, and the expenses you anticipate during your retirement years.

Wealth Management

DECEMBER 18, 2023

In this replay of an earlier episode, David Lenok and Kelley Wolfington discuss the values-driven spending habits of younger generations.

A Wealth of Common Sense

DECEMBER 18, 2023

Today’s Talk Your Book is brought to you by Alternative Fund Advisors: We are joined by Marco Hanig, Managing and Founding Principal of Alternative Fund Advisors to discuss the momentum behind private credit. On today’s show, we discuss: What is Private Credit? Why banks are no longer lending to some businesses The difference between a loan and a bond Interval funds vs mutual funds Why private credit deserve.

Speaker: Ashley Harlan, MBA

What if your role as a fractional CFO went beyond operational support to actively shaping the future of your clients’ businesses? 💼 ✨ In this session, discover how fractional finance professionals can position themselves as architects of growth, guiding their clients toward sustainable success and preparing them for full-time financial leadership.

Wealth Management

DECEMBER 18, 2023

The once popular securities lost their appeal this year as the Federal Reserve hiked interest rates to control inflation.

Calculated Risk

DECEMBER 18, 2023

From Matthew Graham at Mortgage News Daily: Mortgage Rates Almost Perfectly Unchanged Near 7 Month Lows Little--if anything--happened to create any meaningful movement in the underlying bond market. Treasury yields have also flat-lined since last Thursday afternoon. Financial markets will now be waiting until the first week of January for the next piece of economic data that could truly be considered "top tier" (a description that arguably only applies to the jobs report and the Consumer Price I

Wealth Management

DECEMBER 18, 2023

Julie Cane is managing partner and CEO at Democracy Investments.

Calculated Risk

DECEMBER 18, 2023

From the MBA: Share of Mortgage Loans in Forbearance Decreases to 0.26% in November The Mortgage Bankers Association’s (MBA) monthly Loan Monitoring Survey revealed that the total number of loans now in forbearance decreased by 3 basis points from 0.29% of servicers’ portfolio volume in the prior month to 0.26% as of November 30, 2023. According to MBA’s estimate, 130,000 homeowners are in forbearance plans.

Speaker: Abdi Ali, Sr. Lease Accounting Consultant

Join this insightful webinar with industry expert Abdi Ali, who will discuss the challenges that can arise from managing lease accounting with spreadsheets! He will share real-world examples of errors, compliance issues, and risks that may be present within your spreadsheets. Learn how these tools, while useful, can sometimes lead to inefficiencies that affect your time, resources, and peace of mind.

Wealth Management

DECEMBER 18, 2023

Olivia Eisinger is the general manager of advisory at Apex Fintech Solutions.

Calculated Risk

DECEMBER 18, 2023

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 37, up from 34 last month. Any number below 50 indicates that more builders view sales conditions as poor than good. From the NAHB: Builder Sentiment Rises on Falling Interest Rates Falling mortgage rates helped end a four-month decline in builder confidence, and recent economic data signal improving housing conditions heading into 2024.

Wealth Management

DECEMBER 18, 2023

These 10 individuals are set to innovate and influence the wealth management industry in 2024.

Trade Brains

DECEMBER 18, 2023

Azad Engineering IPO Review : Companies in the Aerospace and defense industry have been welcomed grandly on the Stock Market with bumper listing gains. Just take the example of MTAR Tech and Paras Defense. Both of them were listed, showering gains of 77% and 180% respectively. In this article on Azad Engineering IPO Review, we shall see about the company, financials, Key Players in the market and much more.

Advertisement

Change is difficult, whether in our private or work life. However, without change, growth and learning are difficult not to mention keeping up with the market and staying competitive. We have all worked for or ourselves are the bosses that prefer to keep the status quo. We will discuss how to address the "change challenge" to enable you to be a changemaker and a graceful recipient of change.

Let's personalize your content