The Implications of a Higher Risk-Free Rate on the Equity Risk Premium

Wealth Management

MAY 14, 2024

Does a higher cash rate tide lift, hurt or have no significant impact on all asset returns?

Wealth Management

MAY 14, 2024

Does a higher cash rate tide lift, hurt or have no significant impact on all asset returns?

Calculated Risk

MAY 14, 2024

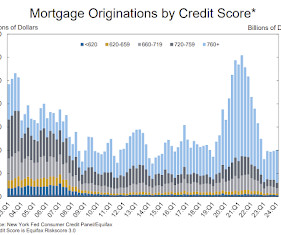

From the NY Fed: Household Debt Rose by $184 Billion in Q1 2024; Delinquency Transition Rates Increased Across All Debt Types The Federal Reserve Bank of New York’s Center for Microeconomic Data today issued its Quarterly Report on Household Debt and Credit. The report shows total household debt increased by $184 billion (1.1%) in the first quarter of 2024, to $17.69 trillion.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

MAY 14, 2024

Updated throughout Wealth Management EDGE, this live blog is focused on WealthStack.

Abnormal Returns

MAY 14, 2024

Modeling How much can machine learning techniques help in model making? (aqr.com) Fancier models don't necessarily estimate the ERP better. (alphaarchitect.com) The case for ensemble models. (mrzepczynski.blogspot.com) Can AI replace stock analysts? (papers.ssrn.com) Research Crashes are the bane of momentum investors. (mrzepczynski.blogspot.com) Why time horizon matters when it comes to investing in TIPS.

Speaker: Erroll Amacker

As businesses increasingly adopt automation, finance leaders must navigate the delicate balance between technology and human expertise. This webinar explores the critical role of human oversight in accounts payable (AP) automation and how a people-centric approach can drive better financial performance. Join us for an insightful discussion on how integrating human expertise into automated workflows enhances decision-making, reduces fraud risks, strengthens vendor relationships, and accelerates R

Wealth Management

MAY 14, 2024

This live blog focused on the RIA Edge track of Wealth Management EDGE will be updated throughout the conference.

Abnormal Returns

MAY 14, 2024

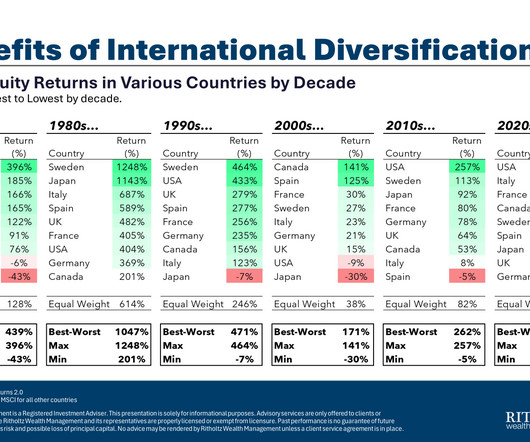

Diversification The S&P 500 is now nearly 40% of global market cap. (apolloacademy.com) International diversification requires a long time horizon. (awealthofcommonsense.com) Strategy Investment misses are inevitable. (morningstar.com) Don't confuse selling calls with income. (rogersplanning.blogspot.com) Gold won't save you if stuff really hits the fan.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Nerd's Eye View

MAY 14, 2024

Welcome everyone! Welcome to the 385th episode of the Financial Advisor Success Podcast ! My guest on today's podcast is Danielle Howard. Danielle is the owner of Wealth By Design, a hybrid advisory firm based in Glenwood Springs, Colorado, that oversees about $35 million in assets under advisement for 35 client households. What's unique about Danielle, though, is how she has created a process she calls "Financial Fingerprints To Footprints ", where she helps clients who are struggling to implem

Wealth Management

MAY 14, 2024

Despite persistent concerns from clients about the state of the economy, indicators are either fine or improving, according to Cetera Chief Market Strategist Brian Klimke.

Calculated Risk

MAY 14, 2024

CPI for April will be released on Wednesday. The consensus is for 0.3% increase in CPI (up 3.4% YoY), and a 0.3% increase in core CPI (up 3.6% YoY). Here are a couple of analyst's forecasts. From BofA: For the April CPI report, we forecast headline CPI rose by 0.3% m/m. Based on our forecast, the y/y rate should tick down to 3.4%. The main factor behind our expectation for a relatively firmer headline CPI print is energy prices.

Wealth Management

MAY 14, 2024

During a conversation at Wealth Management EDGE, the former CEO of United Capital called private equity “economic creatures” that may add leverage and unnecessary changes.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Calculated Risk

MAY 14, 2024

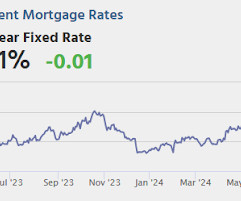

Note: Mortgage rates are from MortgageNewsDaily.com and are for top tier scenarios. Wednesday: • At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index. • At 8:30 AM, The Consumer Price Index for April from the BLS. The consensus is for 0.3% increase in CPI (up 3.4% YoY), and a 0.3% increase in core CPI (up 3.6% YoY). • Also at 8:30 AM, Retail sales for April is scheduled to be released.

Wealth Management

MAY 14, 2024

Several pros who have blazed trails in the ETF sector shared tips for achieving success.

Calculated Risk

MAY 14, 2024

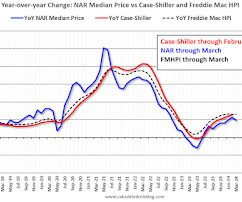

Today, in the Calculated Risk Real Estate Newsletter: Part 2: Current State of the Housing Market; Overview for mid-May 2024 A brief excerpt: On Friday, in Part 1: Current State of the Housing Market; Overview for mid-May 2024 I reviewed home inventory, housing starts and sales. In Part 2, I will look at house prices, mortgage rates, rents and more.

Wealth Management

MAY 14, 2024

Whether creating or editing images, videos, audio or emails, advisors can use AI to improve efficiency and free up time to work with clients.

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

A Wealth of Common Sense

MAY 14, 2024

A lot of investors have abandoned international diversification (or at least strongly considered it) in recent years. I understand why this is happening. The U.S. stock market has destroyed all comers ever since the Great Financial Crisis ended. Since 2009, a total U.S. stock market index fund is up more than 660% while a total international index fund is up more like 180%.

Wealth Management

MAY 14, 2024

The first full day of Wealth Management EDGE included conversations with Joe Duran, former basketball star Jay Williams and much, much more.

Advisor Perspectives

MAY 14, 2024

Household debt rose by $184 billion (1.09%) to $17.69 trillion in Q1 2024. The increase in debt this quarter was largely driven by mortgage and auto loan balances. Meanwhile, credit card balances declined, as is typical for the first quarter.

Wealth Management

MAY 14, 2024

The Inside ETFs+ live blog will be updated throughout Wealth Management EDGE.

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

Advisor Perspectives

MAY 14, 2024

The generational wealth transfer is the mountain range on our horizon, likely dominating the landscape for much of our careers. Yet many firms struggle to move from acknowledgement to action.

Wealth Management

MAY 14, 2024

Private equity money continues to fund inorganic growth for its chosen firms, and with more buyers comes more competition, according to panelists at RIA Edge.

Diamond Consultants

MAY 14, 2024

This new wave of transitioning advisors is feeling the pushes and pulls of an evolving industry. Over 9,000 advisors changed firms in 2023, marking a 7% increase from the year before.* While this movement is prevalent across all industry channels, it is particularly pronounced within the RIA world and represents a growing trend that’s a dichotomy of sorts.

Wealth Management

MAY 14, 2024

Martine Lellis, who joined Mercer as chief talent officer in 2020, will serve as principal of M&A partner development, supporting Dave Barton, who continues to lead M&A across the firm.

Speaker: Sierre Lindgren

Fraud is a battle that every organization must face – it’s no longer a question of “if” but “when.” Every organization is a potential target for fraud, and the finance department is often the bullseye. From cleverly disguised emails to fraudulent payment requests, the tactics of cybercriminals are advancing rapidly. Drawing insights from real-world cases and industry expertise, we’ll explore the vulnerabilities in your processes and how to fortify them effectively.

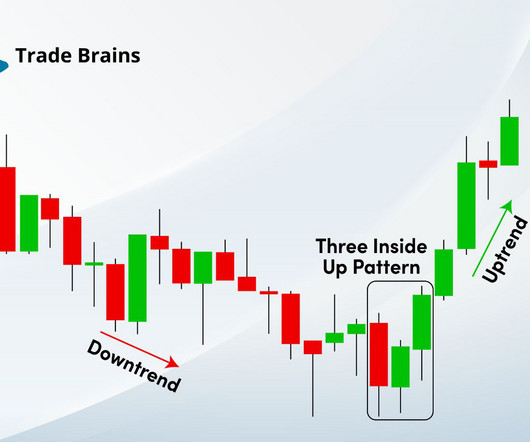

Trade Brains

MAY 14, 2024

Three Inside Up Candlestick Pattern: In the world of technical analysis, candlestick patterns serve as invaluable tools for traders, offering insights into market sentiment and potential price movements. Among the myriad of patterns, the Three Inside Up stands out for its reliability and significance. In this article, we will delve into the Three Inside Up candlestick pattern, exploring its formation, Psychology, and trading ideas with its example.

Wealth Management

MAY 14, 2024

The pace of ETF launches slowed in April. Following a March that saw nearly 50 new funds, in April managers brought 27 new ETFs onto the market.

Advisor Perspectives

MAY 14, 2024

Gas prices are down for a third straight week. As of May 13th, the price of regular and premium gas fell 3 and 4 cents from the previous week, respectively. The WTIC end-of-day spot price for crude oil closed at $79.12, up 0.8% from last week.

Wealth Management

MAY 14, 2024

The demand for assets that fit ESG goals is growing. But both asset managers and RIAs need to choose products that are alpha drivers, and not “concessions.

Advertisement

It's the time of year to give our close process some TLC. Join us in this one hour webinar where we discuss how to adopt leading practices and infuse technology into the month-end close process to improve our experience and increase our productivity during month-end and quarter-end close. Learning Objectives: This course's objective is to understand how the month-end close can be improved with automation and adoption of leading practices.

Million Dollar Round Table (MDRT)

MAY 14, 2024

By Tara Clark Social media offers a powerhouse of opportunity, but financial advisors worldwide can make mistakes that prevent them from unleashing its true potential. It can be difficult to know what to share and say online, specifically on LinkedIn. There are 90 million senior-level influencers and 63 million decision-makers who use LinkedIn, so you don’t want to miss out on the many opportunities available on this platform.

Wealth Management

MAY 14, 2024

Ramji worked at New York-based BlackRock, the world’s biggest asset manager, for about a decade and was considered one of several potential successors to CEO Larry Fink.

Advisor Perspectives

MAY 14, 2024

US household debt has reached a record and more borrowers are struggling to keep up.

Random Roger's Retirement Planning

MAY 14, 2024

A new, interesting and expensive fund popped up on my radar from something I saw on Twitter, yes I am still calling it Twitter. The Invenomic Institutional Fund (BIVIX/BIVRX) is a long/short equity fund that has been around since mid-2017. The fund's literature goes out of its way to note that it only positions in domestic stocks. It has a 5 Star rating from Morningstar and in its five full year plus two partials, it has had two huge up years.

Speaker: Aaron Berson

Managing spend is more than a cost cutting exercise – it's a pathway to smarter decisions that unlock efficiency and drive growth. By understanding and refining the spending process, financial leaders can empower their organizations to achieve more with less. Explore the art of balancing financial control with operational growth. From uncovering hidden inefficiencies to designing workflows that scale your business, we’ll share strategies to align your organization’s spending with its strategic g

Let's personalize your content