The 10 Best and 10 Worst States to Retire In

Wealth Management

SEPTEMBER 18, 2023

The South and Midwest dominate the top of the rankings.

Wealth Management

SEPTEMBER 18, 2023

The South and Midwest dominate the top of the rankings.

Calculated Risk

SEPTEMBER 18, 2023

From the MBA: Share of Mortgage Loans in Forbearance Decreases to 0.33% in August The Mortgage Bankers Association’s (MBA) monthly Loan Monitoring Survey revealed that the total number of loans now in forbearance decreased by 6 basis points from 0.39% of servicers’ portfolio volume in the prior month to 0.33% as of August 31, 2023. According to MBA’s estimate, 165,000 homeowners are in forbearance plans.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

SEPTEMBER 18, 2023

One way to mitigate the impact of a failed exchange is “tax straddling,” which involves timing the exchange so the sale falls in one tax year and the receipt of proceeds in the following year.

Calculated Risk

SEPTEMBER 18, 2023

Altos reports that active single-family inventory was up 1.9% week-over-week. Click on graph for larger image. This inventory graph is courtesy of Altos Research. As of September 15th, inventory was at 519 thousand (7-day average), compared to 509 thousand the prior week. Year-to-date, inventory is up 5.7%. And inventory is up 27.9% from the seasonal bottom 22 weeks ago.

Speaker: Claire Grosjean

Wealth Management

SEPTEMBER 18, 2023

Reject the notion that team members should leave their personal lives behind when they walk through the office door.

Abnormal Returns

SEPTEMBER 18, 2023

Podcasts Daniel Crosby talks with Michael Kitces about automation and the future of financial advice. (standarddeviationspod.com) Michael Kitces talks with Jason Wenk, CEO of Altruist, about how he is trying to build an all-in-one investment OS. (kitces.com) Brendan Frazier talks with Samantha Lamas and Danielle Labotka about why clients hire and fire their financial advisers.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Nerd's Eye View

SEPTEMBER 18, 2023

When an advisor runs their own solo advisory firm, their capacity to meet with current and prospective clients is limited to the extent that they are also responsible for all of the non-client-facing tasks of running their firm. Which may not be a serious limitation when they are just starting out and don’t have a lot of clients to serve, but as the firm grows, they will eventually run out of time available for working with clients – at which point, it becomes necessary to decide whe

Wealth Management

SEPTEMBER 18, 2023

With demand driven by the boom in artificial intelligence development, the San Francisco office market is showing signs of life, reports The Wall Street Journal. More than 550 New York office buildings have been identified as candidates for apartment conversions, according to the New York Business Journal. These are among the must reads from the real estate investment world to start the new week.

Calculated Risk

SEPTEMBER 18, 2023

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 45, down from 50 last month. Any number above 50 indicates that more builders view sales conditions as good than poor. From the NAHB: High Mortgage Rates Continue to Weaken Builder Confidence Persistently high mortgage rates above 7% continue to erode builder confidence, as sentiment levels have dropped below the key break-even measure of 50 for the first time in five months.

Wealth Management

SEPTEMBER 18, 2023

Dakota Wealth, Mariner, Paragon, Cetera, tru Independence and Osaic all added advisors this week, while Berthel Fisher and Dynasty Financial Partners announced some executive changes.

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

Calculated Risk

SEPTEMBER 18, 2023

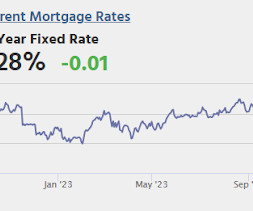

From Matthew Graham at Mortgage News Daily: Mortgage Rates Roughly Unchanged After Mid-Day Improvements The average lender was only 0.02% higher than Friday this morning, and the improvement brought them 0.01% lower than Friday. These moves are so small that many borrowers would not see any detectable different in mortgage quotes between today and Friday.

Wealth Management

SEPTEMBER 18, 2023

Recruited away from Morgan Stanley, Los Angeles-based The Francis Group is the latest team to join LPL’s SWS division, the IBD’s premium affiliation model that went live in April 2020.

Abnormal Returns

SEPTEMBER 18, 2023

Strategy Why selling a stock is harder than buying. (flyoverstocks.com) Rebalancing frequency is less important than actually rebalancing. (obliviousinvestor.com) Five excuses that people use to excuse wrong predictions. (mrzepczynski.blogspot.com) Companies What does Disney ($DIS) look like without its legacy media businesses? (cnbc.com) Will Amazon ($AMZN) ever find a fourth pillar for its business?

Wealth Management

SEPTEMBER 18, 2023

The ratings agencies are concerned that Cetera’s planned acquisition of Avantax could weaken its financial profile.

Speaker: Erroll Amacker

As businesses increasingly adopt automation, finance leaders must navigate the delicate balance between technology and human expertise. This webinar explores the critical role of human oversight in accounts payable (AP) automation and how a people-centric approach can drive better financial performance. Join us for an insightful discussion on how integrating human expertise into automated workflows enhances decision-making, reduces fraud risks, strengthens vendor relationships, and accelerates R

Calculated Risk

SEPTEMBER 18, 2023

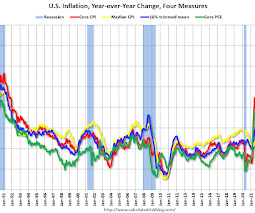

Note: I didn't update this last week. The Cleveland Fed released the median CPI and the trimmed-mean CPI. According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.3% in August. The 16% trimmed-mean Consumer Price Index also increased 0.3% in August. "The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics’ (BLS) monthly CPI report".

Wealth Management

SEPTEMBER 18, 2023

Capital Group's Jonathan Young discusses the latest retirement plan trends.

Calculated Risk

SEPTEMBER 18, 2023

Today, in the Calculated Risk Real Estate Newsletter: Lawler: Early Read on Existing Home Sales in August and Some New Household/Housing Stock Data A brief excerpt: From housing economist Tom Lawler: Based on publicly-available local realtor/MLS reports released across the country through today, I project that existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 4.07 million in August, unchanged from July’s preliminary pace and down

Wealth Management

SEPTEMBER 18, 2023

Adhere to state and federal laws when operating a CGA program.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

The Big Picture

SEPTEMBER 18, 2023

My morning train WFH reads: • A 3% Mortgage Rate in a 7% World? This Startup Says It Can Do That : Loan assumptions, which let a home buyer essentially take over a seller’s mortgage, are hard to find and hard to pull off. ( Wall Street Journal ) • Why the UAW Strike Isn’t the Biggest Problem for Ford and GM : The labor action highlights the biggest issue: Can the auto makers afford to spend what it takes to thrive in the new world of EVs?

Wealth Management

SEPTEMBER 18, 2023

Do not forget the basics regarding compliance and ligitation of 401(k) retirement plans.

Advisor Perspectives

SEPTEMBER 18, 2023

If someone’s good enough to regularly trounce the market, they don’t want your money.

Wealth Management

SEPTEMBER 18, 2023

Martin M. Shenkman and Joy Matak share how you can help a family navigate the host of tax decisions to be made after the death of a loved one.

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

A Wealth of Common Sense

SEPTEMBER 18, 2023

Today’s Talk Your Book is presented by GLASfunds: On today’s show, we are joined again by Brett Hillard, CIO of GLASfunds to discuss an update on investing in alternatives. On today’s show, we discuss: Who GLASfunds is, and what they do GLASfunds vs. a feeder-fund Wealth management vs. institutional investment in alternatives How advisors are utilizing GLASfunds Investing in alternatives in a rising-.

Wealth Management

SEPTEMBER 18, 2023

The Giving USA Report provides insights to help meet our clients’ situations and goals.

Integrity Financial Planning

SEPTEMBER 18, 2023

The initial impression customers have of your business often influences how much they decide to spend with your company. This is well known, but have you ever considered how first impressions affect the way potential investors value your business? When raising capital, investors’ initial perception of your business significantly impacts their valuation, affecting both the equity you’ll need to give up for growth and the company’s value when selling.

Wealth Management

SEPTEMBER 18, 2023

A critical step in the giving process.

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

Carson Wealth

SEPTEMBER 18, 2023

Stocks continue to trade in a choppy range after the best seven-month start to a year since 1997. August and September tend to see seasonal weakness, and this is playing out once again as expected. Bullish investors may view this as encouraging, as they would prefer to see stocks catch their breath before an eventual move higher, which we still expect over the coming months.

Wealth Management

SEPTEMBER 18, 2023

Editor in Chief Susan R. Lipp discusses this month's issue.

Advisor Perspectives

SEPTEMBER 18, 2023

Managing volatility is a high priority for advisors. The right investments can stabilize a portfolio and dampen volatility, while keeping goals on track. Increasing bond allocations used to be the standard way to reduce volatility, but with bonds more correlated to equities, their diversification value has decreased. With high inflation, bonds also aren’t providing enough real income for many investors.

Wealth Management

SEPTEMBER 18, 2023

David A. Handler and Alison E. Lothes highlight the most important tax developments of the past month.

Speaker: Sierre Lindgren

Fraud is a battle that every organization must face – it’s no longer a question of “if” but “when.” Every organization is a potential target for fraud, and the finance department is often the bullseye. From cleverly disguised emails to fraudulent payment requests, the tactics of cybercriminals are advancing rapidly. Drawing insights from real-world cases and industry expertise, we’ll explore the vulnerabilities in your processes and how to fortify them effectively.

Let's personalize your content