Retail Investors Won on Fees But Are Losing on Risk

Wealth Management

SEPTEMBER 24, 2024

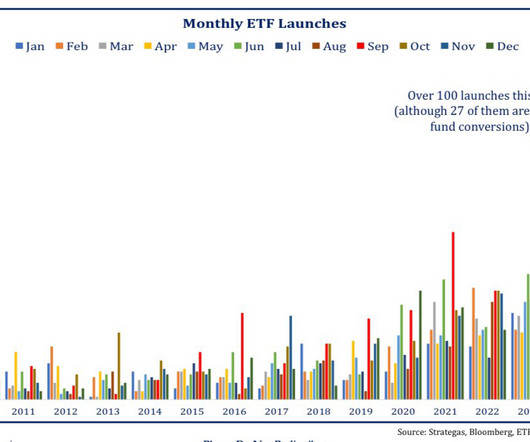

Gamified trading apps and niche ETFs have a cost that’s harder to spot but is little different from the damage inflicted on portfolios by high fees.

Wealth Management

SEPTEMBER 24, 2024

Gamified trading apps and niche ETFs have a cost that’s harder to spot but is little different from the damage inflicted on portfolios by high fees.

Abnormal Returns

SEPTEMBER 24, 2024

Statistics Comparing the Sharpe and Sortino ratios. (caia.org) Correlations, 101. (clearerthinking.org) Research How identifying economic regimes can help in portfolio allocation. (alphaarchitect.com) What investors get wrong about high quality stocks. (caia.org) You don't need individual securities to get the benefits of tax loss harvesting. (advisorperspectives.com) A review of historical private equity performance.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

SEPTEMBER 24, 2024

Don’t let the uncertainty about future tax policy interfere with taking action to meet your client’s goals.

Abnormal Returns

SEPTEMBER 24, 2024

Strategy Investors have won the war on fees. Then there's risk. (wealthmanagement.com) The shorter the time horizon, the more that has to go right. (behaviouralinvestment.com) Why it's hard to be a real contrarian. (riskofruinpod.substack.com) Crypto You can now trade options on BlackRock’s iShares Bitcoin Trust ($IBIT). (etf.com) Is MicroStrategy ($MSTR) any good at timing Bitcoin purchases?

Speaker: Erroll Amacker

As businesses increasingly adopt automation, finance leaders must navigate the delicate balance between technology and human expertise. This webinar explores the critical role of human oversight in accounts payable (AP) automation and how a people-centric approach can drive better financial performance. Join us for an insightful discussion on how integrating human expertise into automated workflows enhances decision-making, reduces fraud risks, strengthens vendor relationships, and accelerates R

Wealth Management

SEPTEMBER 24, 2024

According to SEC Enforcement Director Gurbir Grewal, Qatalyst Partners did not have to pay a monetary penalty because it self-reported the results of its investigation.

Calculated Risk

SEPTEMBER 24, 2024

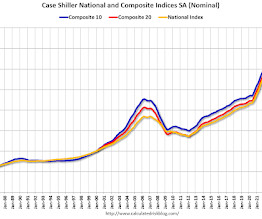

S&P/Case-Shiller released the monthly Home Price Indices for July ("July" is a 3-month average of May, June and July closing prices). This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index. From S&P S&P CoreLogic Case-Shiller Index All-Time Highs Continue in July 2024 The S&P CoreLogic Case-Shiller U.S.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Calculated Risk

SEPTEMBER 24, 2024

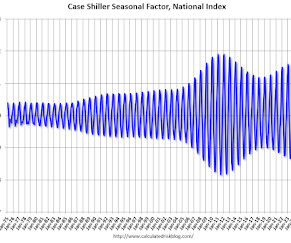

Two key points: 1) There is a clear seasonal pattern for house prices. 2) The surge in distressed sales during the housing bust distorted the seasonal pattern. This was because distressed sales (at lower price points) happened at a steady rate all year, while regular sales followed the normal seasonal pattern. This made for larger swings in the seasonal factor during the housing bust.

Wealth Management

SEPTEMBER 24, 2024

The RIA custodian partnered with fixed income tech startup Moment to power the new features.

Calculated Risk

SEPTEMBER 24, 2024

Today, in the Calculated Risk Real Estate Newsletter: Case-Shiller: National House Price Index Up 5.0% year-over-year in July Excerpt: S&P/Case-Shiller released the monthly Home Price Indices for July ("July" is a 3-month average of May, June and July closing prices). July closing prices include some contracts signed in March, so there is a significant lag to this data.

Wealth Management

SEPTEMBER 24, 2024

ETFs continue to gain fund flows at the expense of mutual funds, according to the latest data from Morningstar. BlackRock’s Larry Fink sees a massive opportunity in using private indexes to build ETFs and other funds, but it’s still unclear how, reports Reuters. These are among the investment must reads we found this week for wealth advisors.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Calculated Risk

SEPTEMBER 24, 2024

Note: Mortgage rates are from MortgageNewsDaily.com and are for top tier scenarios. Wednesday: • At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index. • At 10:00 AM: New Home Sales for August from the Census Bureau. The consensus is for 700 thousand SAAR, down from 739 thousand in July.

Wealth Management

SEPTEMBER 24, 2024

Elizabeth Hioe, a former McKinsey executive, replaces Martine Lellis, who was promoted to principal of M&A partner development in May.

A Wealth of Common Sense

SEPTEMBER 24, 2024

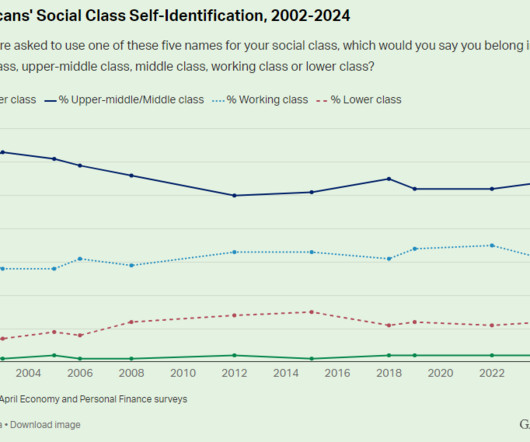

Gallup has a poll that asks Americans what income strata they belong in. The results are relatively stable over the past 20+ years: Most people say middle class while very few people think they are upper class. The Pew Research Center has a new tool that allows you to enter your income and see where it is you fit both nationally and locally. Their numbers show the Gallup poll is right on the money as far as middle-class.

Wealth Management

SEPTEMBER 24, 2024

Elizabeth Hioe, a former McKinsey executive, replaces Martine Lellis, who was promoted to principal of M&A partner development in May.

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

Advisor Perspectives

SEPTEMBER 24, 2024

MassMutual Head of Annuity Distribution Matt DiGangi recently sat down with VettaFi to discuss the increasing demand he is seeing for annuities, and how MassMutual has sought to meet client investor needs.

Wealth Management

SEPTEMBER 24, 2024

The advisory firm takes minority stakes in BFG Wealth and Canon Capital Wealth Management.

Million Dollar Round Table (MDRT)

SEPTEMBER 24, 2024

By Bryce Sanders If you’re giving clients and prospects too many choices, they may freeze and not make any decisions because they don’t understand the differences in the choices. They then may pick none, meaning there is no sale. To overcome this, simplify the process for clients. How it works Suppose a prospect came to you and said, “I sold my house, and I need income.

Wealth Management

SEPTEMBER 24, 2024

The deal adds 17 advisors to Kingswood’s RIA, as well as a turnkey asset management platform.

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

A Wealth of Common Sense

SEPTEMBER 24, 2024

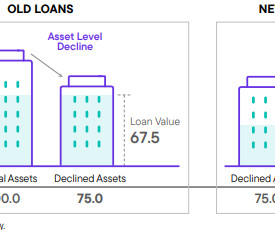

Today’s Talk Your Book is sponsored by Benefit Street Partners: On today’s show, we spoke with Richard Byrne, President of Benefit Street Partners to discuss private real estate debt investing. On today’s show, we discuss: An update on the commercial real estate crisis Price discovery of office buildings within commercial real estate How interest rates affect private debt deals What separates one asse.

Wealth Management

SEPTEMBER 24, 2024

Revolut Invest will offer nearly 5,000 assets on debut, including US and European stocks, exchange-traded funds, commodities and bonds, as well as new products such as contracts for difference.

Advisor Perspectives

SEPTEMBER 24, 2024

The Conference Board's Consumer Confidence Index® fell in September after notching a six-month high in August. The index declined to 98.7 this month from August's upwardly revised 105.6. This month's reading was worse than expected, falling short of the 103.9 forecast.

Wealth Management

SEPTEMBER 24, 2024

There’s still a level of uncertainty lingering in the industry, causing some investors to remain cautious about jumping in too early.

Speaker: Sierre Lindgren

Fraud is a battle that every organization must face – it’s no longer a question of “if” but “when.” Every organization is a potential target for fraud, and the finance department is often the bullseye. From cleverly disguised emails to fraudulent payment requests, the tactics of cybercriminals are advancing rapidly. Drawing insights from real-world cases and industry expertise, we’ll explore the vulnerabilities in your processes and how to fortify them effectively.

Advisor Perspectives

SEPTEMBER 24, 2024

The ability of color to persuade has long been a focal point of research. In the late 1970s, researchers from the University of California at Berkeley conducted a study within the California prison system. Prison guards were asked to curl dumbbell weights. The subjects did as many repetitions as possible.

MainStreet Financial Planning

SEPTEMBER 24, 2024

What is Spaving? I got home from my weekly grocery shopping trip and my daughter asks me in that “all knowing teenager” look “Mom, why did you buy 2 cantaloupes when it’s just us?” At the time, it seemed like a great deal; It was summer, and I know how much she loves this fruit. The store was having a sale, “buy one get a second one half off”, so I was happy to scoop up a second one to have for the week.

Advisor Perspectives

SEPTEMBER 24, 2024

The truth is, relationship-building and trust-building are mutually exclusive, like two parallel planes that don’t intersect.

Financial Symmetry

SEPTEMBER 24, 2024

Retirement, a phase many of us anticipate for a long time, comes with its own set of financial intricacies. Specifically, how do you effectively withdraw funds from your savings to ensure a comfortable, sustainable, and tax-efficient lifestyle? A well-crafted retirement … Continued The post How to Avoid Common Pitfalls in Your Retirement Withdrawal Strategy, Ep #225 appeared first on Financial Symmetry, Inc.

Advertisement

It's the time of year to give our close process some TLC. Join us in this one hour webinar where we discuss how to adopt leading practices and infuse technology into the month-end close process to improve our experience and increase our productivity during month-end and quarter-end close. Learning Objectives: This course's objective is to understand how the month-end close can be improved with automation and adoption of leading practices.

Advisor Perspectives

SEPTEMBER 24, 2024

After more than six months of indicating that it lacked conviction regarding the path of inflation, the Federal Reserve (Fed) seems to have gotten a conviction boost so large that it pushed it to lower the federal funds rate by 50 basis points at the September Federal Open Market Committee (FOMC) meeting.

Steve Sanduski

SEPTEMBER 24, 2024

Guest: Josh Self , CLU, ChFC, CFP®, Managing Partner of Ridgeline Wealth Advisors in Raleigh, NC. In a Nutshell: Do you serve your business or does it serve you? Josh Self decided to do a complete rebrand and design his business around his personal passion of being an everyday explorer. He wanted to attract other like-minded outdoor enthusiasts so his website and podcast are 100% geared toward that specific demographic.

Advisor Perspectives

SEPTEMBER 24, 2024

In today’s fast-paced digital world, where cyber threats are always lurking, safeguarding your personal and professional information is no longer optional – it’s essential. One often-overlooked strategy in the realm of cybersecurity is the simple yet effective practice of using multiple email accounts.

SEI

SEPTEMBER 24, 2024

Commitment to Goals-Based Wealth Management and Tax-Optimization Bolsters Growth

Speaker: Aaron Berson

Managing spend is more than a cost cutting exercise – it's a pathway to smarter decisions that unlock efficiency and drive growth. By understanding and refining the spending process, financial leaders can empower their organizations to achieve more with less. Explore the art of balancing financial control with operational growth. From uncovering hidden inefficiencies to designing workflows that scale your business, we’ll share strategies to align your organization’s spending with its strategic g

Let's personalize your content