No Seriously, What If You Only Invested In Stocks When They Were Cheap?

The Irrelevant Investor

DECEMBER 22, 2015

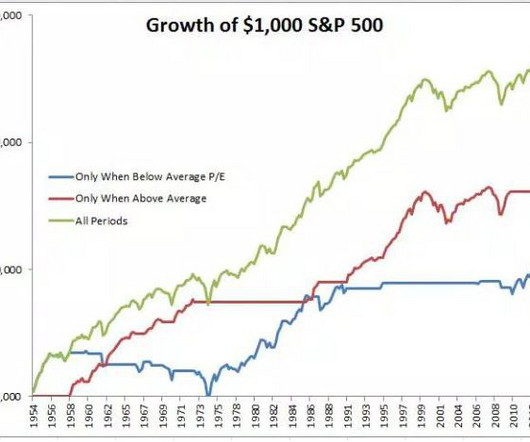

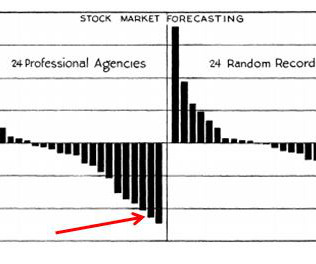

Last week I asked the question "what if you only invested in stocks when they were cheap?" The chart below got a lot of scrutiny, understandably so. It's hard to believe that stocks did better when they were above their average valuation versus when they were below. I'm happy to chow on some crow here, the chart below is indeed greatly flawed. I think the message I was trying to convey got lost in translation, so I wanted to take the opportunity to address this.

Let's personalize your content