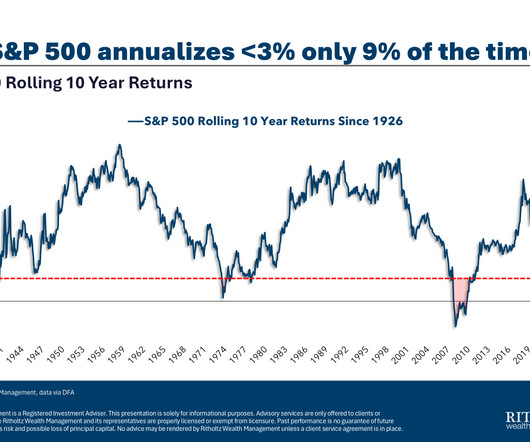

3%: Great Depression, GFC, 1970s & 2020s?

The Big Picture

OCTOBER 24, 2024

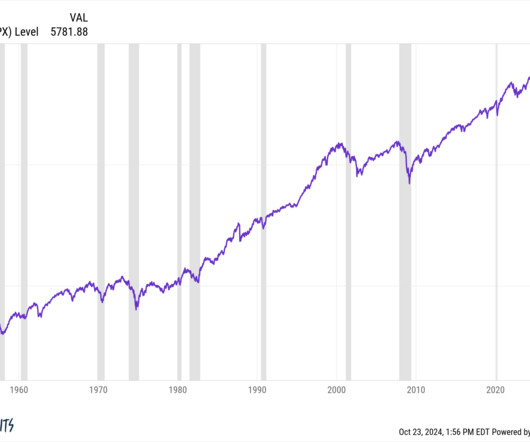

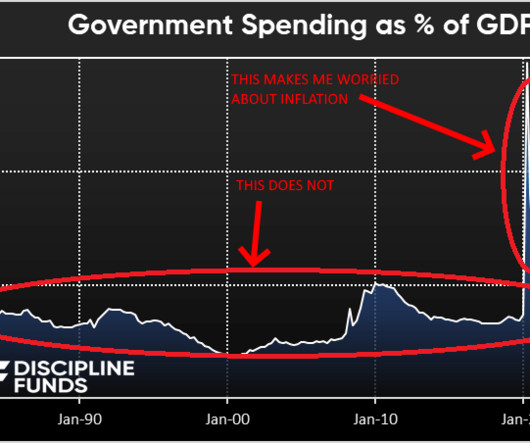

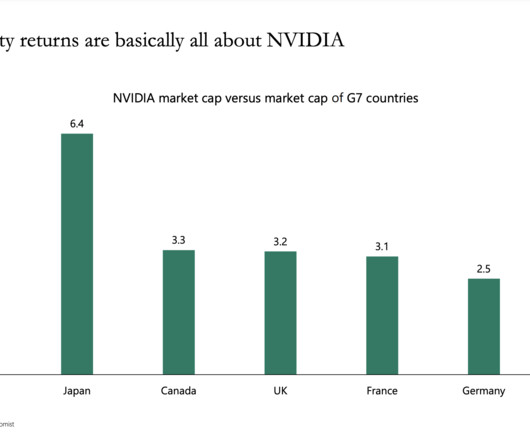

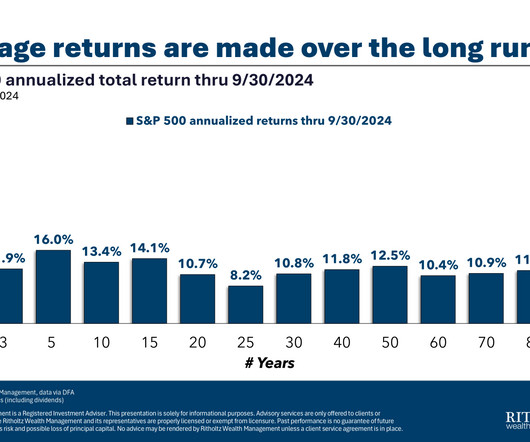

What do the Great Depression, the Great Financial Crisis, the Stagflationary 1970s, and the upcoming 10-years have in common? If you are a strategist at Goldman Sachs , then a lot. At least if you do forecasts for market returns over the next decade (lol), you may see incredible similarities. ICYMI: David Kostin and his team of strategists see a 72% chance the S&P 500 underperforms Treasuries, and a 33% possibility equities return less than inflation.

Let's personalize your content